QUOTE(Avangelice @ Mar 2 2017, 11:16 AM)

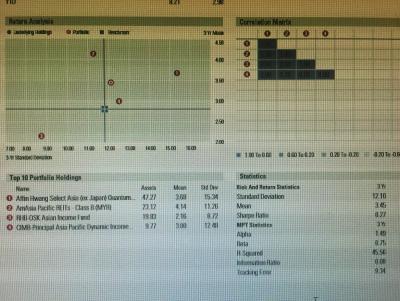

Topped up

Ponzi 2.0, myr 500

Rhb Asian Income Fund myr 300

AmAsia REITs myr 200

Dragon fund. myr 300

for the month of March.

Friend Avangelice, the term Dragon fund, being a nickname assigned to CIMB Greater China fund may not be appropriate anymore because Manulife has launched a fund named Manulife Dragon Growth Fund. It may cause confusion. Ponzi 2.0, myr 500

Rhb Asian Income Fund myr 300

AmAsia REITs myr 200

Dragon fund. myr 300

for the month of March.

Xuzen

Mar 2 2017, 11:35 AM

Mar 2 2017, 11:35 AM

Quote

Quote

0.0435sec

0.0435sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled