QUOTE(Smurfs @ Jan 29 2021, 09:01 AM)

It must be one of the i3 loser who started those stupid comments.

Lose money? Blame IBs and shorties.

BWC

|

|

Jan 29 2021, 09:08 AM Jan 29 2021, 09:08 AM

Return to original view | IPv6 | Post

#1721

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 29 2021, 09:09 AM Jan 29 2021, 09:09 AM

Return to original view | IPv6 | Post

#1722

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 29 2021, 11:41 AM Jan 29 2021, 11:41 AM

Return to original view | Post

#1723

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Smurfs @ Jan 29 2021, 09:21 AM) And out of so many stocks, why would the telegram group choose to pump up TopGlove Clearly many are stuck, so create telegram group and hope and pray they can copycat GME. why not other random ACE market stocks They think their gloves stocks is getting no low and no where but down, despite their insane current earnings (harlo ... do they understand forward earnings? just imagine.... what if .... yup .... what if ... the glove earnings growth starts to decline. |

|

|

Jan 29 2021, 11:42 AM Jan 29 2021, 11:42 AM

Return to original view | Post

#1724

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(prophetjul @ Jan 29 2021, 10:16 AM) |

|

|

Jan 29 2021, 11:48 AM Jan 29 2021, 11:48 AM

Return to original view | Post

#1725

|

All Stars

15,942 posts Joined: Jun 2008 |

p/s .... and this is why sites like i3 are so toxic ....... the minute a share go down... blame sini, blame sana .... blame it on the shorts.

And shorting is so, so, so much more difficult to make money. The understanding of the company's fundamentals has got to be so spot on. The valuations ..... and understanding the stock itself. .... and then there is a time frame too. Simply short .... u die one .... So if one see a bunch of short in a stock... why force yourself into a bet, arguing the shorts are wrong? do they think they get extra credit for winning such trade? |

|

|

Jan 29 2021, 12:00 PM Jan 29 2021, 12:00 PM

Return to original view | Post

#1726

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 29 2021, 11:51 AM) Basic human psychology. The self must be preserved. Two simple questions such as ....It is never really our fault, always other factors at play. Really expensive way of thinking in the markets. 1. Did we overpay for the stock? 2. Was our valuation of the stock too optimistic? usually not asked ...... got some other stocks doing fairly well.... |

|

|

|

|

|

Jan 29 2021, 12:21 PM Jan 29 2021, 12:21 PM

Return to original view | Post

#1727

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 29 2021, 01:03 PM Jan 29 2021, 01:03 PM

Return to original view | Post

#1728

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 29 2021, 12:24 PM) The shocking thing for most retailers I talk to is that they don't even know if the company they bought shares in turned a profit or a loss last quarter. .... and then .... were you around when stock forums had stock promoters? One famous one that posted in lowyat, i3 and had own blog is called Bone***** of course recently ... telegrams.... but the game still remain the same.... seducing suckers to gobble up what they spit out.... |

|

|

Jan 29 2021, 03:59 PM Jan 29 2021, 03:59 PM

Return to original view | Post

#1729

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 29 2021, 03:41 PM) I don't think I was active in the stock forum when the promoters were here. http://www.investsmartsc.my/pump-and-dump/For the longest time, I was more of a solo investor without social interaction in regards to Bursa. Guess the lockdown changed my patterns a bit to actually see what everyone else was up to. Google the name mentioned.... In all honesty, not much different than old fart at i3... And yeah....every now and then... a smaller version would show up even in lowyat. Forums/social media... cavaet emptor |

|

|

Jan 29 2021, 05:05 PM Jan 29 2021, 05:05 PM

Return to original view | Post

#1730

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 29 2021, 06:52 PM Jan 29 2021, 06:52 PM

Return to original view | Post

#1731

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 29 2021, 06:54 PM Jan 29 2021, 06:54 PM

