QUOTE(Boon3 @ Aug 19 2020, 09:07 AM)

Sorry went for a morning walk...

not much view on it ....

I had SuperMan on my fake trade cos technically it was a sell and I wanted to see if I can catch a trade based on 'the correction had been too much too fast etc'...

well... i didn't catch a trade .. even for my 555 book.

I really got nothing much to say...

more negative on the bonus issue...

this is what I am guessing...

once it goes ex and the price is adjusted...

those few days... it might see a pop but once the bonus shares are credited into account... i think could see the stock actually slide...

size of a shares matters a lot for me....

big shares stock is much harder to move .....

compared to smaller size....

stocks like TG will be a 8 billion size listing....

it's not gonna be easy to move ....

i had to wait until closing today to check with you again!

if u can take a fresh look at TG... for learning purposes.

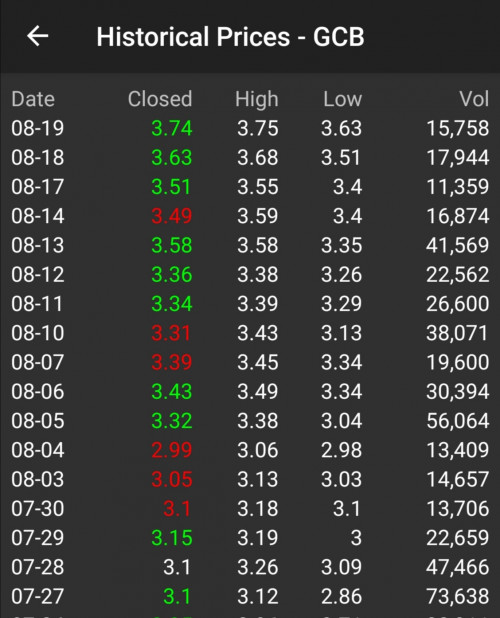

.. i see 3 white soldiers after 9 days of correction/flat... should be a confirmed reversal, bullish next week!?

.. uptrend is intact.

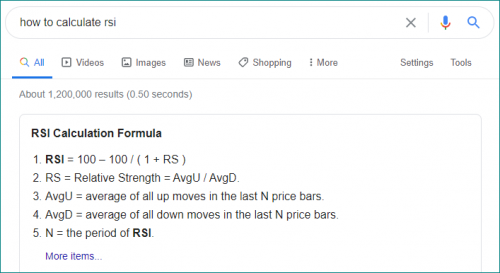

.. rsi 61 is ok, not overbought.

.. vol is not big but is decent.

.. bonus/split ex-date sep 3.

.. QR sep 17.

i dun see same with any other.

superman is a bit like TG but not as good... i have doubts.

talking of which i make rm50 from spmx today!

Aug 19 2020, 04:42 PM

Aug 19 2020, 04:42 PM

Quote

Quote

0.0375sec

0.0375sec

0.91

0.91

6 queries

6 queries

GZIP Disabled

GZIP Disabled