damn, i was looking at the wrong thread for the past 2 months

BWC

|

|

Apr 4 2017, 11:55 AM Apr 4 2017, 11:55 AM

Return to original view | Post

#1

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

|

|

|

Apr 4 2017, 11:51 PM Apr 4 2017, 11:51 PM

Return to original view | Post

#2

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Apr 4 2017, 03:00 PM) damn, i was looking at the wrong thread for the past 2 months your sarcasm is getting stronger liaoShit! Looks like I gotta dig another new hole to hide.................. chartians, if this 1 break 2.42, how ah? I try answer based on what you ask.... If it breaks 242 it will be higher than 242. Correct? of cuz we know it will be higher right after 242, but what happens after that? U turn, limit up, false signal? BTW, now is 243 how to set this trade? larger chart

BTW, for deeper research » Click to show Spoiler - click again to hide... « |

|

|

Apr 6 2017, 11:46 PM Apr 6 2017, 11:46 PM

Return to original view | Post

#3

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Apr 5 2017, 08:59 AM) LOL! Sorry la.. h Wow. so comprehensive. damn deep. but looks like insider know? but how do you know insider knows? because the price managed to bounce back before the release quarter report? looks like this counter only can buy low, but we don't know how low can it goes down to.» Click to show Spoiler - click again to hide... « chase high? you bet it, some insider may dump to you knowing that the upcoming is not very good. such good fundamental stocks also can be hard to trade. my mistake for indicating the resistance to be 2.42, it should be around 235 but just to be very sure it broken the line, i have to put 242 you probably might want to take into consideration that the stock did not really have a decent consolidation period i see ok wad. overall earnings should be better than last year. but then 330 is the barrier to break if next quarter is still impressive. i doubt so cause this quarter figure is higher due to fx gain |

|

|

May 14 2017, 11:08 PM May 14 2017, 11:08 PM

Return to original view | Post

#4

|

Senior Member

1,087 posts Joined: Apr 2013 |

how are you guys? was being very busy lately

ILoveLalat.net may i ask why Supermax is in your banned list? Their earning on quarter is decent. dividend yield is among the best. TA wise - will soon follow harta, kossan and topglove Boon3 remember the 4 horses on dunno which sunny day you posted? Kossan is the dark horse currently. Harta result was explosive. topglove story can leave it after supermax Some set up ideas to ponder many of us here is still all new tulips bulbs weh This post has been edited by spring onion: May 14 2017, 11:21 PM |

|

|

Jun 28 2017, 11:54 PM Jun 28 2017, 11:54 PM

Return to original view | Post

#5

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Suicidal Guy @ Jun 28 2017, 09:05 PM) Hello hello hello!!! interesting to see harta getting higher and higher. wonder when it will burst.Anyone looking at glove counters? COMFORT CAREPLS HARTA TOPGLOV KOSSAN SUPERMX Choose your horses... my pick would be supermax decent dividend yield, PE ratio, but because of the chairman remark 10 years back comfort looks good on paper but no dividend. macam mana ya?. resistance on RM1 my conclusion: trader POV, Comfort >> Careplus >> TG >> Harta >> kossan >> Supermax investor POV, Supermax >> TG >> kossan>> careplus >> harta >> Comfort |

|

|

Jun 30 2017, 12:01 AM Jun 30 2017, 12:01 AM

Return to original view | Post

#6

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Jun 29 2017, 06:57 AM) haiyo boon, don't always pour cold water lehbest investor always choose stock which is not laku ok ok back to trader corner. currently looking at Luxchem, macam exploding. breakout from resistance, what's next? and wanna ask, how come stock like harta, vitrox, kesm... all macam no brake one? how do you explain such matter? high PE means very laku? but earning trend DOES NOT lie, Q-Q up 20% but share price up 100%, where has logic gone to? |

|

|

|

|

|

Jun 30 2017, 08:19 AM Jun 30 2017, 08:19 AM

Return to original view | Post

#7

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Jun 30 2017, 05:56 AM) your opinion is pretty much valid, but already onboard to supermax since 3 years back. have to agree with your statement that it doesn't perform like others consolation? dividend that are on par with FD |

|

|

Oct 15 2017, 09:58 PM Oct 15 2017, 09:58 PM

Return to original view | Post

#8

|

Senior Member

1,087 posts Joined: Apr 2013 |

What's up guys? my harddisk blew off. took me 2 month to repair

Let's go. analysis stock no. 1 Kerjaya Prospek. Still have Legs? Bagging many projects

6 month chart. waiting to break resistance? Wow. gone up 7 times since 2013

very healthy wor. recently declare min 25% dividend policy Sometimes, how to consider a stock whether expensive or not? using PE? using Historical value? Cash flow? i dunno man |

|

|

Feb 25 2018, 10:58 PM Feb 25 2018, 10:58 PM

Return to original view | Post

#9

|

Senior Member

1,087 posts Joined: Apr 2013 |

so quiet this month ya. recently just repaired my 10 year old laptop.

my recent watchlist includes few of chemical company 1. Luxchem - producer of plastic chemical products 2. Samchem - chemical producer also 3. Pet chemical - big elephant 4. Hexza Recent, Samchem reported a solid qtr result, Luxhem so-so. need some help in TA can help analyze ah? |

|

|

Mar 1 2018, 10:48 PM Mar 1 2018, 10:48 PM

Return to original view | Post

#10

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Mar 1 2018, 10:34 PM) someone say, share which swings to extreme high and low are the best stock to trade*only watches it goes from 0.8 to 4.5* |

|

|

Mar 1 2018, 11:20 PM Mar 1 2018, 11:20 PM

Return to original view | Post

#11

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Apr 5 2018, 11:17 PM Apr 5 2018, 11:17 PM

Return to original view | Post

#12

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Oct 20 2018, 12:52 AM Oct 20 2018, 12:52 AM

Return to original view | Post

#13

|

Senior Member

1,087 posts Joined: Apr 2013 |

So dead ah this thread. Same goes to bursa also. So many stock discussed is now undervalue.

1. Samchem 2. Luxchem 3. Homer 4. Ah lat 5. Thong guan |

|

|

|

|

|

Mar 7 2019, 12:30 AM Mar 7 2019, 12:30 AM

Return to original view | Post

#14

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

|

|

Mar 10 2019, 11:20 PM Mar 10 2019, 11:20 PM

Return to original view | Post

#15

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Mar 9 2019, 12:31 PM) Boon like participation. i'll start the ball rollingBpplastic investment holding company, manufactures and trades plastic products in Malaysia. The company's products have two divisions, which include Industrial Packaging Division and Stretch Film Division. The Industrial Packaging Division includes plain and printed polyethylene (PE) collation shrink film, PE lamination-based film, general purpose bag and film, PE shrink hood and sheeting, printed Form-Fill-Seal (FFS) film, protective-based film, and magazine wraps. Thong Guan trading of plastic packaging products. It operates in two segments including Plastic products and Food, beverages and other consumable products. The company generates the majority of the revenue from the plastic products segment which comprises of stretch films, garbage bags, industrial bags and PVC (Polyvinyl chloride) food wrap. In short, both are plastic manufacturer. They import Resin and produce plastic product, mainly stretch film and plastic packaging |

|

|

Mar 10 2019, 11:30 PM Mar 10 2019, 11:30 PM

Return to original view | Post

#16

|

Senior Member

1,087 posts Joined: Apr 2013 |

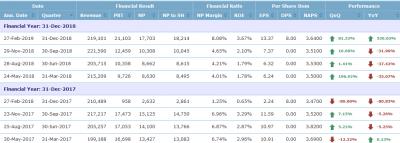

TGUAN

Revenue increasing, Profit erratic. Means sales improving BPPLATIC

Revenue maintained, Profit improving. Margin improved, Resin price drop? What's good if without chart for traders?

Clearly BPPLASTIC resistance broken today from mini cup and handler TGUAN Handler forming n progress My 2 cent opinion: BPPLASTIC is a better choice. Cash cow, every quarter milking milk. more stable company with better track record Thong Guan, when you look back, nothing particularly special, looking forward, they are improving their manufacturing technology, can you depends on track record to foresee the future earning? I i dont know So, how high can both go? this 2 stocks cannot fly without brake one remember the export theme in 2016? i win alot, and lose alot

This post has been edited by spring onion: Mar 10 2019, 11:49 PM |

|

|

Mar 12 2019, 11:42 PM Mar 12 2019, 11:42 PM

Return to original view | Post

#17

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Mar 12 2019, 04:38 PM) There are few other stocks in this family one could have selected a few months back.... not hard to find... Can’t be. Resin price? Probably Few other stocks? So many abang adik? Not many. Tomypack? Not good ScGM? Not good Uchitech? Hmmm Scienctex? Not in line wo Luxchem? Inverse relationship Don’t always hide in bushes come Come share some knowledge ler This post has been edited by spring onion: Mar 12 2019, 11:57 PM |

|

|

Mar 14 2019, 12:32 AM Mar 14 2019, 12:32 AM

Return to original view | Post

#18

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Mar 13 2019, 09:36 AM) Aiyoh.. miss out this one in the list Hahaha.. this stock reported earning ahead of bpplatic Both spiked after this stock announced its revised result on now 10 However, traders should also take note on Q to Q comparison which reported on 2nd nov , also which earnings were worse then aug earnings. All were trading cautiously until breakout appear This post has been edited by spring onion: Mar 14 2019, 12:38 AM |

|

|

Mar 15 2019, 12:02 AM Mar 15 2019, 12:02 AM

Return to original view | Post

#19

|

Senior Member

1,087 posts Joined: Apr 2013 |

QUOTE(Boon3 @ Mar 14 2019, 08:01 AM) The best entry trades are usually made when the market is irrationally cautious, esp witnessed during end last year. The market started 2018 around 1800 and ended close to 1600plus. The fear that market would crash. Billion dollar question Now q-q comparisons. You cannot do comparison like Aug with Nov because you would commit the grave mistake because many companies have seasonal characteristics with their earnings. For example many might have better year end profits compared to start of the year earnings. Most important that Nov earning represented the 3 consecutive quarter of profit growth, which makes a stark contrast if one compares with its previous year earnings result. In simple England, clearly the earnings has had turned around positively. Now with that info, ask the other logical question. Does the stock deserve to be trading where it was? If the answer was yes.... then what should the speculator have done? Wished I would know how. So how to speculate wisely? |

|

|

Mar 15 2019, 12:03 AM Mar 15 2019, 12:03 AM

Return to original view | Post

#20

|

Senior Member

1,087 posts Joined: Apr 2013 |

|

| Change to: |  0.0273sec 0.0273sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 10:45 AM |