QUOTE(LoTek @ May 3 2021, 01:05 PM)

Eastspring Investments Dinasti Equity Fund not bad la FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

May 3 2021, 01:08 PM May 3 2021, 01:08 PM

Return to original view | IPv6 | Post

#481

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

May 3 2021, 03:49 PM May 3 2021, 03:49 PM

Return to original view | IPv6 | Post

#482

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 3 2021, 03:51 PM May 3 2021, 03:51 PM

Return to original view | IPv6 | Post

#483

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(LoTek @ May 3 2021, 01:52 PM) U wanna buy low n sell high?But u dare to enter? Later ppl said wait n see bcoz price to low, OR wait the price too high. At last didn't buy any fund, LPPL only 😝 This post has been edited by ironman16: May 3 2021, 05:06 PM |

|

|

May 4 2021, 04:17 PM May 4 2021, 04:17 PM

Return to original view | Post

#484

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(majorarmstrong @ May 4 2021, 03:22 PM) anyone start to pick up China? curse in MAY >>> sell in May n cabut just added an additional 5% of my portfolio to china just added Reits another 2% to my overall portfolio cash out 50% of on tech United Global Tech not sure why my friend ask me to cash out, but i listen saja la cash out end of April. Tech - 15% China - 22% Asia Pacific Ex Japan - 18% Reits - 18% Malaysia - 12% Cash - 15% <--- gonna slowly masuk china (not asia pacific) and reits QUOTE(ryse_photo @ May 4 2021, 02:18 PM) Hi, quick question. I'm planning on rebalancing my investment portfolio next month. Did some research on it, found the 2 methods of rebalancing; if long term investment and DCA sure pick number 2.1. Sell some of the overweight position & buy into the underweight position 2. No selling, only buy - Add more into the underweighted position Is there any pro n cons with any of these method? If you have ever did a rebalancing before, can share ur experience ah? Thank you in advance! p/s: this is my first time doing rebalancing. started investing in 2020, decided to do rebalancing annually on June if u dun wan add ur bullet (may b go some where invest) just pick number 1 lo This post has been edited by ironman16: May 4 2021, 04:19 PM ryse_photo liked this post

|

|

|

May 4 2021, 04:48 PM May 4 2021, 04:48 PM

Return to original view | Post

#485

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 8 2021, 01:22 PM May 8 2021, 01:22 PM

Return to original view | Post

#486

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

May 8 2021, 01:53 PM May 8 2021, 01:53 PM

Return to original view | Post

#487

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xuzen @ May 8 2021, 01:44 PM) Actually not really tukar channel, United Tech 70% is mainly US ( 2/3 exposure ) but specific to Tech Sector. thats mean sifu wanna all in US liao...... Now switch to 100% US but exposed to all sector. Xu' thanks for the info.....got time will go do some home work liao......sifu kasi hints oledi |

|

|

May 10 2021, 01:26 PM May 10 2021, 01:26 PM

Return to original view | Post

#488

|

Senior Member

2,437 posts Joined: Sep 2016 |

ETF Day Promotion: 0% Commission on ETFs In conjunction with FSMOne ETF Day event, we are offering 0% commission on both buy and sell of ETFs listed on Bursa Malaysia, from 10 May 2021 till 4 June 2021. Terms and conditions of 0% commission (processing fee) on ETFs: |

|

|

May 10 2021, 01:44 PM May 10 2021, 01:44 PM

Return to original view | IPv6 | Post

#489

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

May 10 2021, 08:10 PM May 10 2021, 08:10 PM

Return to original view | Post

#490

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(Sitting Duck @ May 10 2021, 07:46 PM) Hi Bros, i think they just change the age onlyI've received a sms from Principle Asset Management that reads: RM0 Principal: Refer http://coe3.us/PRSR2S for letter to default option members for Principal Islamic PRS Plus & Principal PRS Plus. When I click on the link given, I don't quite understand what it means. I'm investing in PRINCIPAL PRS PLUS ASIA PACIFIC EX JAPAN EQUITY - CLASS C via FSM since 2020, and I'm over 40 years old. Does it mean that for my subsequent investment into this PRS fund that the investment would go into "Principal PRS Plus Moderate" instead of "PRINCIPAL PRS PLUS ASIA PACIFIC EX JAPAN EQUITY - CLASS C" unless I write in a letter? This is the link to the FIRST SUPPLEMENTAL DISCLOSURE DOCUMENT: https://www.principal.com.my/sites/default/...20-%20Final.pdf Thanks. eg. last time growth for age below 40, after this year become 45 moderate last time is 40 until 49, after this year become 54 they just increase 5 year. this one for the ppl that subscribe to the auto mode punya. i think if u select non-core (PRINCIPAL PRS PLUS ASIA PACIFIC EX JAPAN EQUITY - CLASS C) punya should b no problem hope my understanding is correct |

|

|

May 16 2021, 01:30 PM May 16 2021, 01:30 PM

Return to original view | IPv6 | Post

#491

|

Senior Member

2,437 posts Joined: Sep 2016 |

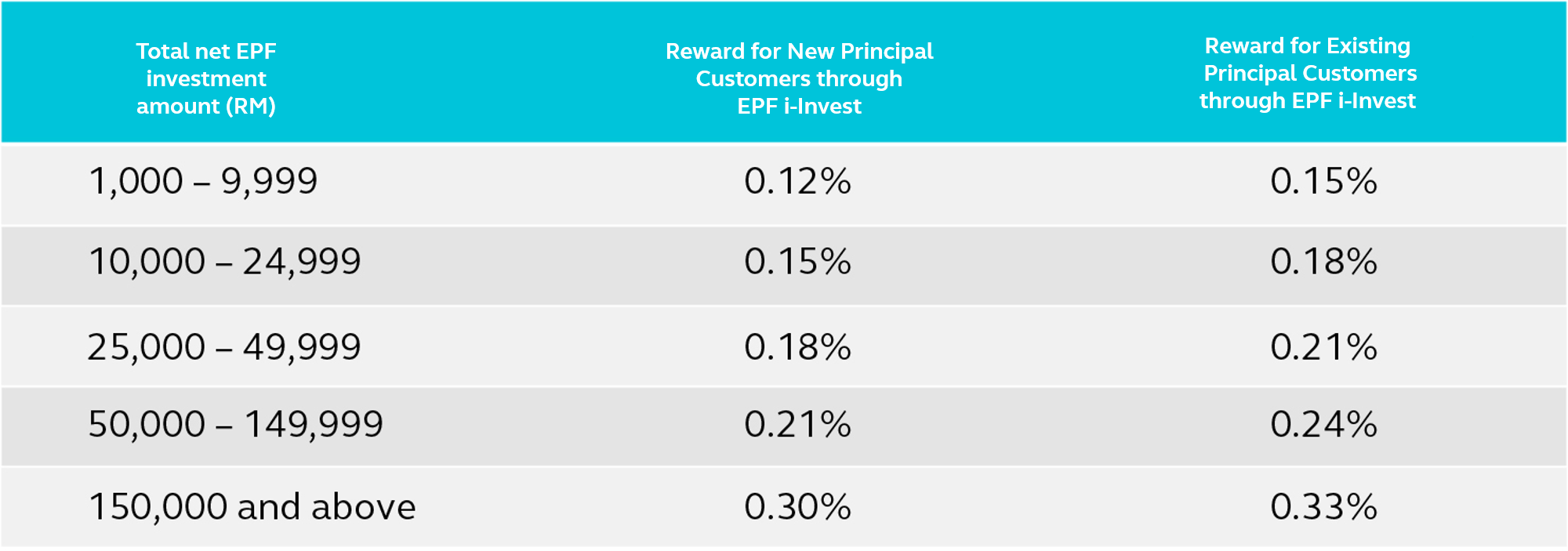

QUOTE(Kaka23 @ May 16 2021, 12:38 PM) Effective from 1 May 2020, for a duration of one year, EPF has imposed a maximum sales charge of 1.5% on subscription via EPF form submission (ePPA). As such, your EPF sales charge will be stamped with 1.5% sales charge.https://www.fsmone.com.my/support/frequentl...tUniqueKey=2362 Invest with Principal through EPF i-Invest try principal....oso not bad From now until 31 May 2021, Jom Dapat Lebih Kaw rewards when you invest with Principal through EPF i-Invest using the campaign code “LEBIHKAW”. https://www.principal.com.my/en/principal-j...BEaAh3VEALw_wcB  This post has been edited by ironman16: May 16 2021, 01:35 PM |

|

|

May 16 2021, 02:40 PM May 16 2021, 02:40 PM

Return to original view | IPv6 | Post

#492

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GamaX320 @ May 16 2021, 02:36 PM) sure la......unless u wanna kena penalty or u got the special reason lo.....have a look first https://www.fsmone.com.my/support/frequentl...tUniqueKey=2430 This post has been edited by ironman16: May 16 2021, 02:41 PM GamaX320 liked this post

|

|

|

Jun 3 2021, 01:03 PM Jun 3 2021, 01:03 PM

Return to original view | IPv6 | Post

#493

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Jun 5 2021, 11:58 AM Jun 5 2021, 11:58 AM

Return to original view | IPv6 | Post

#494

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xuzen @ Jun 5 2021, 11:31 AM) Hi folks, Fuyoo, 5 figure MOM,....... 👍How are you keeping during this FMCO? As for me, it has been hell of busy as my company is listed as Hardware ( Family DIY ) which means we are open throughout this FMCO but we are working with only 60% workforce. Just to share with fellow UTers aka Unit Trust Investers my Apr-2021 port is in. Apr-2021 was a very good month for me with a strong five figure M-o-M return equivalent to a 3.3% gain M-o-M. The main contributor is of course China with a slight assist from US. Hope Mehsia portion can pick up soon. Xu' |

|

|

Jun 9 2021, 03:07 PM Jun 9 2021, 03:07 PM

Return to original view | Post

#495

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(jj_jz @ Jun 9 2021, 02:28 PM) Hi guys, its been a while since my last visit here. RHB US Focus Equity Fund >> US small capJust to update before I ask a question, DCA continuously for the past few months, focusing on China & Asia ex Japan (when there was a huge dip back in March & April). Portfolio overall is improving, slowly recovering from the pain when the world market collapse few months back, at least its green now. And just one question, any fund is actually focusing on those small cap like China A50 or small cap in US? I do have my portfolio in those big company but would like seek some opportunities in those small company that potentially getting some advantage when the world slowly back to normal. Thanks in advance. https://www.fsmone.com.my/funds/tools/facts...c=fund-selector Principal China Direct Opportunities Fund - MYR /SG/USD >> China small cap https://www.fsmone.com.my/funds/tools/facts...c=fund-selector This post has been edited by ironman16: Jun 9 2021, 03:10 PM jj_jz liked this post

|

|

|

Jun 9 2021, 05:21 PM Jun 9 2021, 05:21 PM

Return to original view | Post

#496

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(jj_jz @ Jun 9 2021, 03:10 PM) Thanks brother, I will put that in my watchlist first although i am not a fans for RHB fund. no.............just asia pac and ASEAN small cap in my portfolio only Do you have any watchlist as well for China small cap? extinct_83 and jj_jz liked this post

|

|

|

Jun 11 2021, 09:18 PM Jun 11 2021, 09:18 PM

Return to original view | Post

#497

|

Senior Member

2,437 posts Joined: Sep 2016 |

Fund Launch: Nomura Global Sustainable Equity Fund Jun 19, 2021 10:30 AM in Kuala Lumpur https://us02web.zoom.us/webinar/register/WN...QTtuFn_aetncITA new fund launch with zoom......harap got special sales....... Hope it not the wholesales fund This post has been edited by ironman16: Jun 11 2021, 09:21 PM extinct_83 liked this post

|

|

|

Jun 17 2021, 09:02 PM Jun 17 2021, 09:02 PM

Return to original view | Post

#498

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(debonairs91 @ Jun 17 2021, 06:51 PM) Two different views. And yes the reason I didn't get into both of them is because of the sky-high price. I've been waiting for us to go down but only up up up lol. i saw ur MMF quite high , about 30%.......is this ur emergency fund ? or just the allocation that havent invest ? or waiting the dip n top up again (spare )?Any specific fund to look for commodities? I know what fund to go when I want to enter us. No idea with commodities r u sure u want go with commodities ? if kena lock , sure long time u wait ....unless ur timing is good, buy the dip n rally after that.... Mind sharing what fund u hold ? based on geo allocation just fine from my view.....i will suggest increase the asia pac % .... but im not cert financial advisor..... This post has been edited by ironman16: Jun 17 2021, 09:03 PM |

|

|

Jun 18 2021, 07:11 PM Jun 18 2021, 07:11 PM

Return to original view | Post

#499

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(debonairs91 @ Jun 18 2021, 06:54 PM) Just the standard fund seen ok la.......may b can take the opportunity to top a bit in Dinasti ? Dynasti Dana makmur Rhb Islamic global Principal Islamic Asia pacific All up around 5% since start of this year except for dynasti haizz can try up a bit Global ?.....or try invest in gold lo.....try maintain below 5%...... may b others sifu can give u some recommendation This post has been edited by ironman16: Jun 18 2021, 07:13 PM |

|

|

Jun 26 2021, 02:12 PM Jun 26 2021, 02:12 PM

Return to original view | Post

#500

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xuzen @ Jun 26 2021, 11:00 AM) May 2021 result is in. x sabar2 wanna see............. Port made a loss of 0.7% equivalent to a four figure loss in ringgit term. Loss comes from Mehsia exposure. Now I have tracked up to 58 months, once I reached 60 data points which is equivalent to 5 year observation period, I will publish my long term risk to reward profile. Stay tuned. |

| Change to: |  0.6407sec 0.6407sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 01:35 PM |