Attached thumbnail(s)

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 13 2019, 12:16 PM Aug 13 2019, 12:16 PM

Return to original view | Post

#1261

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Aug 14 2019, 07:35 PM Aug 14 2019, 07:35 PM

Return to original view | Post

#1262

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Aug 14 2019, 09:33 PM Aug 14 2019, 09:33 PM

Return to original view | Post

#1263

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Aug 16 2019, 03:40 PM Aug 16 2019, 03:40 PM

Return to original view | Post

#1264

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Aug 19 2019, 07:17 PM Aug 19 2019, 07:17 PM

Return to original view | Post

#1265

|

Senior Member

5,143 posts Joined: Jan 2015 |

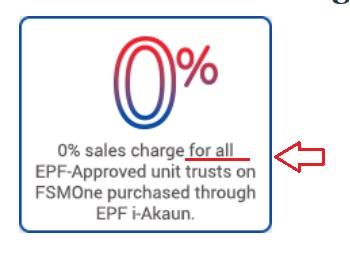

the 3% pie had been harder to come by already..... now the struggle for the food would really be in tenser going forward. NOW 0% SC but for many, it would be |

|

|

Aug 21 2019, 01:20 PM Aug 21 2019, 01:20 PM

Return to original view | Post

#1266

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kucingfight @ Aug 21 2019, 01:10 PM) from the site.....https://www.fundsupermart.com.my/fsmone/art...through-i-Akaun Attached image(s)  |

|

|

|

|

|

Aug 21 2019, 01:51 PM Aug 21 2019, 01:51 PM

Return to original view | Post

#1267

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Aug 21 2019, 02:17 PM Aug 21 2019, 02:17 PM

Return to original view | Post

#1268

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Jackrau @ Aug 21 2019, 02:04 PM) No, what I mean is the price of all income fund was increasing oddly and started dropping since 19/8. Amincome fund is an example of the exception?many said....FI and eq funds generally goes opposites way....have you check the performance of the equity funds since 19/8? Attached thumbnail(s)

|

|

|

Aug 21 2019, 02:23 PM Aug 21 2019, 02:23 PM

Return to original view | Post

#1269

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Jackrau @ Aug 21 2019, 02:17 PM) as per yesterday's.....QUOTE(yklooi @ Aug 20 2019, 10:36 AM) after 22 trading days of good runs,...finally Nomura lost 0.22% yesterday.... QUOTE(MUM @ Aug 20 2019, 10:59 AM) a day after China reduced its interest rate? btw...Nomura dropped 0.42% yesterday...thus total is 0.64% in 2 days.....but it had also been up >2.5% in 1 month. China's central bank is cutting interest rates https://edition.cnn.com/2019/08/19/investin...-cut/index.html if that is the reason.....it will be a coming trend of not so good performance already? ..... |

|

|

Aug 27 2019, 07:52 AM Aug 27 2019, 07:52 AM

Return to original view | Post

#1270

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(jtdc @ Aug 26 2019, 10:55 PM) just yesterday, there was a "sales" that is much better than those % of discount expected to be given during the FSM Merdeka promothus not just "make sure ready" with cash, but with steadfast emotion too right or wrong to buy it now, will it go down lower next few months? no one knows and no one cares, as long as happy to buy it at that moment in time with the money one can spare. as posted by QUOTE(Ramjade @ Aug 20 2019, 09:33 AM) |

|

|

Aug 29 2019, 01:30 PM Aug 29 2019, 01:30 PM

Return to original view | Post

#1271

|

Senior Member

5,143 posts Joined: Jan 2015 |

just don't be surprised if your Manu Reits dropped > 3% on 28 Aug......

or your AmAsia Pac Reits had dropped on 23 Aug too.... it is Ex date |

|

|

Sep 17 2019, 11:42 PM Sep 17 2019, 11:42 PM

Return to original view | Post

#1272

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(sya_dc @ Sep 17 2019, 11:29 PM) Hi, I am new to investing and i was told too look into FSM. May someone advice the best funds for me to invest? I have loads more to learn, and I feel the best teacher is being hands on and experience. I am the type “learn as I go” Do suggest me an account which is moderately risky (5 or 6) Thanks so much in advance for the help and tips the last we read you had EPF-MIS EQ funds in you portfolio thru CIMB Islamic DALI Equity Growth Fund CIMB Islamic DALI Equity Fund & Public Islamic Equity Fund with about all of your funds in your port focusing solely in Malaysia only....I guess your risk appetite is more than your intended moderately risky appetite.... This post has been edited by T231H: Sep 17 2019, 11:52 PM |

|

|

Sep 18 2019, 02:07 PM Sep 18 2019, 02:07 PM

Return to original view | Post

#1273

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(sya_dc @ Sep 18 2019, 01:34 PM) Actually I have no idea on investing. That was more of a friend asking me to invest my KWSP monies and I agreed..5 years later I found out its not profitable,making loss and I was angry. But it got me more interested with investing as well, so hence wanting to learn more about it. ok,....noted your reply...Back in June 1st time did with PB before I go all serious about finding out about Investing. Anyway after this I think im going to go independent on investing KWSP funds in FSM. At the same time looking to invest small amount to a somewhat okay2 fund for me to learn more. I see. How do I know I am not choosing wrongly? Haha here some articles that may of interest.... Not Sure How To Choose A Fund? Right This Way. Shawn Teow Published on 26 Oct 2018 https://secure.fundsupermart.com/fsm/articl...-right-this-way Search for the Holy Grail: Buying Low, Selling High? Tan Chu Ren Published on 26 Oct 2018 https://secure.fundsupermart.com/fsm/articl...ow-selling-high as you are currently I think is over focused in Malaysia, thus do try to see if this article can help or not Idea of the Week: Do You Really Understand Risk Diversification? https://secure.fundsupermart.com.hk/fsm/art...ification-14649 Mindsets for your investing success https://www.thestar.com.my/business/busines...esting-success/ one of my favorites (copied from earlier forummer) from Wong Sui Jau's blog.... "The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher." |

|

|

|

|

|

Sep 19 2019, 10:33 AM Sep 19 2019, 10:33 AM

Return to original view | Post

#1274

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(chooeh2 @ Sep 19 2019, 09:21 AM) This morning news regarding Indian Market! FSM also has an article about India published yesterday....http://www.enanyang.my/?p=1289834&fbclid=I...WLa6Rq6MBzpQGWU India: What's with the fall? In this article, we look to share with investors some of the possible reasons behind the recent volatility in Indian equities. Tan Wei Yine | Published on Sep 17, 2019 https://www.fundsupermart.com.my/fsmone/art...-with-the-fall- |

|

|

Sep 20 2019, 03:33 PM Sep 20 2019, 03:33 PM

Return to original view | Post

#1275

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Drian @ Sep 20 2019, 01:07 PM) The 3 bond funds that I have(AM Dynamic, Nomura) all seem to display the same thing now . Stagnant. However Normura dropped a lot (for a bond fund). But in August alone Nomura raised about 2.5% in a month.......That to me is a lot too much for a bond fundThis post has been edited by T231H: Sep 20 2019, 03:36 PM |

|

|

Sep 20 2019, 03:35 PM Sep 20 2019, 03:35 PM

Return to original view | Post

#1276

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(WhitE LighteR @ Sep 20 2019, 12:35 PM) HSBC has this to says....Instead of paying a "very high price” for negative returns in fixed income, Joseph Little, who helps run multi-asset teams at the U.K. firm, says clients should buy global equities. The economic pessimism priced into bonds is so high that even if the growth outlook improves modestly, the reversal in defensive assets could be dramatic, he said. "The gap between equity and bond valuations is pretty extreme at the moment, ” Little, the London-based global co-chief investment officer of multi-asset at HSBC Global Asset Management, said in a phone interview. "There’s an awful lot of bad news that is being currently reflected in the pricing today of long-term government bonds. It doesn’t take that much to really cause a bit of a shock to current pricing.” Read more at https://www.thestar.com.my/business/busines...UEqLJu5blcvk.99 |

|

|

Oct 4 2019, 04:30 PM Oct 4 2019, 04:30 PM

Return to original view | Post

#1277

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(JUSTmee @ Oct 4 2019, 03:06 PM) Hi all, I'm new for FSM. I'm planning to invest in unit trust. I'm more towards long term investment/savings in unit trust. Below is my plan and I'm open for any advised/suggestion. Thank you in advance. TA Global Technology Start with RM10k, monthly top up RM500 CIMB-Principal Greater China Equity Start with RM10k, monthly top up RM500 try form a portfolio of funds.... 2014 FSM Portfolio Construction Process https://www.fundsupermart.com.my/fsmone/art...mped-Portfolio- Forming a Portfolio https://www.fundsupermart.com.my/fsmone/art...ing-a-Portfolio Forming A Supplementary Portfolio https://www.fundsupermart.com.my/fsmone/art...ntary-Portfolio Alternative Investments https://www.fundsupermart.com.my/fsmone/art...ive-Investments Assessing Performance via Risk Metrics https://www.fundsupermart.com.my/fsmone/art...ia-Risk-Metrics The Importance of Rebalancing https://www.fundsupermart.com.my/fsmone/art...-of-Rebalancing |

|

|

Oct 18 2019, 01:09 PM Oct 18 2019, 01:09 PM

Return to original view | Post

#1278

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(voyage23 @ Oct 18 2019, 10:07 AM) Quite many KGF holders here, any KGF series 2 holders? It's been doing quite well and slightly better than KGF. Good alternative? on this....looks like this series 2 one is more diversified from the FF sept....only 55% in Malaysia + Asiathus if want a more diversified fund then it is a good alternative between these 2, unless one want a M'sia only focused fund QUOTE(chilskater @ Oct 18 2019, 12:19 PM) there are just a handful of Reit funds in FSM....either this or AmAsiaPac Reit...are often mentioned here no you cannot view PM funds in FSM platform..... |

|

|

Oct 20 2019, 12:59 AM Oct 20 2019, 12:59 AM

Return to original view | Post

#1279

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Drian @ Oct 19 2019, 09:01 PM) maybe due to the large % of exposure and the amount of bond sukuk value?previous June incident some funds NAV affected by -9 % in a day https://www.fundsupermart.com.my/fsmone/art...hin-Half-A-Year Attached thumbnail(s)

|

|

|

Oct 24 2019, 09:54 PM Oct 24 2019, 09:54 PM

Return to original view | Post

#1280

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(skynode @ Oct 24 2019, 09:45 PM) What's the latest recommendation for bond funds? see post 19169 while waiting for responses?I am looking for one with short/mid term holdings; and another with long term holdings. or try this per JULY? https://www.fundsupermart.com.my/fsmone/art...ng-market-bonds This post has been edited by T231H: Oct 24 2019, 09:56 PM |

| Change to: |  0.8089sec 0.8089sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:37 AM |