QUOTE(xcxa23 @ Nov 11 2020, 06:43 PM)

Hopefully the rebound is even better 🙏QUOTE(ericlaiys @ Nov 11 2020, 07:37 PM)

Hahaha, dca method but not for meFundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Nov 11 2020, 07:44 PM Nov 11 2020, 07:44 PM

Return to original view | IPv6 | Post

#121

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

|

|

|

Nov 11 2020, 09:54 PM Nov 11 2020, 09:54 PM

Return to original view | IPv6 | Post

#122

|

Senior Member

3,602 posts Joined: Jan 2003 |

Sorry for the Wrong info, actually NAV drop 0.05 = 3.8% (PGC)

And tomorrow we gonna see another drop 🙁 based on today’s news This post has been edited by whirlwind: Nov 11 2020, 10:06 PM |

|

|

Nov 11 2020, 09:55 PM Nov 11 2020, 09:55 PM

Return to original view | IPv6 | Post

#123

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 12 2020, 12:49 PM Nov 12 2020, 12:49 PM

Return to original view | IPv6 | Post

#124

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(xuzen @ Nov 12 2020, 12:35 PM) T 1 U N 1 4 H S 3 N G! 😱 I just top up on Monday ( 9th Nov 2020 ) RM 5,000.00 into AmChina-A Share, the RM 5K being the minimum top up value. Looks like I top up at the peak. Xuzen. PGC yesterday 3.8%, today gonna be another drop Based on the news, worry the clamp down from the China government might leave a permanent drop |

|

|

Nov 12 2020, 01:03 PM Nov 12 2020, 01:03 PM

Return to original view | Post

#125

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 12 2020, 01:37 PM Nov 12 2020, 01:37 PM

Return to original view | IPv6 | Post

#126

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(WhitE LighteR @ Nov 12 2020, 01:13 PM) Hahaha, I don’t think UT sucks. It’s the beginners like me. QUOTE(MUM @ Nov 12 2020, 01:14 PM) so are China funds from this FHs For PGC on month of nov so far +3.73%did not check whether all the gains from the rally from 2 Nov had been wiped out or not yet |

|

|

|

|

|

Nov 12 2020, 11:54 PM Nov 12 2020, 11:54 PM

Return to original view | IPv6 | Post

#127

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(encikbuta @ Nov 12 2020, 04:21 PM) yea i tend to agree with this statement Yup not easynot very easy ler to find a fund that consistently gives 5 - 7% every year and summore promise a minimum of 2.5%. if not because of the 55 yrs old withdrawal thingy, i would have just dumped all my investable money into EPF. no need to bother trying to manage my own investments. I’m still not giving up I believed with sufficient experience and perseverance UT will be able to provide a better return WhitE LighteR liked this post

|

|

|

Nov 13 2020, 12:02 AM Nov 13 2020, 12:02 AM

Return to original view | IPv6 | Post

#128

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 13 2020, 10:30 AM Nov 13 2020, 10:30 AM

Return to original view | IPv6 | Post

#129

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(GrumpyNooby @ Nov 13 2020, 08:02 AM) Asia also drop when US drop🙁Asian stocks dip as virus spread tamps vaccine hopes https://www.theedgemarkets.com/article/asia...s-vaccine-hopes |

|

|

Nov 13 2020, 12:23 PM Nov 13 2020, 12:23 PM

Return to original view | IPv6 | Post

#130

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(GrumpyNooby @ Nov 13 2020, 10:32 AM) Drop is good; an opportunity to buy more! 2 days ago due to China clamp down on China techI won't cry for it. But I'm curious why with the drop? Perhaps the rising cases in US is swinging the market mood. But today 🤷♂️ QUOTE(polarzbearz @ Nov 13 2020, 11:45 AM) One thing that might help - is to stop looking at news (contradictory I know) 😅Maybe then won't feel as worried and let emotions take control of your investment. That’s gonna be hard |

|

|

Nov 13 2020, 01:45 PM Nov 13 2020, 01:45 PM

Return to original view | IPv6 | Post

#131

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 13 2020, 01:52 PM Nov 13 2020, 01:52 PM

Return to original view | IPv6 | Post

#132

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(polarzbearz @ Nov 13 2020, 12:37 PM) Nothing is easy. Since you've decided to use EPF fund to invest, just stick around and stop looking at news and continously switching funds. Even if returns don't kill you the switching fees (if any) will. Revisit your portfolio half a year (or a year, or two) later and decide if rebalance is needed or if direction change is required. 👌Emotions and Investment don't work well together. I thought I need to update myself with business news That’s why reading business everyday and look at the fund performance 😅 QUOTE(WhitE LighteR @ Nov 13 2020, 01:33 PM) U don't need to react to every news. The direction is always up. Pick a good fund n just look for buying opportunity. 👌 I still not sure whether my funds are ok or not All are equities Consist of Greater China, Asia, Global and Malaysia Small Cap |

|

|

Nov 13 2020, 01:54 PM Nov 13 2020, 01:54 PM

Return to original view | IPv6 | Post

#133

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(GrumpyNooby @ Nov 13 2020, 01:46 PM) Yes it is meant for long term but you're being affected emotionally in short term. Adapting myself Irony I would say ... Trying to control myself with any short term changes By the way, principal ASEAN been continuing going up for this month. Fyi This post has been edited by whirlwind: Nov 13 2020, 01:57 PM |

|

|

|

|

|

Nov 13 2020, 02:01 PM Nov 13 2020, 02:01 PM

Return to original view | IPv6 | Post

#134

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 13 2020, 02:03 PM Nov 13 2020, 02:03 PM

Return to original view | IPv6 | Post

#135

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 13 2020, 06:51 PM Nov 13 2020, 06:51 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

3,602 posts Joined: Jan 2003 |

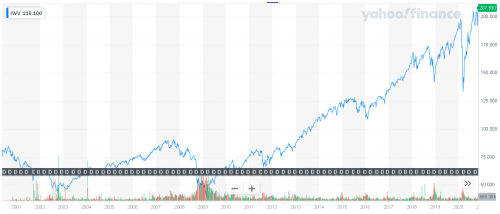

QUOTE(wongmunkeong @ Nov 13 2020, 03:44 PM) bro - when U look at short term, U see crazy stuff 👍iShares Russell 3000 ETF (IWV) which holds 98%+/- of US stocks  BUT when U zoom out - whatcha see? steady climb up with a trip (dang pebble/shoe laces) here/there right?  U can look up other ETfs and zoom in/out to get a feel of what U should be focusing on and what NOT to be focusing on eg. like driving - yes look ahead at the road in front BUT more important focus is getting to the destination, using whatever roads (if immediate road jammed) right? Actually many sifus here reminded me before. It’s just that I easily get “emotional” In my mind, it’s always are my funds really the correct ones? Then we I start to see the drop, I start comparing, hahaha. |

|

|

Nov 13 2020, 06:59 PM Nov 13 2020, 06:59 PM

Return to original view | IPv6 | Post

#137

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Nov 13 2020, 07:03 PM Nov 13 2020, 07:03 PM

Return to original view | IPv6 | Post

#138

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(MUM @ Nov 13 2020, 06:57 PM) even if your fund "maybe' the correct one for now (or for another X months)....it does not mean that it will stay the "correct" for ever..... Notedso, just hope that your "emotion" can "corrects" itself Will continue update myself so that I don’t miss out on the good fund |

|

|

Nov 14 2020, 12:34 AM Nov 14 2020, 12:34 AM

Return to original view | IPv6 | Post

#139

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(GrumpyNooby @ Nov 13 2020, 07:03 PM) You mean like this?QUOTE(MUM @ Nov 13 2020, 07:08 PM) Just a note,... By the time you realised n updated yourself n confirmed that it was a good fund n switched in.... It may already at peak.... I have an assumption at the moment that Precious Metal Securities might be in this scenario. The fund shoot up during the emergence of covid and now since there’s many news on vaccines therefore Investing in gold fund at the moment is very risky. Some call that the perils of rear view investing.... No harm trying that as one can only loss time n some money QUOTE(WhitE LighteR @ Nov 13 2020, 07:50 PM) there is only a few common good funds that is always discuss here. most of the funds in fsm is cannot pakai one. 👌from time to time the senior here will discover new better performing fund n share in here. u can update your watchlist. after a while u will get the hang of how to evaluate a good performing fund too. in the begining just learn from others first before forming your own opinion. try not to bring any of your own misconseption into this. if u dont agree with others later on, go ahead n follow your own mindset. ultimately its your money. there is no right or wrong as long as u dont lose money. losing money is the biggest no no. "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1." try out small amount first. this is you "life lesson fee" into investing your own money. even if u lose it. u wont feel so heart pain. |

|

|

Nov 14 2020, 11:01 AM Nov 14 2020, 11:01 AM

Return to original view | IPv6 | Post

#140

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(encikbuta @ Nov 14 2020, 07:55 AM) maybe you could run a long term experiment to test out this theory for yourself. it is sometimes easier to 'see it to believe it'. so say you got RM10k overall investable fund right now. Already invested most of the available fund in my epf. Not much fund left for dcaRM5k you put into a globally diversified large cap unit trust (Principal Global Titans?) and dump RM100/month or whatever inside. Don't change no matter the market up or down. We call this the 'boring portfolio'. Then another RM5k (along with additional RM100/month), you do your own allocation (i.e. some in Large Cap, ASEAN, Precious Metals, Greater China, Healthcare, etc) and make constant adjustments based on your sources. We call this the 'active portfolio'. I guess kinda like what you doing now? Check back after 5 years and compare the total ROI%. This post has been edited by whirlwind: Nov 14 2020, 01:00 PM |

| Change to: |  0.0717sec 0.0717sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:22 PM |