Most region in green except MY in slightly red zone. anyone DCA or waiting for 20% discount?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 15 2017, 02:19 PM Aug 15 2017, 02:19 PM

Return to original view | IPv6 | Post

#101

|

Senior Member

1,203 posts Joined: Dec 2008 |

Most region in green except MY in slightly red zone. anyone DCA or waiting for 20% discount?

|

|

|

|

|

|

Sep 28 2017, 08:04 AM Sep 28 2017, 08:04 AM

Return to original view | Post

#102

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(Ramjade @ Sep 27 2017, 10:42 PM) Er I think you weren't paying attention to what I wrote earlier. SG UT is 0% service charge, 0% platform fees, 0% switching fees (depending on what platform you use) That is interesting Bro Ram, please share some info procedure.So example if I were to put in SGD1000, the full SGD1000 will be invested. The only think I will lose - Bank's TT (min 1% of my total transfer value) - But as I said, I found a way around the bank's charges as fintech truly is awesome. Moneymatch gives same/better return than what money changers give. Best part of all, all can be done via online So what do I lose? No bank charges, no service charge, no platform fees, same or higher returns as Malaysia. So want to join me or not? No need to set foot in SG at all. You can do it all from Kuching. PM link TQ |

|

|

Sep 28 2017, 08:36 AM Sep 28 2017, 08:36 AM

Return to original view | Post

#103

|

Senior Member

1,203 posts Joined: Dec 2008 |

|

|

|

Feb 25 2019, 09:54 AM Feb 25 2019, 09:54 AM

Return to original view | Post

#104

|

Senior Member

1,203 posts Joined: Dec 2008 |

If you were to park your money in FSM, invest it in CMF or Cash Account

|

|

|

Feb 26 2019, 10:48 PM Feb 26 2019, 10:48 PM

Return to original view | Post

#105

|

Senior Member

1,203 posts Joined: Dec 2008 |

May I know what different CMF and Cash Account ?

|

|

|

Feb 26 2019, 11:10 PM Feb 26 2019, 11:10 PM

Return to original view | Post

#106

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(David83 @ Feb 26 2019, 10:58 PM) CMF is RHB managed money market fund. Wondering FSM objective for setting this Cash Account for ?Cash Account is Read Chapter 21 about Cash Account in FAQ: https://www.fundsupermart.com.my/fsmone/funds/faq-funds The interest rate is quite low for Cash Account: The net interest rate for the Cash Account in MYR is 2.60% (base interest rate of 3.10% - 0.5%). The 0.5% represents FSMOne and bank’s admin fees, which are at 0.25% per annum respectively. Currently, there is no interest earn for Cash Account in AUD, SGD and USD. Since lower interest, and slight confusing on their purchasing stage you still can choose the currency AUD, SGD or USD. but in faq did mention no interest earn for it. This post has been edited by aoisky: Feb 26 2019, 11:13 PM |

|

|

|

|

|

Feb 26 2019, 11:16 PM Feb 26 2019, 11:16 PM

Return to original view | Post

#107

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(David83 @ Feb 26 2019, 11:11 PM) Some people could be complaining that selling proceed into CMF takes longer TAT. but nowadays selling CMF take shorter period of day dy 2 days received. Cash Account is instantly maybe.This Cash Account to shorten the period. Just my guess. They're not holding the money themselves. They're just agent. |

|

|

Feb 26 2019, 11:19 PM Feb 26 2019, 11:19 PM

Return to original view | Post

#108

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(David83 @ Feb 26 2019, 11:11 PM) Some people could be complaining that selling proceed into CMF takes longer TAT. This Cash Account to shorten the period. Just my guess. They're not holding the money themselves. They're just agent. QUOTE 1. Cut down on transaction time when you buy and sell mutual funds via the Cash Account; 2. No minimum balance is required and there is no lock-in period; 3. No monthly charge; 4. View your balance online anytime; 5. Deposit and withdraw money anytime; and 6. Earn higher interest rates FSMOne consolidates the monies deposited by all investors in the cash account and deposits it with a licensed bank in Malaysia. As long as there are sufficient funds in your Cash Account, the funds can be used to pay for your unit trust purchases immediately. This post has been edited by aoisky: Feb 26 2019, 11:24 PM |

|

|

Feb 26 2019, 11:25 PM Feb 26 2019, 11:25 PM

Return to original view | Post

#109

|

Senior Member

1,203 posts Joined: Dec 2008 |

QUOTE(David83 @ Feb 26 2019, 11:18 PM) CMF still takes time because it's still a fund managed by RHB. Noted. Appreciate your reply.You need execute the sell order and fund managers need to buy the units back. Cash Account is just like e-wallet. When you cash out, you will get the money within the working day itself (if before 3pm) as stated in FAQ. |

|

|

Dec 23 2020, 07:29 AM Dec 23 2020, 07:29 AM

Return to original view | Post

#110

|

Senior Member

1,203 posts Joined: Dec 2008 |

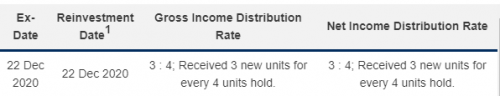

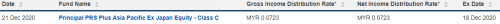

QUOTE(GrumpyNooby @ Dec 21 2020, 06:37 PM) Unit split declared for Principal Asia Pacific Dynamic Income Fund - MYR -> 3 : 4; Received 3 new units for every 4 units hold. This is first time they have done Unit Split Interestingly that the PRS fund declared its first time distribution first:  Wondering if that unit split will alter the PRS fund NAV too? Reinvest Date 22 Dec mean today will appear. This post has been edited by aoisky: Dec 23 2020, 07:34 AM |

|

|

Jan 27 2022, 11:15 PM Jan 27 2022, 11:15 PM

Return to original view | IPv6 | Post

#111

|

Senior Member

1,203 posts Joined: Dec 2008 |

Hi, anyone receive red packet already ?

|

| Change to: |  0.0714sec 0.0714sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 05:44 AM |