Return to original view | Post

#1732

|

All Stars

15,942 posts Joined: Jun 2008 |

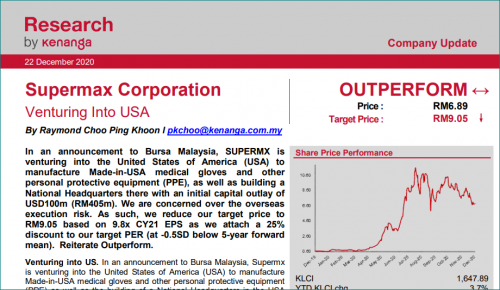

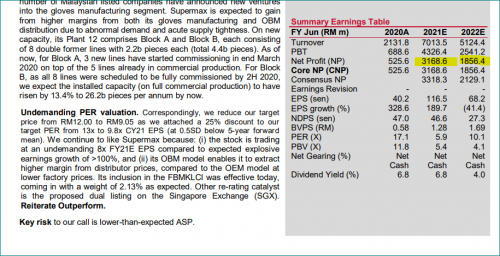

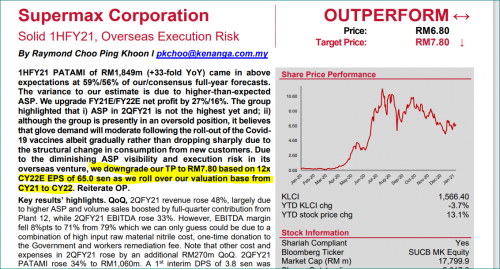

QUOTE(Boon3 @ Jan 26 2021, 01:26 PM) Superman's Q coming, yes? Well.. we got the billion dollar profit. In the same context ...  and this is Kenanga last report on Superman...  the earnings estimation ....  Water observations 1. They use CY (calendar year) instead of FY. 2. Their FY21 estimate is at 3.16 Billion 3. Their FY22 estimate shows a lower trend. Just like TopGlove. 4. Comparing their FY21 estimates with actual Superman numbers. Their estimates is at 3.168 billion. Superman did 789 million for its FY21 Q1. Meaning to say, Kenanga assumes/estimates that Superman will report 3.168-0.789 ~ 2.379 million remaining 3 quarters. Average out = 793 million per quarter. ( Haven't been paying attention but the bar is set very low... ) |

|

|

Jan 29 2021, 07:47 PM Jan 29 2021, 07:47 PM

Return to original view | Post

#1733

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 29 2021, 08:02 PM Jan 29 2021, 08:02 PM

Return to original view | Post

#1734

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 29 2021, 07:50 PM) Just referencing the running joke that every single billion profit QR the glove companies have announced, the share price drops the very next day. The latest was Harta last week. So people have been calling it the Glove Jinx. Let's see if SPMX becomes the first to break the jinx. Okay... I won't say more. Well, have a good weekend. Cheers! |

|

|

Feb 2 2021, 09:53 AM Feb 2 2021, 09:53 AM

Return to original view | Post

#1735

|

All Stars

15,942 posts Joined: Jun 2008 |

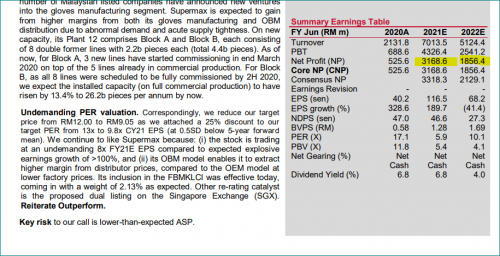

This is CIMB coverage on Superman

1. Remember post #3603... In Nov the TP was 13.20 In post #3603, the lowered it to 10.80 Latest, they up the TP higher to 11.80 2. Their earnings forecast they changed... 21F 3.231 Billion changed to 4.453 Billion 22F 2.286 Billion changed to 2.703 Billion 23F 1.598 Billion changed to 1.607 Billion (LOL! ... really? They increased the estimates all over 3. The declining earnings trend is the same, Superman is expected to earn much less money next FY. 4. They are basing the earnings on CY22 numbers. Be very careful... it's calendar year and not fiscal year. CY22 numbers for Superman will effectively consists of the following quarters... fy22 Q2, fy 22Q3, fy 22Q4 and fy 23Q1 numbers.... 5. The target price of 11.80 is based on 15x CY22F P/E..... which means their CY22 estimate eps is 11.80 / 15 = 78.6sen With a share base of 2.721 billion shares, the estimate profits should be around 2.138 Billion. 6. Point 4. CY22 consisting of fy22 Q2, fy 22Q3, fy 22Q4 and fy 23Q1 numbers.... note .... fy 21 Quarterly profits aren't there. It's no longer used to calculate the TP. Yup... what is important for the market is what the stock can earn in the future. This post has been edited by Boon3: Feb 2 2021, 09:54 AM |

