Noob here..

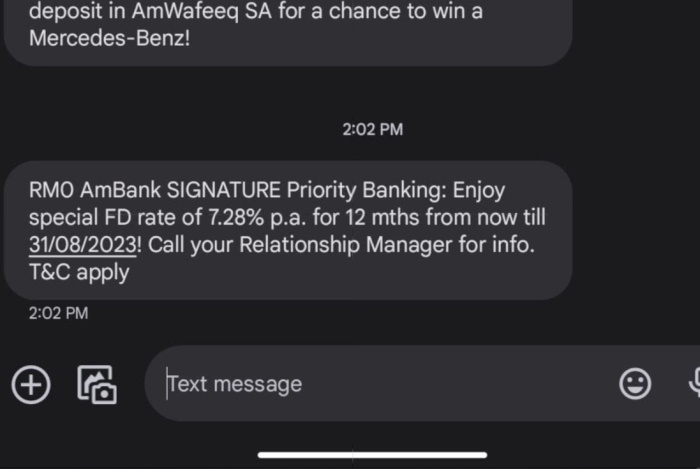

So the highest promo @ 6m FD right now seems to be from Agro Bank @ 4.1% via OTC.

What exactly is the process to open a FD account? From this thread it seems to differ by bank, with some requiring opening a savings account in tandem.

Also, what is the best way to transfer the funds? Again, from this thread there seems to be quite a few options including personal cheque, bank draft, GIRO, RENTAS etc. And all seem to have different limits and fees.

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Dec 12 2022, 11:31 PM

Dec 12 2022, 11:31 PM

Quote

Quote

0.0560sec

0.0560sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled