Outline ·

[ Standard ] ·

Linear+

Tax relief due to retrenchment

|

TSlawrencesha

|

Mar 14 2017, 05:42 PM, updated 8y ago Mar 14 2017, 05:42 PM, updated 8y ago

|

|

Hi, I got retrenched in March 2106 and since then I could not get a job in MY. I was told by the HR that I can file for tax relief due to retrenchment. However, I could not find this option in the BE form. May I know how to go about this? Thanks.

|

|

|

|

|

|

sunami

|

Mar 14 2017, 05:49 PM Mar 14 2017, 05:49 PM

|

|

what kind of tax relief you are looking for?

|

|

|

|

|

|

TSlawrencesha

|

Mar 14 2017, 05:53 PM Mar 14 2017, 05:53 PM

|

|

QUOTE(sunami @ Mar 14 2017, 05:49 PM) what kind of tax relief you are looking for? This compensation is exempted from tax If compensation received is due to ill health Compensation received in other cases: Termination before 1st July 2008 - exemption of RM6,000 for every completed year of service with the same employer or with companies in the same group Termination on or after 1st July 2008 - exemption of RM10,000 for every completed year of service with the same employer or with companies in the same group |

|

|

|

|

|

SmallPenguin

|

Mar 14 2017, 05:54 PM Mar 14 2017, 05:54 PM

|

|

Did you receive any compensation or gratuity from your previous company? It's taxable but it also has exemption. I think there's no personal relief for retrenchment. Only if you have a family, your wife/husband doesn't work, then under joint assessment, you can deduct for RM4k only. First year learning tax, don't blame me if I'm wrong. Just trying to help.  |

|

|

|

|

|

SmallPenguin

|

Mar 14 2017, 05:57 PM Mar 14 2017, 05:57 PM

|

|

QUOTE(lawrencesha @ Mar 14 2017, 05:53 PM) This compensation is exempted from tax If compensation received is due to ill health Compensation received in other cases: Termination before 1st July 2008 - exemption of RM6,000 for every completed year of service with the same employer or with companies in the same group Termination on or after 1st July 2008 - exemption of RM10,000 for every completed year of service with the same employer or with companies in the same groupYes, compensation is a part of your gross income in Section 13 (1)(e), you can deduct for this one. But if you got gratuity, it goes to Section 13 (1)(a). RM1k for each completed year of service |

|

|

|

|

|

TSlawrencesha

|

Mar 14 2017, 06:40 PM Mar 14 2017, 06:40 PM

|

|

QUOTE(SmallPenguin @ Mar 14 2017, 05:54 PM) Did you receive any compensation or gratuity from your previous company? It's taxable but it also has exemption. I think there's no personal relief for retrenchment. Only if you have a family, your wife/husband doesn't work, then under joint assessment, you can deduct for RM4k only. First year learning tax, don't blame me if I'm wrong. Just trying to help.  QUOTE(SmallPenguin @ Mar 14 2017, 05:57 PM) Yes, compensation is a part of your gross income in Section 13 (1)(e), you can deduct for this one. But if you got gratuity, it goes to Section 13 (1)(a). RM1k for each completed year of service Thank you so much. I'll take a look at it right now! |

|

|

|

|

|

SmallPenguin

|

Mar 14 2017, 06:43 PM Mar 14 2017, 06:43 PM

|

|

QUOTE(lawrencesha @ Mar 14 2017, 06:40 PM) Thank you so much. I'll take a look at it right now! Your welcome  |

|

|

|

|

|

cpk

|

Mar 14 2017, 06:49 PM Mar 14 2017, 06:49 PM

|

Getting Started

|

Interested to know, saw those info in other site, The question is where and how to file? visit LHDN?

|

|

|

|

|

|

kucinggemok

|

Mar 14 2017, 07:12 PM Mar 14 2017, 07:12 PM

|

Getting Started

|

U can just follow the amount as per ur ea form

|

|

|

|

|

|

kucinggemok

|

Mar 14 2017, 07:15 PM Mar 14 2017, 07:15 PM

|

Getting Started

|

Btw its cp22a tax relief form that you are asking. Ur employer should fill in the notification of cessation of employment to lhdn

|

|

|

|

|

|

cpk

|

Mar 14 2017, 07:22 PM Mar 14 2017, 07:22 PM

|

Getting Started

|

How/Where to specify exemption of RM10,000 for every completed year of service? Don't see any column to fill in.

