QUOTE(Boon3 @ Mar 4 2022, 04:52 PM)

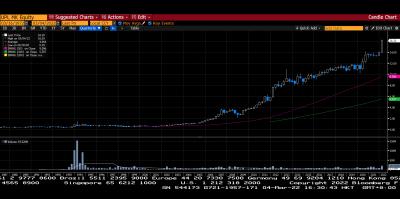

And today... for comparison, the last quarter alone, UP net profit is around 150+ million.... with total net profit estimated above 550 million.

yeah... from a net profit of 40 million in 2001... to a net profit estimated around 550 million in 2021..... that should explain the monstrous rise in stock price since 2001....

but plantations... obviously... the size of the plantation land is so crucial.... the bigger the planted land, the crop returns should grow ...

and then one needs to factor in the fertility of the planted land.

this fertility issue sounds so trivial but issues like this does crop out in our cpo stocks.

there's way too much factors involved.... which is way too complex for me... study land, study fertility, study weather, study other crops.... and then... it's palm oil.... which means we got the lobby factor (ie countries lobbying against our palm oil) .... and then... workers issue.... and then of course, not all management is the same....which means I surrender.

as for land, they are primarily in Perak, where home of flat land in peninsular, which makes it very easy for their mechanisation effort.

on rainfall, malaysian average annual rainfall of >2500 make our shore very suitable for oil palm planting.

land fertility dunno how to comment, but if they have prepare their land in a very good shape for planting from the start, they have no problem of going into 3 planting cycles easily. one cycle is 25 years + 3 years of immature from replanting = 28 years.

There's always ppl who are against your palm oil, but everybody knows that with scarcity of lands, oil palm is the only crop that can give the most produce in every hectare of planting, compared to corn, sunflower, etc etc....

workers issue is definitely one, but they are not as heavily hit as their mechanisation helped a lot......

anymore did i miss?

Mar 4 2022, 04:17 PM

Mar 4 2022, 04:17 PM

Quote

Quote

0.2015sec

0.2015sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled