Continue from;

https://forum.lowyat.net/topic/3680981/+2560

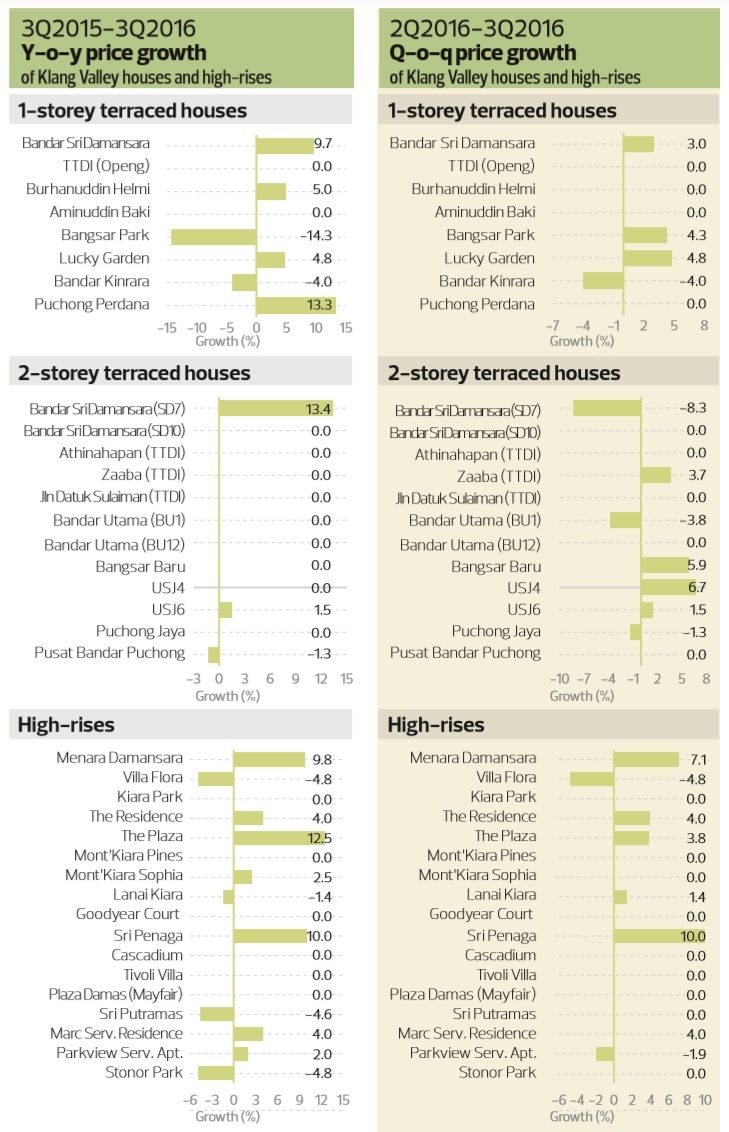

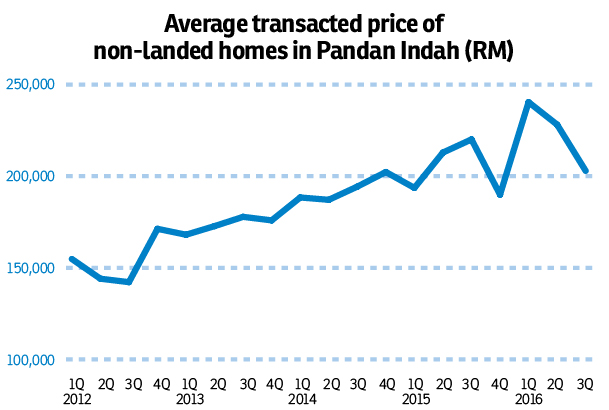

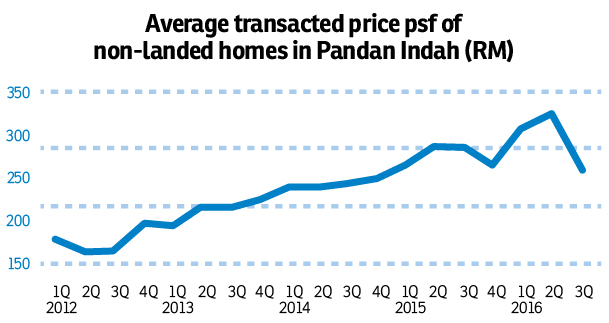

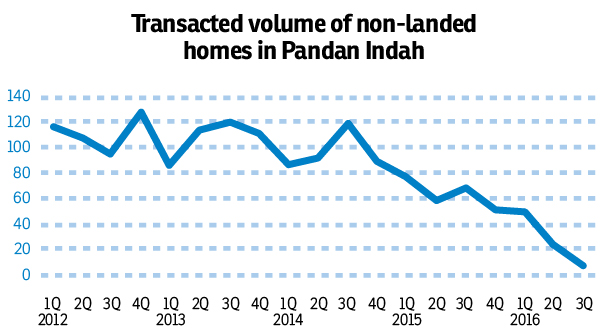

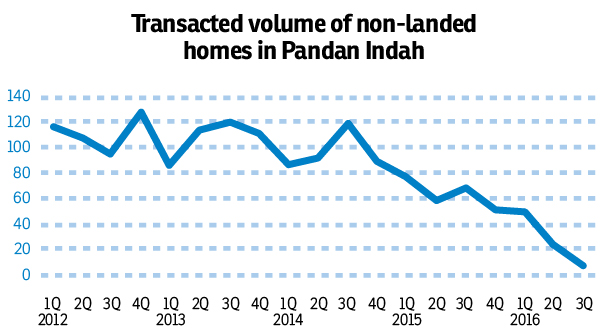

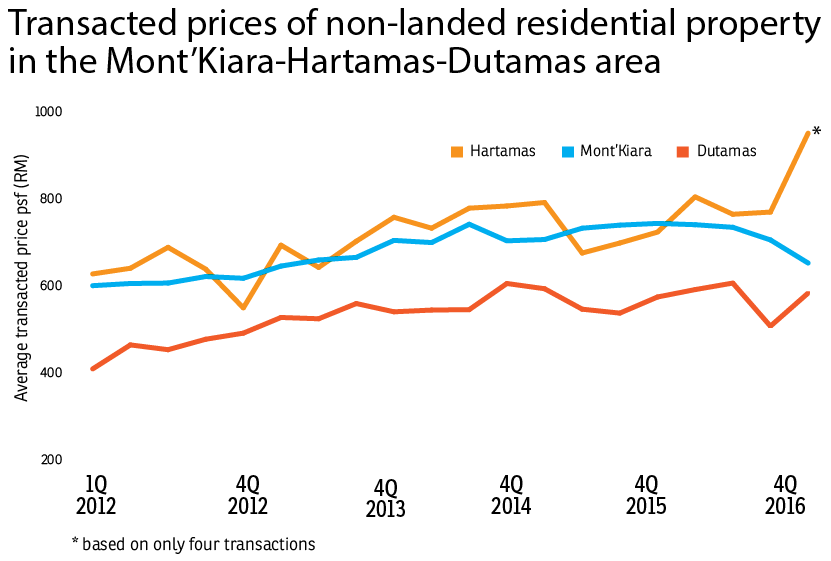

KV property is on down trend for the last seven consecutive quarters.

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Dec 23 2016, 04:32 PM, updated 2w ago Dec 23 2016, 04:32 PM, updated 2w ago

Show posts by this member only | Post

#1

|

All Stars

21,456 posts Joined: Jul 2012 |

Continue from;

https://forum.lowyat.net/topic/3680981/+2560 KV property is on down trend for the last seven consecutive quarters. |

|

|

|

|

|

Dec 23 2016, 04:34 PM Dec 23 2016, 04:34 PM

Show posts by this member only | IPv6 | Post

#2

|

All Stars

24,219 posts Joined: Mar 2007 From: Kuala Lumpur |

Oh well.. Thats is what is expected already. On the positive side, properties prices are coming down albeit slow. More people can afford to buy their own homes.

This post has been edited by TOMEI-R: Dec 23 2016, 04:34 PM |

|

|

Dec 23 2016, 04:35 PM Dec 23 2016, 04:35 PM

Show posts by this member only | Post

#3

|

Junior Member

343 posts Joined: Jul 2011 From: Land of SaberLion :3 |

im tired of hearing buble buble bubble. jasonanthony liked this post

|

|

|

Dec 23 2016, 04:38 PM Dec 23 2016, 04:38 PM

Show posts by this member only | Post

#4

|

All Stars

21,456 posts Joined: Jul 2012 |

Recently, it seems;

- On some vped units; bank valuation is at about 90% of developer SNP price. - At some banks, NPL on residential property has jumped by double digits %. - Some banks are not providing end finance to certain developers projects. If market sentiment doesn't improve, expect the above to persists. This post has been edited by icemanfx: Dec 23 2016, 04:41 PM |

|

|

Dec 23 2016, 04:40 PM Dec 23 2016, 04:40 PM

Show posts by this member only | Post

#5

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(icemanfx @ Dec 23 2016, 04:38 PM) Recently, it seems; so many auction units now. so many choice- On some vped units; bank valuation is at about 90% of developer SNP price. - At some banks, NPL on residential property has jumped by double digits %. If market sentiment doesn't improve, expect the above to persists. |

|

|

Dec 23 2016, 04:47 PM Dec 23 2016, 04:47 PM

Show posts by this member only | Post

#6

|

Junior Member

63 posts Joined: Nov 2011 |

BBB all the wayyyyyyyyyyyyyyyyyyyyyyyyyyy

|

|

|

|

|

|

Dec 23 2016, 04:58 PM Dec 23 2016, 04:58 PM

Show posts by this member only | Post

#7

|

Junior Member

352 posts Joined: Mar 2009 |

DDD!

|

|

|

Dec 23 2016, 07:22 PM Dec 23 2016, 07:22 PM

Show posts by this member only | Post

#8

|

Junior Member

352 posts Joined: Mar 2009 |

Omg!!! ..just found out my fren condo is up for an auction from browsing the auction site 😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱

So shocking! |

|

|

Dec 23 2016, 07:26 PM Dec 23 2016, 07:26 PM

Show posts by this member only | Post

#9

|

Junior Member

284 posts Joined: Nov 2016 |

QUOTE KUALA LUMPUR: The year ends on yet another gloomy note for the Malaysian property market as both the residential and commercial segments saw an extension of the downward purchasing momentum from 2015. Past President of the Malaysian Institute of Estate Agents (MIEA) Siva Shanker opined that the property market had reached the bottom of its cycle in 2016 after being in a slowdown mode since 2012. “In 2013, we saw the number of transactions fall, but with the value still going up. In 2014, we saw a slight increase in value, but unfortunately, the improvement did not carry through to 2015. “In my opinion, the property market will end the year on a weak note,” he told Bernama. QUOTE As property is a long-term investment, people who get caught in the cycle are the ones trying to be short-term investors or also labelled as “property-flippers”. A key reason for the lower purchasing activity in the industry is the difficulty in obtaining housing loans from financial institutions. As revealed by the National Property Information Centre (NAPIC) in its Property Market Report for the first half of 2016, the ratio of loan approvals against applications shrunk to a low 40%. It was also the lowest recorded in a six-year period. Property buyers seemed to be burdened by the rising prices of residential and commercial buildings against the background of a weaker economy. It was noted that the Malaysian House Price Index continued to improve moderately in the second quarter of 2016 at 235.4 points, up 5.3%. The same goes for commercial buildings, whereby prices of shop lots continued to strengthen in areas with hype commercial activities and efficient connectivity, in ranging between RM1.2 million and RM2 million for a double-storey unit, depending on locality. This situation has resulted in a huge property overhang for the year, especially in the residential segment. – Bernama http://www.thestar.com.my/business/busines...d-on-weak-note/ TLDR: Lower number of transactions, price slightly up, flippers suffer This post has been edited by Coup De Grace: Dec 23 2016, 07:26 PM |

|

|

Dec 23 2016, 07:30 PM Dec 23 2016, 07:30 PM

|

Senior Member

4,232 posts Joined: Jan 2003 From: Selangor |

'down trend for the last seven consecutive quarters'

|

|

|

Dec 23 2016, 07:37 PM Dec 23 2016, 07:37 PM

|

Senior Member

3,617 posts Joined: Oct 2010 |

But Penang properties only UUU.

Penangkia have strong holding power because all houses they owned were purchased below RM100K last time, now selling price RM1Million You want to buy? dun want i hold coz i already finish paid the morgage. |

|

|

Dec 23 2016, 07:43 PM Dec 23 2016, 07:43 PM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

Hope we see "Con9lan7firm Property Bubble Burst V1" thread soon.

|

|

|

Dec 23 2016, 07:46 PM Dec 23 2016, 07:46 PM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

|

|

|

|

|

|

Dec 23 2016, 07:49 PM Dec 23 2016, 07:49 PM

|

Senior Member

1,678 posts Joined: Mar 2016 |

BBB time cumming...

Rubbing hands in glee... |

|

|

Dec 23 2016, 07:58 PM Dec 23 2016, 07:58 PM

|

Senior Member

4,719 posts Joined: Jan 2003 |

|

|

|

Dec 23 2016, 07:59 PM Dec 23 2016, 07:59 PM

|

Junior Member

352 posts Joined: Mar 2009 |

|

|

|

Dec 23 2016, 08:49 PM Dec 23 2016, 08:49 PM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

|

|

|

Dec 23 2016, 08:56 PM Dec 23 2016, 08:56 PM

|

Senior Member

852 posts Joined: Apr 2012 |

Denial mode on

UUU BBB |

|

|

Dec 23 2016, 09:00 PM Dec 23 2016, 09:00 PM

|

Senior Member

600 posts Joined: Jun 2014 |

My friend house in GVH drop below developer price... bearbearwong can u confirm this?

|

|

|

Dec 23 2016, 09:31 PM Dec 23 2016, 09:31 PM

|

Junior Member

400 posts Joined: Jan 2003 |

if myr/usd drop 10% property also will up 10% but it applies to old property not those overpriced new project Fenix98 liked this post

|

|

|

Dec 23 2016, 11:57 PM Dec 23 2016, 11:57 PM

Show posts by this member only | IPv6 | Post

#21

|

All Stars

21,456 posts Joined: Jul 2012 |

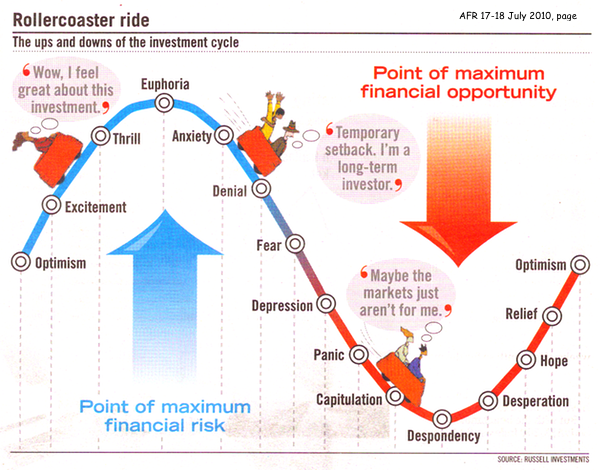

KV property is at early stage of down trend, many are in denial. This post has been edited by icemanfx: Dec 24 2016, 12:04 AM |

|

|

Dec 24 2016, 07:51 AM Dec 24 2016, 07:51 AM

|

Senior Member

9,616 posts Joined: Dec 2013 |

|

|

|

Dec 24 2016, 10:55 AM Dec 24 2016, 10:55 AM

Show posts by this member only | IPv6 | Post

#23

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Dec 24 2016, 11:08 AM Dec 24 2016, 11:08 AM

|

Junior Member

352 posts Joined: Mar 2009 |

|

|

|

Dec 25 2016, 11:57 AM Dec 25 2016, 11:57 AM

|

Senior Member

9,533 posts Joined: Jun 2013 |

|

|

|

Dec 25 2016, 06:57 PM Dec 25 2016, 06:57 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(goks @ Dec 25 2016, 05:19 PM) If u r a yield investor, see which one makes investment sense, new is nice but u may get 3% yield, old maybe u can get 7-8% then why worry? If one knows where to look, could find dead chicken even during property bullrun. Bravo!I have not bought a new property in the last 7 years, but I have purchased 4 properties, all on auction and 30-40% under prevailing market rate. I like new properties but I am not emotional, I only buy when I can get minimum 7% yield. So put ur emotions aside and make a business decision. Many think new properties will have tremendous capital gain, not always true except 1st buyer but tha too no one does a nett investment calculation after all the interest u have paid during construction if the capital gain is great or not. QUOTE(goks @ Dec 25 2016, 10:59 PM) It's always a calculated risk. My margin of loan is only 70% so 10% down isn't an issue. If I can be blunt, if u can't afford 10% of purchase price you should not be buying a property. This is the bull shit developers now created by illegal discounts which by law is illegal but no enforcement. I saved like hell 16 years back to buy my first property, 2 years saving, no car, then BY luck I got a decent relocation bonus from company, then I dumped 10% into a house. Today young Turks want everything fast and easy. This post has been edited by icemanfx: Dec 25 2016, 11:14 PMMaintenance is almost always paid by bank for all outstanding. I have not seen cases where buyer pays. Repairs - again no different then buying a sub sale. Any property u buy u will spend money to dget it up to ur taste, even new one. Vacant possession - can be an issue, keep 5k as contingency if u need to get court order. A good auction agent is key, don't ever trust normal real estate agents who only do auction part time as they only want to rip u off some commission , i work only with full time auction agents like auction list or Lelong tips. They help me sort out allot of issues and th y do this day in and out. Finally auction u can gain allot but it's also not something for people who are cash strapped. Example I may end up buying touts and syndicates out or give my agent some money to sort matters out, on average each auction cost me 5-8k of the addition cost but that gives me peace of mind. Property is a life long, illiquid, hard commitments. Many young Malaysians in general dive into it without and exit plan or holding plan. |

|

|

Dec 26 2016, 02:53 PM Dec 26 2016, 02:53 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Dec 30 2016, 12:49 PM Dec 30 2016, 12:49 PM

|

Senior Member

1,548 posts Joined: Apr 2005 |

QUOTE(axisresidence17 @ Dec 23 2016, 07:22 PM) Omg!!! ..just found out my fren condo is up for an auction from browsing the auction site 😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱 I had the same shock a while ago, when I noticed a house on auction in my neighborhood. After checking it was very close to my own house. Then after a while I noticed they started removing everything they possibly could from the house.So shocking! |

|

|

Dec 30 2016, 01:34 PM Dec 30 2016, 01:34 PM

|

Junior Member

352 posts Joined: Mar 2009 |

QUOTE(prody @ Dec 30 2016, 12:49 PM) I had the same shock a while ago, when I noticed a house on auction in my neighborhood. After checking it was very close to my own house. Then after a while I noticed they started removing everything they possibly could from the house. Omg! 😱😱😱 Must be traumatising especially if it is for families! |

|

|

Dec 30 2016, 01:46 PM Dec 30 2016, 01:46 PM

|

Junior Member

8 posts Joined: Aug 2016 |

worst to come. please get UUU to show you how many VP projects for 2017, 2018, and 2019

especially those pigeon holesssss |

|

|

Dec 30 2016, 01:48 PM Dec 30 2016, 01:48 PM

|

Junior Member

551 posts Joined: May 2013 |

Now renting also got good choices. Best

|

|

|

Dec 31 2016, 12:31 PM Dec 31 2016, 12:31 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Invest in u.s stocks a few years ago could be a better option than kV property even without considering depreciating rm. |

|

|

Jan 3 2017, 10:28 AM Jan 3 2017, 10:28 AM

|

Junior Member

352 posts Joined: Mar 2009 |

So any bargain to be made in property yet? I was busy shopping at Zara to get items at 50% off 😂😂😍

|

|

|

Jan 3 2017, 06:13 PM Jan 3 2017, 06:13 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(TOMEI-R @ Jan 3 2017, 04:00 PM) How are the 'crooks' going to catch themselves? You already know who are the biggest 'crooks' in siphoning big sums of money out of the country. Expect banks to tighten lending with rising npl. Those hoping for quick flip is in for the long haul.buying domestic assets could never hedge against forex loss. Like mentioned, its just another better way of parking one's money other than saving it in the bank. You are right on the High NPL rates. This I confirmed with my bankers. Not only NPL high on residential loans, car loans, personal loans and credit cards are also recording high NPLs. This post has been edited by icemanfx: Jan 3 2017, 06:15 PM |

|

|

Jan 3 2017, 06:15 PM Jan 3 2017, 06:15 PM

Show posts by this member only | IPv6 | Post

#35

|

All Stars

24,219 posts Joined: Mar 2007 From: Kuala Lumpur |

QUOTE(icemanfx @ Jan 3 2017, 06:13 PM) Expect banks to tighten lending with rising npl. Those hoping for quick flip is in for the long haul. Bro you tagged my comment in the wrong thread. Btw, loans are sibeh hard to solicit right now. Bankers all giving stupid excuses for rejecting loans. Little bit reject, little bit ask for guarantor. This post has been edited by TOMEI-R: Jan 3 2017, 06:17 PM |

|

|

Jan 3 2017, 06:48 PM Jan 3 2017, 06:48 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Dec 31 2016, 12:31 PM)  Invest in u.s stocks a few years ago could be a better option than kV property even without considering depreciating rm. Ayam more worry if us not doing good Ayam may get lesser return but at much lower risk (currency risk?), less mistakes to be made (not all us stock make money) and less leveraged risk, long term wise property is a BBB UUU and easily outperform U.S. market. Nothing can stop it. Keep waiting for the bubble. |

|

|

Jan 5 2017, 03:31 AM Jan 5 2017, 03:31 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 3 2017, 06:48 PM) Sure us market is doing good Instead of individual stock, one could choose etf and brk.b.Ayam more worry if us not doing good Ayam may get lesser return but at much lower risk (currency risk?), less mistakes to be made (not all us stock make money) and less leveraged risk, long term wise property is a BBB UUU and easily outperform U.S. market. Nothing can stop it. Keep waiting for the bubble. On forex, rm already depreciated by over 30% in one year and likely to depreciates further. Most bought property on leverage. Profit as well as losses is magnified by leverage. Unless market sentiment changed, kV property is on downtrend. With oversupply and bank tightening residential loan, kV property is unlikely to uuu anytime soon. This post has been edited by icemanfx: Jan 5 2017, 03:37 AM |

|

|

Jan 5 2017, 04:51 AM Jan 5 2017, 04:51 AM

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

Challenging times ahead for property sector

|

|

|

Jan 5 2017, 11:16 PM Jan 5 2017, 11:16 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Jan 5 2017, 03:31 AM) Instead of individual stock, one could choose etf and brk.b. House do not exposed to any of the risk.On forex, rm already depreciated by over 30% in one year and likely to depreciates further. Most bought property on leverage. Profit as well as losses is magnified by leverage. Unless market sentiment changed, kV property is on downtrend. With oversupply and bank tightening residential loan, kV property is unlikely to uuu anytime soon. And Ayam is getting guaranteed 10-15% income every year? Why do Ayam need to worry about the risk? |

|

|

Jan 5 2017, 11:29 PM Jan 5 2017, 11:29 PM

Show posts by this member only | IPv6 | Post

#40

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 5 2017, 11:16 PM) House do not exposed to any of the risk. Every investment carry certain risks.And Ayam is getting guaranteed 10-15% income every year? Why do Ayam need to worry about the risk? If kv property could guaranteed 10-15% income every year, funds manager like Blackrock and every obasans would have invested, developers need not spend millions of RM on advertisement. |

|

|

Jan 5 2017, 11:42 PM Jan 5 2017, 11:42 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Jan 5 2017, 11:29 PM) Every investment carry certain risks. Jew won't belip itIf kv property could guaranteed 10-15% income every year, funds manager like Blackrock and every obasans would have invested, developers need not spend millions of RM on advertisement. It is why Ayam become millionaire just from the income alone. Banker always call me for new house loan, ayam can keep leveraging Ayam income. It is why Ayam find no reason Ayam need to care about the risk Jew mentioned |

|

|

Jan 6 2017, 12:06 AM Jan 6 2017, 12:06 AM

Show posts by this member only | IPv6 | Post

#42

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Jan 5 2017, 11:42 PM) Jew won't belip it Leverage magnified profit as well as losses.It is why Ayam become millionaire just from the income alone. Banker always call me for new house loan, ayam can keep leveraging Ayam income. It is why Ayam find no reason Ayam need to care about the risk Jew mentioned To become a millionaire from 10 to 15% income, one need to start with multi-million. |

|

|

Jan 6 2017, 12:07 AM Jan 6 2017, 12:07 AM

|

Senior Member

2,040 posts Joined: Sep 2014 |

|

|

|

Jan 6 2017, 12:14 AM Jan 6 2017, 12:14 AM

Show posts by this member only | IPv6 | Post

#44

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jan 6 2017, 12:19 AM Jan 6 2017, 12:19 AM

|

Senior Member

2,040 posts Joined: Sep 2014 |

|

|

|

Jan 6 2017, 12:21 AM Jan 6 2017, 12:21 AM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Jan 6 2017, 12:06 AM) Leverage magnified profit as well as losses. Is it very difficult to do it in u.s stock?To become a millionaire from 10 to 15% income, one need to start with multi-million. Ayam didn't know it is very difficult. Bank keep giving Ayam new loan Ayam think it is very easy to do so in stock also. |

|

|

Jan 6 2017, 11:17 AM Jan 6 2017, 11:17 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 12:19 AM) all this while trying, and still trying.. so asking for your expertise statistics and numbers expert for advise.. hope can hit straight in between the balls.. http://publications.credit-suisse.com/task...20A1A254A3E24A5For reasons, there are less than 3% of adults in the kangkong have over us$100k net worth. To become a rm millionaire will takes more than just working smart, investing like a herd won't be one. QUOTE(cocbum4 @ Jan 6 2017, 12:21 AM) Is it very difficult to do it in u.s stock? If you have the financial strength as you claimed; you could have made more than a 150m2 condo in klcc vicinity from US stocks since US presidential election in November.Ayam didn't know it is very difficult. Bank keep giving Ayam new loan Ayam think it is very easy to do so in stock also. This post has been edited by icemanfx: Jan 6 2017, 12:04 PM |

|

|

Jan 6 2017, 02:57 PM Jan 6 2017, 02:57 PM

|

Senior Member

2,040 posts Joined: Sep 2014 |

QUOTE(icemanfx @ Jan 6 2017, 11:17 AM) http://publications.credit-suisse.com/task...20A1A254A3E24A5 hello, i dont want listen you analyze statistics, chart, or numbers, because i dont understand.. For reasons, there are less than 3% of adults in the kangkong have over us$100k net worth. To become a rm millionaire will takes more than just working smart, investing like a herd won't be one. If i know how to work smart i dont have to ask for your advise already.. By your expert on statistics, chart and numbers, i believe you can turn my RM2k become RM20mil easily... So please help me to become millionaire.. or even one of the 3% who have US$100k networth |

|

|

Jan 6 2017, 03:01 PM Jan 6 2017, 03:01 PM

|

Senior Member

540 posts Joined: Mar 2008 |

|

|

|

Jan 6 2017, 03:37 PM Jan 6 2017, 03:37 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 02:57 PM) hello, i dont want listen you analyze statistics, chart, or numbers, because i dont understand.. Beside sport toto, you could buy a suit with rm2k to get a job at a investment bank or funds management in sg, hk or shanghai. If you know your stuffs and ways round, you could become the top 3% in 5 to 10 years.If i know how to work smart i dont have to ask for your advise already.. By your expert on statistics, chart and numbers, i believe you can turn my RM2k become RM20mil easily... So please help me to become millionaire.. or even one of the 3% who have US$100k networth This post has been edited by icemanfx: Jan 6 2017, 03:37 PM |

|

|

Jan 6 2017, 05:01 PM Jan 6 2017, 05:01 PM

|

Senior Member

2,040 posts Joined: Sep 2014 |

QUOTE(icemanfx @ Jan 6 2017, 03:37 PM) Beside sport toto, you could buy a suit with rm2k to get a job at a investment bank or funds management in sg, hk or shanghai. If you know your stuffs and ways round, you could become the top 3% in 5 to 10 years. Nowadays, doesnt require certificate ka? buy suit can get job already? I graduate in "Specialist in Property Management", SPM, can work in investment bank and funds management ka? If i apply for cleaner job maybe can lar.. work as cleaner in sg, hk or shanghai, can become top 3% in 5 to 10 years?No other kang tau you can help me generate from RM2k to become RM20mil or even at least 3% of the US$100k networth? |

|

|

Jan 6 2017, 05:08 PM Jan 6 2017, 05:08 PM

|

Junior Member

20 posts Joined: Jul 2009 |

So bubble is here? Or stagnant?

|

|

|

Jan 6 2017, 05:18 PM Jan 6 2017, 05:18 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 05:01 PM) Nowadays, doesnt require certificate ka? buy suit can get job already? I graduate in "Specialist in Property Management", SPM, can work in investment bank and funds management ka? If i apply for cleaner job maybe can lar.. work as cleaner in sg, hk or shanghai, can become top 3% in 5 to 10 years? If you are in property industry, you may has a chance to marry into developers family else accept to be a member of 97%.No other kang tau you can help me generate from RM2k to become RM20mil or even at least 3% of the US$100k networth? |

|

|

Jan 6 2017, 05:20 PM Jan 6 2017, 05:20 PM

|

Senior Member

1,520 posts Joined: May 2008 |

We will see a dead cat bounce first before the real burst happen.

|

|

|

Jan 6 2017, 05:38 PM Jan 6 2017, 05:38 PM

|

Senior Member

2,040 posts Joined: Sep 2014 |

QUOTE(icemanfx @ Jan 6 2017, 05:18 PM) If you are in property industry, you may has a chance to marry into developers family else accept to be a member of 97%. With a SPM cert on hand, and working as cleaner i can have chancy mary into developer family? very ambitious ah..i'm now member of 97% so thats y i seek for your advise.. but look like you're one of the 97% also.. because you pusing pusing.. no solution for me at all.. |

|

|

Jan 6 2017, 07:41 PM Jan 6 2017, 07:41 PM

|

Senior Member

4,719 posts Joined: Jan 2003 |

|

|

|

Jan 6 2017, 08:16 PM Jan 6 2017, 08:16 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Cabinda @ Jan 6 2017, 05:38 PM) With a SPM cert on hand, and working as cleaner i can have chancy mary into developer family? very ambitious ah.. Students are obviously in 97% members.i'm now member of 97% so thats y i seek for your advise.. but look like you're one of the 97% also.. because you pusing pusing.. no solution for me at all.. |

|

|

Jan 6 2017, 09:26 PM Jan 6 2017, 09:26 PM

|

Senior Member

1,520 posts Joined: May 2008 |

|

|

|

Jan 7 2017, 08:58 AM Jan 7 2017, 08:58 AM

|

Senior Member

4,719 posts Joined: Jan 2003 |

but for property it is not the same as stocks... location is important for property also...

good location area...i don't think there will be dead cat bounce...at most... the graph is upward trend and if there's slowdown...prices will be mostly flat before it picks up again... let us continue to monitor.... QUOTE(blanket84 @ Jan 6 2017, 09:26 PM) |

|

|

Jan 7 2017, 10:46 AM Jan 7 2017, 10:46 AM

Show posts by this member only | IPv6 | Post

#60

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(kevyeoh @ Jan 7 2017, 08:58 AM) but for property it is not the same as stocks... location is important for property also... Why no downward? R u uuu?good location area...i don't think there will be dead cat bounce...at most... the graph is upward trend and if there's slowdown...prices will be mostly flat before it picks up again... let us continue to monitor.... |

|

|

Jan 7 2017, 11:01 AM Jan 7 2017, 11:01 AM

|

Senior Member

4,719 posts Joined: Jan 2003 |

I believe in buying and holding long term for good location properties and then get rental income while holding long term.... is this consider uuu?

For properties in good location... i don't see the price DVD... i have been stressing on this keyword = location, but usually people like to generalize and say property downtrend now... AFAIK... prime or good location area the price hardly go down... probably stay flat in bad times only.... but over long term... it is up trend.... QUOTE(kurtkob78 @ Jan 7 2017, 10:46 AM) |

|

|

Jan 7 2017, 11:12 AM Jan 7 2017, 11:12 AM

Show posts by this member only | IPv6 | Post

#62

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(kevyeoh @ Jan 7 2017, 11:01 AM) I believe in buying and holding long term for good location properties and then get rental income while holding long term.... is this consider uuu? Prime locations held by reits e.g. klcc, pavilion, mv, sunway pyramid, etc are unlikely to sell, won't see price drop. To use this as a benchmark is detached from the general market.For properties in good location... i don't see the price DVD... i have been stressing on this keyword = location, but usually people like to generalize and say property downtrend now... AFAIK... prime or good location area the price hardly go down... probably stay flat in bad times only.... but over long term... it is up trend.... On residential property, believe there isn't a consensus that which area or development is super prime and will immune to any price downfall. And most people purchase are not super prime. Historically, property price rise in the long term but at about inflation rate. Due to oversupply in kv, unless there is a change in market sentiment, price is likely continue to downtrend and falling behind inflation rate. This post has been edited by icemanfx: Jan 7 2017, 08:01 PM |

|

|

Jan 9 2017, 02:10 PM Jan 9 2017, 02:10 PM

|

Junior Member

352 posts Joined: Mar 2009 |

Im looking at bungalow lot now..and the price is kinda stubborn..not to mention procedures can make you dizzy too 🤕🤕🤕

|

|

|

Jan 10 2017, 11:18 PM Jan 10 2017, 11:18 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(kevyeoh @ Jan 7 2017, 11:01 AM) I believe in buying and holding long term for good location properties and then get rental income while holding long term.... is this consider uuu? Everything is based on generalisation la, property downward trend means that properties in most areas prices are falling just the same like stocks market la, it's a bear cycle when most stock prices go down. There will NEVER be a scenario where ALL properties or stocks go down, even in the worse kinda market some stocks will still perform well or maintain their prices, just like properties. For properties in good location... i don't see the price DVD... i have been stressing on this keyword = location, but usually people like to generalize and say property downtrend now... AFAIK... prime or good location area the price hardly go down... probably stay flat in bad times only.... but over long term... it is up trend.... If follow your definition, then there is no such thing as a downward trend for anything la. Even now, some prime locations like BB, DAMANSARA already got property prices dropping la, maybe not as significant as other sub prime areas but even prime properties are dropping, so still wanna say no downward trend? The only difference is that PRIME areas drop slower and lesser, but it's still a drop even if drop only by 5%, it's still a drop. Let's not deny that. |

|

|

Jan 13 2017, 04:29 PM Jan 13 2017, 04:29 PM

|

Senior Member

4,719 posts Joined: Jan 2003 |

Wow... 86% urban household with no savings ? It is like almost 9 out of every 10 households don't have savings... really curious if this is indeed true !

QUOTE(podracerx1 @ Jan 13 2017, 02:46 PM)  http://www.malaysiandigest.com/frontpage/2...ne-of-them.html If the above is accurate or close, few have reserve at flexi account. |

|

|

Jan 13 2017, 04:38 PM Jan 13 2017, 04:38 PM

|

Senior Member

1,061 posts Joined: Mar 2005 From: Я мир |

keyword 0 zero

so 1k can be saving too then gg |

|

|

Jan 13 2017, 04:54 PM Jan 13 2017, 04:54 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(podracerx1 @ Jan 13 2017, 02:46 PM)  http://www.malaysiandigest.com/frontpage/2...ne-of-them.html If the above is accurate or close, few have reserve at flexi account. |

|

|

Jan 15 2017, 05:11 PM Jan 15 2017, 05:11 PM

Show posts by this member only | IPv6 | Post

#68

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(kenlaw72 @ Jan 13 2017, 05:52 PM) hear form developer, they already get the tenants. CBJ is so vibrant that commie rental could be free for one year.they give free rental one years to potential shop tenants which open at 3rd avenue. QUOTE(Donald Trump @ Jan 13 2017, 09:23 PM) it was 100% empty after more than a year Icon city is said to be mv in the making.AT LAST 1 shop doing reno....🎉🎂 [=Donald Trump,Jan 13 2017, 10:50 PM] Soli correction.....my pucat friend say this is not shop renovating....is actually TLG MS use to store their crap😌......my bad so is still maintain 100% NOT OCCUPY for more than a year and counting QUOTE(Quang1819 @ Jan 13 2017, 11:33 PM) worked there for a year couple months back. more shops are closing down in the mall and the shoplots outside the mall as well. heard that my old working would be shifting as well lol Another uuu[=Quang1819,Jan 13 2017, 11:35 PM] but most of them are known brands like Oldtown, Subway and a few more. Those that aren't well known all closed down This post has been edited by icemanfx: Jan 15 2017, 06:11 PM |

|

|

Jan 15 2017, 06:09 PM Jan 15 2017, 06:09 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

根据Lelongtips.com.my的统计数据显示,从2004年开始至今,全国有逾36万间房屋被拍卖,每月有至少2500间,即每日平均约有120间房屋被拍卖,其中又以非有地產业佔多数,如服务公寓、公寓或组屋单位。

「如今隆市也有许多新房屋发展计划,推出免头期或低头期优惠,吸引年轻人购买,但问题在于年轻人无法承担房贷,导致从去年开始隆雪拍卖屋中有约70%的屋主是80后的青年。」 http://www.orientaldaily.com.my/central/zm1206 Believe this is only the beginning and will increase with npl. This post has been edited by icemanfx: Jan 15 2017, 06:10 PM |

|

|

Jan 15 2017, 06:33 PM Jan 15 2017, 06:33 PM

|

Senior Member

2,604 posts Joined: Dec 2012 |

|

|

|

Jan 16 2017, 12:16 AM Jan 16 2017, 12:16 AM

Show posts by this member only | IPv6 | Post

#71

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(ManutdGiggs @ Jan 15 2017, 11:49 PM) Since when tms is a reliable dev??? It seems many of uuu/bbb herd has boarded the thief boat to holland.It's quite a norm for buyers to b conned by tns. Nothin new I guess. It ll b headline if it's not a con job. Now all eyes r on sg buluh. This post has been edited by icemanfx: Jan 16 2017, 05:41 PM |

|

|

Jan 16 2017, 05:37 PM Jan 16 2017, 05:37 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

According to Napic; average take up rate 9 months after launch is about 55%.

Those claimed 70%, 80% or 85% sold at launch is as real as Robert Kiyosaki's rich dad. This post has been edited by icemanfx: Jan 16 2017, 05:41 PM |

|

|

Jan 16 2017, 11:14 PM Jan 16 2017, 11:14 PM

Show posts by this member only | IPv6 | Post

#73

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Jan 17 2017, 06:11 PM Jan 17 2017, 06:11 PM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(podracerx1 @ Jan 13 2017, 02:46 PM)  http://www.malaysiandigest.com/frontpage/2...ne-of-them.html If the above is accurate or close, few have reserve at flexi account. |

|

|

Jan 17 2017, 06:14 PM Jan 17 2017, 06:14 PM

|

Senior Member

813 posts Joined: May 2013 |

QUOTE(scorptim @ Jan 10 2017, 11:18 PM) Everything is based on generalisation la, property downward trend means that properties in most areas prices are falling just the same like stocks market la, it's a bear cycle when most stock prices go down. There will NEVER be a scenario where ALL properties or stocks go down, even in the worse kinda market some stocks will still perform well or maintain their prices, just like properties. From 2007 until now..it up by 100%. 5% drop tis year...still consider drop??If follow your definition, then there is no such thing as a downward trend for anything la. Even now, some prime locations like BB, DAMANSARA already got property prices dropping la, maybe not as significant as other sub prime areas but even prime properties are dropping, so still wanna say no downward trend? The only difference is that PRIME areas drop slower and lesser, but it's still a drop even if drop only by 5%, it's still a drop. Let's not deny that. |

|

|

Jan 17 2017, 06:22 PM Jan 17 2017, 06:22 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(podracerx1 @ Jan 13 2017, 02:46 PM)  http://www.malaysiandigest.com/frontpage/2...ne-of-them.html If the above is accurate or close, few have reserve at flexi account. |

|

|

Jan 17 2017, 06:29 PM Jan 17 2017, 06:29 PM

|

Senior Member

813 posts Joined: May 2013 |

QUOTE(podracerx1 @ Jan 17 2017, 06:22 PM) I can compare even from 2011, 2012, 2013, 2014 and 2015. The tend is up but a little downward u guys were super happy till forgot how much u realli lost bcoz kept waiting... ayamxxx liked this post

|

|

|

Jan 17 2017, 07:14 PM Jan 17 2017, 07:14 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(party @ Jan 17 2017, 06:14 PM) Of course it's considered a drop, if not then you apply the same concept to everything lo, then everything in this world also no drop la like that. You go to a shop eat fried noodles, yesterday they charge you 6.50, today it's RM6, you don't consider drop is it? Because 10 years ago it was only RM 3. Follow that mindset then EVERYTHING in this world never drop always UUU lo. You buy stock at RM 10 last year, this year become RM 9, but when the stock was first listed it was only RM 1. So, to you the stock drop or didn't drop? |

|

|

Jan 17 2017, 07:16 PM Jan 17 2017, 07:16 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(party @ Jan 17 2017, 06:14 PM) prop baught in 2015 or later either experience price drop or dont appreciate much.thats why so low prop sales volume now. because its riskier to buy now. cannot flip anymore. so many flippers stuck. its not recovering in the near future. This post has been edited by kurtkob78: Jan 17 2017, 07:18 PM |

|

|

Jan 17 2017, 08:24 PM Jan 17 2017, 08:24 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(party @ Jan 17 2017, 06:29 PM) I can compare even from 2011, 2012, 2013, 2014 and 2015. The tend is up but a little downward u guys were super happy till forgot how much u realli lost bcoz kept waiting... After considered loan interest element, you will find your assumption is not as rosy as you thought. Beside bank interest rate is not fixed and likely to rise.Kv property price rise from 2011 to 2014 was a fallout of u.s qe. Believe we have yet to see the aftershocks of tapering. This post has been edited by icemanfx: Jan 18 2017, 12:04 AM |

|

|

Jan 19 2017, 12:22 PM Jan 19 2017, 12:22 PM

|

Junior Member

407 posts Joined: Aug 2011 |

|

|

|

Jan 19 2017, 12:25 PM Jan 19 2017, 12:25 PM

|

Junior Member

407 posts Joined: Aug 2011 |

QUOTE(podracerx1 @ Jan 19 2017, 12:17 PM) Last year, it was reported that developers had not been able to sell 18,908 of the 81,894 units of residential and commercial properties launched in the first quarter of 2016. The unsold units were valued at RM9.4 billion. Waiting for mega sales in 2018http://www.freemalaysiatoday.com/category/...ays-consultant/ |

|

|

Jan 22 2017, 02:04 AM Jan 22 2017, 02:04 AM

|

Senior Member

1,060 posts Joined: Feb 2010 |

SS2 Mall "closed for redevelopment"? Well ... if that's what they call "mall closed for business", then yes.

But redevelopment would include a schedule, and I haven't seen one there about - when development is due to start - when it will finish - when the mall will reopen. Even the Atria opened late ... QUOTE(podracerx1 @ Jan 22 2017, 12:21 AM) According to Savills Malaysia, Klang Valley will have more than 60 million sq ft of retail space in 2017. Average occupancy rate is expected to drop from 90% to around 85% with increasing competition, hesitant tenants and low retail sentiments. Some malls, such as SS2 Mall and Bukit Bintang Plaza, have already closed their doors pending redevelopment, while many others, such as Jaya Shopping Center, Citta Mall, The Strand, and Sunway Nexis, are struggling to fill their space. Shuttered shops are an increasingly common sight at malls such as Amcorp Mall and Quill City Mall. http://www.propertypricetag.com/properties/275441.html At 85% occupancy rate, some malls are half empty. |

|

|

Jan 25 2017, 12:13 PM Jan 25 2017, 12:13 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Futures and forwards both allow people to buy or sell an asset at a specific time at a given price, but forward contracts are not standardized or traded on an exchange. They are private agreements with terms that may vary from contract to contract. Also, settlement occurs at the end of a forward contract. The parties to a forward contract tend to bear more credit risk than the parties to futures contracts because there is no clearinghouse involved that guarantees performance. Thus, there is always a chance that a party to a forward contract will default, and the harmed party's only recourse may be to sue. As a result, forward-contract prices often include premiums for the added credit risk. http://www.investopedia.com/terms/f/forwardcontract.asp Buying new launch is not dissimilar from forward contract. Many people deem forward contract on commodity, stocks, currency, etc risky. Property price movement depending on aggregate economy, liquidity (bank lending), market sentiments, inflation rate, bank interest rate, etc. Forward contract on commodity, stocks, currency is generally shorter and more liquidity than property new launch. |

|

|

Jan 26 2017, 10:23 AM Jan 26 2017, 10:23 AM

|

Junior Member

352 posts Joined: Mar 2009 |

QUOTE(estcin @ Jan 19 2017, 12:22 PM) Wow lots of hi-end units but there were some within the affordable range also. Quite surprised to see Riana in the mix too. |

|

|

Jan 26 2017, 01:12 PM Jan 26 2017, 01:12 PM

|

Senior Member

965 posts Joined: Apr 2006 |

QUOTE(estcin @ Jan 19 2017, 12:22 PM) M square Puchong havent open already auctioned.. wah.... |

|

|

Jan 26 2017, 01:47 PM Jan 26 2017, 01:47 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

|

|

|

Jan 26 2017, 04:06 PM Jan 26 2017, 04:06 PM

|

Senior Member

965 posts Joined: Apr 2006 |

|

|

|

Jan 26 2017, 05:19 PM Jan 26 2017, 05:19 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Feb 6 2017, 08:00 PM Feb 6 2017, 08:00 PM

Show posts by this member only | IPv6 | Post

#90

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(UncleanOne @ Feb 6 2017, 03:06 PM) Hi, I bought a property 2 years ago (which is undercon, about 6 months to VP). But I found out that I'm not going to stay there since most of the time I spent in oversea. I wonder has anyone successfully sell the property back to developer? If does, how you convince the developer? I just want to know whether is it ok to do in Malaysia? Thanks all sifu QUOTE(UncleanOne @ Feb 6 2017, 06:13 PM) |

|

|

Feb 7 2017, 11:10 AM Feb 7 2017, 11:10 AM

|

Senior Member

4,719 posts Joined: Jan 2003 |

|

|

|

Feb 7 2017, 12:04 PM Feb 7 2017, 12:04 PM

|

Junior Member

352 posts Joined: Mar 2009 |

|

|

|

Feb 10 2017, 09:12 PM Feb 10 2017, 09:12 PM

|

Senior Member

1,548 posts Joined: Apr 2005 |

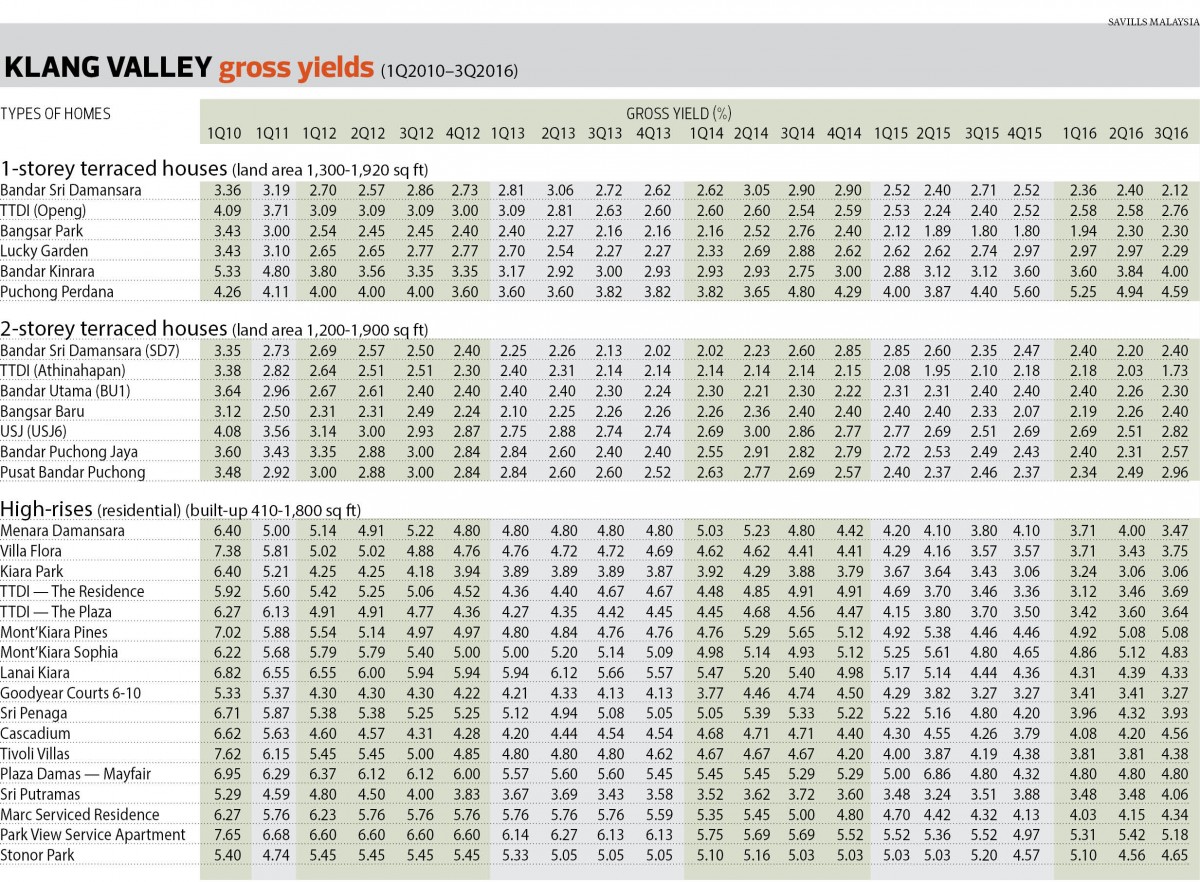

Prices can only drop, especially for properties with extremely low rental yield.

|

|

|

Feb 15 2017, 05:43 PM Feb 15 2017, 05:43 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

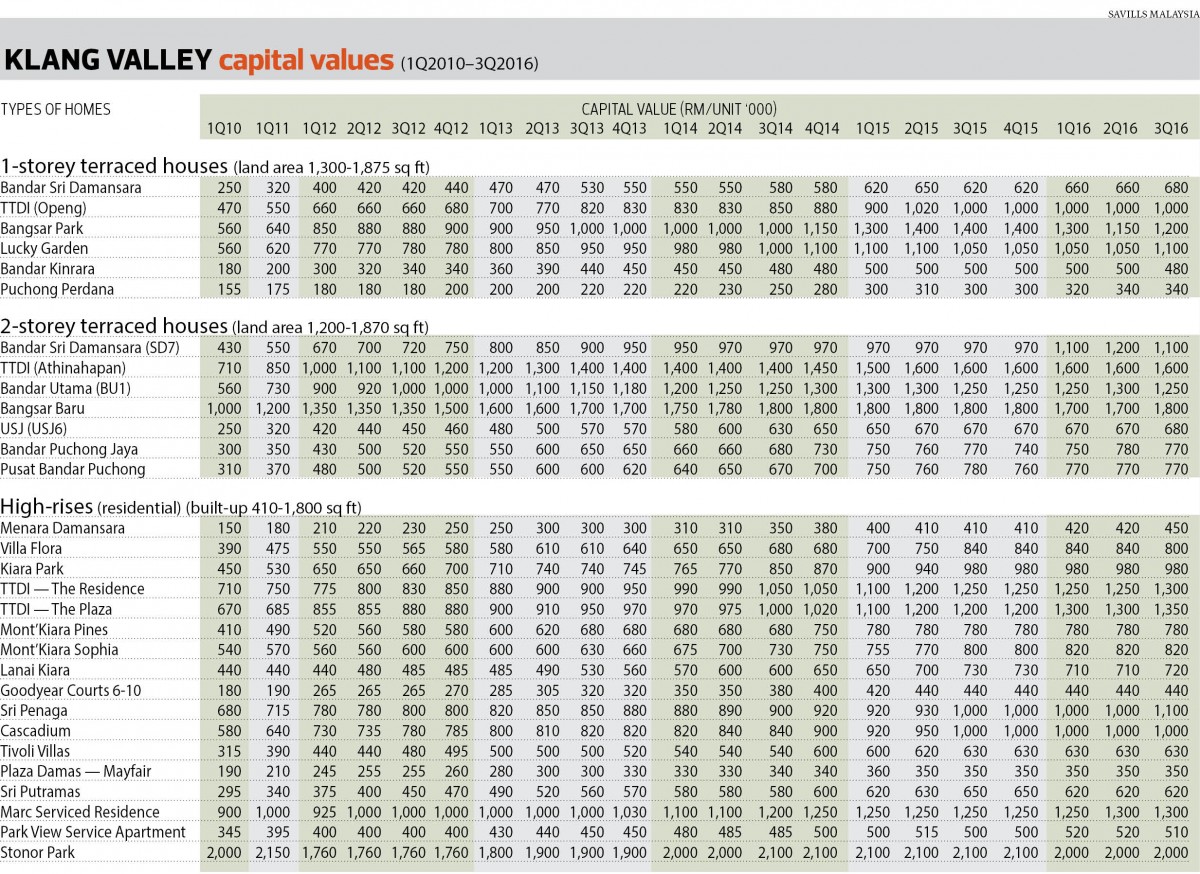

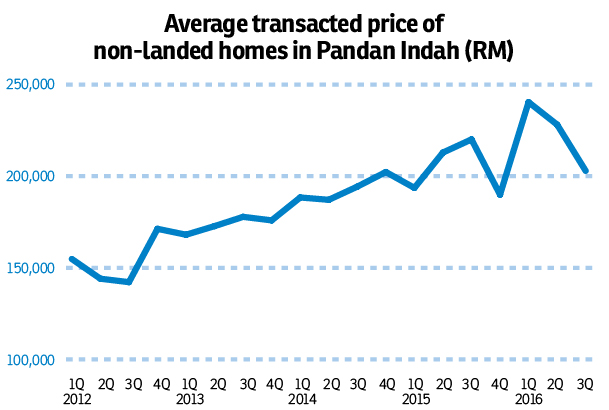

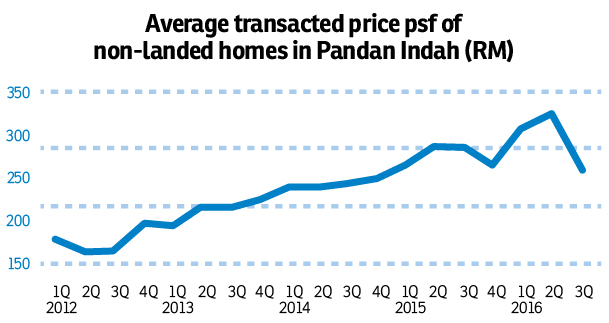

THE residential market in Greater KL is expected to remain the same for the next six months to one year, with few changes in transacted prices.

“Things will be more of the same. Prices may not decline drastically but there will be little growth in the residential market, primarily in prime KL areas,” says Jeffri Rahim, Savills Malaysia vice-president, agency/project marketing, in his presentation of The Edge/Savills Klang Valley Residential Monitor 3Q2016.     http://www.theedgeproperty.com.my/content/...-move-much-year This post has been edited by icemanfx: Feb 15 2017, 05:45 PM |

|

|

Feb 15 2017, 05:44 PM Feb 15 2017, 05:44 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

Still 3q data. Old stats. Boring

|

|

|

Feb 15 2017, 05:45 PM Feb 15 2017, 05:45 PM

|

Senior Member

7,606 posts Joined: Dec 2004 From: Subang |

Bangsar park 13% price drop? Wow.

|

|

|

Feb 15 2017, 05:47 PM Feb 15 2017, 05:47 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Feb 15 2017, 05:48 PM Feb 15 2017, 05:48 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

|

|

|

Feb 15 2017, 05:50 PM Feb 15 2017, 05:50 PM

|

Junior Member

486 posts Joined: Dec 2013 |

Most old developments.. price already near peak

|

|

|

Feb 15 2017, 05:51 PM Feb 15 2017, 05:51 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

|

|

|

Feb 16 2017, 12:55 PM Feb 16 2017, 12:55 PM

|

Senior Member

1,548 posts Joined: Apr 2005 |

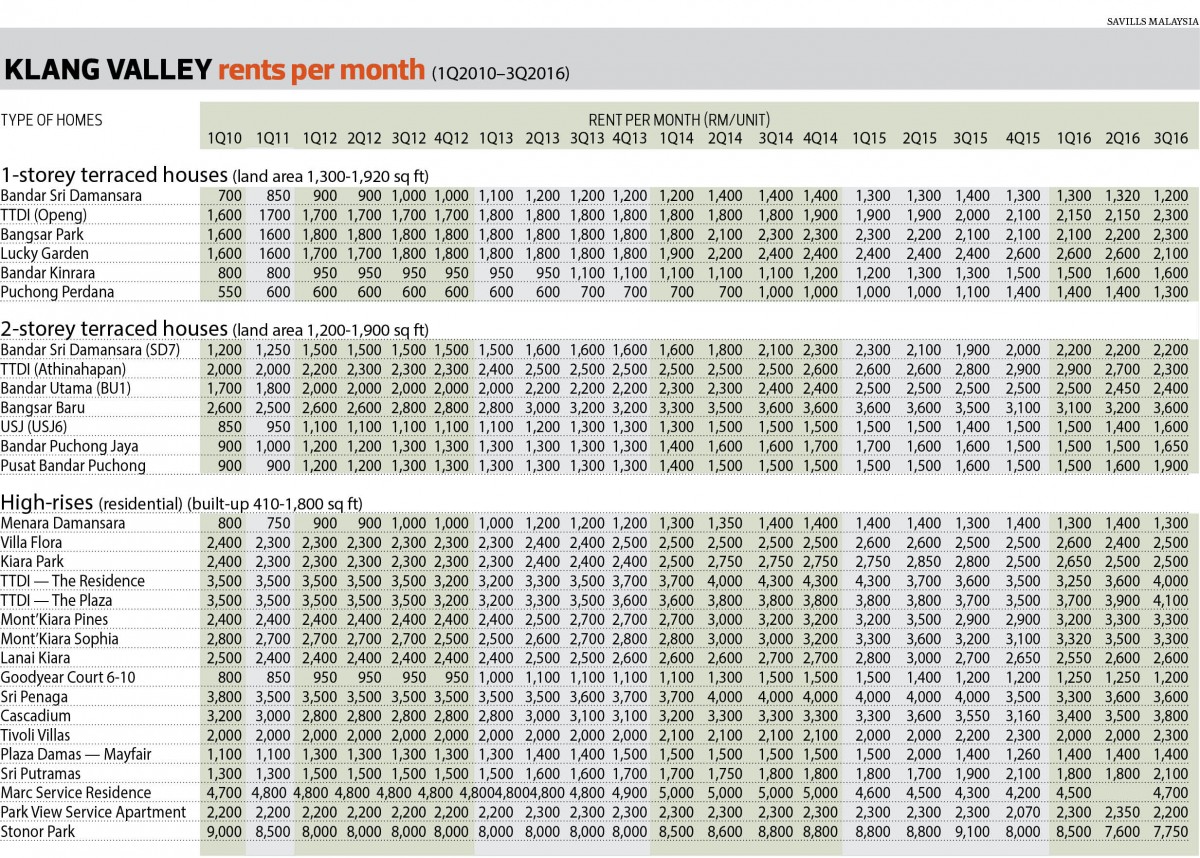

QUOTE(sunami @ Feb 15 2017, 05:48 PM) Yeah for most of the properties bought at high prices the owner will need to chip in.I recently saw a rental for 2k. Capital cost for the same house is about 1.4m. Installment would be about 7k. Not taking into consideration all the other costs (quit rent, maintenance etc.) he would already need to put in an extra 5k per month if he manages to rent it out. |

|

|

Feb 16 2017, 01:05 PM Feb 16 2017, 01:05 PM

|

Junior Member

155 posts Joined: May 2006 |

QUOTE(prody @ Feb 16 2017, 12:55 PM) Yeah for most of the properties bought at high prices the owner will need to chip in. Mind sharing the location/condo name of the unit? 2k rental for 1.4m property is seriously very very low. But on the hindsight the owner might have bought it when prices have not spiraled exponentially lately.I recently saw a rental for 2k. Capital cost for the same house is about 1.4m. Installment would be about 7k. Not taking into consideration all the other costs (quit rent, maintenance etc.) he would already need to put in an extra 5k per month if he manages to rent it out. |

|

|

Feb 16 2017, 04:28 PM Feb 16 2017, 04:28 PM

|

Senior Member

1,548 posts Joined: Apr 2005 |

QUOTE(ZenGTMM @ Feb 16 2017, 01:05 PM) Mind sharing the location/condo name of the unit? 2k rental for 1.4m property is seriously very very low. But on the hindsight the owner might have bought it when prices have not spiraled exponentially lately. This is in Setia Alam. It was probably bought when people were still thinking prices would go up 10-20% each year. |

|

|

Feb 17 2017, 01:51 PM Feb 17 2017, 01:51 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

The retail sector performance has been going south since 2013 and with the weakening ringgit reducing margins for most retailers, poorer sentiments, smaller disposable incomes and a double-digit drop in sales turnover last year, 2017 is expected to be more of the same, he told TheEdgeProperty.com. “The retail industry is consolidating and the impact is that new malls are finding it hard to fill up and A-list tenants are elusive while terms are becoming more in favour of tenants,” Soo said, adding that the market is seeing a reversal in fortunes from the early 90’s when tenants were chasing landlords. In addition, the rising cost of construction, an uncertain market, the rising oversupply of malls, a dilution in retail sales turnover, intensified competition for tenants, and drop in rents for new malls are dragging down the retail market. “Developers will now have to consider the first term of tenancy as a build-up, with rents at least 20% to 30% below rack rental values,” he added. http://www.theedgeproperty.com.my/content/...y-outlook-malls Unlesss there is a rise in income, disposable income will be reduced with more property vp. |

|

|

Feb 17 2017, 02:02 PM Feb 17 2017, 02:02 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

Property consultancy firm Rahim & Co said it expects the Malaysian property market to recover within the next year or so, as the decline in property transactions is seen to be slowing down.

Rahim & Co director Sulaiman Akhmady Mohd Saheh (pictured) pointed out that the market has been declining since it peaked in 2012. "The market peaked in 2011 and 2012 and had fallen in 2013, and the drop continued to 2016. By the third quarter of 2016, the total volume dropped by 11.9% while value dropped by 16.4%. "Since 2010, we had an average of 96,000 transactions per quarter but for the first three quarters of 2016, it averaged below 80,000, which reflects the current subdued market," he said during the company's review of the Malaysian Property Market and the prospects of 2017 today. While he acknowledged that 2017 would still be a slow year for the property market, he noted that the rate of decline has been slowing down. "The market will be slowing down its decline in 2017, and we hope that within the next 12 to 18 months it will halt its decline. It'll gradually pick up from there on," he said. http://www.theedgeproperty.com.my/content/...ve-12-18-months Somehow property experts don't seems able to explain or reason why property market will recover. |

|

|

Feb 17 2017, 03:44 PM Feb 17 2017, 03:44 PM

Show posts by this member only | IPv6 | Post

#106

|

All Stars

21,456 posts Joined: Jul 2012 |

The rate of decline in the total number of property transactions is expected to slowdown this year to 5-10% from an estimated drop of 10-15% last year. Rahim & Co Group of Companies executive chairman Tan Sri Abdul Rahim Abdul Rahman said market activity is likely to be subdued this year while average property prices, though still holding, may face some corrective pressure. For the first nine months of 2016, transaction volume fell 11.9% year-on-year to 239,983 units while total value of transactions fell 16.4% year-on-year to RM95.4 billion. http://www.thesundaily.my/news/2164577 |

|

|

Feb 17 2017, 03:49 PM Feb 17 2017, 03:49 PM

Show posts by this member only | IPv6 | Post

#107

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

Still slowing down. More agents are going to be wiped out

|

|

|

Feb 18 2017, 06:14 PM Feb 18 2017, 06:14 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Feb 22 2017, 08:07 PM Feb 22 2017, 08:07 PM

|

Junior Member

352 posts Joined: Mar 2009 |

Discounts on the retail sectors seemed to continue on! Been busy looking at discounted items! 😍

|

|

|

Mar 5 2017, 09:28 PM Mar 5 2017, 09:28 PM

|

Senior Member

1,588 posts Joined: Oct 2010 |

Can we believe this guy ?

http://www.starproperty.my/index.php/artic...-while-you-can/ QUOTE “IF YOUR grandfather did not do, your father forgot to do, you still do not want to do, your grandson will not know what to do,” joked MCT Bhd leasing director Teoh Eng Poh on the dilemma faced by property buyers. In the recent inaugural Star-925, he suggested that properties in Malaysia are staring at a high possibility of a second wave of price hike, similar to the booming of house prices from 2009 to 2014, in which the compound annual growth rate stood at a whopping 10.1%. “Two major boosters are going to affect the property prices. Firstly, Greater Kuala Lumpur is moving towards an infrastructural era with the upcoming mega transportation projects. “Secondly, China’s One Belt One Road initiative will see Chinese investment pouring in our property market. Hence, a big wave is on its way,” Teoh said. According to the latest data from JLL’s Global Capital Flows, China has hit a record of US$33bil (approximately RM146bil) in overseas commercial and residential property investment last year. On top of that, Teoh touted Bandar Malaysia to be one of the main drivers for the property market in years to come, drawing comparisons to the success of Kuala Lumpur city centre (KLCC). “Twenty years ago, KLCC was developed within a 100-acre land at RM400 per sq ft. Today, it is approximately RM3,000 per sq ft. “Bandar Malaysia site covers a total area of 486 acres. The potential is huge,” he added.Teoh also said the property market slowdown in recent years was due to the mismatch in supply and demand. “When we talk about supply and demand, there is a misconception. It is not a case of supply outstripping demand, but rather an oversupply of products not suited to the consumers’ demand,” he explained. However, facing a soft market, property developers are now building more affordable houses, which opens the door for the younger generation to own a home. “One who has the capacity to buy now should not wait till you miss out the opportunity of owning a home. The longer you wait, the tougher homeownership will become. “In emerging markets like Malaysia, property remains an asset that can build wealth for multi-generations,” he said. Teoh warned that in developed markets such as Hong Kong, where prices have shot through the roof, it can take generations to acquire a property. The Property Market Outlook talk was jointly organised by Starproperty.my and the 925 movement. The Star-925 initiative is intended to help employees become more valuable at their workplace, which enables growth in their income stream. Thus, it will allow them to gain more leverage to build wealth through sustainable property ownership. This initiative will run frequent events that bring together specialised speakers to benefit its members and the attendees. |

|

|

Mar 5 2017, 10:49 PM Mar 5 2017, 10:49 PM

Show posts by this member only | IPv6 | Post

#111

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(langstrasse @ Mar 5 2017, 09:28 PM) so far, none of property guru could explain or understand reason for kv property bull run 2011 to 2014.kv property bull run 2011 to 2014 was a fallout of u.s qe. consequently, kv property market stagnant after local bank lending to residential properties got harder following tapered u.s qe. moving forward, kv property is likely to face after shock of u.s. rate rise in the next few years. |

|

|

Mar 5 2017, 11:16 PM Mar 5 2017, 11:16 PM

|

Junior Member

57 posts Joined: Jan 2015 |

Ayam want to belip property bubble

|

|

|

Mar 5 2017, 11:18 PM Mar 5 2017, 11:18 PM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

|

|

|

Mar 5 2017, 11:20 PM Mar 5 2017, 11:20 PM

|

Senior Member

2,983 posts Joined: Nov 2011 |

Burst only la, I can't wait.

|

|

|

Mar 5 2017, 11:21 PM Mar 5 2017, 11:21 PM

|

Junior Member

57 posts Joined: Jan 2015 |

|

|

|

Mar 5 2017, 11:23 PM Mar 5 2017, 11:23 PM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

|

|

|

Mar 5 2017, 11:24 PM Mar 5 2017, 11:24 PM

Show posts by this member only | IPv6 | Post

#117

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 5 2017, 11:28 PM Mar 5 2017, 11:28 PM

|

Junior Member

57 posts Joined: Jan 2015 |

|

|

|

Mar 5 2017, 11:30 PM Mar 5 2017, 11:30 PM

Show posts by this member only | IPv6 | Post

#119

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 5 2017, 11:31 PM Mar 5 2017, 11:31 PM

|

Junior Member

57 posts Joined: Jan 2015 |

|

|

|

Mar 5 2017, 11:35 PM Mar 5 2017, 11:35 PM

Show posts by this member only | IPv6 | Post

#121

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Mar 5 2017, 11:31 PM) Obviously jew know nothing about the index The ultra rich make their money from the herd members. most ultra rich would have left the market (e.g. oil, property, gold, etc) long before bubble burst, bullrun is created to attract the herd members.The ultra rich is doing everything to make sure nothing bubble will happen This post has been edited by icemanfx: Mar 5 2017, 11:36 PM |

|

|

Mar 5 2017, 11:39 PM Mar 5 2017, 11:39 PM

|

Senior Member

813 posts Joined: May 2013 |

I trust iceman...3years later still cant buy condo nx to klcc for 50k..demit

|

|

|

Mar 5 2017, 11:45 PM Mar 5 2017, 11:45 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

its fun to see flipper hold.

most agents also out of job already. financing will not get any easier. interesting time indeed. |

|

|

Mar 6 2017, 12:50 AM Mar 6 2017, 12:50 AM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(icemanfx @ Mar 5 2017, 11:35 PM) The ultra rich make their money from the herd members. most ultra rich would have left the market (e.g. oil, property, gold, etc) long before bubble burst, bullrun is created to attract the herd members. When index is 16000, the ultra rich already left the marketWhen index is 20000, the ultra rich already left the market When index is 21000, the ultra rich already left the market . . We have so many ultra rich, how long will it take to make all of them leave the market? This post has been edited by cocbum4: Mar 6 2017, 12:54 AM |

|

|

Mar 6 2017, 01:06 AM Mar 6 2017, 01:06 AM

|

Junior Member

57 posts Joined: Jan 2015 |

|

|

|

Mar 6 2017, 06:13 AM Mar 6 2017, 06:13 AM

Show posts by this member only | IPv6 | Post

#126

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(cocbum4 @ Mar 6 2017, 12:50 AM) When index is 16000, the ultra rich already left the market When index is 20000, the ultra rich already left the market When index is 21000, the ultra rich already left the market . . We have so many ultra rich, how long will it take to make all of them leave the market? QUOTE(cocbum4 @ Mar 6 2017, 01:06 AM) U.s economy is currently stronger than many realized, almost at full employment without trump budget. Gop is pro business, deregulation (e.g limiting epa power, banking compliance) will increase corporate profit. Loosening lending will push stocks, house price and inflation higher until next bubble is formed. |

|

|

Mar 6 2017, 06:58 AM Mar 6 2017, 06:58 AM

|

Senior Member

4,719 posts Joined: Jan 2003 |

Next bubble??? So current bubble when pop first ?

QUOTE(icemanfx @ Mar 6 2017, 06:13 AM) U.s economy is currently stronger than many realized, almost at full employment without trump budget. Gop is pro business, deregulation (e.g limiting epa power, banking compliance) will increase corporate profit. Loosening lending will push stocks, house price and inflation higher until next bubble is formed. |

|

|

Mar 6 2017, 10:30 AM Mar 6 2017, 10:30 AM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 6 2017, 12:57 PM Mar 6 2017, 12:57 PM

|

Senior Member

600 posts Joined: Jun 2014 |

|

|

|

Mar 6 2017, 01:22 PM Mar 6 2017, 01:22 PM

|

Junior Member

57 posts Joined: Jan 2015 |

|

|

|

Mar 6 2017, 02:02 PM Mar 6 2017, 02:02 PM

|

Junior Member

269 posts Joined: Feb 2011 |

QUOTE(axisresidence17 @ Dec 23 2016, 07:22 PM) Omg!!! ..just found out my fren condo is up for an auction from browsing the auction site 😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱 Got kacau ur friend or not?So shocking! QUOTE(axisresidence17 @ Jan 9 2017, 02:10 PM) Im looking at bungalow lot now..and the price is kinda stubborn..not to mention procedures can make you dizzy too 🤕🤕🤕 Dude, bungalows and condos are different market la. QUOTE(Quang1819 @ Jan 15 2017, 06:33 PM) Inkambing like Viva mall... first launch food court macam hggh now see the sad condition.QUOTE(kurtkob78 @ Mar 5 2017, 11:45 PM) its fun to see flipper hold. Let them hold... Its like hoping a gangrene to cure by itself in fact is it need to be cut off.most agents also out of job already. financing will not get any easier. interesting time indeed. These agents also, like vermins only. Spam fb and sms and whatsapp. |

|

|

Mar 6 2017, 03:42 PM Mar 6 2017, 03:42 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(Jliew168 @ Mar 6 2017, 12:57 PM) Over inflated property price deflate longer than most expected e.g. property in the US and UK took about 6 years to reach bottom. due to slower foreclosure process in the kangkong land, kv property price will take longer than 6 years to reach bottom, and this 6+ years count down to bottom is only about to begin or just begun.This post has been edited by icemanfx: Mar 6 2017, 04:00 PM |

|

|

Mar 6 2017, 04:18 PM Mar 6 2017, 04:18 PM

|

Senior Member

600 posts Joined: Jun 2014 |

QUOTE(icemanfx @ Mar 6 2017, 03:42 PM) Over inflated property price deflate longer than most expected e.g. property in the US and UK took about 6 years to reach bottom. due to slower foreclosure process in the kangkong land, kv property price will take longer than 6 years to reach bottom, and this 6+ years count down to bottom is only about to begin or just begun. U stated predict 3 years ago and now drag another 6years ...omg almost 9 years only good time |

|

|

Mar 6 2017, 04:33 PM Mar 6 2017, 04:33 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

|

|

|

Mar 6 2017, 04:44 PM Mar 6 2017, 04:44 PM

|

Senior Member

1,520 posts Joined: May 2008 |

QUOTE(icemanfx @ Mar 5 2017, 10:49 PM) so far, none of property guru could explain or understand reason for kv property bull run 2011 to 2014. Four letters.kv property bull run 2011 to 2014 was a fallout of u.s qe. consequently, kv property market stagnant after local bank lending to residential properties got harder following tapered u.s qe. moving forward, kv property is likely to face after shock of u.s. rate rise in the next few years. D I B S |

|

|

Mar 6 2017, 04:51 PM Mar 6 2017, 04:51 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

applying mortgage on 4 four banks, only one responded, i want to cry

|

|

|

Mar 6 2017, 05:42 PM Mar 6 2017, 05:42 PM

|

Junior Member

73 posts Joined: Mar 2010 |

|

|

|

Mar 6 2017, 05:45 PM Mar 6 2017, 05:45 PM

|

Senior Member

688 posts Joined: Feb 2014 |

QUOTE(Jliew168 @ Mar 6 2017, 04:18 PM) Said the same thing to TS few years ago. Nay sayer always say drop, but .... QUOTE(zerorating @ Mar 6 2017, 04:51 PM) You call ask why fail. Then prove that you can afford to pay. QUOTE(dzila_87 @ Mar 6 2017, 05:42 PM) Youi not qualified. You apply for Pr1ma, |

|

|

Mar 6 2017, 05:51 PM Mar 6 2017, 05:51 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

loan also so strict now. so low sales. how flippers ?

so any overpriced high rise prop just vped last year ? can sell or not? |

|

|

Mar 6 2017, 06:15 PM Mar 6 2017, 06:15 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

|

|

|

Mar 6 2017, 06:16 PM Mar 6 2017, 06:16 PM

|

Senior Member

688 posts Joined: Feb 2014 |

|

|

|

Mar 6 2017, 06:23 PM Mar 6 2017, 06:23 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

QUOTE(KoChun @ Mar 6 2017, 06:16 PM) Banks who process application have lots. So they dont call everyone. using runner for application,malas nak tanya which bank branches he submit the application , but oh well, im only purchase those property if only bank are willing to take risk lol. I know that the bank nearly reaching their loan-to-deposit ratio limit, so they will not give loan suka2 hati.You can call to ask and find out. Otherwise, best apply for Pr1ma. so for now, im committed to proceed with the only bank responded lol, hopefully that the loan process goes well, so far so good, dsr ratio is good, ccris records is good This post has been edited by zerorating: Mar 6 2017, 06:29 PM |

|

|

Mar 6 2017, 07:24 PM Mar 6 2017, 07:24 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(zerorating @ Mar 6 2017, 06:23 PM) using runner for application,malas nak tanya which bank branches he submit the application , but oh well, im only purchase those property if only bank are willing to take risk lol. I know that the bank nearly reaching their loan-to-deposit ratio limit, so they will not give loan suka2 hati. sometimes cannot trust runner. they say will submit to 10 bank. but in reality they submit mayb 1-2 only... dont be surprised if u call the bank they say dont have your application.so for now, im committed to proceed with the only bank responded lol, hopefully that the loan process goes well, so far so good, dsr ratio is good, ccris records is good |

|

|

Mar 6 2017, 07:39 PM Mar 6 2017, 07:39 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

QUOTE(WhitE LighteR @ Mar 6 2017, 07:24 PM) sometimes cannot trust runner. they say will submit to 10 bank. but in reality they submit mayb 1-2 only... dont be surprised if u call the bank they say dont have your application. im awared of that, but i dont know any good mortgage officers anyway, so the runner (also property agent) know better than me anyway. I managed to get a loan meaning he closed the deal and getting commission.its not a property that i die2 must buy anyway. This post has been edited by zerorating: Mar 6 2017, 07:42 PM |

|

|

Mar 6 2017, 07:39 PM Mar 6 2017, 07:39 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

|

|

|

Mar 6 2017, 07:42 PM Mar 6 2017, 07:42 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(icemanfx @ Mar 6 2017, 03:42 PM) Over inflated property price deflate longer than most expected e.g. property in the US and UK took about 6 years to reach bottom. due to slower foreclosure process in the kangkong land, kv property price will take longer than 6 years to reach bottom, and this 6+ years count down to bottom is only about to begin or just begun. QUOTE(icemanfx @ Mar 6 2017, 04:33 PM) Well, I'd say you can't follow US or UK simply because people's mentality are different, you must look at Asian countries for a better indicator or better still look at past trends in Malaysia itself. The last time there was a down trend in property prices was back in 2009 during the economy crisis. But this lasted only for 2 years then properties started shooting up. This time around should be the same. The downtrend maxxxxx lah, until early 2020 but I predict by early or mid 2019 it should already end and go upwards. The downward price trend started somewhere end of last year. |

|

|

Mar 6 2017, 07:47 PM Mar 6 2017, 07:47 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(cocbum4 @ Mar 5 2017, 11:21 PM) Super bubble burst will not happen. I predict max also market price drop by 40%...maybe 50% la.... But more likely most properties will just see 30% reduction in price. QUOTE(ALeUNe @ Mar 5 2017, 11:23 PM) Ready 500k++, I think end 2018 or next yr can get some smaller and older 3r2b condos for around there. Those below 1500sq feet la. QUOTE(party @ Mar 5 2017, 11:39 PM) 50k you rewind 20 yrs also can't get la. Wat tok Jew. |

|

|

Mar 6 2017, 08:23 PM Mar 6 2017, 08:23 PM

Show posts by this member only | IPv6 | Post

#148

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(scorptim @ Mar 6 2017, 07:42 PM) Well, I'd say you can't follow US or UK simply because people's mentality are different, you must look at Asian countries for a better indicator or better still look at past trends in Malaysia itself. The last time there was a down trend in property prices was back in 2009 during the economy crisis. But this lasted only for 2 years then properties started shooting up. No vendor is willing to sell at below market price, property price drop by way of foreclosure. Foreclosure in the kangkong land could takes years to execute, hence, price will take many years to bottom.This time around should be the same. The downtrend maxxxxx lah, until early 2020 but I predict by early or mid 2019 it should already end and go upwards. The downward price trend started somewhere end of last year. Unless bnm to allow Myr to free fall, expect local bank interest rate to track fed. By 2019/2020, fed rate is likely 2 to 4% higher than currently. This post has been edited by icemanfx: Mar 6 2017, 08:34 PM |

|

|

Mar 6 2017, 08:28 PM Mar 6 2017, 08:28 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(icemanfx @ Mar 6 2017, 08:23 PM) No vendor is willing to sell at below market price, property price drop by way of foreclosure. Foreclosure in the kangkong land could takes years to execute, hence, price will take many years to bottom. Now oledi banyak ppl sell 10% below market price la. They dun say less, they use the term rebate. So many 500k condo rebate 50k...summore can use the rebate for dp. End of day loan 450k only...means already happening la. But they dun make it obvious onli. Wait a while more 20%, 30% also will come la.Unless bnm to allow Myr to free fall, expect local bank interest rate to track fed. By 2019/2020, fed rate is likely 2 to 3% higher than currently. |

|

|

Mar 6 2017, 08:36 PM Mar 6 2017, 08:36 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(scorptim @ Mar 6 2017, 07:47 PM) Super bubble burst will not happen. Bubble everyday deflate and after it deflated it cannot burst, need to inflate everyday so it can burstI predict max also market price drop by 40%...maybe 50% la.... But more likely most properties will just see 30% reduction in price. Ready 500k++, I think end 2018 or next yr can get some smaller and older 3r2b condos for around there. Those below 1500sq feet la. 50k you rewind 20 yrs also can't get la. Wat tok Jew. |

|

|

Mar 6 2017, 08:36 PM Mar 6 2017, 08:36 PM

|

All Stars

21,456 posts Joined: Jul 2012 |

QUOTE(scorptim @ Mar 6 2017, 08:28 PM) Now oledi banyak ppl sell 10% below market price la. They dun say less, they use the term rebate. So many 500k condo rebate 50k...summore can use the rebate for dp. End of day loan 450k only...means already happening la. But they dun make it obvious onli. Wait a while more 20%, 30% also will come la. This is only possible if bank value the condo for 500k. |

|

|

Mar 6 2017, 08:36 PM Mar 6 2017, 08:36 PM

|

Senior Member

9,616 posts Joined: Dec 2013 |

Property market gg already, especially lapsap condo/highrise. It's not a very big issue for property that already finished installments, but GOOD LUCK to those 90ltv...

main reasons: 1) supply damn much >>>>>>>> than demands 2) due to greedy developer, built high density shyt products 3) also due to AFFORDABLE HOUSING such as PR1MA/Rumawip/Ruma selangorku. 4) 100 housings, 30 buyers need it to stay, 300 buyers goreng/speculators/so called invest.. so you do the math ya. Fyi, now the condo CAN'T EVEN RENT OUT. The market is very very over supply just like our great country sohem shopping malls. Everyone copy cat lead to everyone wait dai. Marehsia is a great nation in term of copy this and that. #lovejib #lovemarehsia |

|

|

Mar 6 2017, 08:37 PM Mar 6 2017, 08:37 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(heavensea @ Mar 6 2017, 08:36 PM) Property market gg already, especially lapsap condo/highrise. It's not a very big issue for property that already finished installments, but GOOD LUCK to those 90ltv... Malaysia index is flying up fast today, Ayam can't wait to see the bubble to comemain reasons: 1) supply damn much >>>>>>>> than demands 2) due to greedy developer, built high density shyt products 3) also due to AFFORDABLE HOUSING such as PR1MA/Rumawip/Ruma selangorku. 4) 100 housings, 30 buyers need it to stay, 300 buyers goreng/speculators/so called invest.. so you do the math ya. Fyi, now the condo CAN'T EVEN RENT OUT. The market is very very over supply just like our great country sohem shopping malls. Everyone copy cat lead to everyone wait dai. Marehsia is a great nation in term of copy this and that. #lovejib #lovemarehsia |

|

|

Mar 6 2017, 08:38 PM Mar 6 2017, 08:38 PM

|

Senior Member

4,719 posts Joined: Jan 2003 |

Does this mean the buyer getting 100% loan?

QUOTE(scorptim @ Mar 6 2017, 08:28 PM) Now oledi banyak ppl sell 10% below market price la. They dun say less, they use the term rebate. So many 500k condo rebate 50k...summore can use the rebate for dp. End of day loan 450k only...means already happening la. But they dun make it obvious onli. Wait a while more 20%, 30% also will come la. |

|

|

Mar 6 2017, 08:40 PM Mar 6 2017, 08:40 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

QUOTE(heavensea @ Mar 6 2017, 08:36 PM) Property market gg already, especially lapsap condo/highrise. It's not a very big issue for property that already finished installments, but GOOD LUCK to those 90ltv... lets suggest to gomen for importing more awang hitam, profit profit main reasons: 1) supply damn much >>>>>>>> than demands 2) due to greedy developer, built high density shyt products 3) also due to AFFORDABLE HOUSING such as PR1MA/Rumawip/Ruma selangorku. 4) 100 housings, 30 buyers need it to stay, 300 buyers goreng/speculators/so called invest.. so you do the math ya. Fyi, now the condo CAN'T EVEN RENT OUT. The market is very very over supply just like our great country sohem shopping malls. Everyone copy cat lead to everyone wait dai. Marehsia is a great nation in term of copy this and that. #lovejib #lovemarehsia |

|

|

Mar 6 2017, 08:45 PM Mar 6 2017, 08:45 PM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(kevyeoh @ Mar 6 2017, 08:38 PM) Yes, it's a trick/gimmick from a lot of property developer recently. Sell prop for 500k with 50k rebate. Use rebate as deposit, submit to bank loan for 450k (90%) of selling price which is stated as 500k. But in the end, yes they getting 100% loan. 1 cent dp also din pay. |

|

|

Mar 6 2017, 08:47 PM Mar 6 2017, 08:47 PM

|

Senior Member

700 posts Joined: Nov 2009 |

|

|

|

Mar 6 2017, 08:49 PM Mar 6 2017, 08:49 PM

Show posts by this member only | IPv6 | Post

#158

|

Senior Member

9,616 posts Joined: Dec 2013 |

QUOTE(cocbum4 @ Mar 6 2017, 08:37 PM) Ayam stocks jatuh, sedih.QUOTE(zerorating @ Mar 6 2017, 08:40 PM) Ph is the saviour for condo owners.And about those MRT project, ask the SA stop their skl... a public transport can save the whole market while avoiding rental price war? This's some bs like BR1M can save our country inflation that's caused by our suprim leader... About those MRT projects, ask those skl sa buy two for themselves dulu la. |

|

|

Mar 6 2017, 09:22 PM Mar 6 2017, 09:22 PM

|

Junior Member

57 posts Joined: Jan 2015 |

QUOTE(heavensea @ Mar 6 2017, 08:49 PM) Ayam stocks jatuh, sedih. Ayam can simply make 10-20% from the recent bull run, just any stock will doPh is the saviour for condo owners. And about those MRT project, ask the SA stop their skl... a public transport can save the whole market while avoiding rental price war? This's some bs like BR1M can save our country inflation that's caused by our suprim leader... About those MRT projects, ask those skl sa buy two for themselves dulu la. It has never been so bull before |

|

|

Mar 6 2017, 09:28 PM Mar 6 2017, 09:28 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

QUOTE(scorptim @ Mar 6 2017, 08:47 PM) If not possible Jew think developer dare to do. They sure kaotim with the bank d la. Plus market price memang around there onli. So bank valuation sure lepas 1 but nowdays rehda complaining banks rejecting alot of applications, other than DSR/income factor, maybe sangkut on the valuation part? |

|

|

Mar 6 2017, 09:34 PM Mar 6 2017, 09:34 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(zerorating @ Mar 6 2017, 09:28 PM) but nowdays rehda complaining banks rejecting alot of applications, other than DSR/income factor, maybe sangkut on the valuation part? Banks are deleveraging their balance sheet due to bad loans from the OnG fallout and also from personal loans. They are likely going to cap their loan amount until they have cleaned their books.Imho from the recent results, they are mostly done. Last 2 years was very bad with lots of writeoffs. |

|

|

Mar 6 2017, 09:37 PM Mar 6 2017, 09:37 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

next year more fun.

strata owner not paying maintenance will get their units auction off. o yeahhhhhhhhhhh hahahahahahahahahhaaaaa ahahaa ha ha ha This post has been edited by kurtkob78: Mar 6 2017, 09:38 PM |

|

|

Mar 6 2017, 09:50 PM Mar 6 2017, 09:50 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

|

|

|

Mar 6 2017, 09:58 PM Mar 6 2017, 09:58 PM

|

Senior Member

688 posts Joined: Feb 2014 |