|

|

|

|

|

|

TSlawrencesha

|

Mar 14 2017, 07:24 PM Mar 14 2017, 07:24 PM

|

|

QUOTE(kucinggemok @ Mar 14 2017, 07:12 PM) U can just follow the amount as per ur ea form Agree. there is already an item for "5. Pampasan kerana kehilangan pekerjaan"... |

|

|

|

|

|

cpk

|

Mar 14 2017, 08:30 PM Mar 14 2017, 08:30 PM

|

Getting Started

|

Thanks for responding.  Doing e-filling. Don't see item "5. Pampasan kerana kehilangan pekerjaan"... You think can fill in no 1 or 2? Attached thumbnail(s)

|

|

|

|

|

|

kslian

|

Mar 14 2017, 08:32 PM Mar 14 2017, 08:32 PM

|

Getting Started

|

QUOTE(cpk @ Mar 14 2017, 08:30 PM) Thanks for responding.  Doing e-filling. Don't see item "5. Pampasan kerana kehilangan pekerjaan"... You think can fill in no 1 or 2? 10k relief per year of service. |

|

|

|

|

|

cpk

|

Mar 14 2017, 11:02 PM Mar 14 2017, 11:02 PM

|

Getting Started

|

QUOTE(kslian @ Mar 14 2017, 08:32 PM) 10k relief per year of service. Yes, we know. Does anyone know and which part of the form to file in e-filing? |

|

|

|

|

|

kslian

|

Mar 14 2017, 11:14 PM Mar 14 2017, 11:14 PM

|

Getting Started

|

QUOTE(cpk @ Mar 14 2017, 11:02 PM) Yes, we know. Does anyone know and which part of the form to file in e-filing? If I recall correctly, 4 yrs ago I spoke with LHDN and they advised that I just take out RM70k from the EA issued by my previous employment. Just ensure you keep the termination letter with the amount indicated. Also, IIRC, there is a limit of RM10k per year upto max 7 yrs. You guys really need to call LHDN to discuss this. Get the correct feedback accordingly. This post has been edited by kslian: Mar 15 2017, 08:36 AM |

|

|

|

|

|

kslian

|

Mar 15 2017, 09:50 AM Mar 15 2017, 09:50 AM

|

Getting Started

|

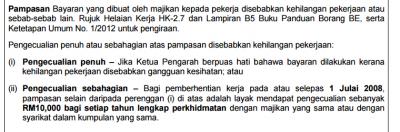

Just saw this in my nota penerangan. it is RM10k relief per year of full service. Didnt say anything about 7 yrs limit. And it is to be deducted from your total EA form amount. Again, call LHDN to reconfirm this. Attached thumbnail(s)

|

|

|

|

|

|

it.fusion

|

May 25 2017, 11:41 AM May 25 2017, 11:41 AM

|

Getting Started

|

believe we need to get letter from HR and walk in to LHDN office to get exemption letter and revert back to HR to exempt it..

This is the practice advised by the hr from company i am working for...and yea.. this shall be done before last payment is done to your account from the company...

|

|

|

|

|

|

amykhe

|

Mar 18 2018, 11:36 AM Mar 18 2018, 11:36 AM

|

New Member

|

I am also having the same problem.. May I know which column of EA 2017 I can fill in?

|

|

|

|

|

|

amykhe

|

Mar 18 2018, 11:37 AM Mar 18 2018, 11:37 AM

|

New Member

|

QUOTE(cpk @ Mar 14 2017, 09:30 PM) Thanks for responding.  Doing e-filling. Don't see item "5. Pampasan kerana kehilangan pekerjaan"... You think can fill in no 1 or 2? Please help. I have same problem now.. Any ppl can assist? |

|

|

|

|

Mar 14 2017, 05:42 PM, updated 8y ago

Mar 14 2017, 05:42 PM, updated 8y ago

Quote

Quote

0.0165sec

0.0165sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled