QUOTE(BoomChaCha @ Mar 16 2023, 07:17 PM)

» Click to show Spoiler - click again to hide... «

But my Am Bank branch already wrote down and stated clearly on the paper (and I needed to sign, I was not allowed to take a picture)

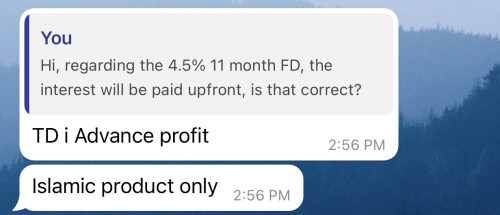

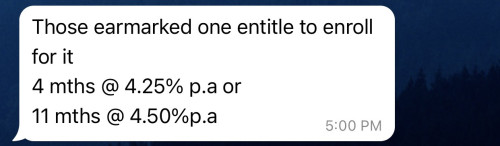

how much money will switch from saving to 4.5% FD from 3 April to 7 April.

I just noticed from online banking that AM Bank has locked the main fund that I signed and agreed to switch to 4.5% FD on 3 April.

I tried to Duit Now the earmark (parking fund) RM 10K, it looked like RM 10K was okay to ready to transfer out from my true saver.

My earmark parking RM 10K is under available balance in online banking, I think can transfer out.

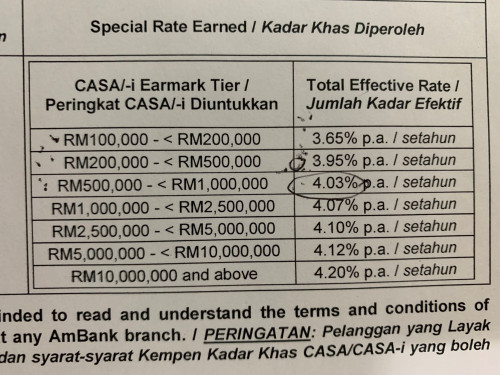

On 3rd April, you can decide how much to switch to fd, RM0 also ok, and the amount will also earn interest upto 2nd April. Yeah, i was also informed that each amount credited will follow the tier independently.

QUOTE(oldkiasu @ Mar 16 2023, 07:54 PM)

My friends and I are so old that we can simply withdraw any amount anytime online but xander has his point that it is not instant like ATM from CASA. Of course, must have open online with EPF beforehand.

If uplift FD early, of course lose all the interest at once on early withdrawal, but interest is still paid at EPF according to EPF method of calculating interest.

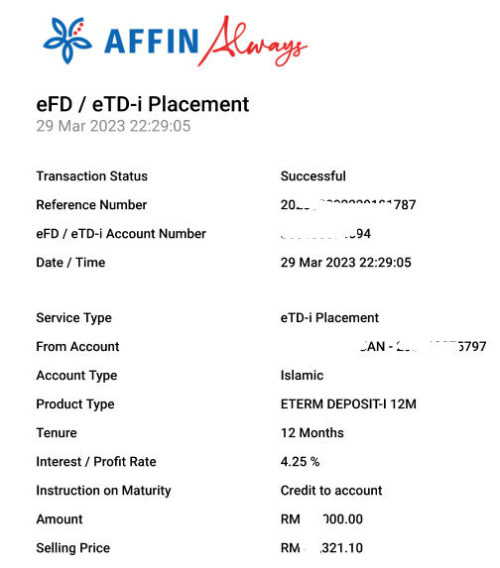

Usually put in money each year, and then get EPF to credit a set amount of money regularly monthly to buy medicine for 12 months at a time. Not so convenient to go to bank to withdraw FD, or place FD where the monthly interest paid is not stable. Too bad the eFD promo rate is not so high.

Someone mention that if perform standing instruction of monthly withdrawal, whole amount yearly is earmark without dividend. I believe i have read it many years ago too under kwsp webpage, just not sure whether its still the case now. Just need two days and withdrawal will be in bank , no need such a fuss.

This post has been edited by magika: Mar 16 2023, 11:03 PM

Jan 20 2023, 10:52 AM

Jan 20 2023, 10:52 AM

Quote

Quote

0.0536sec

0.0536sec

0.19

0.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled