QUOTE(wongmunkeong @ Nov 13 2020, 03:44 PM)

bro - when U look at short term, U see crazy stuff

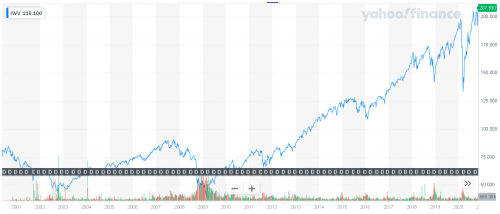

iShares Russell 3000 ETF (IWV) which holds 98%+/- of US stocks

BUT when U zoom out - whatcha see?

steady climb up with a trip (dang pebble/shoe laces) here/there right?

U can look up other ETfs and zoom in/out to get a feel of what U should be focusing on and what NOT to be focusing on

eg. like driving - yes look ahead at the road in front BUT more important focus is getting to the destination, using whatever roads (if immediate road jammed) right?

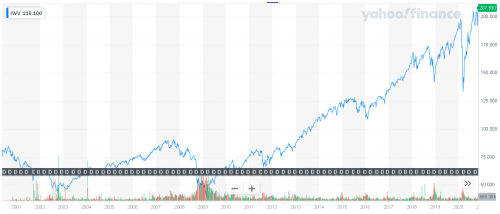

👍iShares Russell 3000 ETF (IWV) which holds 98%+/- of US stocks

BUT when U zoom out - whatcha see?

steady climb up with a trip (dang pebble/shoe laces) here/there right?

U can look up other ETfs and zoom in/out to get a feel of what U should be focusing on and what NOT to be focusing on

eg. like driving - yes look ahead at the road in front BUT more important focus is getting to the destination, using whatever roads (if immediate road jammed) right?

Actually many sifus here reminded me before.

It’s just that I easily get “emotional”

In my mind, it’s always are my funds really the correct ones? Then we I start to see the drop, I start comparing, hahaha.

Nov 13 2020, 06:51 PM

Nov 13 2020, 06:51 PM

Quote

Quote 0.0276sec

0.0276sec

0.48

0.48

6 queries

6 queries

GZIP Disabled

GZIP Disabled