QUOTE(fishman @ Jan 30 2017, 02:30 PM)

I have been reading up on this forum for a while now, trying to learn & absorb the knowledge & experience that u guys r so kind to share..

The thing is, I am in my mid-40s. I have never been interested in financial stuff. M working in a MNC & felt as long as I have a job, I m OK. Then I realised that's not enough as I am not getting any younger. My time horizon is getting shorter & shorter.

So my regret is that I never took the initiative to learn & plan my financials much earlier... and I need to start now.

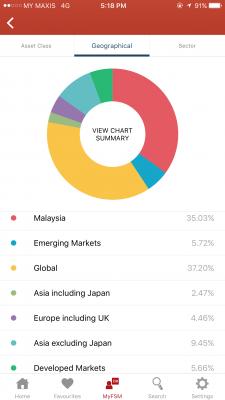

So I signed up with FSM a few weeks ago, and look fwd to be a "new" investor. I hope to learn from u guys, no matter your age or gender.

Thanks for all your past sharings & thanks in advance for all you future guidances.

Welcome to FSM bro. It is never too late to start investing. Assuming you have 20 years of working life ahead, you will still end up with a tidy sum of money upon your retirement.

In our late 30's to 40's, we would usually be at the peak of our career and earning capacity. We might as well take advantage of it.

P/S : Based on my observation, all things being equal, it is the expenses and not the income level that affects our retirement plan.

Jan 27 2017, 12:21 AM

Jan 27 2017, 12:21 AM

Quote

Quote

0.1186sec

0.1186sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled