QUOTE(yimingwuzere @ Jul 23 2025, 12:57 PM)

Air miles is the only thing worth redeeming with points, IMHO.

Maybe break down what you spend, and where on a monthly basis? That'll be easier to identify what cards suit you best.

i see, as i know if high spender like 10-20k per month only worth to invest on airmiles right? not too sure on this, which card would u recommend if focus on points?

usually usage more on dining, retails etc.

QUOTE(nexus2238 @ Jul 23 2025, 01:05 PM)

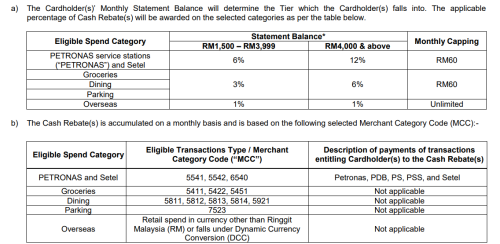

if you monthly spend is RM4-6k, with combination of cc, it is quite easy to get 3% to 4% cb per month.

That's RM120 (3% of 4k) to RM240 (4% of 6k) cb per month.

Some find it appealing, some find it troublesome to play.

It's your personal preference lah

yeah looks like quite hassle to keep track if using multiple card to utilize the cashbacks. which card would u recommend if focus more on points?

Jul 18 2025, 09:33 PM

Jul 18 2025, 09:33 PM

Quote

Quote

0.0192sec

0.0192sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled