QUOTE(pearl_white @ Jul 30 2020, 11:42 AM)

Banks are in the businesses of making profits.

Time and time again, savers and FDers ("depositors") alike make the same mistake thinking that to the banks, they are "customers".

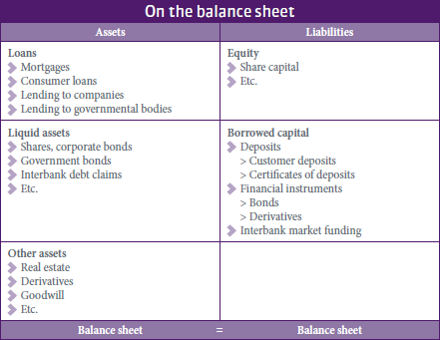

Depositors fail to realise that banks pay interest/profits to you. You are a liability, in other words a vendor. Vendors scrape for the best deals and will be given whatever is left the bottom of the barrel. You are at the bottom of the food chain as far as the banks are concerned.

(P/s The deposits rates are not very high_competitive now is because downward biased interest rate outlook + subdued loan growth)

When banks go bankrupt, it is always the depositors that gets whatever is left LAST after liquidation process.

I just want to correct some views here.

First, depositors are customers to bank. Im not sure why u think otherwise. Moreover, banks need depositors to provide fund, to give out loans. Bank needs depositors as much as they need borrowers. Banks need to strike a balance. (I work in bank risk management)

Shareholders are the LAST in liquidation process.

Depositors are creditor of banks. They will be ranked before sub debt holders and shareholders and after fixed charge holders.

The bad experiences are likely because CS from call centre are not 100% knowledgeable on everything simply because theyre not on the ground (work at branch). There will be something they need to confirm with branch staff or seek clarification from higher top.

I do agree some CS seems clueless about ongoing promotion but it is understandable so as long they able to clarify and revert correctly in the end

This post has been edited by Kyan0411: Aug 1 2020, 10:28 PM

May 23 2020, 09:41 PM

May 23 2020, 09:41 PM

Quote

Quote

0.0638sec

0.0638sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled