QUOTE(T231H @ Mar 13 2019, 07:02 PM)

someone must be very happy lor

but hor....not too happy lor....

that is just TOP volume %

wait wait....

seems like ????

what are the probability of BOTH top performing and top volume having the SAME result?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 13 2019, 08:42 PM Mar 13 2019, 08:42 PM

Return to original view | Post

#161

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

|

|

|

Mar 13 2019, 09:03 PM Mar 13 2019, 09:03 PM

Return to original view | Post

#162

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(T231H @ Mar 13 2019, 08:53 PM) maybe but only lumpsum once on late 2018 and then dca every month.. with fsm hard promo on china based UT and last week went to banks, had chat with some of the staff there, apparently they are interested with china and india market as well. and i notice since nov/oct 2018, their cash reserve was 6% now the reserve as reported dec 2018, down to 5.15% probably started using their reserve after trade war suspended This post has been edited by xcxa23: Mar 13 2019, 09:04 PM |

|

|

Mar 13 2019, 09:58 PM Mar 13 2019, 09:58 PM

Return to original view | Post

#163

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ancient-XinG- @ Mar 13 2019, 09:32 PM) Not yet suspended. But now is good time la. To enter. https://www.npr.org/2019/02/24/697562568/tr...-in-trade-talksBut I prefer GEM over Direct China as I have GC already. opps.. i meant suspend hiking the rate hows ur GEM perform? i prefer direct china since its higher risk = higher return but also higher loss |

|

|

Mar 14 2019, 09:40 AM Mar 14 2019, 09:40 AM

Return to original view | Post

#164

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ancient-XinG- @ Mar 13 2019, 10:11 PM) Gem ar. As usual la. Dropping lol Up less then GC and aaxj, but when drop. konlanfirm drop more than this 2 Damn right wey.. when drop, the % is owaz higher or faster than up..Will Brexit bring any impact on marlet ar? Because recently EU stoxx also quite flat. I din pay much attention to them cos my port only about 10%.. But I jz briefly read about uk financial planning, something about boosting sales and purchases.. it's a good sign I guess.. need some more reading |

|

|

Mar 15 2019, 06:29 PM Mar 15 2019, 06:29 PM

Return to original view | Post

#165

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(yklooi @ Mar 15 2019, 05:51 PM) The government has detailed the assets Lembaga Tabung Haji transferred to a special purpose vehicle (SPV) for RM19.9 billion even though the book value of those assets is only around RM10 billion. The government intent on restoring Tabung Haji's financial position by taking over its losses so as to close its deficithttps://www.malaysiakini.com/news/468076 there is a list of stock holdings involved.... "The new SPV handling the transferred assets was named Urusharta Jamaah Sdn Bhd (UJSB). The Prime Minister's Department said UJSB's goal will be to rehabilitate the assets transferred from Tabung Haji and restructuring them." With these rehabilitation and restructurings.....to recovers the RM10 billion variance.......how long will it impact Malaysian markets? will they dump 1 billion per year for 10 years? will they push and dump once or twice a year to generate some profits? or will they do ...... any veterans stock markets investors mind to shed some lights into the impact? currently I am having 15% of the port in Malaysia Eq funds from my understanding, seems like gomen intend to ''bail out'' tabung haji loss whether anyone will goreng or not, my guess yes... somewhat related to politic » Click to show Spoiler - click again to hide... « |

|

|

Mar 25 2019, 12:07 PM Mar 25 2019, 12:07 PM

Return to original view | Post

#166

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(killdavid @ Mar 25 2019, 11:34 AM) QUOTE(killdavid @ Mar 25 2019, 11:43 AM) A lot of indicators already showing. The share prices are irrational propped up by buyback in US. This will not sustain. Lots of companies already start lay offs. Bloodbath just a figure of speech. I believe the recession will be slow and a downward trend. Not a crash. Just my feeling ya .... nobody can tell the future. Actually, the sign already shown during late 2016So what are you trying to say/do? Stop all investment? Hold on until xxx? Curious what will your course of action |

|

|

|

|

|

Mar 25 2019, 12:41 PM Mar 25 2019, 12:41 PM

Return to original view | Post

#167

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Apr 8 2019, 03:43 PM Apr 8 2019, 03:43 PM

Return to original view | Post

#168

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Apr 8 2019, 06:11 PM Apr 8 2019, 06:11 PM

Return to original view | Post

#169

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Apr 8 2019, 08:36 PM Apr 8 2019, 08:36 PM

Return to original view | Post

#170

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(David83 @ Apr 8 2019, 07:36 PM) Not sure if you guys are aware. I believe the market is somehow starting to heat up. i was not here as well.. newbie since late 2017In this section alone, we have a lot of newcomers asking for ETFs, SA, P2P investment, China/EM funds and etc. To me, it's like a repeat of 2007/2008 when China funds are overheated and started to crumple. The risk appetite is growing higher and higher. Just my 2 cents. Ignore me if you don't think so! but simple google search https://www.cnbc.com/id/41172751 Beware China's Overheated Economy and Stock Market Simon Hobbs Published 11:05 AM ET Thu, 20 Jan 2011 Updated 11:12 AM ET Thu, 20 Jan 2011 and most of the news are reported on 2011 but what actually happened? the china index during 2009 to 2016.. This post has been edited by xcxa23: Apr 8 2019, 08:36 PM |

|

|

Apr 25 2019, 10:54 AM Apr 25 2019, 10:54 AM

Return to original view | Post

#171

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ancient-XinG- @ Apr 24 2019, 09:18 PM) wow. another level lol but seriously good stuff. Same here.. start with stock age around 22, am in financial economy during uni and seriously, my dad teaches and gave more sound and useful advice.when come to bond fund, I ma simply man. Refer lipper. see top fund. check fsm. check fund sheet. check region. check investment area. check grade if they have. go chart centre. checks volatility. the best get my vote. buy. because it just a stabilizer and I already have 60% of total port in asnb FP. yo nick. I started around 20 too. But way too casual as compared to you. LOL. Well, I don't read any books on it at least. But are you sure you're 20 this year? Sounds too good. Then started focus on fd, around 24 to 26.. nothing much to say.. highest effective rate + pidm = good Then 27 until now, focuses on fund/equity.. thanks to this thread and many sound advice from you all.. able to kick start my engine. Slowly but steadily gaining knowledge. And seriously, you guys make more sense then those banker on unit trust.. |

|

|

May 14 2019, 12:43 PM May 14 2019, 12:43 PM

Return to original view | Post

#172

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(T231H @ May 14 2019, 11:48 AM) maybe that is why... Can it be hybrid? DCAT.. lolFSM placed this as the fund choice of the month FSM Fund Choice: Eastspring Investments Small-Cap Fund [May 2019] Malaysia equities have underperformed their regional peers in 2019 thus far. In this article, we share our views on the small-cap segment of the domestic economy and how investors could tap into these growth opportunities via Eastspring Investment Small-Cap Fund. https://www.fundsupermart.com.my/fsmone/art...-Fund-May-2019- maybe that is why...... to some people, it is better to do periodic investment like DCA...as DCA had been said to take the emotion factor out of the investment. last year some forummers had been shouting about timing the markets, wait for it come down to -20% or -40%.....but as shown, at times when the buying target arrives......they are still hesitate and wanted to continue to wait..... when wanted something one will give reasons, when one does not want something one will gives excuses....both are always right. no right or wrong...it is their posts and their money. the current best time was for those that are "forced" to buy due to tax relief purposes.......those that bought PRS in DEC 2018 + tax break %....huat abit lah.... but will DEC always be the "BEST" time? I have been dca since late 2017 and whenever market dip, will dca again.. of cos not every dip within a month.. my intention to buy is unlimited but my cash is limited |

|

|

May 14 2019, 02:45 PM May 14 2019, 02:45 PM

Return to original view | Post

#173

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MUM @ May 14 2019, 01:19 PM) If you planned to do dca after every payday... Then every beginning of month dca.... Dca on 1st week of the month.. If you plan dca on every drop...... Then plan set a min drops of % maybe every 10%? Unless got unlimited cash then every drops would be good...... Then what about every up? Honestly, I did not set any min drop for dca. Just like timing current market, after news of tarrif increase, pretty sure market will dip for at least two days.. then had to wait for China retaliate and so it happen today.. 1st week of May already monthly dca and probably this week dca. Some might argue, why don't wait until g20 submit? Rumours Trump and xi gonna meet up. I will say depend on your strategy.. mine is dca monthly and when the market dip. As for up, still same strategy. We buy in because we trust the fund will up up up.. My final goal is xxx amount invested in fsm. Once the goal reached. Will stop dca. Probably will buy in during dip only QUOTE(real55555 @ May 14 2019, 02:22 PM) Can, it depends on your objective, and like other ppl mentioned, you must have a clearly defined rule for you to DCA (say after it dropped 10% etc), otherwise you are basically just timing the market also, although the method is to DCA. Lol.. mine is dca monthly and when market dip dca, will try to time get the lowest price possible.DCA work best if it is done on a regular basis regardless of market movements, of course what I did is to go in again after the fund dropped 10% and my DCA still running every month. |

|

|

|

|

|

May 14 2019, 06:04 PM May 14 2019, 06:04 PM

Return to original view | Post

#174

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(yklooi @ May 14 2019, 05:05 PM) unless the income continued to flow at that time,...else the investment strategy may need to be realigned. QUOTE(yklooi @ May 14 2019, 05:08 PM) was updating my NAVs value.... whats does that even mean? then noticed this..... still managed to be + despite the drop in index. (error in computation at the source? then need to add back?) |

|

|

Jun 26 2019, 12:34 PM Jun 26 2019, 12:34 PM

Return to original view | Post

#175

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(yklooi @ Jun 26 2019, 12:23 PM) still holding on to S'pore focused funds? Me!Singapore seen set to suffer more than other regional nations due to trade war Read more at https://www.thestar.com.my/business/busines...UkOFrsiARalo.99 As of yesterday still negative, -0.28% |

|

|

Jun 26 2019, 01:08 PM Jun 26 2019, 01:08 PM

Return to original view | Post

#176

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(yklooi @ Jun 26 2019, 12:53 PM) Me too had 6% of my port in it for over a year since Oct 2017. Same same.. also Nikko am held till last week. sold off at -1.5% mine too was Nikko Am Spore Div (Myr) Mine is around 9% since 2017 also.. Been DCA every month As of now, I believe it will uptrend in the future, like in 5 years time.. Planning to buy in which? Or holding ammo 1st? |

|

|

Jun 26 2019, 01:52 PM Jun 26 2019, 01:52 PM

Return to original view | Post

#177

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MUM @ Jun 26 2019, 01:14 PM) yes, the usual you will pick up....but the question will be when? Just saw his postanyway from that article...I think you will as usual "wait" again for the cheaper.... :thumbsup: "With U.S.-China hostilities showing no signs of abating, Singapore will have to weather the storm for some time to come. "We are not out of the woods yet," said Sian Fenner, lead economist at Oxford Economics. "We haven't seen the worst." Read more at https://www.thestar.com.my/business/busines...GY4b4ETEcoV1.99 I think he is not buying yet or holding ammo 1st ...for days ago,...he mentioned active income stopped.... Voluntarily stopped active income Probably already reach his treasure chest pot 😁.. hehe Time to harvest and enjoy life |

|

|

Jun 26 2019, 02:15 PM Jun 26 2019, 02:15 PM

Return to original view | Post

#178

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Jun 27 2019, 09:42 AM Jun 27 2019, 09:42 AM

Return to original view | Post

#179

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MUM @ Jun 27 2019, 07:37 AM) Trump: China needs trade deal as economy 'going down the tubes' On Wednesday, the president strongly indicated he was ready to slap tariffs on all remaining Chinese imports -- more than $300 billion worth. "You have another $325 billion that I haven't taxed yet -- it's ripe for taxing, for putting tariffs on," he told Fox. According to Trump, it's China that's feeling all the pain. https://www.bangkokpost.com/world/1702368/t...-tubes#cxrecs_s This morning I read that trump and china willing to delay/bring down the tarrif to 10% But forgotten at which news site |

|

|

Jun 27 2019, 09:54 AM Jun 27 2019, 09:54 AM

Return to original view | Post

#180

|

Senior Member

2,649 posts Joined: Nov 2010 |

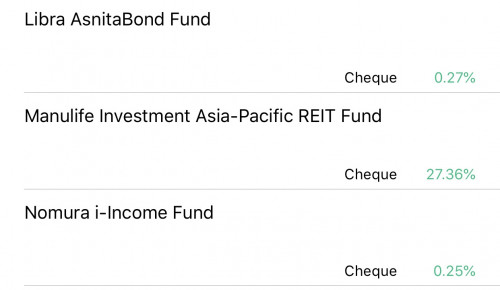

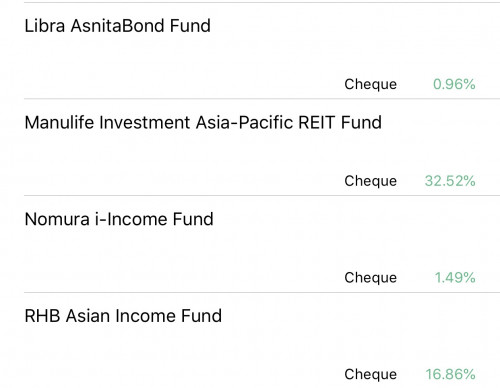

QUOTE(Drian @ Jun 27 2019, 09:44 AM) Another vote for normura i-income. :thumbsup: This two weeks most of the fund are pretty much uptrend due to possibilities/positive view of truce with the trade warMay 30th 2019  June 27th 2019  1.5% in ~5 weeks ... pretty impressive. Every few days checking my funds, it's always green , goes up steadily, no worries about what trump will tweet. But now I'm getting a little worried. How does a bond like fund get such high returns ? Don't want another RHB bond fund episode. And seems like circulation of positive news are in the wind. Of cos with trump, nothing is confirmed.. lol |

| Change to: |  0.0501sec 0.0501sec

0.16 0.16

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 07:12 AM |