QUOTE(dcUni @ Oct 5 2023, 11:46 PM)

Hi all, I would like to request recommendations with details below.

1. Annual Income: RM54K (Include basic + Allowance)

2. Free Lifetime Annual Fee: Prefer yes

3. Card required for:

- For grocery and installment plan

- Sometimes can be used for petrol

4. Existing credit cards (if any): No

5. Interested in CC from: Any bank

6. Others: I do not own any card before and I am over 30 years old which is consider as white base. I did have a car loan from Maybank.

While I am not an expert, car loan consider got credit history. Should be able to get.

Can consider Maybank Islamic Ikhwan Gold MasterCard.

whatever he said covers more groundQUOTE(keong8867 @ Oct 7 2023, 08:02 PM)

What is the best card to apply . I’m using UOB one card only. I’m thinking to get 1 more credit card, any suggestion. It could be cash back or get point to redeem, but which is better? Please recommend thank you

No follow format how to help you. Can look into affin duo.

Maybank visa signature, Maybank Ikhwan Gold also got for popular spending.

QUOTE(rocketm @ Oct 13 2023, 10:09 PM)

Hi seeking sifu for credit card recomendation:

1. Annual Income: RM81,000

2. Free Lifetime Annual Fee: Preferable

3. Card required for: Online shopping, pay utility bills and reload Tng ewallet

4. Existing credit cards (if any): Nil

5. Interested in CC from: Nil

6. Others: Preferable credit card that can waiver for annual fee and government service tax. Also focus on cash back.

Thank you.

Affin duo

If your online shopping focuses on shopee and Lazada, I recommend Maybank Ikhwan platinum amex.

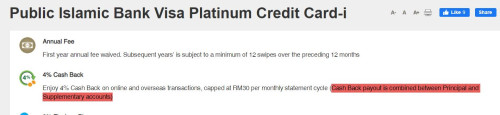

PB VS covers online too. I think still can get cash back for utility bills, please double check this.

QUOTE(a4techx7 @ Oct 3 2023, 12:49 AM)

1. Annual Income: RM400k

2. Free Lifetime Annual Fee: Yes, or can be waived with spending

3. Card required for: Just need another card to separate my personal spending and company expenses. Best for air miles collection.

4. Existing credit cards (if any): Maybank Visa Infinite only

5. Interested in CC from: Any bank

6. Others: Most of my spendings are usually company related expenses and also air tickets for business trip (spending > 200k per year, and most of the time i change the currency to usd if possible when checking out too).

Previously was thinking of applying another maybank 2 cards so that i can have existing visa infinite for personal and m2p for all company stuffs

Not sure how your plan is gonna be but the best airmiles collection is Maybank 2 card premier, because of amex reserve.

You can spend more than enough to waive the annual fee.

This post has been edited by adele123: Oct 14 2023, 12:25 AM

Jun 29 2023, 11:05 PM

Jun 29 2023, 11:05 PM

Quote

Quote

0.0275sec

0.0275sec

0.20

0.20

7 queries

7 queries

GZIP Disabled

GZIP Disabled