|

|

Feb 2 2021, 10:02 AM Feb 2 2021, 10:02 AM

Return to original view | Post

#1736

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Jan 26 2021, 01:26 PM) Superman's Q coming, yes? ... and this is Kenanga's writeup on Superman....In the same context ...  and this is Kenanga last report on Superman...  the earnings estimation ....  Water observations 1. They use CY (calendar year) instead of FY. 2. Their FY21 estimate is at 3.16 Billion 3. Their FY22 estimate shows a lower trend. Just like TopGlove. 4. Comparing their FY21 estimates with actual Superman numbers. Their estimates is at 3.168 billion. Superman did 789 million for its FY21 Q1. Meaning to say, Kenanga assumes/estimates that Superman will report 3.168-0.789 ~ 2.379 million remaining 3 quarters. Average out = 793 million per quarter. ( Haven't been paying attention but the bar is set very low... ) they lowered ..... the TP.   Estimates are raised higher but fy22 numbers are much lower.... And they are also using CY estimates.... |

|

|

Feb 2 2021, 10:24 AM Feb 2 2021, 10:24 AM

Return to original view | Post

#1737

|

All Stars

15,942 posts Joined: Jun 2008 |

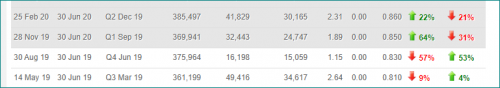

QUOTE(statikinetic @ Feb 2 2021, 10:06 AM) Good read in the morning. Looks like the Q result forced them on an upward revision in terms of their numbers. Well.... exactly... The drop off between 21F and 22F looks especially steep. I've read somewhere that the orderbook extends at least into 22F so maybe they know something I don't. The last point in the most interesting one in this narrative because everyone seems to be in agreement that it will earn in the short term but will fall in the longer term. Exactly which point in time the drop will come and how steep seems to be the common area of disagreement. This particular report paints the view that the pandemic would be out of the critical zone by beginning 22F and done with by 23F. Incredibly, this was the view that the market had. They all had the same conclusion on their working estimates. Then MacQuarie had the guts to call it out last Sep. It's a genuinely unique position. It's very hard to fanthom that the glove makers are making billions CURRENTLY and yet, the bear camp are treating them as if the glove makers are carrying a plague.... Earn so much... but price so low... Hence.... ppl started looking for excuses.... the research reports... the call warrants... the shorties..... Let's reverse the situation.... Say one was a buyer of .... errr... Superman. Around end March or April .... that would have been the buying zone.... Now, at that time... was Superman's earnings very good? The below screenshot... shows the current or trailing 12 months earnings for Superman. It was very really average. There was no boom boom earnings...  Yet... the stock soared ..... many bags could have been won! why? Isn't it because.... due to the pandemic... the glove makers were PROJECTED to make mega bucks? So based on what the stock is estimated in the future, the stock soared..... Now... current earnings show big bucks .... but the future (?) ... the earnings is expected to decline. See? |

|

|

Feb 2 2021, 10:28 AM Feb 2 2021, 10:28 AM

Return to original view | Post

#1738

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Smurfs @ Feb 2 2021, 10:17 AM) There is a common blind spot too about Fundamental Analysis... All data used in Fundamental Analysis are usually PAST figures , things that already happened....Be it EPS / cash flow etc Yes, no doubt all these data are good for analysis purpose...those figures in balance sheet can help identify company with high debt...those figures in cash flow statement can somehow see the "style" of company in managing their cash.. Just becareful, dont buy into stocks because the PAST data ask you to buy. Just keep it simple...yes the company is doing very well in the past 5 years, BUT can the company earn more in coming years? This is why stock market investing is interesting For the glove cases, roughly one can estimate based on annual production volume & ASP...the main main / concern here is the declining ASP. (eventually in the future)...which lead to decline profit..Hence i'm not sure current share price is traded how many years ahead I believe they do not realise that .. a simple decline of a mere 20% in ASP .... would bring havoc to earnings. |

