QUOTE(fense @ Mar 17 2017, 11:38 AM)

wah lao. stalk until like that meh.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 17 2017, 12:49 PM Mar 17 2017, 12:49 PM

Return to original view | Post

#241

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

|

|

|

Mar 17 2017, 01:12 PM Mar 17 2017, 01:12 PM

Return to original view | Post

#242

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Aurora Boreali @ Mar 17 2017, 01:11 PM) Hi peeps, first question need answering. what currency are we talkingI recently came back to Malaysia after close to 2 years of earning foreign income and brought back with me some foreign currency which is sitting in my FCA now... With the current weakening RM, should I convert it out to RM and then invest in funds through FSM or should I just keep it in the FCA without earning any interests to hedge against the historically downward trend of RM? Dilemma. Sifu please advise |

|

|

Mar 17 2017, 02:47 PM Mar 17 2017, 02:47 PM

Return to original view | Post

#243

|

Senior Member

5,272 posts Joined: Jun 2008 |

my Manulife India returns have hit 21%. part of me is saying leave it there whilst another says cash it. oh dear Lord

|

|

|

Mar 17 2017, 02:54 PM Mar 17 2017, 02:54 PM

Return to original view | Post

#244

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Ramjade @ Mar 17 2017, 02:48 PM) I never really asked this but what's the use keeping profits in their paper form? I know skimming profits it's to lock it down but what about the other scenario where you leave it there? |

|

|

Mar 17 2017, 02:59 PM Mar 17 2017, 02:59 PM

Return to original view | Post

#245

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(xuzen @ Mar 17 2017, 02:56 PM) Why so happy? U bunch of lozers! Don't like that sifu. as they say the faster you climb the more risk there is that you fall. 20% ROI in one month you baru shout about it lar..... bikin malu aje! Xuzen QUOTE(ykit_88 @ Mar 17 2017, 02:57 PM) I know about reinvesting profits but I never come across a proper explanation as to keeping profits the way they are as in paper form. |

|

|

Mar 17 2017, 04:22 PM Mar 17 2017, 04:22 PM

Return to original view | Post

#246

|

Senior Member

5,272 posts Joined: Jun 2008 |

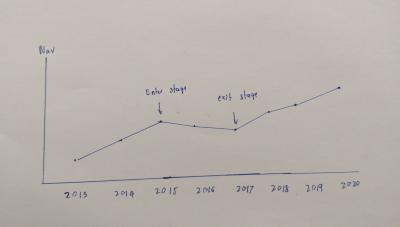

QUOTE(john123x @ Mar 17 2017, 04:09 PM) Its the only red in my portfolio, just checked, its -1.45% here's an example. If 2 years doesnt perform, i so gonna switch to manulife reit I suck at finding charts from Google so I had the off day to do this.

what am I saying now the "window" of performance you give it maybe the time it is underperforming but if you look at the long term chart the fund is actually doing alright. that's why we do not look short term but rather long term. I'm not in the finance industry but having a long hindsight helps. |

|

|

|

|

|

Mar 17 2017, 06:40 PM Mar 17 2017, 06:40 PM

Return to original view | Post

#247

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Mar 17 2017, 06:44 PM Mar 17 2017, 06:44 PM

Return to original view | Post

#248

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Mar 17 2017, 06:56 PM Mar 17 2017, 06:56 PM

Return to original view | Post

#249

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(dasecret @ Mar 17 2017, 06:02 PM) https://www.fundsupermart.com.my/main/resea...ia-Pacific-8124 diew. I'm working on Saturday lah! fsm why you always have seminars in kuching on Saturday??Looks like no one posted this yet? The East Msians, please go and attend n bring your auntie and uncles also; promote to them so they would switch from Public Mutual to FSM |

|

|

Mar 17 2017, 07:08 PM Mar 17 2017, 07:08 PM

Return to original view | Post

#250

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Mar 17 2017, 08:27 PM Mar 17 2017, 08:27 PM

Return to original view | Post

#251

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(dasecret @ Mar 17 2017, 07:30 PM) Question is why do you want to sell? Is there anymore upside in that market? Do you foresee it to come crashing down? ROI is just a number; a rather poor indication of performance if you ask me. That's why IRR is more superior for comparison I was thinking locking in the profits and placing them in a stable bond fund. I'm just playing scenarios in my head why keep profits? do they gain capital appreciation by sitting there? I have many funds with >20% ROI but that's because I've held them for >1 year. If I sell them, what should I buy? If the potential is there like ponzi 1.0, instead of selling, you should be looking to buy more i know in stocks, you buy it cheap and let it go up and up and collect the dividends but unit trust is different as we do not get rewarded for staying long. yeah this has been plaguing in my mind for a long time. |

|

|

Mar 17 2017, 11:44 PM Mar 17 2017, 11:44 PM

Return to original view | Post

#252

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Ramjade @ Mar 17 2017, 11:32 PM) Xuzen uses allocation. If it exceed that certain value he transfer it out so that the allocation come back to what he want. I'll think about it. then again I'm in this for less than two years so I'll just let my portfolio grow until my 100k mark then I'll be more active. right now I think I should worry about building my asset rather than keeping it healthyEg. The fund is supposed to be 10% of his total portfolio, it increase to 20%, so he take 10% and divert it to another fund which is (-) |

|

|

Mar 20 2017, 10:45 AM Mar 20 2017, 10:45 AM

Return to original view | Post

#253

|

Senior Member

5,272 posts Joined: Jun 2008 |

Again another fresh discussion on eut....service charge...then later going to FSM sg.

Getting bored of it |

|

|

|

|

|

Mar 21 2017, 10:08 AM Mar 21 2017, 10:08 AM

Return to original view | Post

#254

|

Senior Member

5,272 posts Joined: Jun 2008 |

I think I have reached zen in my UT investment. I hardly think about it, check my holdings and even come over to this thread.

Does it mean I have reached enlightenment and become a master? (tongue in cheek post) |

|

|

Mar 21 2017, 11:02 AM Mar 21 2017, 11:02 AM

Return to original view | Post

#255

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(xuzen @ Mar 21 2017, 10:55 AM) Don't you have to use your mind to decide how to spend the profit / gains you got? Like holiday kat mana? Batam? Haadyai? Golok? cannot lah. need to spend on an engagement ring and proposal vacation in Japan this November. then there's filling my house with furniture and repairing the crack walls. then wedding reception summore. getting a wife is expensive diew. adult life sucks. you got all the money but don't dare to splurge. |

|

|

Mar 21 2017, 11:47 AM Mar 21 2017, 11:47 AM

Return to original view | Post

#256

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(killdavid @ Mar 21 2017, 11:34 AM) QUOTE(ykit_88 @ Mar 21 2017, 11:37 AM) (lari topic for a little bit) nah I'm a firm believer of not buying blood diamonds to fund child laborers in the mines. plus they are over priced pieces of rock that have zero value. luckily the girl I am marrying is a lover of gemstones. All in all I got a carat aquamarine from Thailand for 800 myr and getting Sarawakian based jeweler to custom make it with germanic silver. no gold. no rose gold. none of those cancer stuff that you need to buff and shine every year.

getting something like this to be made. for those interested can visit them https://lnrartisanhandcraft.com will try not to derail the topic further. hope this helps for those looking to invest in a diamond ring. some poor friend of mind had to spend nearly 10k on a 1 carat diamond and end up his girlfriend told my girlfriend she is afraid to show it to her lawyer friends because it's so small. |

|

|

Mar 21 2017, 02:24 PM Mar 21 2017, 02:24 PM

Return to original view | Post

#257

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(elea88 @ Mar 21 2017, 01:43 PM) I told the couple (Elaine and Damian) that I am setting a budget for the ring and they can meet my expectations around that. she agrees that a valuable time piece shouldn't cost an arm or a leg and customizing one is better at representing the love shared amongst two person rather than going to Habib Jewels to buy one over priced jewelry that you are pressured to buy esp as a man. also they are international recognized so I'm proud of advertising them to everyone. need to get rid of the notion if I spend alot of money on a ring it will represent my love. anyways let's not turn this tread into cupid. I'm always open to conversations via PM. |

|

|

Mar 21 2017, 09:59 PM Mar 21 2017, 09:59 PM

Return to original view | Post

#258

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(WhitE LighteR @ Mar 21 2017, 08:43 PM) the way I see it a marriage is like an investment, you keep putting your time, money and effort into a gamble that the person stays with you and deals with the daily stuff they have to put up with while making sure you don't die from loneliness. so yeah. it's a definite must have in every person's investment horizon. then.... there's kids.... |

|

|

Mar 22 2017, 11:45 AM Mar 22 2017, 11:45 AM

Return to original view | Post

#259

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(dasecret @ Mar 22 2017, 09:35 AM) Btw, the FSM rep posted on Cari Chinese forum thread that ponzi 1.0 will have a soft close soon for cash investment. In the next few weeks. Apparently fund manager want to control the fund size I tried reading on soft close and it's a bad thing when funds get too big? so what happens when it gets too big? sell the investments and give back to the investors? break the fund into two funds?So for those who wants to enter, please take note. |

|

|

Mar 22 2017, 12:16 PM Mar 22 2017, 12:16 PM

Return to original view | Post

#260

|

Senior Member

5,272 posts Joined: Jun 2008 |

Correction is under way. there is profit taking going all around the Bursa and just recently almost foreign investors have scopped up almost a billion of Malaysian stocks.

Looks like Trump power is fizzling out. |

| Change to: |  0.8206sec 0.8206sec

1.04 1.04

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:06 PM |