QUOTE(ideaplus @ Aug 28 2025, 01:28 PM)

I might suggest you as listed below for CB, which I think you might prefer CB since you have MBB 2 Amex Platinum

Bank Islam Platinum3% Cash Back for monthly spend from RM500 to RM1,499.99 for Online, Auto Billings, Grocery and Dining

You need to spend RM1000, then you can get the maximum of RM30/month

If your insurance is under Auto debit, it's eligible for the CB (which I tested, Great Eastern is eligible)

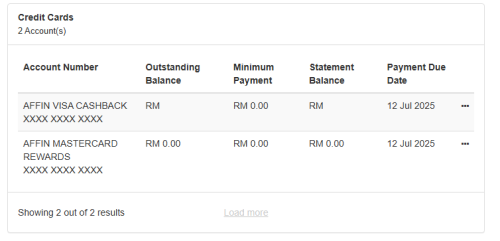

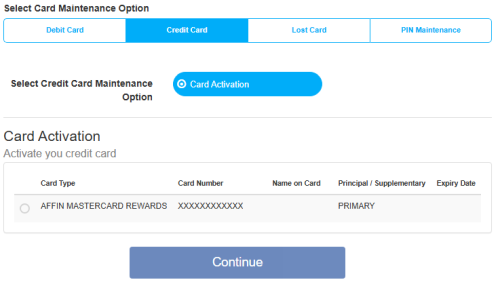

Affin DuoMore or less same like Bank Islam Platinum, but sorry to informed that you can't just activate Visa only.

Alliance Visa SignatureSpend RM3000 and you will get RM55.50/month. Quite easy for those lazy to think about the categories.

Thanks for the recommendation, will consider affin duo and bank islam

as for alliance bank, I hardly hit RM3k

QUOTE(1mr3tard3d @ Aug 28 2025, 02:54 PM)

are you new cardmember of Maybank?

would be interesting if they did not charge SST on Visa card 3 months after approval date, according to their

FAQfor Affin duo, it is possible to activate Visa only

» Click to show Spoiler - click again to hide... «

unless you have fully utilised/unable to utilise Amex, Affin duo should complement nicely

Not really consider new cardmember for Maybank, guess using around 2022 or 2023, cannot remember

And as of now still didn't charge RM25 SST for my Visa, and MAE apps still showing pending activation

Every month I easily fully utilized RM50 cashback for my Amex, that why thinking alternate cash back card

Miss old days Public bank quantum card, too bad benefit had change hence terminated

Though looking for HSBC Live+, looks like affin duo is the best

Btw how you all fully hit affin duo (visa) cashback?

This post has been edited by AlexisStarZ: Aug 28 2025, 10:31 PM

Jun 13 2024, 12:34 PM

Jun 13 2024, 12:34 PM

Quote

Quote

0.0220sec

0.0220sec

0.20

0.20

7 queries

7 queries

GZIP Disabled

GZIP Disabled