QUOTE(MUM @ Jul 10 2022, 12:20 PM)

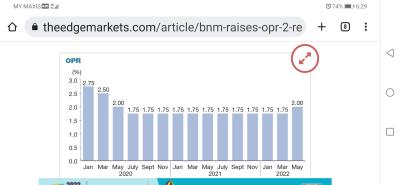

If you looked at the previous charts again,... You will notice that, even with the high opr rate, (@3.25%) the MYR vs USD is still not much improvement,..

So will rising opr rate to 3.25% this time, has significant impact to the status of MYR to usd to a point that malaysians won't be poor?

As a matter of interest,... From the attached charts, it is interesting to note that, when opr falls and stayed low ( 2020), the MYR also can rises too...

Thus you blamed bnm for making all m'sians poorer when opr was raised by 0.25 to 2.25%...

Which I think is not so "correct"....

BNM cannot just do prevention to control inflation by rising interest rate indiscrimately....

For if BNM do that, there could be serious negatives consequences that could affect the economy.

Me too are "Just discussing my view. NOT intended to quarrel"

Yes even if turkey has retirement schemes,... Is it mandatory for all private employees like malaysia?. Since they are new (official gazette 2006), how big is the fund size? does it has positive inflow?

Anyway, I think cannot compare Turkey to Malaysia and use Turkey to foretell that Malaysia will be like Turkey.

Many reasons why Turkey is having problems (which I see Malaysia does not have) *yet* 🙄

Btw, my guess which could be wrong the MYR to usd remained low could partly also be due to BNM's "Prohibiting Facilitation of NDF Related Transactions" since 2016.

Need to research the impact if interested to know in depth.

I was being sarcastic when I made the statement about BNM raising OPR by 0.25% because I was expecting 0.5% hike so that Malaysia OPR will not be lower than angmoh rate by end of July. Angmoh will very likely go to 2.5% by month's end.

We must not forget currencies are traded vis a vis other currencies. Ringgit does not exist in a vacuum. Hence, my point is that with OPR lower than angmoh rate, Ringgit will suffer. The rising Ringgit in the period you highlighted also coincided with the angmoh lowering rate till 0.75%. OPR during this period was 1.75%. Of course Ringgit will do okay.

But, over the very long term, like I said in my previous post, Ringgit has depreciated steadily and consistently since 1980s. You can double check. My own view is that politics got to do with this more persistent drop. OPR will affect only the short term fx, like 1 or 2 yrs. But, politics will affect for decades! If the cronyism and favoritism continue to swindle the country's wealth and render Malaysia less and less competitive, I don't think Ringgit will ever reverse. Malaysia needs to encourage whistleblowing and protect the whistleblower. And stop all the U-turning policies. Even simple things like in what language maths and science should be taught in also keep flip flopping. Not only make the students confused and less competitive when they go out to the workplace, also demonstrate how fickle minded the gov is, how can foreign investors be confident about owning Ringgit? Is it a wonder why it keep dropping vis a vis others? Ringgit can rise against other currencies, if that other country is even more badly managed. Why compare to the worst? Why not compare to those doing better? Stop doing things for personal gains. Think in the interest of the whole country.

Jul 10 2022, 04:15 PM

Jul 10 2022, 04:15 PM

Quote

Quote

0.0247sec

0.0247sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled