QUOTE(davidxxx @ Jun 28 2024, 10:45 PM)

just here is enough since it's not popular and no topic starter to manage a new topicfeel free to contact admin for clearance.

Credit Cards Credit Card v20, Post/Ask general questions here, Please read post 1-3 before posting, tq

|

|

Jun 29 2024, 05:22 AM Jun 29 2024, 05:22 AM

Return to original view | IPv6 | Post

#541

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jun 29 2024, 05:52 PM Jun 29 2024, 05:52 PM

Return to original view | IPv6 | Post

#542

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(jasmineh2y @ Jun 29 2024, 05:29 PM) Hi all, i need to consolidate my credit cards and appreciate if anyone could give me advise. I'm looking for cashback credit card for retail spend. follow template in post #2My current holding: Affin Duo cards - 3% for auto billing and online txn Affin Sign Visa - 3% for paywave retail spend PIB - 4% online txn MBB Barcelona - 1% for all spend except gov thinking to hold PIB and Affin Sign Visa. My biggest spend is insurance (auto bill) and retail & online spend. Thanks in advance. https://forum.lowyat.net/topic/4161836 |

|

|

Jul 1 2024, 05:58 PM Jul 1 2024, 05:58 PM

Return to original view | Post

#543

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(cmxPIE @ Jul 1 2024, 05:49 PM) Hi guys, ignore agentNeed some advise also. Am almost same senario with sorsotzaii, 31y/o Currently working in SG earning sgd 3k+ i got no commitment what so ever. ccris and ctos is empty clean. yesterday went JB and bump to UOB credit card agent. they said that if after 31 y/o and 0 record. hardly any bank will approve CC for me. Any agent here could clarify? looking forward to get 1 soon to build up my records. try submit online application, and follow the required documentation approval is from bank's card dept/HQ, not the agent Human Nature liked this post

|

|

|

Jul 1 2024, 10:01 PM Jul 1 2024, 10:01 PM

Return to original view | Post

#544

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(cmxPIE @ Jul 1 2024, 09:57 PM) I've been looking with several bank online application. try manual submission using pdf application formBut when it come to working details, bank system (look up function) only manage for local Malaysia address or details. I cant complete all my registration that I currently tried. Hence I did not try any more luck |

|

|

Aug 1 2024, 03:20 PM Aug 1 2024, 03:20 PM

Return to original view | Post

#545

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(Sunshape @ Aug 1 2024, 03:04 PM) OCBC ccb bank when dealing with banks, do not owe (unpaid) even for 1sen.I had credit cards with them for many years but were closed few years ago leaving few cents unpaid due to interest charges after final payments. Called them just to waive it since just few cents and they disapproved the waiver request. CCB When you are their clients and they can earn money, they treat you well. When you leave, choi ni dou shou! you were assuming you can get away with it |

|

|

Aug 1 2024, 03:32 PM Aug 1 2024, 03:32 PM

Return to original view | Post

#546

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(Sunshape @ Aug 1 2024, 03:26 PM) it was not purposely as when you received the statement and there is amount owing (principal + interest), you made full payment but still, you will be charged for interest for some of the days. immaterial to youJust few cents and immaterial at all. If the bank concerns about the recognition, they can waive if cardholder has requested. Still, they disapproved. The only bank so far has rejected such request because the cards were cancelled and they forced you to pay, coz no more relationship. U leave and you are no more "our profit driving tools". You must pay. but the outstanding number still exist in their financial ledger. i'm sure bank has a way to clear off the finance charge while calculation still ongoing. just that you left it unattended without rechecking again. yes, that's how banks treats customers when they exit/left. no point wasting time and energy arguing with them, unless you're so free to keep escalating this. |

|

|

|

|

|

Aug 12 2024, 11:13 AM Aug 12 2024, 11:13 AM

Return to original view | Post

#547

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(kimi0148 @ Aug 12 2024, 10:45 AM) I have existing RHB Shell Islamic cc since 2020. Last month, I applied RHB Shell conventional cc through RP and received rejection SMS in July. Wondering can i apply again through official RHB website within this short period and will it make a difference? rejection from rhb. RP has no authority to approve your cc application.you reapply wont help, as it still goes to rhb again anyway kimi0148 liked this post

|

|

|

Aug 15 2024, 09:01 AM Aug 15 2024, 09:01 AM

Return to original view | Post

#548

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(hottemper @ Aug 14 2024, 10:10 PM) Lets say if i swipe my cc, and pay off every transaction instead of end of month total bill, will this help build credit score? Or i have to pay the statement bill in one shot after statement date to build credit score? imo, doesnt matterrepayment, early or by due date, gives you brownie points too since banks are giving you a credit line with repayment due date, sticking to it is as good as pay-off every transaction (like a debit card). |

|

|

Aug 18 2024, 09:15 AM Aug 18 2024, 09:15 AM

Return to original view | Post

#549

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(rocketm @ Aug 18 2024, 09:07 AM) In reality does bank using this rule to consider to approve cc applicants for yearly income more than RM36K, besides looking on the payment history? or course no lamore than 36k, you can own cards from many issuers subject to their own approval policies. no bank works the same. rocketm liked this post

|

|

|

Oct 30 2024, 11:46 AM Oct 30 2024, 11:46 AM

Return to original view | Post

#550

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(hustlerism @ Oct 29 2024, 10:41 PM) If I wanted to use my credit cards overseas, do I need to call bank to activate it or no issue? as a good practice, better call all your card issuers and "declare" your travel period. some banks may put a note into their CRM system as notes.PB and MB CC while at it, can also try to request for temporary CL increase due to travel expense use (planning purposes) ... if got, then bonus to support your travel. if dont get, no loss. hustlerism liked this post

|

|

|

Dec 18 2024, 07:16 AM Dec 18 2024, 07:16 AM

Return to original view | Post

#551

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(wklim090 @ Dec 17 2024, 11:50 PM) Hi guys, I would like to ask: each bank have their own scoring and review of your ongoing credit applications (eg cc, loans, etc)1. Request increase credit limit on one bank credit card, conventional side 2. Then apply to add one credit card on same bank, but on Islamic side (*I had one credit card on Islamic side too) 3. Then apply one new credit card on another bank as new to bank applicant Will my applications on all above will be rejected if I perform all these at same time? not impossible for them to review your 1-2-3 above as desperate or excessive, compared to your other criteria (eg income, repayment history, etc) |

|

|

Dec 18 2024, 09:14 AM Dec 18 2024, 09:14 AM

Return to original view | Post

#552

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Jan 22 2025, 11:40 AM Jan 22 2025, 11:40 AM

Return to original view | Post

#553

|

All Stars

65,307 posts Joined: Jan 2003 |

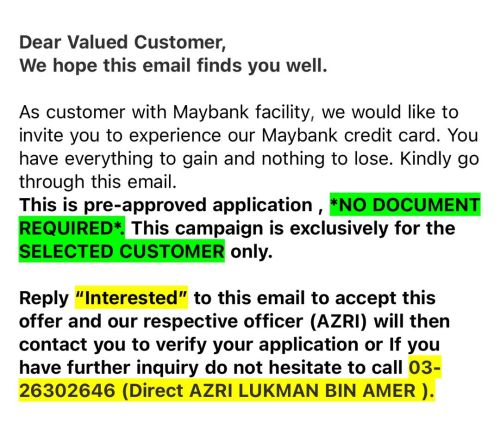

QUOTE(richtrons @ Jan 22 2025, 11:38 AM) Hi all, i received an email from Maybank which mentioned "This is pre-approved application" "This campaign is exclusively for the selected customer only" nope, many have gotten this pre-approved invitation from maybankis this a scam? or if Maybank indeed do these campaign? the email also have a few cards listed below.  feel free to contact the pic for clarifications and confirmation before you commit to apply the card This post has been edited by cybpsych: Jan 22 2025, 11:41 AM |

|

|

|

|

|

Feb 1 2025, 05:08 PM Feb 1 2025, 05:08 PM

Return to original view | Post

#554

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(Human Nature @ Feb 1 2025, 05:05 PM) slightly off topic, anyone here having login issue to Bank Islam online portal? I have typed the correct username but the security code is not the one that I set. nope, can login fine. security image/word correct too. Human Nature liked this post

|

|

|

Feb 3 2025, 03:19 PM Feb 3 2025, 03:19 PM

Return to original view | Post

#555

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(Human Nature @ Feb 3 2025, 03:05 PM) dude..........................!!!  Human Nature liked this post

|

|

|

Feb 8 2025, 05:07 PM Feb 8 2025, 05:07 PM

Return to original view | IPv6 | Post

#556

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Feb 13 2025, 05:06 PM Feb 13 2025, 05:06 PM

Return to original view | Post

#557

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Feb 20 2025, 10:48 AM Feb 20 2025, 10:48 AM

Return to original view | Post

#558

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Mar 17 2025, 11:00 AM Mar 17 2025, 11:00 AM

Return to original view | IPv6 | Post

#559

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Jun 4 2025, 09:11 AM Jun 4 2025, 09:11 AM

Return to original view | Post

#560

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(Patent @ Jun 4 2025, 02:05 AM) Hi guys question about limit, whats the requirement to have an islamic credit card with more than 50k credit? no, not specific to card type/premium-nessCan apply online or need to go to branch? Must it be a premium card? you dont get to dictate how much credit limit you want from the bank. only bank decide how much they willing to give you (i.e risk exposure). the only way you can get your desired credit limit is through FD pledging/collateral. do ask the banks around and see what they have, and apply accordingly lo target those banks which focuses on islamic products like cimb or bsn, bank rakyat, bank islam, affin, etc |

| Change to: |  0.1384sec 0.1384sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:26 AM |