QUOTE(sjteh @ Jan 25 2021, 07:50 PM)

Hi boon gor,

Think is kenanga foresee 3rd q earned 1b, so 4th q also 1b without revise asp.

Total 4q is bout 2.7-2.8b

Almost there la....

😁

Would you call it a fantastic blowout quarter?

BWC

|

|

Jan 25 2021, 07:57 PM Jan 25 2021, 07:57 PM

Return to original view | Post

#1681

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 26 2021, 08:57 AM Jan 26 2021, 08:57 AM

Return to original view | Post

#1682

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 25 2021, 08:03 PM) Man, those ESOS prices. The ones I usually see are 10 - 20% range of the market. You are in Superman. This one is literally a guaranteed skim cepat kaya. My portfolio kept sinking on average due to market weakness that I had to make a punt to try and prop up the portfolio value. I snuck into SPMX last week. If things keep sinking and goes contrary to the glove counters, I'll hedge em. Well, today's focus would be on Harta. Please refer post made earlier. As a trader those were the 2 points I would focus on. Was the earnings pretty much in line with expectations or was it a total blowout quarter (ie surprisingly good). If it's in line with expectations, generally the so called good earnings is already priced in. If it surprises to the upside, well, maybe you could get a big bang. And then... did the stock moved up before the earnings release? The ESOS ..... see this is one of the many reasons why I don't like about TopGlove. Already considered billionaire atas class already. Still need to enrich themselves with ESOS priced so low? |

|

|

Jan 26 2021, 09:20 AM Jan 26 2021, 09:20 AM

Return to original view | Post

#1683

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 26 2021, 09:09 AM) In terms on being a billionaire, I guess the dream of beating Maybank might be gone so why not replace it with individual wealth instead? the boss gets 335,097 ESOS shares too!! Ok, he is on a million dollar salary but does the company really need to issue so much ESOS to him too? https://www.topglove.com/App_ClientFile/7ff...2020_Latest.pdf pg. 62. |

|

|

Jan 26 2021, 09:23 AM Jan 26 2021, 09:23 AM

Return to original view | Post

#1684

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 26 2021, 09:09 AM) Gloves moved up on a block yesterday when everything is bleeding red. and Harta is now down.I guess the assurance on the lockdown news is turning the market back green today morning with gloves as usual taking the opposite direction. Overall, feels like a market reaction to the MCO factor rather than an earnings reaction. yup not unexpected for me. Earnings, although was very good, but the market was already expecting those good numbers. This post has been edited by Boon3: Jan 26 2021, 09:23 AM |

|

|

Jan 26 2021, 12:04 PM Jan 26 2021, 12:04 PM

Return to original view | Post

#1685

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 26 2021, 12:17 PM Jan 26 2021, 12:17 PM

Return to original view | Post

#1686

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 26 2021, 12:24 PM Jan 26 2021, 12:24 PM

Return to original view | Post

#1687

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 26 2021, 12:42 PM Jan 26 2021, 12:42 PM

Return to original view | Post

#1688

|

All Stars

15,942 posts Joined: Jun 2008 |

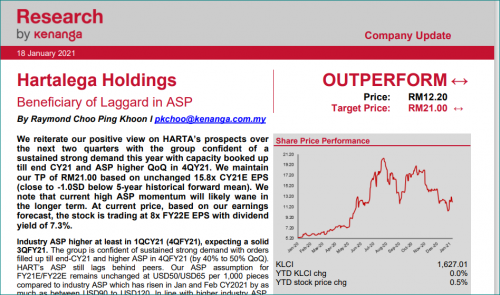

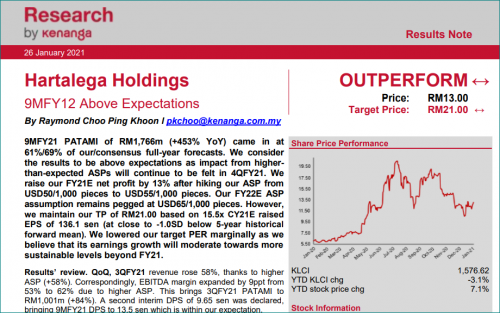

Comparing Kenanga's report on Harta before and after Harta's earnings report.

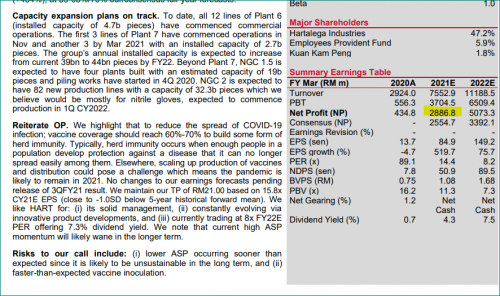

Before  After  Water Observations 1. They said above expectations. 2. They increased FY21 earnings by 13% 3. It's tricky cos yesterday earnings was fy21 Q3. Now instead of basing the Toilet Paper prices on fy22, Kenanga decided to use CY 21 earnings. Calendar year earnings. Which means Toilet paper earnings will be based on FY21 Q3 (already reported) + FY21 Q4 + FY22 Q1 + FY22 Q2 earnings. We know that the Q3 earnings was already high at 1 billion. 4. Yup, despite earnings beat expectations, they did NOT raise the Toilet Paper price of 21.00. Before  After  Water Observations 1. FY21 net profit estimate is raised from 2.88 Billion to 3.2 Billion 2. FY22 net profit is left unchanged. (Ah, Harta's earnings is estimated to be higher in FY22. Unlike TopGlove) 3. To put fy21 numbers into perspective... currently Harta 3 quarters net profit already totals 1.76 bil. Which means Kenanga is estimating Harta would earn 1.52 bil for its next quarter (fy21 Q4). Yes, from 1 bil to 1.52 billion. That's how high the EXPECTATIONS. 4. Look at the risk to their call. They are saying that the risk is that they might be too optimistic. Interesting? |

|

|

Jan 26 2021, 01:26 PM Jan 26 2021, 01:26 PM

Return to original view | Post

#1689

|

All Stars

15,942 posts Joined: Jun 2008 |

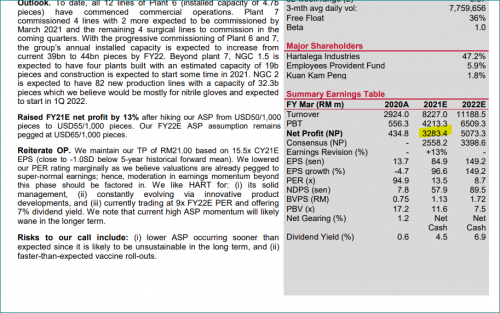

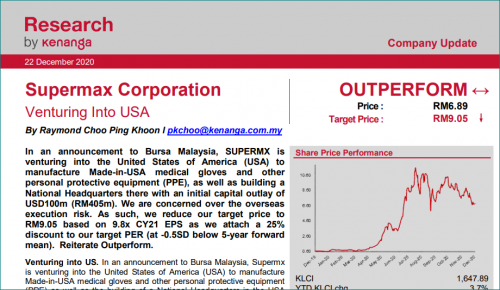

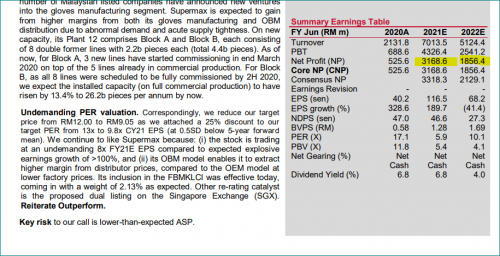

QUOTE(statikinetic @ Jan 26 2021, 12:51 PM) It is interesting. Superman's Q coming, yes?It is almost a case of putting the cart before the horse. Instead of looking at the data and deriving some off it, it is instead concluding Harta is a great buy at the start and seeing what numbers can be pulled together tu support that view. The volatility of glove makers probably nobody knows how to value them due to the fluid situation we have, blending vaccinations and new mutations. On another note, I am ready for CNY considering how festive my portfolio looks right now. It's gone from the red and green of Christmas to mostly red. In the same context ...  and this is Kenanga last report on Superman...  the earnings estimation ....  Water observations 1. They use CY (calendar year) instead of FY. 2. Their FY21 estimate is at 3.16 Billion 3. Their FY22 estimate shows a lower trend. Just like TopGlove. 4. Comparing their FY21 estimates with actual Superman numbers. Their estimates is at 3.168 billion. Superman did 789 million for its FY21 Q1. Meaning to say, Kenanga assumes/estimates that Superman will report 3.168-0.789 ~ 2.379 million remaining 3 quarters. Average out = 793 million per quarter. ( Haven't been paying attention but the bar is set very low... ) |

|

|

Jan 26 2021, 01:55 PM Jan 26 2021, 01:55 PM

Return to original view | Post

#1690

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 26 2021, 01:41 PM) My expectation of Superman's QR is it should include the letter 'B'. If you look at the screenshot, the consensus net profit is only slightly higher at 3.3 Billion for fy21. CIMB is at 3.231. Kenanga is less bullish of Superman's prospects, and the falloff for '23 is interesting. Out of curiousity, between the Big 4, which would be your personal pick if you were forced into one? Just came across the article below in the Star. Covid-19 pandemic could last four or five years: Singapore minister https://www.thestar.com.my/aseanplus/aseanp...gapore-minister Anyway, for Kenanga, in Aug 2020, after Superman reported an earnings of 526 million, the fy21 Estimates numbers was 1.63 billion. That was upgraded to 3.168 billion in Oct. So ya... a billion dollar net profit for its next quarter should be considered a blowout quarter ..... That's the number you would want to see..... * but note .... see how Superman's earnings is supposed to fall off the cliff in 2022. This post has been edited by Boon3: Jan 26 2021, 01:56 PM |

|

|

Jan 27 2021, 09:03 AM Jan 27 2021, 09:03 AM

Return to original view | Post

#1691

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 26 2021, 09:29 PM) I do agree that the benchmark to value a business is in the revenue generation. WOW!! first of alll... great stuff.If you are using the measurement of a business in turning earnings to net cash (Disregarding profit margins, revenue growth, etc), wouldn't it be better to use Cash from Op instead? Free Cash Flow (As a bank balance) is influenced by investing and financing activities, and high growth companies use a fair amount of cash to expand so how much they leave in the bank will be skewed. The number of years used in the formula influences the final value so was wondering of the significance of the 5 years. So if I use a smaller number like 4, I end up with a smaller value (2.91). If I expand it to 6, it increases the value.[B] Anyhow, let's jump into the projected growth of the company at 10%. I think the industry is expected to grow at 6-7%, not sure if I remembered it wrongly as I read it somewhere and is purely from memory. If that is true, then would it be better to use industry growth rate as a projection? Sorry for the deluge of questions! ya.. I do note that the number of years do play a significant part. Discount it too far into the future and the figures do really get dizzy. even the discount rate .... |

|

|

Jan 27 2021, 09:05 AM Jan 27 2021, 09:05 AM

Return to original view | Post

#1692

|

All Stars

15,942 posts Joined: Jun 2008 |

smurfs

saw it yesterday evening.... » Click to show Spoiler - click again to hide... « |

|

|

Jan 27 2021, 09:22 AM Jan 27 2021, 09:22 AM

Return to original view | Post

#1693

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 27 2021, 09:26 AM Jan 27 2021, 09:26 AM

Return to original view | Post

#1694

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MedElite23 @ Jan 26 2021, 07:56 PM) CODE @statikinetic Projected growth rate of Thong Guan’s cash flow in the next 5 years. TGuan’s YoY net profit has been growing at CAGR of 15.23% (NP T4Q 80615 - 39679 NP 2015 over the last 5 years). *all figures are in 000’* Conservatively speaking, I’ll take CAGR 10% after factoring in possible drop in sales, fluctuation of resin prices & foreign exchange losses). Discount factor formula: 1/(1+risk free rate)^n , whereby n = number of years to be discounted. Our current OPR is 1.75%. (In United States, risk free bond rate is used instead). Based on above formula: Discount factor of TGuan in next 5 years: 1/1.0175, 1/1.0353, 1/1.0534, 1/1.0719, 1/1.0906 for year 2020, 2021, 2022, 2023, 2024 respective. Discount factor of TGuan: 0.983, 0.966, 0.949, 0.933, 0.917 Next, we need to find the discounted value of all future cash flow. (DV) DV = Projected cash flow x Discount factor Assuming the projected earnings and cash flow to be increasing at the rate 10% annually, the projected cash flow for year 2020 = free cash flow 2019 + 10% growth.. free cash flow for year 2021 = free cash flow 2020 + 10% growth…etc.. Free cash flow 2019: 227,217 Projected free cash flow 2020: 249,938 Projected free cash flow 2021: 274,931 Projected free cash flow 2022: 302,424 Projected free cash flow 2023: 332,666 Projected free cash flow 2024: 365,932 Total discount value for year 2020-2024: 245,689 + 265,583 + 287,000 + 310,377 + 335,559 Total number of outstanding shares to date: 380,969 Intrinsic value: sum of discount value / NOSH = 3.79 MYR. Hence,based on projected free cash flow in the next 5 years, discounted to present value, one share is worth 3.79 MYR as of today. Try ... change the rate to 5% instead of 10% for the free cash flow.... what would you get? |

|

|

Jan 27 2021, 12:31 PM Jan 27 2021, 12:31 PM

Return to original view | Post

#1695

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MedElite23 @ Jan 27 2021, 12:12 PM) Thanks Boon, I’m still learning haha.. Oh I do understand where that 10% came from. I feel 5% would give one an alternative value .... one which is not as optimistic as a 10% over 5 years.Anyway, I derived the free cash flow growth rate based on its track record..not plucking any numbers from the sky to fit the equation haha.. |

|

|

Jan 27 2021, 12:39 PM Jan 27 2021, 12:39 PM

Return to original view | Post

#1696

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 27 2021, 11:33 AM) Another day of just sitting in the market. Sitting is a very important phase, in regardless one is a trader or an investor.Numbers are pointing that I'm way better at picking funds than picking stocks. Might have to portfolio adjust next quarter. Looking at the whole GME drama for entertainment. I am in a sitting period too. I once sat more than a year before, not trading. So don't get too worked out over sitting. |

|

|

Jan 27 2021, 12:56 PM Jan 27 2021, 12:56 PM

Return to original view | Post

#1697

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(MedElite23 @ Jan 27 2021, 12:40 PM) Yup.. you’re right.. I hope my memory does not fail me. Some 1 taught me this b4.Tbh these calculations are rather personal to me, anyone else doing it would derive a different number. For this reason, initially I wanted to pm statikinetic instead of posting it publicly but at the end gave in due to technical reason At the end of the day, the intrinsic value one get may well be used as a tool for self-comforting purpose only.. because if the market doesn’t agree with you..man it’s an endless waiting game.. Borrowing a quote from John Maynard Keynes: “the market can remain irrational longer than you stay solvent.” Use the 10 year CAGR and then compare it versus the 5 year CAGR (which you used). Now if the 5 year CAGR is lower than the 10 year CAGR, then there is a possibility that the company growth is slowing ..... But then this is something I am not entirely keen on myself. lol. Cause, generally, our companies really do not have the strong competitive moat... so seeing the 10 year stuff is really ancient. Anyway, ya... the discount rate and the growth rate ... the 2 most important assumptions here.... and not forgetting time. |

|

|

Jan 27 2021, 01:06 PM Jan 27 2021, 01:06 PM

Return to original view | Post

#1698

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(statikinetic @ Jan 27 2021, 01:00 PM) "The money is in the sitting". Doing nothing when there is nothing to do - and this one is about the hardest thing to do... more so when one just came out from a very huge win. Hands all gatal... itching and itching and itching to buy again... Quote I heard from somewhere before. Peeping at the announcements at the end of the day for SPMX QR. howyoulikethat liked this post

|

|

|

Jan 27 2021, 01:16 PM Jan 27 2021, 01:16 PM

Return to original view | Post

#1699

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 27 2021, 01:46 PM Jan 27 2021, 01:46 PM

Return to original view | Post

#1700

|

All Stars

15,942 posts Joined: Jun 2008 |

|

| Change to: |  0.1872sec 0.1872sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 01:43 AM |