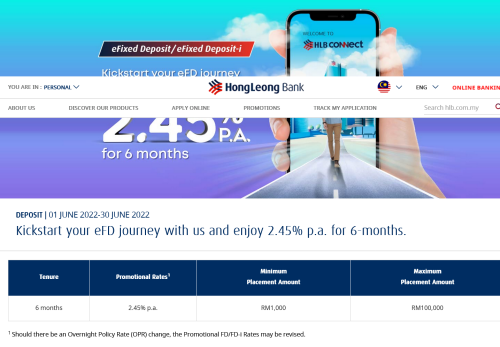

HLB 2.45% 06mts

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jun 1 2022, 01:08 PM Jun 1 2022, 01:08 PM

Return to original view | Post

#1

|

Junior Member

59 posts Joined: Sep 2021 |

jonoave liked this post

|

|

|

|

|

|

Jun 1 2022, 01:18 PM Jun 1 2022, 01:18 PM

Return to original view | Post

#2

|

Junior Member

59 posts Joined: Sep 2021 |

RHB eFD 12mts. 2.73%

|

|

|

Jun 2 2022, 01:09 PM Jun 2 2022, 01:09 PM

Return to original view | Post

#3

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Jul 3 2022, 08:01 PM Jul 3 2022, 08:01 PM

Return to original view | Post

#4

|

Junior Member

59 posts Joined: Sep 2021 |

QUOTE(oldkiasu @ Jul 2 2022, 01:37 PM) Hong Leong TIA-i promo (islamic investment, no PIDM) at HLConnect. have been placing in this product for years. So far interest paid as stated3m 2.55% 6m 2.65% 12m 3.10% minimum initial TIA-i at RM 500 (whatever that means). Placement is not by FPX, but by debit on-line with HLConnect internet banking from existing SA balance. Principal can be selected to be auto-creditted into the SA on maturity. |

|

|

Jul 6 2022, 07:13 PM Jul 6 2022, 07:13 PM

Return to original view | Post

#5

|

Junior Member

59 posts Joined: Sep 2021 |

Maybank will raise its BR from 2% to 2.5%, and its BLR will be revised from 5.65% to 5.9% per annum.

Similarly, the Islamic base rate and base financing rate will be increased by 25bps from 2% to 2.25% and from 5.65% to 5.9% respectively. In line with the revision, Maybank and Maybank Islamic’s fixed deposit rates will also be adjusted upwards effective July 8. |

|

|

Jul 30 2022, 03:19 PM Jul 30 2022, 03:19 PM

Return to original view | Post

#6

|

Junior Member

59 posts Joined: Sep 2021 |

QUOTE(Junichiro Tanizaki @ Jul 27 2022, 04:00 PM) quote "Does anybody have this issue. I found out RHB FD is like cheating customers. If your maturity date is today, you can't withdraw until tomorrow or you will lose all your interest. When tomorrow you withdraw, it will say you lost 1 day of interests! vmad.gif I don't have these kind of issues with other banks so far." unquote I withdrew my RHB efd on maturity yesterday. I encountered problems at their new web site. I switch back to their old web site n withdrew it successfully. My first attempt on their new web site failed because my mobile did not received their OTP. Yes RHB FD maturity can only withdraw one day after the maturity date. And always loose that days interest. The bank staff knows about it, but it seems nobody doing anything about it. Also the RHB Secure Plus for transferring money out of the bank is a joke. Can never get it to work, unless previously already set up favorite to your transfer list. |

|

|

|

|

|

Jul 30 2022, 03:26 PM Jul 30 2022, 03:26 PM

Return to original view | Post

#7

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Sep 26 2022, 03:13 PM Sep 26 2022, 03:13 PM

Return to original view | Post

#8

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Sep 26 2022, 03:15 PM Sep 26 2022, 03:15 PM

Return to original view | Post

#9

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Sep 28 2022, 10:40 AM Sep 28 2022, 10:40 AM

Return to original view | Post

#10

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Oct 2 2022, 01:51 PM Oct 2 2022, 01:51 PM

Return to original view | Post

#11

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Oct 3 2022, 10:16 AM Oct 3 2022, 10:16 AM

Return to original view | Post

#12

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Oct 4 2022, 12:21 PM Oct 4 2022, 12:21 PM

Return to original view | Post

#13

|

Junior Member

59 posts Joined: Sep 2021 |

QUOTE(CommodoreAmiga @ Oct 4 2022, 10:53 AM) 3.5% for first 50k? Sure boh? I thought it's 3% up to 200k max and after that it's 2.25%? Revised already? KDI Save Now Offers Interest Rates Of Up To 3.5% p.a.Ringgitplus.com › Investment 20 hours ago — KDI Save users can now earn up to 3.5% p.a. on their money parked in the cash management fund – effective immediately. Investment amount in KDI Save Promotional return rate (% p.a.) Up to RM50,000 3.5% Between RM50,001 to RM200,000 3.0% More than RM200,000 2.5% |

|

|

|

|

|

Oct 6 2022, 02:25 PM Oct 6 2022, 02:25 PM

Return to original view | Post

#14

|

Junior Member

59 posts Joined: Sep 2021 |

BoomChaCha liked this post

|

|

|

Oct 7 2022, 02:47 PM Oct 7 2022, 02:47 PM

Return to original view | Post

#15

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Oct 7 2022, 02:51 PM Oct 7 2022, 02:51 PM

Return to original view | Post

#16

|

Junior Member

59 posts Joined: Sep 2021 |

QUOTE(oldkiasu @ Oct 6 2022, 04:17 PM) Effective Rate calculations for Bank Islam bundle promo 15 Sep to 31 Dec 2022. Thanks3 mths 70x4.35 + 30x0.05 = 304.5 + 1.5 = 306.0 ie 3.06 % ER 6 mths 70x4.45 + 30x0.05 = 311.5 + 1.5 = 313.0 ie 3.13 % ER The 70 TD-i is PIDM protected. The 30 Al-Awfar is not PIDM protected. |

|

|

Oct 9 2022, 12:59 PM Oct 9 2022, 12:59 PM

Return to original view | Post

#17

|

Junior Member

59 posts Joined: Sep 2021 |

QUOTE(HumanLobster @ Oct 9 2022, 12:09 PM) I don’t see a problem with discussing this here. We’re all after the best FD rates so comparing it with other alternatives but not delving into too much specifics seems inline with the topic to me. I think its good to enlightened newbies like me, to inform theres alternative out there. BoomChaCha and CommodoreAmiga liked this post

|

|

|

Oct 15 2022, 08:08 PM Oct 15 2022, 08:08 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

59 posts Joined: Sep 2021 |

any promo from Bank Rakyat FD?

|

|

|

Oct 17 2022, 10:24 AM Oct 17 2022, 10:24 AM

Return to original view | Post

#19

|

Junior Member

59 posts Joined: Sep 2021 |

|

|

|

Oct 21 2022, 08:11 AM Oct 21 2022, 08:11 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

59 posts Joined: Sep 2021 |

|

| Change to: |  0.0582sec 0.0582sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:09 AM |