eUT / POEMs / Phillip Mutual Berhad UT discussion, Coz' Fundsupermart not cheapo enuf'!

|

|

Apr 23 2020, 09:05 AM Apr 23 2020, 09:05 AM

Return to original view | IPv6 | Post

#1

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jul 16 2020, 09:50 PM Jul 16 2020, 09:50 PM

Return to original view | IPv6 | Post

#2

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 21 2020, 09:07 AM Jul 21 2020, 09:07 AM

Return to original view | Post

#3

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 21 2020, 12:24 PM Jul 21 2020, 12:24 PM

Return to original view | Post

#4

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 21 2020, 01:32 PM Jul 21 2020, 01:32 PM

Return to original view | Post

#5

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 21 2020, 04:46 PM Jul 21 2020, 04:46 PM

Return to original view | IPv6 | Post

#6

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Jul 21 2020, 04:40 PM) i believe so and now my account open my RM1 hilang transaction history also no show got RM1 i also dont know how, maybe they cheat if RM1 also want to cheat let it be la i have more question, does the below 2 fund also give 2.4%?  QUOTE(majorarmstrong @ Jul 21 2020, 04:40 PM) Have you checked your bank account if the RM 1 has been reversed? |

|

|

|

|

|

Jul 21 2020, 08:51 PM Jul 21 2020, 08:51 PM

Return to original view | IPv6 | Post

#7

|

All Stars

12,387 posts Joined: Feb 2020 |

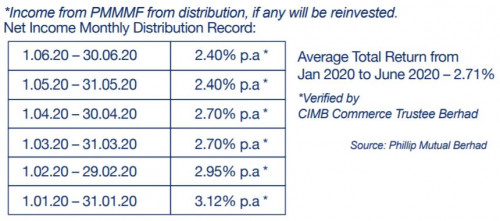

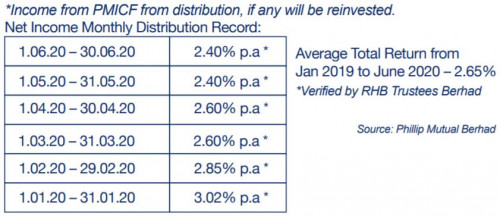

QUOTE(majorarmstrong @ Jul 21 2020, 08:44 PM) PMMMF Mandate:Primarily in government / government-backed securities, bills of exchange, negotiable certificate of deposits, promissory notes, call deposits and other short-term government/ bank-backed securities and money market instruments. There is no minimum asset allocation for Phillip Master Money Market Fund as it is 100% invested in fixed income securities and / or money market instruments.  https://www.eunittrust.com.my/pdf/Factsheet...00072020_fs.pdf PMICF Mandate: 1. At least 90% of the NAV of the Fund will be invested in Islamic money market instruments and Islamic Deposits which have a remaining maturity period of not more than 365 days. 2. Up to 10% of the NAV of the Fund will be invested in Islamic money market instruments and Islamic Deposits which have a remaining maturity period of more than 365 days but fewer than 732 days.  https://www.eunittrust.com.my/pdf/Factsheet...06072020_fs.pdf I don't see much huge difference between them. |

|

|

Jul 22 2020, 09:29 AM Jul 22 2020, 09:29 AM

Return to original view | Post

#8

|

All Stars

12,387 posts Joined: Feb 2020 |

If there's element of fraud, can always lodge a complaint to SIRDEC.

|

|

|

Jul 22 2020, 06:32 PM Jul 22 2020, 06:32 PM

Return to original view | IPv6 | Post

#9

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Jul 22 2020, 04:18 PM) the % of calendar year return show about 3.xx does it include the income distribution or not, if not then would be higher, if yes then this fund so so saja  QUOTE(ironman16 @ Jul 22 2020, 04:20 PM) Uncle, that's why i said short term ma, 😂 just wanna fight 1 month FD nia Malaysia 10-year MGS yields fall to record lowBetter than money market fund but can't fight with FI Nomura not bad liao KUALA LUMPUR (July 22): The 10-year Malaysian Government Securities (MGS) yields have fallen to a record low of 2.63%, after the nation registered in June 2020 its highest net foreign inflow in six years since May 2014. Bank Negara Malaysia said on its website that trading yields for the 10-year MGS maturing in August 2029, fell one basis point to close at 2.63% yesterday (July 21). https://www.theedgemarkets.com/article/mala...fall-record-low This may impact those FI funds that invest heavy in MGS and/or MGII. |

|

|

Jul 22 2020, 09:08 PM Jul 22 2020, 09:08 PM

Return to original view | IPv6 | Post

#10

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Jul 22 2020, 09:06 PM) It may impact OPUS Shariah Short Term Low Risk Asset Fund.Fund Mandate: The fund seeks to achieve higher returns compared to the benchmark over the short term* while preserving capital** by investing in sukuk issued or guaranteed by the government of Malaysia and/or Bank Negara Malaysia. https://www.opusasset.com/wp-content/upload...v=1595423236551 This post has been edited by GrumpyNooby: Jul 22 2020, 09:43 PM ironman16 liked this post

|

|

|

Jul 22 2020, 09:44 PM Jul 22 2020, 09:44 PM

Return to original view | IPv6 | Post

#11

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Jul 22 2020, 09:42 PM) Below is what i have so far i still dont know which one got invest in MGS Go open every fund factsheet and read the fund mandate.1. AmanahRaya Syariah Trust Fund 2. AmanahRaya Unit Trust Fund 3. Phillip Master Money Market Fund 4. OPUS IPF 5. OPUS MPF 6. ASN Equity 3 Fund 7. ASN Sara 1 Fund 8. P e-INCOME 9. P e-ISLAMIC INCOME 10. P BOND 11. P ISLAMIC ASIA TACTICAL ALLOCATION 12. PB AIMAN SUKUK Also observe its top 5/10 holdings. I don't research in fixed income segment. Others may help you. This post has been edited by GrumpyNooby: Jul 22 2020, 09:45 PM |

|

|

Jul 22 2020, 09:54 PM Jul 22 2020, 09:54 PM

Return to original view | IPv6 | Post

#12

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 22 2020, 10:01 PM Jul 22 2020, 10:01 PM

Return to original view | IPv6 | Post

#13

|

All Stars

12,387 posts Joined: Feb 2020 |

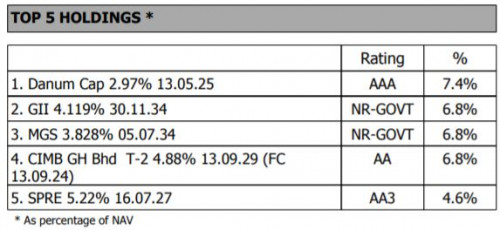

QUOTE(majorarmstrong @ Jul 22 2020, 09:59 PM) Why panic? It has only 6.8% holding for a 15-years MGS; not 68%. ironman16 liked this post

|

|

|

|

|

|

Jul 22 2020, 10:14 PM Jul 22 2020, 10:14 PM

Return to original view | IPv6 | Post

#14

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Jul 22 2020, 10:11 PM) That's why it's better for him to just keep the money in FD, EPF and SSPN. His heart is not that strong to sustain market high volatility. Spend time at banks lounge and can get freebies if place FD (for instance, FD from Bank Rakyat). |

|

|

Jul 23 2020, 07:48 AM Jul 23 2020, 07:48 AM

Return to original view | Post

#15

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Jul 23 2020, 12:41 AM) Uncle can use 100 - ur age rule, this is the equity u can have, example 100 - uncle age (assume uncle age 60) = 40, mean suggested uncle can hold 40% of equity fund but uncle can lower it to 20% equity fund. Other uncle can put in may b money market fund 50% and 30% FI ( i assume uncle very Conservative investors). That won't work for him as he said "i just dont want to burn my saving that i kept for myself and my wife"Among the 20% equity, uncle can choose a few fund let say 5 or 6 and spread it consist global, asia n Malaysia fund. If uncle feel that 20% still high, lower to 10% or 5% oso ok. Increase later when u feel confident n comfortable. Suggest only. In unit trust, nothing is guaranteed. Things can go south. For investment, there's always a risk-ratio even with the lowest risk financial vehicle such as MMF which is sensitive to OPR cut (interest rate risk). That's why EPF, ASx FP, SSPN and FD are the best choices for him. He can sleep soundly at night. |

|

|

Jul 23 2020, 10:52 PM Jul 23 2020, 10:52 PM

Return to original view | IPv6 | Post

#16

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 23 2020, 11:03 PM Jul 23 2020, 11:03 PM

Return to original view | IPv6 | Post

#17

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jul 23 2020, 11:11 PM Jul 23 2020, 11:11 PM

Return to original view | IPv6 | Post

#18

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Jul 23 2020, 11:08 PM) He seems like contradicting his ownself.One side said "dont want to burn my saving" and another side keeps dumping money here, there aimlessly with the mindset of "just 10k saja ma". You get my point? |

|

|

Jul 23 2020, 11:14 PM Jul 23 2020, 11:14 PM

Return to original view | IPv6 | Post

#19

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Jul 23 2020, 11:13 PM) Well, he has all the time in the world. Let him be then. Another thing, he's rather impatient too if you got what I said. This post has been edited by GrumpyNooby: Jul 23 2020, 11:26 PM |

|

|

Jul 24 2020, 12:18 PM Jul 24 2020, 12:18 PM

Return to original view | Post

#20

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Jul 24 2020, 12:17 PM) But long term do you see reit as a good investments? REIT can be in malls rental & management or office space rental.Even now I go shopping mall some like empty but Malaysia consider good la. Again some tenant also gave up cause cannot pay rental. Have a friend who have 2 lots in berjaya times quare tell me rental 30k per month saja but now 1 day do about 1.2k of business and have 30 employees. Totally cannot cover. It depends on the REIT operator portfolio and mandate. |

| Change to: |  0.0486sec 0.0486sec

0.79 0.79

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 11:06 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote