every investment vehicle has it's usage

by simply dismissing one without knowing its strengths / weaknesses severely limits one's options & flexibility.

having said the above, then the obvious Qs would be:

1. What stocks to buy?

Good companies at worthwhile cost - eg for local Nestle, PBBank, DLady, LPI, etc. for foreign MCD, CVX, KO, 3M, GOOG, etc - at the cost vs value one wants.

No one wants to buy these stocks? Sure?

AND why would i sell in a down market, if i've planned my emergency funds & investing properly?

In fact, i'd buy more

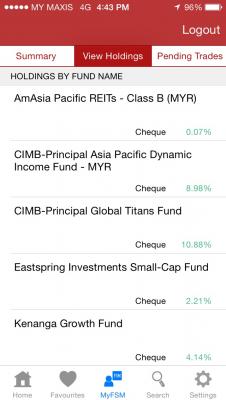

2. If one does about MYR2.5K per transaction (based on old costing, now there are 0% for cash up front funded a/c), the commissions' on stock purchase is lower than even FSM.

However, if one has less than MYR500 per transaction, the commission or service charges are lower for FSM

3. Holding stocks do not cost anything

Holding mutual funds and even ETFs cost a %, thus if markets go sideways forever, guaranteed losses.

Being logical and ever learning in investing goes a long way.

Dismissing stuff without having facts & comparisons in different context severely limits one unless one like "to fall in love" with a particular vehicle - i know some are "only properties", some are "only long stocks", some are only UTs. No wrong, just severely limiting oneself or just drew a line not to cross due to comfort-level, time, etc.

Just a thought

Agree with WongSifu here. I think Dividend Magic said this in his blog as well. Don't have to dismiss them as "kids". Anyway to each their own, as long as you can maximise your growth in NAV within your knowledge and capability.

Dec 23 2016, 02:56 PM

Dec 23 2016, 02:56 PM

Quote

Quote

0.1218sec

0.1218sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled