Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

akhito

|

May 6 2022, 01:41 PM May 6 2022, 01:41 PM

|

|

QUOTE(dannyw @ May 6 2022, 01:35 PM) Really standby the bullet already.  Even the OPR really increase, wonder take how long for bank FD rate to follow. the board rate should change immediately after next working day. No? |

|

|

|

|

|

akhito

|

May 11 2022, 04:25 PM May 11 2022, 04:25 PM

|

|

QUOTE(cclim2011 @ May 11 2022, 03:56 PM) dun be so pessimistic basically now 1month fd must 1.75% which is 0.25% up from previous. my guess 3 month 1.90% 6 month 2.05% 12 month 2.10% special rate let sifu guess This post has been edited by akhito: May 11 2022, 04:27 PM |

|

|

|

|

|

akhito

|

May 11 2022, 08:19 PM May 11 2022, 08:19 PM

|

|

QUOTE(oldkiasu @ May 11 2022, 05:38 PM) Looking to read feedback from FD clients. Just curious question concerning financial literacy of people. As readers at this forum, do you routinely place Fixed Deposits at the minimal Board Rates available (based on Maybank FD Board Rates wef since 9 July 2020), or at the promotion FD rates for general public at any particular period, or at special promotion FD with special conditions for select clients? for my own purpose, my fd is emergency fund so i just put at e-fd 3 months with cycling. promotional rate are indeed attractive but waiting few hours at counter to withdraw kinda defy my purpose for liquidity. hope that answer ur question |

|

|

|

|

|

akhito

|

May 13 2022, 09:01 AM May 13 2022, 09:01 AM

|

|

Public bank FD board rate just updated 13/5/2022 QUOTE Tenure Rate (% p.a)

1 Month 1.75

2 Months 1.90

3 Months 1.95

4 Months 1.95

5 Months 1.95

6 Months 2.05

7 Months 2.05

8 Months 2.05

9 Months 2.05

10 Months 2.05

11 Months 2.05

12 Months 2.10 Maybank also same. Now wait promotional rate sifus This post has been edited by akhito: May 13 2022, 09:02 AM |

|

|

|

|

|

akhito

|

Jun 27 2022, 08:43 PM Jun 27 2022, 08:43 PM

|

|

BNM will have another meeting 05-06 Jul 2022 (Tuesday-Wednesday).

I personally expects another opr hike of 0.5% following 0.75% of FED also in the name to curb inflation.

|

|

|

|

|

|

akhito

|

Jul 6 2022, 03:33 PM Jul 6 2022, 03:33 PM

|

|

seem like BNM is going for gentler approach. Researchers had been expecting 0.25% in September also. Sinchew daily cited that it was 1st in 10 years opr was raised consequently. last it was in 2010

This post has been edited by akhito: Jul 6 2022, 03:39 PM

|

|

|

|

|

|

akhito

|

Jul 8 2022, 08:56 AM Jul 8 2022, 08:56 AM

|

|

PBB updated board rates QUOTE Tenure Rate (% p.a)

1 Month 2.00

2 Months 2.15

3 Months 2.20

4 Months 2.20

5 Months 2.20

6 Months 2.30

7 Months 2.30

8 Months 2.30

9 Months 2.30

10 Months 2.30

11 Months 2.30

12 Months 2.35

13 to 60 Months Negotiable MBB basically same just that 1 month is slightly lower at 1.95% |

|

|

|

|

|

akhito

|

Jul 10 2022, 04:15 PM Jul 10 2022, 04:15 PM

|

|

QUOTE(Joe Yuan @ Jul 10 2022, 04:10 PM) Does SSPN refer to Skim Simpanan Pendidikan Nasional? Any specific treads in this forum discussing about it? yes, there is thread dedicated for it https://forum.lowyat.net/index.php?showtopic=1819492usually users place in sspn to for income tax rebate |

|

|

|

|

|

akhito

|

Jul 28 2022, 12:20 PM Jul 28 2022, 12:20 PM

|

|

QUOTE(gaffer9678 @ Jul 28 2022, 08:59 AM) To withdraw or transact amount > 10K, required secureplus. However, their own website secureplus functionality linkage to their mobile is not working. Been a while, at least close to a year. To transfer or withdraw FD amount > 10K, I use their mobile app. Btw, I just realised from someone post (a few post earlier), there is a different website from RHB https://logon.rhb.com.my/default.htm (RHB online Now) https://onlinebanking.rhbgroup.com/my/login (RHB online) The first one is what I have been using, but could not get the secureplus to send to mobile app previously. So I always use their mobile app to transact. I have not try to do this recently or the 2nd website link. The 2nd website look very similar to their mobile app. 2nd one is their new website. They encourage ppl to transition there (more of a soft landing), got more functionality also |

|

|

|

|

|

akhito

|

Sep 5 2022, 03:05 PM Sep 5 2022, 03:05 PM

|

|

coming opr review during this week https://www.bnm.gov.my/monetary-stability/mpc-meetingsQUOTE 5th 07-08 Sep 2022 (Wednesday-Thursday)

6th 02-03 Nov 2022 (Wednesday-Thursday) |

|

|

|

|

|

akhito

|

Sep 7 2022, 01:50 PM Sep 7 2022, 01:50 PM

|

|

QUOTE(Human Nature @ Sep 7 2022, 01:47 PM) Tmr boss... but exciting times for us FD kaki  tmr but almost 3 working days to up board rate then a more week for promo rate so next week la |

|

|

|

|

|

akhito

|

Sep 8 2022, 03:32 PM Sep 8 2022, 03:32 PM

|

|

QUOTE(oldkiasu @ Sep 8 2022, 03:22 PM) Just asking. Will you place if 3.35 %, 3.5 % or 3.73%, or you will wait for more? Depends on u, if u believe the rate would be hike again in nov then just place 3 months term lo. If not, u place how long also no diff If u wanna ask what do I think, I think Nov will hike again. It is still lower than precovid |

|

|

|

|

|

akhito

|

Sep 10 2022, 12:21 PM Sep 10 2022, 12:21 PM

|

|

MBB board rate CODE Tenure Interest Rates (% p.a)

1 month 2.20

2 months 2.40

3 months 2.45

4 months 2.45

5 months 2.45

6 months 2.55

7 months 2.55

8 months 2.55

9 months 2.55

10 months 2.55

11 months 2.55

12 months 2.60

13 - 35 months 2.60

36 - 47 months 2.65

48 - 59 months 2.75

60 months 2.85 *Effective from 12 September 2022 expecting pbb and others to follow suit soon |

|

|

|

|

|

akhito

|

Sep 12 2022, 11:26 AM Sep 12 2022, 11:26 AM

|

|

QUOTE(akhito @ Sep 10 2022, 12:21 PM) MBB board rate CODE Tenure Interest Rates (% p.a)

1 month 2.20

2 months 2.40

3 months 2.45

4 months 2.45

5 months 2.45

6 months 2.55

7 months 2.55

8 months 2.55

9 months 2.55

10 months 2.55

11 months 2.55

12 months 2.60

13 - 35 months 2.60

36 - 47 months 2.65

48 - 59 months 2.75

60 months 2.85 *Effective from 12 September 2022 expecting pbb and others to follow suit soon QUOTE PLUS Fixed Deposit Rates - effective 12 September 2022

Tenure Rate (% p.a)

1 Month 2.10

2 Months 2.25

3 Months 2.30

4 Months 2.30

5 Months 2.30

6 Months 2.45

7 Months 2.45

8 Months 2.45

9 Months 2.45

10 Months 2.45

11 Months 2.45

12 Months 2.60

13 to 60 Months Negotiable ok bad news for pbb users pbb more kiam than mbb |

|

|

|

|

|

akhito

|

Sep 12 2022, 01:22 PM Sep 12 2022, 01:22 PM

|

|

QUOTE(1mr3tard3d @ Sep 12 2022, 01:00 PM) not an issue until December 2022  #22151 #22151ok means existing pbe users need to instant transfer out then fpx in for 2.6% 3months. thanks for the tip |

|

|

|

|

|

akhito

|

Oct 3 2022, 11:00 AM Oct 3 2022, 11:00 AM

|

|

QUOTE(PJng @ Oct 2 2022, 11:35 PM) how long FD i can leave it on bank? does it expirry? or need renew again? i place FD 3 years ago, FRIA, then i just ignore it, yes interest is down 2.1% QUOTE All Deposit Accounts i.e. Savings Accounts, Current Accounts and Fixed Deposit Accounts (except Foreign Currency Accounts and Gold Investment Accounts) without any customer-initiated transactions (deposit or withdrawal transactions performed through either the counter or via self service banking channels) for a continuous period of twelve (12) months or more will be classified by the Bank as an 'Inactive' account.

The 'Inactive' status would remain unchanged until the account holder reactivates the account by performing a deposit or withdrawal transaction personally at the Bank's counter as all other modes of payment channel such as Self Service Terminals, E-Banking and Tele-Banking would be deactivated.

Should the account holder fail to perform a transaction on the account as mentioned above for a period of seven (7) years from the date of the last customer-initiated transaction, the account would be classified as 'Dormant'.

Before the account becomes 'Dormant', the Bank will send a notice to the account holder at least twenty one (21) calendar days in advance informing him/her/them of the impending dormancy and to reactivate the account personally at the Bank's branch.

If the account holder failed to reactivate the account within twenty one (21) calendar days of the notice, once the account becomes 'Dormant', it will be closed and the money inside the account will be transferred by the Bank to the Registrar of Unclaimed Moneys in accordance with the Unclaimed Moneys Act 1965. source: https://www.pbebank.com/Personal-Banking/Ba...e/Overview.aspxtldr do something be4 7 years then u r fine. the interest so low can take out and place with promo one This post has been edited by akhito: Oct 3 2022, 11:02 AM |

|

|

|

|

|

akhito

|

Oct 4 2022, 09:15 AM Oct 4 2022, 09:15 AM

|

|

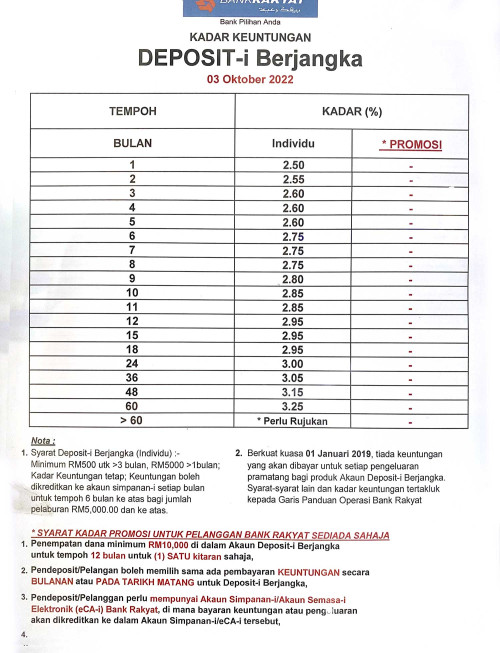

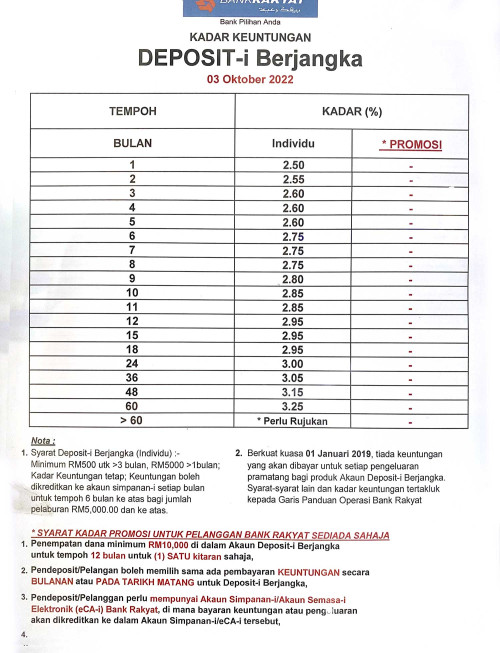

QUOTE(nebulaguava @ Oct 4 2022, 08:59 AM)  Yesterday OCT-3 I went to Bank Rakyat for the 3.55%pa deal but was told it ended in September. The new rates are not attractive at all. To my surprise, to open an account at BR I need to show original copies (soft copy won't do  ) of electricity or water bill with an address that matches my IC. Huh? So I ran away asap and go down the road to check Hong Leong, 6 months is 3.0% 12 months is 3.2%. Decided to go with the 3.0%, in anticipation of bank negara increasing the rates in the next few months.... fingers crossed. well just for comparison KDI save got 3.5% for 1st 50k |

|

|

|

|

|

akhito

|

Oct 4 2022, 11:01 AM Oct 4 2022, 11:01 AM

|

|

QUOTE(CommodoreAmiga @ Oct 4 2022, 10:53 AM) 3.5% for first 50k? Sure boh? I thought it's 3% up to 200k max and after that it's 2.25%? Revised already? QUOTE(cybpsych @ Oct 3 2022, 11:27 AM) checkout sebelah punya thread just mentioning here for baseline benchmarking |

|

|

|

|

|

akhito

|

Nov 3 2022, 02:03 PM Nov 3 2022, 02:03 PM

|

|

QUOTE(bbgoat @ Nov 3 2022, 11:15 AM) Expected announcement around what time, anyone? 3pm sharp keluar statement can F5 at bnm website |

|

|

|

|

|

akhito

|

Nov 7 2022, 10:49 AM Nov 7 2022, 10:49 AM

|

|

QUOTE(Garysydney @ Nov 6 2022, 09:54 AM) I am very keen on short term rates. MBB has put up their online 1 month rate to 2.45 and 2 months to 2.65 , 3 months 2.7, 6 months 2.8, 12 months 2.85 https://www.maybank2u.com.my/maybank2u/mala...ount_rates.pageQUOTE PB eFixed Deposit Rates - effective 7 November 2022

Tenure Rate (% p.a)

1 Month 2.20

2 Months 2.35

3 Months 2.40

4 Months 2.40

5 Months 2.40

6 Months 2.60

7 Months 2.60

8 Months 2.60

9 Months 2.60

10 Months 2.60

11 Months 2.60

12 Months 2.80 comparison with pbb board rate Source: https://www.pbebank.com/Personal-Banking/Ra...ed-Deposit.aspxQUOTE MPC meeting dates 2023

1st 18 & 19 Jan 2023 (Wednesday & Thursday)

2nd 08 & 09 Mar 2023 (Wednesday & Thursday)

3rd 02 & 03 May 2023 (Tuesday & Wednesday)

4th 05 & 06 Jul 2023 (Wednesday & Thursday)

5th 06 & 07 Sep 2023 (Wednesday & Thursday)

6th 01 & 02 Nov 2023 (Wednesday & Thursday) |

|

|

|

|

May 6 2022, 01:41 PM

May 6 2022, 01:41 PM

Quote

Quote

0.0603sec

0.0603sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled