QUOTE(BoomChaCha @ Aug 17 2021, 08:41 AM)

QUOTE(Human Nature @ Aug 17 2021, 10:55 AM)

thanks for pointing out.https://forum.lowyat.net/index.php?showtopi...ost&p=101976363

Ambank CASA 2.88% effective rate shd be lower than BR true 2.78%?

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Aug 17 2021, 11:25 AM Aug 17 2021, 11:25 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(BoomChaCha @ Aug 17 2021, 08:41 AM) QUOTE(Human Nature @ Aug 17 2021, 10:55 AM) thanks for pointing out.https://forum.lowyat.net/index.php?showtopi...ost&p=101976363 Ambank CASA 2.88% effective rate shd be lower than BR true 2.78%? |

|

|

|

|

|

Aug 17 2021, 11:58 AM Aug 17 2021, 11:58 AM

Show posts by this member only | IPv6 | Post

#20002

|

All Stars

26,527 posts Joined: Jan 2003 |

QUOTE(lowya @ Aug 17 2021, 11:25 AM) thanks for pointing out. Yup, I didnt do the calculation but at a glance, it will be lower.https://forum.lowyat.net/index.php?showtopi...ost&p=101976363 Ambank CASA 2.88% effective rate shd be lower than BR true 2.78%? |

|

|

Aug 17 2021, 01:26 PM Aug 17 2021, 01:26 PM

|

All Stars

65,309 posts Joined: Jan 2003 |

QUOTE(lowya @ Aug 17 2021, 11:25 AM) thanks for pointing out. the diagram already stated effective rate between 2.25%-2.52% p.ahttps://forum.lowyat.net/index.php?showtopi...ost&p=101976363 Ambank CASA 2.88% effective rate shd be lower than BR true 2.78%? the T&C also have few calculation examples |

|

|

Aug 17 2021, 07:14 PM Aug 17 2021, 07:14 PM

Show posts by this member only | IPv6 | Post

#20004

|

Senior Member

1,064 posts Joined: May 2016 |

|

|

|

Aug 17 2021, 11:23 PM Aug 17 2021, 11:23 PM

Show posts by this member only | IPv6 | Post

#20005

|

Senior Member

1,628 posts Joined: May 2013 |

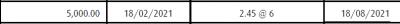

Hi all, my Hong Leong bank TIA matured today.

It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong) I deposited RM5k and received interest of RM59.50. So, my return is 1.19%. Based on your experience, does the differences between the actual rate and effective rate is acceptable? |

|

|

Aug 18 2021, 07:35 AM Aug 18 2021, 07:35 AM

|

All Stars

65,309 posts Joined: Jan 2003 |

QUOTE(rocketm @ Aug 17 2021, 11:23 PM) Hi all, my Hong Leong bank TIA matured today. try check back the placement receipt. what was the indicative rate stated?It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong) I deposited RM5k and received interest of RM59.50. So, my return is 1.19%. Based on your experience, does the differences between the actual rate and effective rate is acceptable? placement = 17 Feb 2021 maturity = 17 Aug 2021 principal amount: RM5,000 indicative rate = 2.45% p.a. tenure = 6 months profit received = RM59.50 If i straight calculate like (e)FD, expected profit = RM60.75 (less RM1.25) If i reverse calculate based on your received-profit, the indicative rate = 2.40% p.a. (less 0.05% p.a.) ---- i've placed 1 time back in Jan 2021 (matured Jul 2021), profit received is less RM0.01 (due to system), but the rate matches with my initiate placement. This post has been edited by cybpsych: Aug 18 2021, 08:20 AM |

|

|

|

|

|

Aug 18 2021, 08:34 AM Aug 18 2021, 08:34 AM

Show posts by this member only | IPv6 | Post

#20007

|

Junior Member

916 posts Joined: Sep 2016 |

QUOTE(rocketm @ Aug 17 2021, 11:23 PM) Hi all, my Hong Leong bank TIA matured today. Effective rate is 1,225%??? Why? they kept your $$ for additional 6 months for zero interest? It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong) I deposited RM5k and received interest of RM59.50. So, my return is 1.19%. Based on your experience, does the differences between the actual rate and effective rate is acceptable? |

|

|

Aug 18 2021, 09:46 AM Aug 18 2021, 09:46 AM

Show posts by this member only | IPv6 | Post

#20008

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(cybpsych @ Aug 18 2021, 07:35 AM) try check back the placement receipt. what was the indicative rate stated? this one looked reduced. probably hongleong reduced the rate. 😕placement = 17 Feb 2021 maturity = 17 Aug 2021 principal amount: RM5,000 indicative rate = 2.45% p.a. tenure = 6 months profit received = RM59.50 If i straight calculate like (e)FD, expected profit = RM60.75 (less RM1.25) If i reverse calculate based on your received-profit, the indicative rate = 2.40% p.a. (less 0.05% p.a.) ---- i've placed 1 time back in Jan 2021 (matured Jul 2021), profit received is less RM0.01 (due to system), but the rate matches with my initiate placement. |

|

|

Aug 18 2021, 09:57 AM Aug 18 2021, 09:57 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(BoomChaCha @ Aug 16 2021, 06:05 PM) Is Bank Rakyat's 18 months FD promo at 2.78% still available? https://www.bankrakyat.com.my/d/campaigns/c...0Conditions.pdfI am thinking to place this 2.78% FD tomorrow.. QUOTE A. Campaign Eligibility do u know if they accept NEW customers too for this 2.78% 18m FD? 1. This Campaign is only open to the following individual with Malaysian citizenship including Permanent Resident (PR): a) EXISTING Term Deposit-i depositors (individual, joint and trustee); b) EXISTING customers who hold or subscribe any products of Bank Rakyat. Anyone has BR relationship manager contacts to share for such clarifications? BoomChaCha cybpsych Human Nature Deal Hunter Did anyone notice this BR's strange clause: QUOTE D. General Terms and Conditions they are selling your data in as revenue for getting their FD promo and not responsible for above stated events, is this even legitimate according to PIDM? 2. Depositors/customers agree to give the exclusive right to the Bank to print and publish the names and picture for promotion purposes in newspapers, magazines, the Bank’s corporate website or any suitable channels defined by the Bank. 3. By participating in this Campaign, Depositors/customers agree to allow the Bank, subsidiaries, affiliates, licensees, directors, officers, agents, independent contractors and advertising agencies the promotional use of the customer’s name and personal details (if required) for the purpose of communication, trade promotion, overall, in any and all media now or hereafter planned, without further compensation, unless prohibited by the law. 8. DISCLAIMER: SUBJECT TO THE EXTENT PERMITTED BY LAW, THE BANK WILL NOT BE LIABLE TO ANY DEPOSITORS/CUSTOMER FOR ANY DIRECT, INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES OR EXEMPLARY DAMAGES (INCLUDING LOSS OF USE, DATA, BUSINESS OR PROFITS) ARISING FROM OR RELATING TO YOUR PARTICIPATION IN THIS CAMPAIGN, WHETHER LIABILITY SHALL ARISE FROM ANY CLAIMS BASED ON CONTRACT, WARRANTY, TORT (INCLUDING NEGLIGENCE), STRICT LIABILITY OR OTHERWISE, AND WHETHER DEPOSITORS/ CUSTOMERS HAVE BEEN ADVISED OR POSSIBILITY OF SUCH LOSS OR DAMAGE CAN OCCUR. 9. The Bank shall not be responsible for any eventuality caused by natural disasters, wars, riots, curfew, fire, flood, drought, storm, epidemic or pandemic, system failures or any circumstances beyond control of the Bank. This post has been edited by lowya: Aug 18 2021, 10:12 AM |

|

|

Aug 18 2021, 09:58 AM Aug 18 2021, 09:58 AM

Show posts by this member only | IPv6 | Post

#20010

|

All Stars

65,309 posts Joined: Jan 2003 |

QUOTE(cclim2011 @ Aug 18 2021, 09:46 AM) if not mistaken, it was a short-term cny TIA promo rocketm liked this post

|

|

|

Aug 18 2021, 11:43 AM Aug 18 2021, 11:43 AM

Show posts by this member only | IPv6 | Post

#20011

|

All Stars

26,527 posts Joined: Jan 2003 |

QUOTE(lowya @ Aug 18 2021, 09:57 AM) https://www.bankrakyat.com.my/d/campaigns/c...0Conditions.pdf They have the same clause during the promo last year too. I doubt they bother la.do u know if they accept NEW customers too for this 2.78% 18m FD? |

|

|

Aug 18 2021, 11:44 AM Aug 18 2021, 11:44 AM

Show posts by this member only | IPv6 | Post

#20012

|

Senior Member

1,701 posts Joined: Feb 2011 |

QUOTE(cybpsych @ Aug 18 2021, 09:58 AM) oh ok. could be giving out the extra later. not sure then. hope not general reduction. rocketm liked this post

|

|

|

Aug 18 2021, 11:49 AM Aug 18 2021, 11:49 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(Human Nature @ Aug 18 2021, 11:43 AM) u mean they accept new customers too for this promo?hope someone with BR contact can share. However i'm already hesitant in view of the already pathetic rate plus the funny clauses. |

|

|

|

|

|

Aug 18 2021, 11:57 AM Aug 18 2021, 11:57 AM

Show posts by this member only | IPv6 | Post

#20014

|

All Stars

65,309 posts Joined: Jan 2003 |

QUOTE(lowya @ Aug 18 2021, 11:49 AM) u mean they accept new customers too for this promo? if you really dig through all the products and services that you use, all would have similar clauses in their T&C or PDPA policies.hope someone with BR contact can share. However i'm already hesitant in view of the already pathetic rate plus the funny clauses. not just BR, or banks or fintechs, but any other products & services that you use.' in short, in order for you to use their products --- or they provide products or render services to you --- they need to use some form of your information in some capacity. if you dont agree to this at all, just dont use their products or services. they dont have reasons to use your info since you are not their customer to begin with. |

|

|

Aug 18 2021, 12:56 PM Aug 18 2021, 12:56 PM

Show posts by this member only | IPv6 | Post

#20015

|

All Stars

26,527 posts Joined: Jan 2003 |

QUOTE(lowya @ Aug 18 2021, 11:49 AM) u mean they accept new customers too for this promo? Interesting, someone posted this last year.hope someone with BR contact can share. However i'm already hesitant in view of the already pathetic rate plus the funny clauses. QUOTE(batsashimi @ Jun 16 2020, 12:09 PM) |

|

|

Aug 18 2021, 01:21 PM Aug 18 2021, 01:21 PM

|

Senior Member

4,821 posts Joined: Mar 2009 |

QUOTE(Human Nature @ Aug 18 2021, 12:56 PM) some good digging u got thereQUOTE(batsashimi @ Jun 16 2020, 12:09 PM) meh i just called, luckily didn't go straight to the branch, so to get this promo you'll have to be their existing customer for purchasing their "financing product or something", i mean seriously this thread needs to be more transparent cos recent promos just feel like bait it's shaddy.let's see if BoomChaCha manage to get it as a new customer without being tricked into getting their other "financing product or something". |

|

|

Aug 18 2021, 01:50 PM Aug 18 2021, 01:50 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(lowya @ Aug 18 2021, 01:21 PM) some good digging u got there No, I did not buy any investment product from Bank Rakyat.it's shaddy. let's see if BoomChaCha manage to get it as a new customer without being tricked into getting their other "financing product or something". I placed 11 months at 2.58% yesterday. Tomorrow, maybe I will place one more 18 months at 2.78% |

|

|

Aug 18 2021, 04:28 PM Aug 18 2021, 04:28 PM

|

Junior Member

743 posts Joined: May 2020 |

QUOTE(rocketm @ Aug 17 2021, 11:23 PM) Hi all, my Hong Leong bank TIA matured today. For HLB TIA, i always get the full indicative rate. The few placement matured last few days are giving the same profit as per indicative rate.It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong) I deposited RM5k and received interest of RM59.50. So, my return is 1.19%. Based on your experience, does the differences between the actual rate and effective rate is acceptable? So I think it might be some small rounding ? And u cannot annualise the rate like that. It doesnt make sense. This post has been edited by Kyan0411: Aug 18 2021, 04:30 PM |

|

|

Aug 18 2021, 07:36 PM Aug 18 2021, 07:36 PM

Show posts by this member only | IPv6 | Post

#20019

|

Senior Member

1,064 posts Joined: May 2016 |

QUOTE(rocketm @ Aug 17 2021, 11:23 PM) Hi all, my Hong Leong bank TIA matured today. If I remember correctly, I tried to place for this when this firecracker Chinese New Year TIA-i promo was mentioned. However, I aborted as the placement as the promo was cut short in only a few days and the rate dropped to 2.40 % instead of the advertised 2.45 % for 11 -26 Feb 2021.It is 6 months 2.45%, the effective rate is 1.225% (correct me if I am wrong) I deposited RM5k and received interest of RM59.50. So, my return is 1.19%. Based on your experience, does the differences between the actual rate and effective rate is acceptable? I believe by 17 Feb 2021, the HLIB TIA-i p0m6 rate was already down to 2.40 %. For RM 5,000, you should get exactly 5000 x 181/36500 x 2.4 = RM59.50. You will not get RM 59.51 because HL Bank is one of the banks that uses the Round Down Nearest Sen (rdns) method for rounding, compared to other banks that use Round To Nearest Sen (rtns) method. If you keep proper records and calculation, you can discover how each bank calculates profits/interests. If somehow you can prove in the receipt that it was 2.45 % at the time of placement, then you can ask the bank to correct it. You can then get 5000 x 181/36500 x 2.45 = RM 60.74 rdns and not RM 60.75 rtns as profit. There are 181 IBD from Effective Date 17 Feb 2021 to 17 Aug 2021, and HL uses 365 divisor for all years. Effective Rate is simply a rough guide and always off (wrong) because it is a simplification that does not take into account the distorting nature of calculating interest based on Interest Bearing Days (IBD). This is one of those instances where the common understanding/calculation is always 100 % wrong all the time because it is just arithmetically impossible. What you are trying to determine is not called Effective Rate which is a % per annum. It can be termed Actual, Real, Paid, Collected, Return or Yield rate on your principal (depending which math, finance book, or author you read or follow}. This post has been edited by Deal Hunter: Aug 18 2021, 07:46 PM rocketm liked this post

|

|

|

Aug 19 2021, 11:14 AM Aug 19 2021, 11:14 AM

|

Senior Member

6,428 posts Joined: Jun 2005 |

QUOTE(Deal Hunter @ Aug 18 2021, 07:36 PM) If I remember correctly, I tried to place for this when this firecracker Chinese New Year TIA-i promo was mentioned. However, I aborted as the placement as the promo was cut short in only a few days and the rate dropped to 2.40 % instead of the advertised 2.45 % for 11 -26 Feb 2021. i think i have also get "cheated" by the 2.45%, as based on my statement, i still see it shown the rate as 2.45% instead of 2.40%, it seem like my other placement on 25 Feb will only get 2.40% instead of 2.45% if what u mentioned is true..I believe by 17 Feb 2021, the HLIB TIA-i p0m6 rate was already down to 2.40 %. For RM 5,000, you should get exactly 5000 x 181/36500 x 2.4 = RM59.50. You will not get RM 59.51 because HL Bank is one of the banks that uses the Round Down Nearest Sen (rdns) method for rounding, compared to other banks that use Round To Nearest Sen (rtns) method. If you keep proper records and calculation, you can discover how each bank calculates profits/interests. If somehow you can prove in the receipt that it was 2.45 % at the time of placement, then you can ask the bank to correct it. You can then get 5000 x 181/36500 x 2.45 = RM 60.74 rdns and not RM 60.75 rtns as profit. There are 181 IBD from Effective Date 17 Feb 2021 to 17 Aug 2021, and HL uses 365 divisor for all years. Effective Rate is simply a rough guide and always off (wrong) because it is a simplification that does not take into account the distorting nature of calculating interest based on Interest Bearing Days (IBD). This is one of those instances where the common understanding/calculation is always 100 % wrong all the time because it is just arithmetically impossible. What you are trying to determine is not called Effective Rate which is a % per annum. It can be termed Actual, Real, Paid, Collected, Return or Yield rate on your principal (depending which math, finance book, or author you read or follow}.

This post has been edited by mamamia: Aug 19 2021, 11:16 AM |

| Change to: |  0.3374sec 0.3374sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 11:46 AM |