QUOTE(brandonkl @ Aug 12 2025, 04:16 PM)

Promo until when ah?Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Aug 16 2025, 01:11 AM Aug 16 2025, 01:11 AM

Show posts by this member only | IPv6 | Post

#33081

|

Junior Member

700 posts Joined: Sep 2008 |

|

|

|

|

|

|

Aug 16 2025, 01:38 AM Aug 16 2025, 01:38 AM

|

Junior Member

994 posts Joined: May 2013 From: Kuala Lumpur |

|

|

|

Aug 16 2025, 04:56 PM Aug 16 2025, 04:56 PM

Show posts by this member only | IPv6 | Post

#33083

|

Junior Member

137 posts Joined: Dec 2016 From: Petaling Jaya |

|

|

|

Aug 16 2025, 06:42 PM Aug 16 2025, 06:42 PM

|

Junior Member

994 posts Joined: May 2013 From: Kuala Lumpur |

QUOTE(Billy.Who @ Aug 16 2025, 04:56 PM) The T&C and details :https://www.alrajhibank.com.my/personal/pro...-term-deposit-i |

|

|

Aug 17 2025, 07:59 AM Aug 17 2025, 07:59 AM

Show posts by this member only | IPv6 | Post

#33085

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(dudester @ Aug 7 2024, 03:29 PM) I find this to be true. Successfully deposited my Term Deposit. When adding withdrawal account, i entered my BI account. It first ask you to choose bank, then enter account manually. After that you return to your deposit details, no option to view the account and of coz you cant find where to edit. So be careful. QUOTE(ericlaiys @ Aug 8 2024, 12:18 AM) I just used contact us from their app and drop an email regarding withdraw ACC. Hi dudester & ericlaiys [update from their response] To address your query, please note the following two conditions, For customers who have Be U Qard Savings Account-i, the maximum limit per placement is RM 1,000,000 and the withdrawal will be automatically withdrawn to the customer’s QSA account upon maturity. For customers who do not have Qard Savings Account-i, the maximum limit per placement is RM 30,000 and the customer needs to set the withdrawal beneficiary account during registration. -->>> so no need worry. it auto go to QSA Sorry for quoting you for your previous post. Can I know will the profit earn for BeU term deposit will be forfeited/deducted if I uplift the term deposit on the maturity date? Is it only able to uplift the next day after the maturity date so the profit will not be forfeited/deducted. |

|

|

Aug 17 2025, 08:59 AM Aug 17 2025, 08:59 AM

|

Senior Member

7,565 posts Joined: May 2012 |

QUOTE(rocketm @ Aug 17 2025, 07:59 AM) Hi dudester & ericlaiys it will auto go to saving after maturity. you dont do anything. i realised it followSorry for quoting you for your previous post. Can I know will the profit earn for BeU term deposit will be forfeited/deducted if I uplift the term deposit on the maturity date? Is it only able to uplift the next day after the maturity date so the profit will not be forfeited/deducted. time you deposit sometimes. not early morning. |

|

|

|

|

|

Aug 17 2025, 09:13 AM Aug 17 2025, 09:13 AM

Show posts by this member only | IPv6 | Post

#33087

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(ericlaiys @ Aug 17 2025, 09:59 AM) it will auto go to saving after maturity. you dont do anything. i realised it follow I do not have BeU saving account. I have selected to transfer to other bank when the term deposit matured.time you deposit sometimes. not early morning. Do you mean if we successfully placed the term deposit on day x at 10:02pm then the principal and interest will auto credited to the bank account at 10:02pm on maturity date? |

|

|

Aug 17 2025, 11:44 AM Aug 17 2025, 11:44 AM

|

Senior Member

2,612 posts Joined: Apr 2012 |

QUOTE(rocketm @ Aug 17 2025, 09:13 AM) I do not have BeU saving account. I have selected to transfer to other bank when the term deposit matured. Can transfer to other bank ?Do you mean if we successfully placed the term deposit on day x at 10:02pm then the principal and interest will auto credited to the bank account at 10:02pm on maturity date? |

|

|

Aug 17 2025, 12:49 PM Aug 17 2025, 12:49 PM

Show posts by this member only | IPv6 | Post

#33089

|

Senior Member

7,565 posts Joined: May 2012 |

QUOTE(rocketm @ Aug 17 2025, 09:13 AM) I do not have BeU saving account. I have selected to transfer to other bank when the term deposit matured. be u qard? do not know can do fd without opening beu accountDo you mean if we successfully placed the term deposit on day x at 10:02pm then the principal and interest will auto credited to the bank account at 10:02pm on maturity date? |

|

|

Aug 17 2025, 01:12 PM Aug 17 2025, 01:12 PM

Show posts by this member only | IPv6 | Post

#33090

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(magika @ Aug 17 2025, 12:44 PM) QUOTE(ericlaiys @ Aug 17 2025, 01:49 PM) Can place term deposit in BeU without opening its saving account (U Qard). In this case, you have to key in your bank details. I just do not know whether I can uplift the term deposit that matured today. I know other bank can uplift/withdraw on the maturity day. |

|

|

Aug 17 2025, 01:13 PM Aug 17 2025, 01:13 PM

Show posts by this member only | IPv6 | Post

#33091

|

Senior Member

7,565 posts Joined: May 2012 |

QUOTE(rocketm @ Aug 17 2025, 01:12 PM) Can place term deposit in BeU without opening its saving account (U Qard). In this case, you have to key in your bank details. dont uplift. it will uplift by itselfI just do not know whether I can uplift the term deposit that matured today. I know other bank can uplift/withdraw on the maturity day. plantcloner and rocketm liked this post

|

|

|

Aug 17 2025, 01:20 PM Aug 17 2025, 01:20 PM

|

Junior Member

62 posts Joined: Jun 2023 |

QUOTE(ericlaiys @ Aug 17 2025, 01:13 PM) The same happened to mine, when the FD matured, the principal plus profit were transferred to my BeU Qaard Savings Account -i rocketm liked this post

|

|

|

Aug 17 2025, 01:24 PM Aug 17 2025, 01:24 PM

Show posts by this member only | IPv6 | Post

#33093

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

|

|

|

Aug 17 2025, 05:23 PM Aug 17 2025, 05:23 PM

|

|

Staff

72,808 posts Joined: Sep 2005 From: KUL |

|

|

|

Aug 17 2025, 07:24 PM Aug 17 2025, 07:24 PM

Show posts by this member only | IPv6 | Post

#33095

|

Junior Member

196 posts Joined: Oct 2016 |

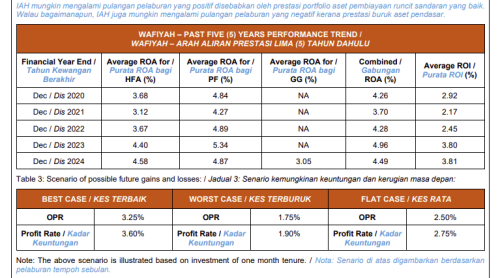

QUOTE(cybpsych @ Aug 5 2025, 11:25 AM) yes So my Bank Islam TdTI matured Thursday and I came through this also. I presume this is not a DEPOSIT product because it is NOT insured by PIDM when i read through the PDS, i tried to read around this section (not just this thread) but also found less info. My question here is, any sifu here know the past performance of this if anyone had used to place fund to this product...read the PDS related to Wafiyah Investment Account https://www.bankislam.com/personal-banking/...stment-account/ https://www.bankislam.com/wp-content/upload...fiyah-Grow-.pdf (Not protected by Perbadanan Insurans Deposit Malaysia) “Wafiyah Investment Account” or “Wafiyah” means this Unrestricted Investment Account product offered by Bank Islam based on the Shariah contract of Wakalah. |

|

|

Aug 17 2025, 07:57 PM Aug 17 2025, 07:57 PM

|

All Stars

65,294 posts Joined: Jan 2003 |

QUOTE(Ichitech @ Aug 17 2025, 07:24 PM) So my Bank Islam TdTI matured Thursday and I came through this also. I presume this is not a DEPOSIT product because it is NOT insured by PIDM when i read through the PDS, i tried to read around this section (not just this thread) but also found less info. My question here is, any sifu here know the past performance of this if anyone had used to place fund to this product... info from their pdshttps://www.bankislam.com/personal-banking/...-of-investment/ |

|

|

Aug 17 2025, 08:13 PM Aug 17 2025, 08:13 PM

Show posts by this member only | IPv6 | Post

#33097

|

Junior Member

196 posts Joined: Oct 2016 |

|

|

|

Aug 18 2025, 09:25 AM Aug 18 2025, 09:25 AM

|

All Stars

65,294 posts Joined: Jan 2003 |

QUOTE(Ichitech @ Aug 17 2025, 08:13 PM) Yes sir.. already go through that but not really understand though.. no ideaIs it we only see the bottom table ? Especially the ROI vs the Profit rate // Not sure how to intemperate this.  suggest you to talk to them directly if you really want to understand their past performance FD/TD users here usually avoid investment-type deposits Ichitech liked this post

|

|

|

Aug 18 2025, 12:00 PM Aug 18 2025, 12:00 PM

Show posts by this member only | IPv6 | Post

#33099

|

Junior Member

110 posts Joined: Aug 2020 |

QUOTE(eymc @ Aug 12 2025, 10:32 AM) just came back from bank muamalat to update my placement since last year. I did reply their sms a month ago for the offered rate 3.85 - 12months. They were waiting for me to popped by and they can recall the customers they sent the promo to. So just proceed. Not sure open to all or not or just returning customers. 3.85% is quite high now after the rate cutOtc 12 months 3.85% no more monthly profit eymc liked this post

|

|

|

Aug 18 2025, 04:21 PM Aug 18 2025, 04:21 PM

Show posts by this member only | IPv6 | Post

#33100

|

All Stars

48,447 posts Joined: Sep 2014 From: REality |

GreenSleeves

Don't need to spam the same Rybank thingy all over lowyat forum... There's dedicated topic to discuss |

| Change to: |  0.0279sec 0.0279sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:02 PM |