QUOTE(yclai118 @ Mar 9 2017, 04:41 PM)

Attached thumbnail(s)

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Mar 19 2017, 12:58 PM Mar 19 2017, 12:58 PM

Return to original view | Post

#1

|

Junior Member

40 posts Joined: Feb 2010 |

|

|

|

|

|

|

Jan 5 2018, 08:34 AM Jan 5 2018, 08:34 AM

Return to original view | Post

#2

|

Junior Member

40 posts Joined: Feb 2010 |

Hold on your money.

Possible 2 interest hikes on 2018. 1st on 25 Jan 2018, 2nd within 2018. Just my 2 cents. http://www.theedgemarkets.com/article/brac...hikes-next-year |

|

|

Jan 25 2018, 06:59 PM Jan 25 2018, 06:59 PM

Return to original view | Post

#3

|

Junior Member

40 posts Joined: Feb 2010 |

Finally, Bank Negara raised the overnight interest rate by 0.25%. (As I expected per my previous post)

Expect FD rate of 4.5%, 4.55% or even 4.6% to come back again!! Good luck. |

|

|

Sep 18 2019, 05:38 PM Sep 18 2019, 05:38 PM

Return to original view | Post

#4

|

Junior Member

40 posts Joined: Feb 2010 |

|

|

|

Sep 18 2019, 05:48 PM Sep 18 2019, 05:48 PM

Return to original view | Post

#5

|

Junior Member

40 posts Joined: Feb 2010 |

Affin Bank discontinue their 4.48% 9:1 ratio promotion last 31 August 2019. They are going to further lower down their 13 months+ 4.15% promotion to 3.95% after 25 Sept 2019. Be hurry if it concerns you.

|

|

|

May 5 2020, 09:34 PM May 5 2020, 09:34 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

40 posts Joined: Feb 2010 |

Public Bank eFD 4 months 3.08% still available. Minimum 10K. Hurry!

|

|

|

|

|

|

May 9 2020, 08:50 PM May 9 2020, 08:50 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

40 posts Joined: Feb 2010 |

|

|

|

Oct 12 2021, 07:49 AM Oct 12 2021, 07:49 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

40 posts Joined: Feb 2010 |

For all Affin bank OTC FD placement, you can choose auto credit to account upon maturity. No need to go branch to redeem it.

|

|

|

Oct 21 2021, 06:10 PM Oct 21 2021, 06:10 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

40 posts Joined: Feb 2010 |

.

This post has been edited by Joe Yuan: Oct 24 2021, 03:27 PM |

|

|

Oct 24 2021, 10:49 AM Oct 24 2021, 10:49 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

40 posts Joined: Feb 2010 |

.

This post has been edited by Joe Yuan: Oct 24 2021, 03:28 PM |

|

|

Jul 10 2022, 04:10 PM Jul 10 2022, 04:10 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(MUM @ Jul 10 2022, 12:33 PM) If i were you,.. I would just put into sspn instead of hunting or parking at the banks locking your money while waiting for opr to rise. Does SSPN refer to Skim Simpanan Pendidikan Nasional? Any specific treads in this forum discussing about it?If i am over 60 or have trustable parents who are over 60,... I would park in kwsp first before sspn. |

|

|

Jul 12 2022, 08:17 PM Jul 12 2022, 08:17 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

40 posts Joined: Feb 2010 |

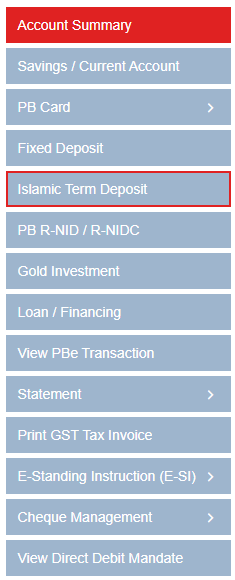

QUOTE(Junichiro Tanizaki @ Jul 12 2022, 06:34 PM) If you only have conventional FD account with PBB, you can open Islamic FD account online and enjoy the promotional rates ! Just open my Islamic eTD-i account. Conventional or islamic uder the same roof jhleo1 liked this post

|

|

|

Jul 12 2022, 10:42 PM Jul 12 2022, 10:42 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(c64 @ Jul 12 2022, 10:10 PM) I am trying to open one. Yes. I answered "No" for all 12 Q. (for >99% Malaysian, should be that way).But i don't understand these questions. 1. Are you a Non-U.S. Foreign Tax resident? Yes No 2. Do you have Non-U.S. foreign residential/mailing address (including a P.O. box address in a Non-U.S. foreign country)? Yes No 3. Do you have Non-U.S. foreign telephone number and do not have any Malaysian telephone number? Yes No 4. Do you have any standing instruction to transfer funds to account maintained in Non-U.S. foreign country? Yes No 5. Do you have any power of attorney or signatory granted to a person with an address in Non-U.S. foreign country? Yes No 6. Do you have hold mail address/in-care-of address in Non-U.S. foreign country which is the sole address? I assume it should be "No" for all, right? Also, do i need to transfer money into my savings first? Because it ask from where the money is coming from. It is not taking FPX from other banks? Not take from your saving account, click 3rd option, eTDi FPX from other bank. Only the 3rd option can enjoy 3.2% and 3.3%. If more than 30K might not be approved, depends on source bank. In that case, do multiple RM 30K. |

|

|

|

|

|

Jul 13 2022, 04:42 PM Jul 13 2022, 04:42 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

40 posts Joined: Feb 2010 |

Best in the market now: Public bank eTD Islamic 18m 3.3% via FPX only. Any other higher?

The world today is much more fragile and unpredictable than before. "BNM very much likely to announce an OPR hike again on 8 Sept 2022" is in the cloud. I prefer to opt for : Best of the CURRENT. Just my 3 cents. |

|

|

Jul 17 2022, 01:55 PM Jul 17 2022, 01:55 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(voc8888 @ Jul 15 2022, 03:42 PM) Huh ? OTC Upliftment is not possible for eFD? Learned something new! UOB, OCBC bank allows online upliftment for OTC placement. Ambank doesn't allow, but you can sent an email to the branch in concern requesting an auto credit of your FDs upon maturity, they will set up standing instructions for you. Done, u get your money on FD maturity date. Generally, i believe local banks will accept email requests, give a reason, like, covid-19. So far I only know that Online Upliftment is not allowed for OTC Placement. voc8888 liked this post

|

|

|

Sep 20 2022, 03:55 PM Sep 20 2022, 03:55 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(woowoo1 @ Sep 20 2022, 03:34 PM) Hah hah gimmick by banks. Not many people understand effective rate. Sometimes people see wah so high and they will put into this bundle. Sometimes, the bundle can be worse off then the normal fd effective rate wise. For bundles, the effective rate was stated clearly. No issue here.4.05% for 18m. Good rate. One thing I don't like about MBSB is when FD matures, you can only transfer out max 10K per day online! Have they changed this rule? This post has been edited by Joe Yuan: Sep 20 2022, 04:05 PM guy3288 liked this post

|

|

|

Sep 21 2022, 09:50 AM Sep 21 2022, 09:50 AM

Return to original view | IPv6 | Post

#17

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(dannyw @ Sep 21 2022, 09:03 AM) HLB eFD promotional rate, 21 September 2022-31 October 2022 HLB 12m, 18m come at the wrong timing. AmB 12m 3.5%, MBSB 18m 4.05%, 12m 3.9% etc all riding on it. Public Bank 18m 3.3% came at July 2022 - > smart timing.3 months 2.75% p.a 6 months 3.05% p.a 12 months 3.25% p.a 18 moths 3.50% p.a https://www.hlb.com.my/en/personal-banking/...fd-i-promo.html This post has been edited by Joe Yuan: Sep 21 2022, 10:12 AM |

|

|

Nov 10 2022, 04:31 PM Nov 10 2022, 04:31 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(AVFAN @ Nov 10 2022, 03:11 PM) it possibly implies PBB is quite sure OPR rates will go up by at least another 50bps in the near future. Looking back on July 2022, PBB is giving 3.3% for 18m, which is the highest at that time, because they are quite sure rates will go up, now proven, way beyond.affin 3.83% 18m, 3.40% 24m wud indicate they think rates will peak and then decline in 18-24 months time. current consenus is BNM will raise 25bps in Jan, Mar, then stop. assumption is USA continues to hike another 2-3 times, total 75bps: Now they are giving 4.2% 18m, IMO that is a strong indicator the "way beyond" cycle will repeat. I agreed it is best to put 6m now. Chances are good you will get ≥ 4.8% for 18m by then. This post has been edited by Joe Yuan: Nov 10 2022, 05:40 PM LoTek, lovelyuser, and 1 other liked this post

|

|

|

Nov 11 2022, 07:25 PM Nov 11 2022, 07:25 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

40 posts Joined: Feb 2010 |

|

|

|

Nov 12 2022, 01:18 PM Nov 12 2022, 01:18 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

40 posts Joined: Feb 2010 |

QUOTE(CommodoreAmiga @ Nov 12 2022, 12:53 PM) Yes, select TD-i Booster, minimum 5K. Now their online % better than OTC, starting 11 Nov 2022.Funds from your CASA, currently no FPX option. This post has been edited by Joe Yuan: Nov 12 2022, 04:15 PM CommodoreAmiga liked this post

|

| Change to: |  0.0590sec 0.0590sec

0.19 0.19

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:52 AM |