Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

wodenus

|

Mar 18 2017, 09:52 AM Mar 18 2017, 09:52 AM

|

|

QUOTE(Kaka23 @ Mar 18 2017, 07:35 AM) My Pub smallcap has highest ROI at 72% My Ponzi 1 ROI is 47% with ocationally top up over the investment period KGF ROI 30% with more frequent topup... etc...  Looking good my portfolio How many years? |

|

|

|

|

|

wodenus

|

Mar 18 2017, 09:54 AM Mar 18 2017, 09:54 AM

|

|

QUOTE(T231H @ Mar 17 2017, 11:37 PM) I think that is called rebalancing...sort of like this.... In order to “play” the game of investing, we need to be “in the game” longer than our fellow peers. Rebalancing is a strategy that can keep you “in the game” for longer. Author : iFAST Research Team https://www.fundsupermart.com.my/main/resea...ebalancing-4232What Is Rebalancing? Why Rebalance? The Importance of Rebalancing A Portfolio https://www.fundsupermart.com.my/main/resea...-Portfolio-5374You can backtest rebalancing vs. no rebalancing in the simulator.. for my port it wasn't worth the extra effort  |

|

|

|

|

|

wodenus

|

Mar 18 2017, 02:52 PM Mar 18 2017, 02:52 PM

|

|

QUOTE(wayne84 @ Mar 18 2017, 12:28 PM) alot of expert claiming they will be a pull back nx week after recent bull run, jus wait for the pull back to its resistant or support level then buy in, u hav more potential to gain higher yeild. go in timing is important Actually it's not, it just makes you feel better about it. In most cases, time in the market is more important than timing the market. This post has been edited by wodenus: Mar 18 2017, 05:59 PM |

|

|

|

|

|

wodenus

|

Mar 21 2017, 10:20 AM Mar 21 2017, 10:20 AM

|

|

QUOTE(alex_cyw1985 @ Mar 20 2017, 04:44 PM) Why I cannot top up Libra AsnitaBond Fund? the Buy icon is missing Usually because fund closed or prospectus expired, waiting for new one  |

|

|

|

|

|

wodenus

|

Mar 22 2017, 02:13 PM Mar 22 2017, 02:13 PM

|

|

QUOTE(Avangelice @ Mar 22 2017, 02:10 PM) meh. just gonna sit back and down a few shots of whiskey until the real correction happens. until then chill and namaste Yes 1% isn't much,, 10% maybe. |

|

|

|

|

|

wodenus

|

Mar 23 2017, 06:14 PM Mar 23 2017, 06:14 PM

|

|

QUOTE(puchongite @ Mar 23 2017, 12:52 PM) That's right. Shows that our senses are more accurate. LOL. Their data is being weird a lot though.. didn't use to have so many errors  |

|

|

|

|

|

wodenus

|

Mar 23 2017, 11:33 PM Mar 23 2017, 11:33 PM

|

|

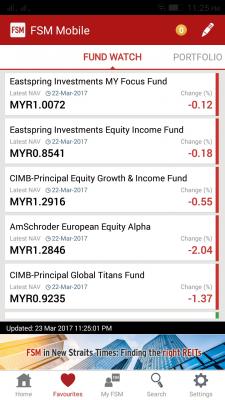

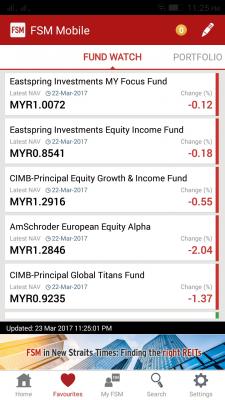

QUOTE(yklooi @ Mar 23 2017, 08:33 PM) ROI dropped by how many % this few days? my portfolio just dropped by about 0.36% from last few days... Haven't really looked.. have to log on the main site, all the stats on the app are broken because of CMF. Probably about the same. |

|

|

|

|

|

wodenus

|

Mar 23 2017, 11:41 PM Mar 23 2017, 11:41 PM

|

|

QUOTE(puchongite @ Mar 23 2017, 07:26 PM) Either business is too good, the clerk who perform manual work is overwhelmed or maybe there is a new clerk on board. LOL. Europe drops 2%+, Australia almost 3%.. this can't be another data entry error?

This post has been edited by wodenus: Mar 23 2017, 11:42 PM

This post has been edited by wodenus: Mar 23 2017, 11:42 PM |

|

|

|

|

|

wodenus

|

Mar 23 2017, 11:46 PM Mar 23 2017, 11:46 PM

|

|

QUOTE(Ramjade @ Mar 23 2017, 10:19 PM) US running out of steam. From S&P500 to Nasdaq, all drop. So Asia also drop. But let's see how much it naik later on  Moniter daily because "shiok sendiri" see portfolio making money after so long. lol Yellen just said that later interest rate hikes won't be so steep. |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:29 AM Mar 24 2017, 09:29 AM

|

|

QUOTE(Avangelice @ Mar 24 2017, 12:35 AM) That is the daily change from the favorites screen. |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:31 AM Mar 24 2017, 09:31 AM

|

|

QUOTE(Steven7 @ Mar 24 2017, 02:01 AM) Damn I got in the market at the wrong time (Tuesday buy, now is already priced). Should I exercise cooling off?  Why do you say it's the wrong time? seems like a good time to me. |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:33 AM Mar 24 2017, 09:33 AM

|

|

QUOTE(Avangelice @ Mar 24 2017, 09:31 AM) Yeap I know I just wanted to show how an Asian centric portfolio can perform during this time. no idea why people buy into Australia centric funds when all the indicators are there saying the Australian economy is not doing good. Diversification I guess maybe, it was doing quite well last year. |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:39 AM Mar 24 2017, 09:39 AM

|

|

QUOTE(shankar_dass93 @ Mar 24 2017, 12:46 AM) On a side note, planning to buy into Manulife India Equity Fund. Is it ok to get in now or am i too late ? When has it ever been too late  |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:40 AM Mar 24 2017, 09:40 AM

|

|

QUOTE(puchongite @ Mar 24 2017, 09:38 AM) Definitely not. We got sense, we know what is data entry error and what is not.  LOL ok  |

|

|

|

|

|

wodenus

|

Mar 24 2017, 09:55 AM Mar 24 2017, 09:55 AM

|

|

QUOTE(Drian @ Mar 24 2017, 09:47 AM) Although that is generally true, but buying at the wrong time might set you back a year or two in terms of ROI. Actually I don't think so.. point is somewhere is going up, you just don't know where. So if you are diversified, no way you won't be positive every year except if there's a global recession. This post has been edited by wodenus: Mar 24 2017, 10:21 AM |

|

|

|

|

|

wodenus

|

Mar 24 2017, 11:06 AM Mar 24 2017, 11:06 AM

|

|

QUOTE(Steven7 @ Mar 24 2017, 10:26 AM) Huh? I could be wrong but when I read the chart, the price I get from my Tuesday purchase are way way higher than the current price. I think it was priced before the correction? Oh you bought on Tuesday.. still doesn't matter.

I don't think it was that much higher.. that's only one or two percent. Bad times are good times to invest  |

|

|

|

|

|

wodenus

|

Mar 24 2017, 03:05 PM Mar 24 2017, 03:05 PM

|

|

QUOTE(Steven7 @ Mar 24 2017, 11:08 AM) Oh I didn't get this fund. Took a small hit on CIMB Global Titan and Dynamic Income Fund - MYR, ~1-2% each. True, which is why I am thinking when or should I topup. I'd wait for 10%, ex commission, which means it should drop 12% before I think of topping up. Otherwise it all goes according to plan. This post has been edited by wodenus: Mar 24 2017, 07:17 PM |

|

|

|

|

|

wodenus

|

Mar 24 2017, 03:47 PM Mar 24 2017, 03:47 PM

|

|

QUOTE(Ramjade @ Mar 24 2017, 02:52 PM) No. The nearest is the eastspring. But look here. THe same fund as mentioned in bloomberg. 5 years in a row beating the index  I agree with John C. Bogle words regarding cost saving. Cost matter. If can save cost, why shouldn't one cut cost?  Incurring unnecessary cost will drag down your returns. Savings can be used to pump back into the market. Being kiamsap is better than acting rich (if you are not rich). Closest in FSM KL is https://www.fundsupermart.com.my/main/fundi...th-Fund-MYHWSJQ probably |

|

|

|

|

|

wodenus

|

Mar 24 2017, 05:24 PM Mar 24 2017, 05:24 PM

|

|

QUOTE(Avangelice @ Mar 24 2017, 04:02 PM) just had a plate of kolo mee at 3myr and kopi o Peng kosong at 1.5 myr. Malaysia masih aman. terima kasih BN. So envious  if I want Rm3 kolo me I have to make it myself lol. |

|

|

|

|

|

wodenus

|

Mar 24 2017, 07:04 PM Mar 24 2017, 07:04 PM

|

|

QUOTE(Nemozai @ Mar 24 2017, 12:20 PM) What if an investor in Japan invested in 1990 with the mindset that the market will always recover in long term? More than 3 decades now and japan Nikkei 225 haven't recover. Something to keep in mind?  Maybe it will "recover" in another 10 years. But do you have such long life to wait until it recover (25y+10y)?  This is true but you'd only have lost money if you were 100% in Japan. If you were globally diversified (and across asset classes as well) you'd have still been profitable in the long run, so what was your point again?  |

|

|

|

|

Looking good my portfolio

Looking good my portfolio

Mar 18 2017, 09:52 AM

Mar 18 2017, 09:52 AM

Quote

Quote

0.0499sec

0.0499sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled