Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

70U63

|

Aug 1 2025, 04:24 PM Aug 1 2025, 04:24 PM

|

Getting Started

|

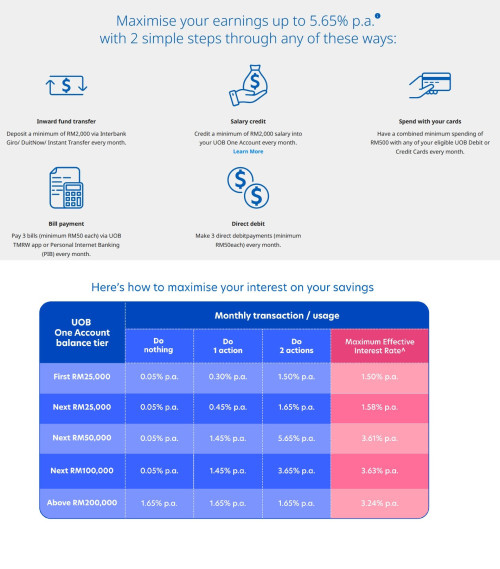

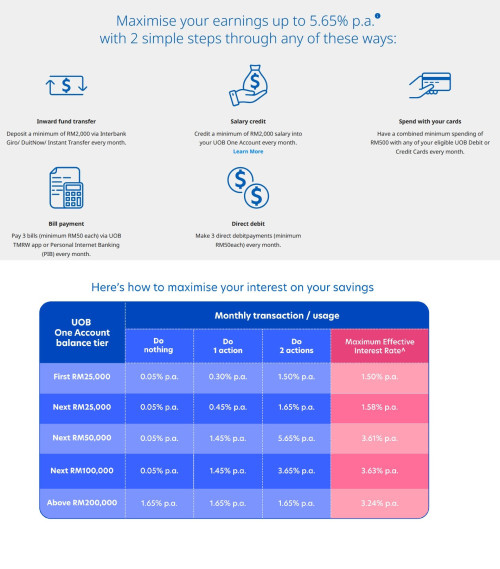

UOB FD & FD-i rate for Aug 2025

3.5% pa for 6 months

3.3% pa for 12 months

Better just keep the money in ONE account, and do '2 actions'

If put 100k, effective interest rate is 3.61%

If put 200k, effective interest rate is 3.63%

|

|

|

|

|

|

70U63

|

Aug 1 2025, 04:58 PM Aug 1 2025, 04:58 PM

|

Getting Started

|

Probably counter. Coz my relationship manager sent me one... QUOTE(ericlaiys @ Aug 1 2025, 04:51 PM) |

|

|

|

|

|

70U63

|

Yesterday, 01:30 PM Yesterday, 01:30 PM

|

Getting Started

|

% given by RM this morning for FD-i: 3.55% for 6 months, 3.4% for 12 months. Might as well keep the money in One Account (and do 2 steps to get the higher %). QUOTE(adele123 @ Dec 1 2025, 08:14 AM) So recently i did receive sms from UOB on higher FD rate for saturday banking. Want to check if anybody knows, withdrawal online is do-able after placement at branch for uob? |

|

|

|

|

|

70U63

|

Yesterday, 09:26 PM Yesterday, 09:26 PM

|

Getting Started

|

QUOTE(pattleongkam @ Dec 1 2025, 04:26 PM) Can elaborate on the two-step thingy??  |

|

|

|

|

|

70U63

|

Today, 09:47 AM Today, 09:47 AM

|

Getting Started

|

UOB revise the rate monthly (& not the highest rate in the market). Probably can refer to other banks as mentioned in the previous posts. Only good thing about UOB One Account is you can use the money whenever u want (coz bukan FD). QUOTE(adele123 @ Dec 1 2025, 10:02 PM) I dont have RM. SMS stated 3.70% for 6 months FD (TnC applies of course). i thought the rate is high enough to be worth a trip but NOT that high that it sounds like a bundle product. hence i asked here... i thought maybe just want to attract for privilege banking sign up... but actually passed already, it was for one of the weekends last month. i thought i ask for future reference. |

|

|

|

|

Aug 1 2025, 04:24 PM

Aug 1 2025, 04:24 PM

Quote

Quote

0.0536sec

0.0536sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled