QUOTE(sgh @ Dec 1 2021, 10:56 AM)

After finding out I can access FSM Msia I do a scan. The recommended funds are not bad. But the Fund Selector Show Columns lack the Dividend Yield %, Dividend Frequency for those who want to target dividend paying UT.

Overall I think the number of Fund Managers are too little. Even the recommended funds section has too little funds.

For e.g Spore recommended funds section our selections are

Core Portfolio Equity,Asia Ex Japan,Asia Pacific Ex Japan,China,Europe,Global,Global Emerging Market,Greater China,Japan,US

Supplementary Portfolio. ASEAN,Emerging Europe,Latin America,China-Local,India,Msia,Russia,Spore

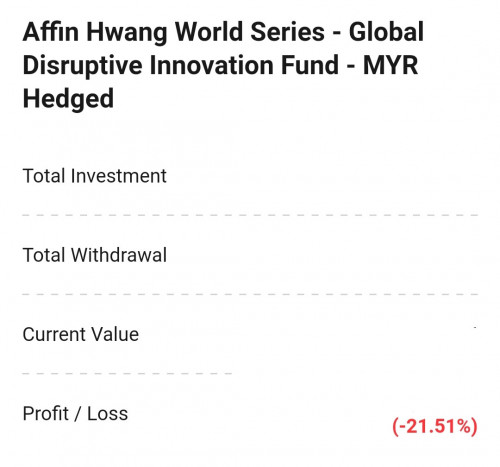

Sector Portfolio. Disruptive Innovation,Financials,Healthcare,Property,Resources,Technology,Asia Pac Property

When

lee82gx mention very little funds worth to hold more than 3 years I now tend to agree with you. Your choices seem more limited so perhaps may want to consider ETF or even stocks. Maybe as times go by FSM Msia bring in more fund managers and funds you consider again.

Btw not sure how Bursa exchange charge but in Spore SGX, besides the 8.80 we pay to FSM we still need to pay some small percentage to SGX as fees. So while ETF,stocks offer faster or more profits please keep in mind all these charges. They are applied for

every buy/sell and that includes RSP as well. These fees will add up depending on your trading frequency.

For SGX Reit stocks, instead of dividend payout we can opt for shares so these shares is like normal shares and you no need pay fees. I am not sure about Bursa Reit stocks though. Reit stocks are quite a hit with Spore investors. Got "allowance" and yet still remain invested in the stock. The capital gain may not be high but remember if you sell all, you need to find another stock or buy back again. This is quite troublesome for semi-passive investors.

REIT stocks are also a separate class with special tax treatment in malaysia (I am not too sure, I think so).

Yes, frequent trading of ETF in Malaysia is same as stocks, which means fees all round similar to you, 8.8+stamp duty, tax, etc. It is not suitable to do frequent, and small amount trading.

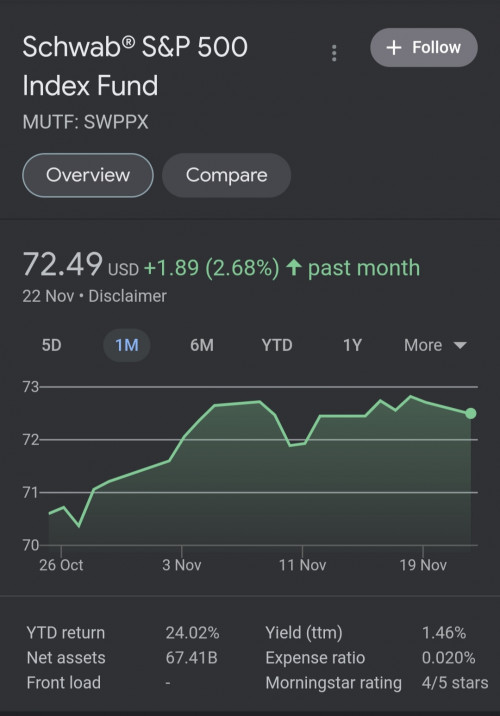

Personally when I talk about ETF, I'm referring to VOO, VTI, QQQ, GLD or even ARRK (yucks for now) those kind of funds. Also the kinds that expose to China like KWEB, CXSE or KGRN. Exposure to high growth markets, basically. With international brokers, they are cheap to trade, liquid, transparent and expose you directly to the underlying securities. Personally I buy and trade QQQ, VOO type of ETF's with near 0 cost.

That;s why I initially say I am would start looking at Stashaway components if I want to buy funds.

Regarding Malaysian mutual trust funds, it is not by accident that Malaysia is one of the worst equity markets in the developing world. When this happens, coupled by Singapore's $ strength, a lot of talent and capital flow away. So we are stuck in a vicious loop for the equity market. Then you add the so-called religion based investment (!).

Jun 29 2021, 01:22 PM

Jun 29 2021, 01:22 PM

Quote

Quote

0.0824sec

0.0824sec

1.10

1.10

7 queries

7 queries

GZIP Disabled

GZIP Disabled