Thanks for the info. Does it make a difference if I invest now or invest after new year's?

FundSuperMart v17 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v17 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 23 2016, 11:21 PM Dec 23 2016, 11:21 PM

|

Senior Member

1,757 posts Joined: May 2011 |

Thanks for the info. Does it make a difference if I invest now or invest after new year's?

|

|

|

|

|

|

Dec 23 2016, 11:24 PM Dec 23 2016, 11:24 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 23 2016, 11:32 PM Dec 23 2016, 11:32 PM

Show posts by this member only | IPv6 | Post

#43

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(drbone @ Dec 23 2016, 11:21 PM) I don't do Prs as I need the money for my wedding but T231H is right try to fill up your prs before year end to enjoy the tax relief if you haven't. once that's done you can start building your portfolio next month. (but I think it's already too late to fill it as fsm said there is already a closing date for prs application) if you already did I would say just enjoy your holidays first. come back next year. most fund managers and stock brokers are already wrapping up 2016. |

|

|

Dec 23 2016, 11:32 PM Dec 23 2016, 11:32 PM

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Dec 23 2016, 11:46 PM Dec 23 2016, 11:46 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

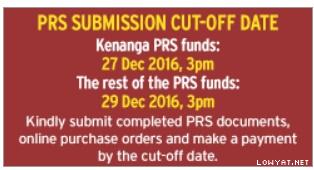

QUOTE(drbone @ Dec 23 2016, 11:32 PM) Evaluate yr tax relief benefits....if very worth it....starts with that next week.....2016 ending soon. Head on to prs thread to read page# 94, post# 1866... https://forum.lowyat.net/topic/2064127/+1860#entry83089883 This post has been edited by T231H: Dec 24 2016, 12:22 AM Attached image(s)  |

|

|

Dec 23 2016, 11:48 PM Dec 23 2016, 11:48 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(T231H @ Dec 23 2016, 11:46 PM) Evaluate yr tax relief benefits....if very worth it....starts with that next week.....2016 ending soon. Head on to prs thread to read my last posting there... i thought we will be given 1k myr for starting our prs since budget 2017 was announced. How come fsm still give 500 myr |

|

|

|

|

|

Dec 24 2016, 12:15 AM Dec 24 2016, 12:15 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 24 2016, 12:26 AM Dec 24 2016, 12:26 AM

Show posts by this member only | IPv6 | Post

#48

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Dec 24 2016, 12:29 AM Dec 24 2016, 12:29 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 24 2016, 02:46 AM Dec 24 2016, 02:46 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(puchongite @ Dec 23 2016, 09:03 PM) From what have been posted, people who prefer to buy-and-stick-to-it are saying these :- #1 is dangerous because it's money that makes money, more money makes more money. If say you are in a fund that has lost 50% and you switch, you have to make double what the old fund will make in the future just be say you are in a better position. For instance if you are in fund A and it is down 50℅. Then you switch and say at the end of the year your new fund has made 8℅ and your old fund 6℅. You think you made the right decision but you didn't, because 6℅ of 100℅ is more than 8℅ of 50℅.1. When you keep switching, particularly when funds are not performing, you realize the paper loss. And your capital shrinks. 2. When you switch to another horse, you still dont know it is going to be a performing horse. The new horse might be worse than the current one. 3. When you switch, often you pay switching fees. Immediate you are incurred 2% loss. Perhaps may I invite the gurus (whose words are carrying more weight) to address these points ? It just looks as if you did. So you are eroding capital, but all the time you think you are doing better. QUOTE(Avangelice @ Dec 23 2016, 11:05 PM) you can follow fsm portfolio allocation. Or you can follow FSMs portfolios.you can follow xuzen's portfolio that has AmAsia reit Manulife US Manulife India Ponzi 2.0 Esther bond fund (Affin hwang select bond fund myr) you can follow mine FSM Funds Affin Hwang Select Bond.... (20%) RHB Asian Income Fund. ....(15%) CIMB-P Asia Pac Dynamic ....(10%) Eastspring Emerging Market...(10%) CIMB-P Greater China Equity ..(10%) Manulife US equity fund (10%) Manulife India.........(10%) AmAsia REITs .... (10 %) TA Global Technology Fund...(5%) divide your 10k into percentages like you see in my portfolio. from there you can either lump sum into each fund or adopt a DCA approach every month. eg 10,000 x 10% = 1000 myr. (lump sum/vca) 1000 ÷5 months= 200 myr (per month/dca) think of it like you are building your pyramid from a pile of marble |

|

|

Dec 24 2016, 07:30 AM Dec 24 2016, 07:30 AM

Show posts by this member only | IPv6 | Post

#51

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Dec 24 2016, 07:32 AM Dec 24 2016, 07:32 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

|

|

|

Dec 24 2016, 08:11 AM Dec 24 2016, 08:11 AM

|

All Stars

33,655 posts Joined: May 2008 |

QUOTE(wodenus @ Dec 24 2016, 02:46 AM) #1 is dangerous because it's money that makes money, more money makes more money. If say you are in a fund that has lost 50% and you switch, you have to make double what the old fund will make in the future just be say you are in a better position. For instance if you are in fund A and it is down 50℅. Then you switch and say at the end of the year your new fund has made 8℅ and your old fund 6℅. You think you made the right decision but you didn't, because 6℅ of 100℅ is more than 8℅ of 50℅. This is a your biased comment. Yes, I have switched out non-performing funds before, eg is KGF, but when I switch it out, it was still positive due to historical gain.It just looks as if you did. So you are eroding capital, but all the time you think you are doing better. Recently I also have switched out some RHB AIF to to up to some US funds. 0% SC. So switching act itself should not be based on it be negative or positive now ( current or past performance ). Switching out should be based on one's analysis or anticipation of the future. This post has been edited by puchongite: Dec 24 2016, 08:21 AM |

|

|

|

|

|

Dec 24 2016, 09:16 AM Dec 24 2016, 09:16 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Vanguard 2015 @ Dec 23 2016, 04:05 PM) I don't know sis. I am not an economist. As usual, my 2 cents worth based on talking to clients, other people and my observation. more .....1. Property market will still be down next year. Developers are suffering. Oversupply of condominiums and office space. Nobody is buying. Young couples who wish to buy a property after paying the 10% deposit...their loan application may still be rejected later by the bank. Local developers are marketing their properties overseas now. 2. Higher priced food and beverage restaurants are suffering. Some business are down by 30% and some others have closed shop. The surviving ones are doing promotional lunch set to survive. Of course I am not talking about the really high end restaurant that caters for the rich like Chynna. The rich will still eat and dine as usual. 3. Banking. Looks bad to me. VSS started this year for Maybank, etc. Not sure whether the banks will have more VSS next year. 4. Automobile industry. Same problem. The family man will not change his car because of the economy uncertainties. For the young, no issue-lah. Die die also, gaya mesti ada. Just take a 9 years car loan lor. Can always file for bankruptcy later. So, in summary, the MY market will be flat pending the outcome of the General Election next year. I hope I am proven wrong. I wish the Malaysian stock market and economy well. Sekian, terima kasih. Will 2017 be a good year for businesses? http://www.thestar.com.my/business/busines...for-businesses/ "With so much uncertainty, peering into the crystal ball will be a useless exercise. But I can certainly predict a tough survival journey for the man in the street as high inflation kicks in. Young entrepreneurs who have not experienced the currency crisis back in 97/98 will certainly get a rude awakening when the ringgit hits 5. You are advised to standby a first aid survival kit, run for cover and keep yourself lean and fit for a journey that will be rocky and strewn with danger at all junctions and corners." |

|

|

Dec 24 2016, 09:25 AM Dec 24 2016, 09:25 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(T231H @ Dec 24 2016, 09:16 AM) more ..... way to ruin Christmas by reading this.Will 2017 be a good year for businesses? http://www.thestar.com.my/business/busines...for-businesses/ "With so much uncertainty, peering into the crystal ball will be a useless exercise. But I can certainly predict a tough survival journey for the man in the street as high inflation kicks in. Young entrepreneurs who have not experienced the currency crisis back in 97/98 will certainly get a rude awakening when the ringgit hits 5. You are advised to standby a first aid survival kit, run for cover and keep yourself lean and fit for a journey that will be rocky and strewn with danger at all junctions and corners." |

|

|

Dec 24 2016, 09:30 AM Dec 24 2016, 09:30 AM

Show posts by this member only | IPv6 | Post

#56

|

All Stars

33,655 posts Joined: May 2008 |

QUOTE(T231H @ Dec 24 2016, 09:16 AM) more ..... The author is not optimistic even in anticipation of the upcoming general election.Will 2017 be a good year for businesses? http://www.thestar.com.my/business/busines...for-businesses/ "With so much uncertainty, peering into the crystal ball will be a useless exercise. But I can certainly predict a tough survival journey for the man in the street as high inflation kicks in. Young entrepreneurs who have not experienced the currency crisis back in 97/98 will certainly get a rude awakening when the ringgit hits 5. You are advised to standby a first aid survival kit, run for cover and keep yourself lean and fit for a journey that will be rocky and strewn with danger at all junctions and corners." |

|

|

Dec 24 2016, 09:43 AM Dec 24 2016, 09:43 AM

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(puchongite @ Dec 24 2016, 09:30 AM) maybe he saw how bad the situation is ...."I am not raising my hopes yet as the very people and institutions that we depend on are dysfunctional at the moment. Headless and clueless. And powerless to make decisions." an example of our MOF Minister reply: "Asked on the fair value for the local currency, he said: "It depends at what point you come in, if you come at 3.30-level you would want the ringgit to be at 3.30 and if you come at 3.80-level you want it to be at that level." http://www.thestar.com.my/news/nation/2016...ll-bounce-back/ "Just saying the ringgit will bounce back without any solid plans will cut no ice with me. How, why and when will it bounce back? Hopefully this bounce back is not part of Vision 2020. Many businesses will be dead by then." and with the coming election.... "With a highly-charged political battle brewed in 2016 and carried into 2017, entrepreneurs should not expect a politically stable environment to operate in. The reverse is to be expected as the ruling politicians divert all their attentions to self preservation and political survival. This country will be managed by civil servants, advisors and cronies. Not good." we knows this has happened, is happening and at going to keep happening again and again,...yet what can we do about it & if possible get the benefits of this situations? study hard and join the civil service with the authority to buy?...... http://malaysiandigest.com/frontpage/282-m...l-auditing.html This post has been edited by MUM: Dec 24 2016, 10:11 AM |

|

|

Dec 24 2016, 10:03 AM Dec 24 2016, 10:03 AM

|

Junior Member

92 posts Joined: Apr 2011 |

QUOTE(Avangelice @ Dec 23 2016, 11:05 PM) you can follow fsm portfolio allocation. nice you can follow xuzen's portfolio that has AmAsia reit Manulife US Manulife India Ponzi 2.0 Esther bond fund (Affin hwang select bond fund myr) you can follow mine FSM Funds Affin Hwang Select Bond.... (20%) RHB Asian Income Fund. ....(15%) CIMB-P Asia Pac Dynamic ....(10%) Eastspring Emerging Market...(10%) CIMB-P Greater China Equity ..(10%) Manulife US equity fund (10%) Manulife India.........(10%) AmAsia REITs .... (10 %) TA Global Technology Fund...(5%) divide your 10k into percentages like you see in my portfolio. from there you can either lump sum into each fund or adopt a DCA approach every month. eg 10,000 x 10% = 1000 myr. (lump sum/vca) 1000 ÷5 months= 200 myr (per month/dca) think of it like you are building your pyramid from a pile of marble wonder anyone here use aladdin fund as core (>50%) and then choose few regional/country/sector fund as supplement (tilt towards individual likeness)? p.s aladdin is all world developed market fund, so if combine with EI global EM fund, you will get all world total stock market coverage This post has been edited by asimov82: Dec 24 2016, 10:06 AM |

|

|

Dec 24 2016, 10:08 AM Dec 24 2016, 10:08 AM

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(asimov82 @ Dec 24 2016, 10:03 AM) nice >50% in a fund?wonder anyone here use aladdin fund as core (>50%) and then choose few regional/country/sector fund as supplement (tilt towards individual likeness)? p.s aladdin is all world developed market fund, so if combine with EI global EM fund, you will get all world total stock market coverage maybe point*8 Manager’s Risk The performance of any unit trust funds is dependent amongst others on the experience, knowledge, expertise and investment techniques/process adopted by the manager and any lack of the above would have an adverse impact on the fund’s performance thereby working to the detriment of Unit holders. https://www.cimb-principal.com.my/Investor_...rust_Funds.aspx |

|

|

Dec 24 2016, 10:28 AM Dec 24 2016, 10:28 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(T231H @ Dec 24 2016, 09:16 AM) more ..... LOL.. time to prep. End of world coming Will 2017 be a good year for businesses? http://www.thestar.com.my/business/busines...for-businesses/ "With so much uncertainty, peering into the crystal ball will be a useless exercise. But I can certainly predict a tough survival journey for the man in the street as high inflation kicks in. Young entrepreneurs who have not experienced the currency crisis back in 97/98 will certainly get a rude awakening when the ringgit hits 5. You are advised to standby a first aid survival kit, run for cover and keep yourself lean and fit for a journey that will be rocky and strewn with danger at all junctions and corners." QUOTE(puchongite @ Dec 24 2016, 08:11 AM) This is a your biased comment. Yes, I have switched out non-performing funds before, eg is KGF, but when I switch it out, it was still positive due to historical gain. But no one knows the future...Recently I also have switched out some RHB AIF to to up to some US funds. 0% SC. So switching act itself should not be based on it be negative or positive now ( current or past performance ). Switching out should be based on one's analysis or anticipation of the future. QUOTE(xuzen @ Dec 24 2016, 11:07 AM) Correction. Your port looks like mine now P/s Tambah nilai lagi for Selina's QUOTE(contestchris @ Dec 25 2016, 02:44 AM) I mean I'm just starting out. But I don't seem to fit to any of the three. I definitely do not want to be totally passive. As I mentioned earlier, at the very least I want to make changes during a recession (switch out or sell when things are about to get worse, switch back or buy when things are starting to get better). Sure you can be totally passive cause after a recession the market will usually quickly recover to its per-recession high, but by taking some corrective measures I believe you could make a handy profit. During a recession everything loses money.. where are you going to switch out to At the same time I do not plan to actively manage. A lot of what I am buying is just overall sectors equities. Unless, in the future if I decide to get some Brazillian equities for example, then yeah I will need to keep pace with the Brazillian market news and switch out when required cause Brazil can be volatile. Over time I guess once I get to know the market trends better I will do some switching in and out for the funds I have, but still I won't call it "actively managed". |

|

Topic ClosedOptions

|

| Change to: |  0.0256sec 0.0256sec

0.87 0.87

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 04:52 AM |