Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

engyr

|

Jul 3 2019, 10:09 PM Jul 3 2019, 10:09 PM

|

|

Are the dividend from unit trust taxable? Are the unit holders need to declare and pay individual income tax?

Is it better to buy after distribution to reduce tax?

This post has been edited by engyr: Jul 3 2019, 10:11 PM

|

|

|

|

|

|

engyr

|

Aug 25 2019, 09:29 AM Aug 25 2019, 09:29 AM

|

|

How to apply wrap account via fundsupermart.com.my? How much does it cost?

|

|

|

|

|

|

engyr

|

Oct 13 2019, 01:56 PM Oct 13 2019, 01:56 PM

|

|

QUOTE(coolguy99 @ Oct 11 2019, 09:42 PM) Is cimb better than other providers? |

|

|

|

|

|

engyr

|

Oct 13 2019, 05:10 PM Oct 13 2019, 05:10 PM

|

|

QUOTE(coolguy99 @ Oct 13 2019, 04:06 PM) I don't think so. Any fund that makes money is a good fund.  QUOTE(coolguy99 @ Oct 11 2019, 09:42 PM) I am new to fsm. If we buy prs via fundsupermart.com.my, do we manage to view it at https://www.ppa.my/? This is nominee account, right? This post has been edited by engyr: Oct 13 2019, 05:36 PM |

|

|

|

|

|

engyr

|

Nov 6 2019, 07:22 PM Nov 6 2019, 07:22 PM

|

|

How many % fundsupermart charge for wrap account?

How to buy unit trusts wrap account at fundsupermart?

|

|

|

|

|

|

engyr

|

Dec 3 2019, 08:38 AM Dec 3 2019, 08:38 AM

|

|

QUOTE(NotHideOnBush @ Dec 2 2019, 11:59 PM) Yes. |

|

|

|

|

|

engyr

|

Feb 29 2020, 04:46 PM Feb 29 2020, 04:46 PM

|

|

Anyone invested manage portfolio?

Do you manage to see what unit trusts fsm invest?

What is the value of the portfolio?

|

|

|

|

|

|

engyr

|

Mar 11 2020, 02:26 PM Mar 11 2020, 02:26 PM

|

|

QUOTE(Amanda85 @ Mar 11 2020, 12:51 PM) I bought moderately aggressive. most is from lump sum since 2018 with minor top up. now -ve 5% lol. QUOTE(xcxa23 @ Mar 11 2020, 09:12 AM) I bought aggressive Since late 2017 without any DCA Now -ve 4% I am interest to invest portfolio. I have few questions. 1) how they set the nav/price of the portfolio? 2) is the nav/price follows market? 3) do you know which unit trusts they invest? |

|

|

|

|

|

engyr

|

Apr 23 2020, 07:01 AM Apr 23 2020, 07:01 AM

|

|

Anyone had bought cimb principal prs from fundsupermart.com.my before? Can you visualise your investment at cimb click portal?

|

|

|

|

|

|

engyr

|

Aug 3 2020, 08:42 PM Aug 3 2020, 08:42 PM

|

|

QUOTE(GrumpyNooby @ Aug 3 2020, 07:34 PM) Principal ASEAN fund is the worst performer in the portfolio (MoM and YTD) FTSE asean 40 once hit 11500. Today close at 8322.56. Principal asean dynamic fund still perform better than public South East asean fund. |

|

|

|

|

|

engyr

|

Dec 17 2020, 02:28 PM Dec 17 2020, 02:28 PM

|

|

QUOTE(killdavid @ Dec 17 2020, 11:58 AM) I am not in any way suggesting anyone to do the same. I already have a portfolio on PM spanning close to two decades. And its short sighted to say that someone would invest into this fund based on the return of this year alone. Its about tapping into the potential of Vietnam. Whether you believe Vietnam have a growth rate far exceeding Malaysia on the long run. QUOTE(iamoracle @ Dec 17 2020, 07:44 AM) Obviously, if you generalize it, there are many funds which outperform this fund or many other funds in PM. We were discussing about funds investing in Vietnam. You are diverting away from the topic. I am aware of the high sales charge in PM. Please suggest a fund in FSM that is investing in Vietnam. Thanks. Public Vietnam global fund only invest 33% in Vietnam. (you can view it from monthly fund review which can be downloaded from public mutual online. I guess return was good because it invest heavily global too. Many funds in fsm perform well this year if you invest before Nov. |

|

|

|

|

|

engyr

|

Apr 28 2021, 07:19 PM Apr 28 2021, 07:19 PM

|

|

QUOTE(ChessRook @ Apr 28 2021, 03:32 PM) I wish what you say is 100% true. I got this two bond funds from R**; R** bond fund and R** Islamic bond fund which has increasing exposure to this Maju Holdings and the MEX project. First in 2019 from Bright Focus bonds, then, 2020 and again 2021 from MEX downgrade. Is it too much to expect UT funds to diversify? My bond funds are causing me more problems than my equity funds  I have since disinvest all my bond holdings from R** bond funds in Mar. My equity funds also perform better than bond funds. All bond funds were dropping since Feb. My pm bond funds - 4% |

|

|

|

|

|

engyr

|

Sep 26 2021, 07:18 AM Sep 26 2021, 07:18 AM

|

|

I have few questions about management portfolio.

1) Will you able to see your market value daily? Is the price changes like unit trust nav?

2) Anyone make redemption before? How long will it takes when you want to sell portfolio?

|

|

|

|

|

|

engyr

|

Feb 11 2022, 07:25 AM Feb 11 2022, 07:25 AM

|

|

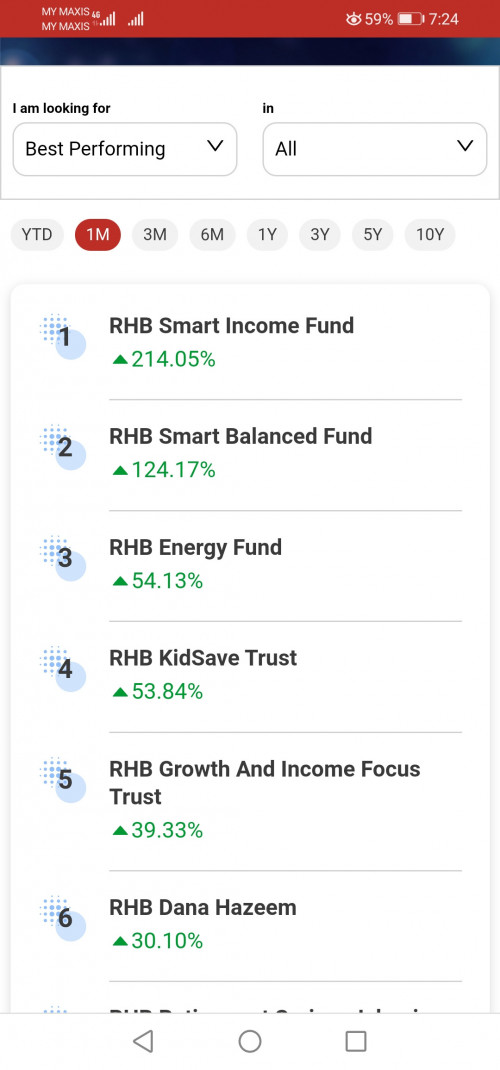

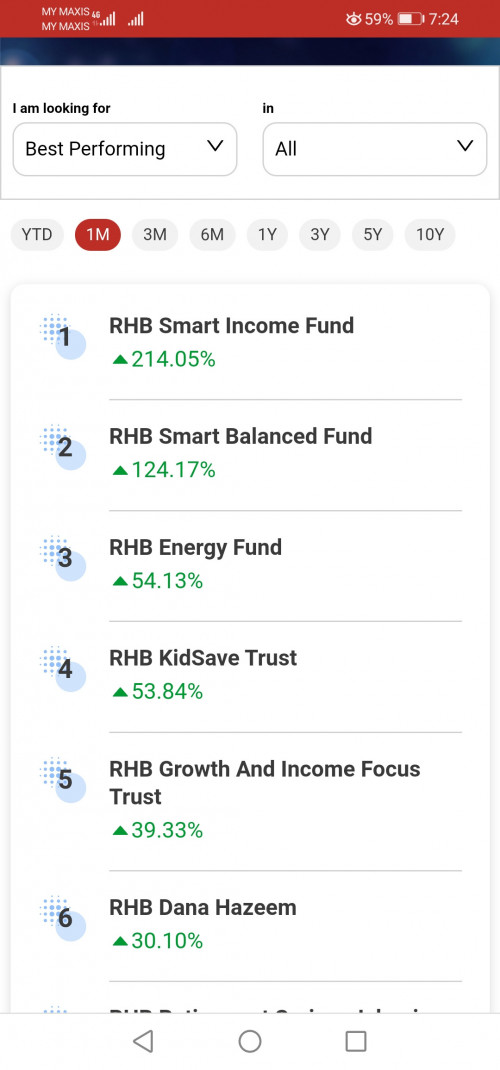

Rhb funds show so good performance within one month?  |

|

|

|

|

|

engyr

|

Mar 7 2022, 11:43 PM Mar 7 2022, 11:43 PM

|

|

Anyone invest? How do we know if it hit 100. |

|

|

|

|

|

engyr

|

Apr 12 2022, 01:43 PM Apr 12 2022, 01:43 PM

|

|

QUOTE(cklimm @ Apr 12 2022, 10:16 AM) Email from FSM: We’re happy to inform that you are one of the winners for FSMOne Bonus Units Campaign! The RM50 worth of Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR will be credited into your FSMOne account latest by 18 April 2022. We thank you for supporting our campaign. Stay tuned for upcoming campaigns and webinars on our website and Facebook page. If you have any enquiries, feel free to drop an email to our Client Services at clienthelp.my@fundsupermart.com or contact our hotline 03-2149 0567. Stay safe and Happy Investing! I got it too. Purchased eastspring Dinasti fund on 9th Mac |

|

|

|

|

|

engyr

|

Jun 30 2022, 09:50 PM Jun 30 2022, 09:50 PM

|

|

Anyone received such email before? Is it safe to download the zip file? |

|

|

|

|

|

engyr

|

Jul 8 2022, 02:51 PM Jul 8 2022, 02:51 PM

|

|

QUOTE(LoTek @ Jul 7 2022, 03:23 PM) historically im very scared everytime fsm makes a good offer: market usually dips after  QUOTE(MUM @ Jul 7 2022, 04:08 PM) 👍 That is quite true for the past few times... 😂😂😭😭 That is usually how some scams works, ha-ha Agree. I purchased managed portfolio end of Feb as 0% subscription fee, mid of Mac market drops. They offer 0% subscription fee in April, then last month market drops. Now my portfolio -4.5% |

|

|

|

|

|

engyr

|

Jul 31 2022, 07:20 PM Jul 31 2022, 07:20 PM

|

|

QUOTE(RigerZ @ Jul 29 2022, 09:23 PM) I got this email today: Dear Valued Customer,

Thank you for investing with FSMOne.

We have been informed by Affin Hwang Asset Management Berhad (“AHAM”) that they intent to change the distribution policy of Affin Hwang Select SGD Income Fund (the “Fund”) to allow the Fund to declare income distribution out of its capital. Currently, distribution of income by the Fund can only be made from realised gains or realised income.

The proposed change would allow the Fund the ability to distribute income on a quarterly basis in accordance with its distribution policy. While AHAM intend to continue declaring distribution from the Fund’s realised gains and / or income, the ability to declare distribution out of the Fund’s capital would enable the Fund to better meet its objective of providing investors with regular income distributions, even when the Fund has insufficient realised gains and / or income to do so.I'm not very sure but this doesnt sound like a good idea....? QUOTE(MUM @ Jul 29 2022, 09:47 PM) Me also think very not good.... QUOTE(frankzane @ Jul 31 2022, 07:10 PM) Thanks for the info. What would be the possible outcome(bad) if income is distributed from the capital? If it is indeed bad, why it says "would enable the Fund to better meet its objective of providing investors with regular income distributions"? Because so far, this Fund has not missed any quarterly distribution (with its current distribution format). I purchased Asia exjapan dividend fund. I received similar email. In my opinion, distribution is not important for unit trust. Nav will drop everytime when distribution is done.. Total value is the same. |

|

|

|

|

|

engyr

|

Sep 18 2022, 08:31 AM Sep 18 2022, 08:31 AM

|

|

QUOTE(bcombat @ Sep 18 2022, 01:26 AM) You mind to read current month fund factsheet? Most of the fund also stated “Up To” 5%. And how much commission FSM is charging currently? 1.5% or lower if there is promotion |

|

|

|

|

Jul 3 2019, 10:09 PM

Jul 3 2019, 10:09 PM

Quote

Quote

0.0733sec

0.0733sec

0.09

0.09

7 queries

7 queries

GZIP Disabled

GZIP Disabled