|

|

Feb 2 2021, 10:37 AM Feb 2 2021, 10:37 AM

Return to original view | Post

#1739

|

All Stars

15,942 posts Joined: Jun 2008 |

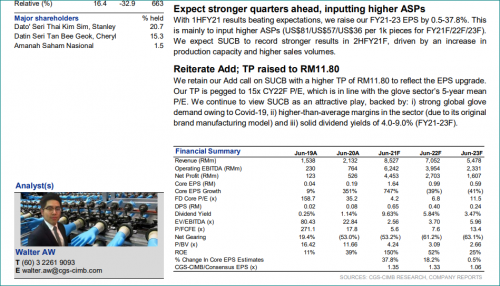

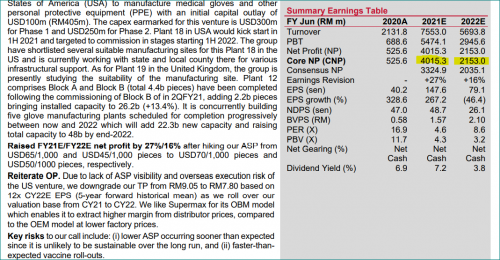

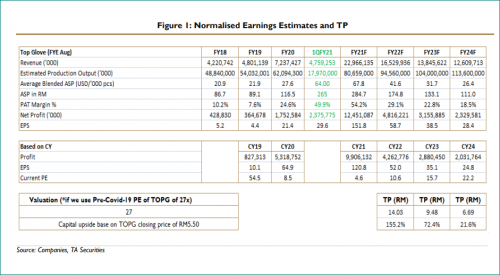

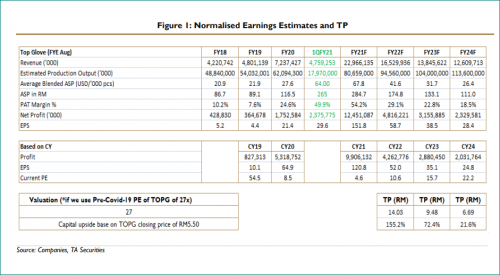

QUOTE(statikinetic @ Feb 2 2021, 10:06 AM) Good read in the morning. Looks like the Q result forced them on an upward revision in terms of their numbers. TA Research has one good estimate table.... you can download the whole file from Bursa website. The drop off between 21F and 22F looks especially steep. I've read somewhere that the orderbook extends at least into 22F so maybe they know something I don't. The last point in the most interesting one in this narrative because everyone seems to be in agreement that it will earn in the short term but will fall in the longer term. Exactly which point in time the drop will come and how steep seems to be the common area of disagreement. This particular report paints the view that the pandemic would be out of the critical zone by beginning 22F and done with by 23F. https://eresearchsystem.bursamalaysia.com/e...ad.pub?id=32845 On that table, they show their calculations + the average ASP (average ASP cos the latex and nitrile gloves sells at different prices) ....  |

|

|

Feb 2 2021, 11:34 AM Feb 2 2021, 11:34 AM

Return to original view | Post

#1740

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Feb 2 2021, 10:38 AM) I'm not in healthcare, so someone who is may have a better view on this. The TA report link... did you download it?I think normalize will mean falliing away from the hyper-demand levels in the pandemic, but will never be pre-Covid. Medical infrastructure has expanded significantly in the Covid battle, and processes & safeguards tightened. Like in China, the average use of gloves went up even for non-Covid cases due to policy changes. Maybe we can wait for our resident medical specialist to comment. there's a lot of interesting points. The table again...  1. It includes the production numbers .... 2. See the ASP estimates for fy21 and fy22. They are projecting ASP of rm284 in fy21 to fall/normalise to rm174.80. That should be around 30% plus... I think. 3. The pre covid level is below rm90. 4. With the production numbers and the revenue of the past, clearly the ASP is the boom boom boom factor. 5. See the naughty CY numbers.... esp for 2019 and 2020. See how the CY numbers differ. (the CY numbers is higher Now for example, the fy22 estimate net profit is 3.888 (see page 1 of the report), the CY22 estimate is 4.262 Billion. So by using CY numbers, we see that the profit numbers are much higher versus the FY numbers. Lastly .... the ASP numbers. My arguments on the past is based on simple business practice. Cos I do not believe a business can jack up their Selling Prices for a long period of time. For TG, using TA numbers, we saw pre covid ASP of rm89 increasing all the way to rm265.00. For me, such alleviated prices can never last..... HereToLearn liked this post

|

| Change to: |  0.1621sec 0.1621sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 10:47 AM |