1. Annual Income: RM100K above

2. Free Lifetime Annual Fee: YES or easily waive annual fee

3. Card required for: Want opinion if I should get another card for daily spending

4. Existing credit cards (if any):

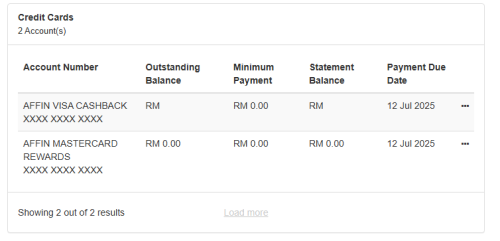

MBB 2Card Amex: Using the AMEX for many years to get weekend cashback

MBB 2Card Mastercard: keep only

HSBC Visa Signature: I've been using this for many years for everything else, including Insurance autobilling, dining out etc. when I can't or don't use the AMEX. Also for PPL access.

5. Interested in CC from: Want to get the opinions of the experts here if I may be missing out on something.

Should i get another card for daily spending, E wallet topup (mainly touch n go), and just reserve the HSBC for PPL access? Although I will still need to use it to waive the AF.

Grateful for any opinions here. Thanks in advance

Credit Cards Recommendation for Credit Cards V4, Please post according to Format stated

Aug 13 2025, 11:43 PM

Aug 13 2025, 11:43 PM

Quote

Quote

0.0254sec

0.0254sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled