QUOTE(Human Nature @ Jul 9 2021, 10:09 AM)

bank raykat can renew FD based on whatapp? the WA is w branch manager or HR directly?

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jul 13 2021, 03:15 PM Jul 13 2021, 03:15 PM

|

Senior Member

1,192 posts Joined: Nov 2008 From: Cheras |

|

|

|

|

|

|

Jul 13 2021, 03:47 PM Jul 13 2021, 03:47 PM

|

All Stars

26,528 posts Joined: Jan 2003 |

|

|

|

Jul 13 2021, 03:51 PM Jul 13 2021, 03:51 PM

|

Senior Member

1,192 posts Joined: Nov 2008 From: Cheras |

|

|

|

Jul 13 2021, 07:11 PM Jul 13 2021, 07:11 PM

|

Junior Member

385 posts Joined: Oct 2013 |

|

|

|

Jul 13 2021, 07:12 PM Jul 13 2021, 07:12 PM

|

Junior Member

385 posts Joined: Oct 2013 |

|

|

|

Jul 13 2021, 07:24 PM Jul 13 2021, 07:24 PM

|

Newbie

9 posts Joined: Aug 2011 |

HLBank @ 13/07/21.

6 Months @ 2.3 % pa OTC. straight FD. ++++++++ |

|

|

|

|

|

Jul 14 2021, 09:04 AM Jul 14 2021, 09:04 AM

|

Junior Member

775 posts Joined: Nov 2015 |

QUOTE(Micky78 @ Jul 13 2021, 04:15 PM) The "ice cream" advertisement flyers from BR with the 2.48, 2.58, 2.78 should include the names and whatsapp numbers of the branch staff that handles this. This renewal by whatsapp works really great, much better than the priority banking of others |

|

|

Jul 14 2021, 12:30 PM Jul 14 2021, 12:30 PM

Show posts by this member only | IPv6 | Post

#19888

|

Junior Member

507 posts Joined: Jun 2015 |

Anyone knows how the FD interest is calculated for CIMB? It seemed that all FD placements in 2020 that are maturing in 2021 are getting less interest than expected. Is is because of leap year calculation? But it should not matter for 1 year FD placement right?

|

|

|

Jul 14 2021, 01:35 PM Jul 14 2021, 01:35 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(Nom-el @ Jul 14 2021, 12:30 PM) Anyone knows how the FD interest is calculated for CIMB? It seemed that all FD placements in 2020 that are maturing in 2021 are getting less interest than expected. Is is because of leap year calculation? But it should not matter for 1 year FD placement right? Should be standard FD calculation. If you can provide the start date, duration (or end date), amount and % , there are many experts here to calculate the exact amount expected for you. |

|

|

Jul 14 2021, 09:44 PM Jul 14 2021, 09:44 PM

Show posts by this member only | IPv6 | Post

#19890

|

Senior Member

1,064 posts Joined: May 2016 |

Forgot Nom-el post, see below for reply.

This post has been edited by Deal Hunter: Jul 14 2021, 09:48 PM |

|

|

Jul 14 2021, 09:46 PM Jul 14 2021, 09:46 PM

Show posts by this member only | IPv6 | Post

#19891

|

Senior Member

1,064 posts Joined: May 2016 |

QUOTE(Nom-el @ Jul 14 2021, 12:30 PM) Anyone knows how the FD interest is calculated for CIMB? It seemed that all FD placements in 2020 that are maturing in 2021 are getting less interest than expected. Is is because of leap year calculation? But it should not matter for 1 year FD placement right? Yes it probably has somehing to do with CIMB using 366 divisor for leap year, unless suspect somehow somebody inside CIMB did something!To your last point - Is the interest the same if the period is for 1 year from some date in 2020 to mature in 2021? to rephrase your "But it should not matter for 1 year FD placement right?" Despite the "common sense", mathematically and logically it is impossible. Perhaps somebody will explain why this is so and what is the problem with the common sense "should not matter". But we do not need to be a mathematician or a logician, because we can sort of "prove it" practically by running scenarios for Effective Date before 29 February 2020 and after. Whether you use 366 divisor or a mixture of 366 divisor for 2020 IBD days and 365 divisor for 2021 IBD days, you will find that it is always less than what you get from using a standard flat 365 day divisor for leap year as well. Just try it. Be practical and accurate. Don't trust your sense or what people say or think or write or believe in formulae that cannot deal with differences-especially if you do not truly understand where things actually deviate from the underlying unexplained logic and assumptions used in the formulae. Most people are not mathematicians and so do not understand that some maths only work because there are conditions to make it work especially in the area of time based calculations. This is not something abstruse, but practical. In general, the interest is - 365 divisor > 366 and 365 divisor mix > 366 divisor. So yes, probably everybody is getting less than expected - for the simple reason - do not know how to do scenarios to get the "right" answer before placement and making does not matter wrong assumptions without doing the due diligence to test assumption/correctness of self belief. The differences can be quite something, not a few sen kind of affair. And I do not have any FD at CIMB nowadays from some years back when I was a big FD customer, so I cannot say I know how they calculate things now. This post has been edited by Deal Hunter: Jul 14 2021, 10:33 PM |

|

|

Jul 15 2021, 05:30 PM Jul 15 2021, 05:30 PM

Show posts by this member only | IPv6 | Post

#19892

|

Junior Member

507 posts Joined: Jun 2015 |

QUOTE(Deal Hunter @ Jul 14 2021, 09:46 PM) Yes it probably has somehing to do with CIMB using 366 divisor for leap year, unless suspect somehow somebody inside CIMB did something! Thanks for your reply. I finally figured out how the interest was calculated after reading your post. CIMB is using a combination of 365 and 366 days for interest calculation. 366 days divisor for 2020 IBD and 365 divisor for 2021 IBD. They sum up the interest to get the final interest. I have forgotten about the cross leap year interest calculation complexity.To your last point - Is the interest the same if the period is for 1 year from some date in 2020 to mature in 2021? to rephrase your "But it should not matter for 1 year FD placement right?" Despite the "common sense", mathematically and logically it is impossible. Perhaps somebody will explain why this is so and what is the problem with the common sense "should not matter". But we do not need to be a mathematician or a logician, because we can sort of "prove it" practically by running scenarios for Effective Date before 29 February 2020 and after. Whether you use 366 divisor or a mixture of 366 divisor for 2020 IBD days and 365 divisor for 2021 IBD days, you will find that it is always less than what you get from using a standard flat 365 day divisor for leap year as well. Just try it. Be practical and accurate. Don't trust your sense or what people say or think or write or believe in formulae that cannot deal with differences-especially if you do not truly understand where things actually deviate from the underlying unexplained logic and assumptions used in the formulae. Most people are not mathematicians and so do not understand that some maths only work because there are conditions to make it work especially in the area of time based calculations. This is not something abstruse, but practical. In general, the interest is - 365 divisor > 366 and 365 divisor mix > 366 divisor. So yes, probably everybody is getting less than expected - for the simple reason - do not know how to do scenarios to get the "right" answer before placement and making does not matter wrong assumptions without doing the due diligence to test assumption/correctness of self belief. The differences can be quite something, not a few sen kind of affair. And I do not have any FD at CIMB nowadays from some years back when I was a big FD customer, so I cannot say I know how they calculate things now. This post has been edited by Nom-el: Jul 15 2021, 05:31 PM |

|

|

Jul 15 2021, 11:36 PM Jul 15 2021, 11:36 PM

|

Junior Member

800 posts Joined: Mar 2009 |

BR looks pretty interesting. Anyone have RM contact in Bangsar? Can PM me.

Plan to open FD account, will a lot of questions be asked, like B.Islam? I am afraid that they will 'interrogate' me. |

|

|

|

|

|

Jul 16 2021, 12:10 PM Jul 16 2021, 12:10 PM

|

Junior Member

771 posts Joined: Jun 2015 |

|

|

|

Jul 16 2021, 03:32 PM Jul 16 2021, 03:32 PM

|

Senior Member

1,103 posts Joined: Nov 2009 |

What is the best bank rate now for online placement ?

Maybank around 1.85% only for 12 mths |

|

|

Jul 16 2021, 05:48 PM Jul 16 2021, 05:48 PM

Show posts by this member only | IPv6 | Post

#19896

|

All Stars

65,312 posts Joined: Jan 2003 |

|

|

|

Jul 16 2021, 05:50 PM Jul 16 2021, 05:50 PM

Show posts by this member only | IPv6 | Post

#19897

|

Senior Member

1,064 posts Joined: May 2016 |

QUOTE(Left4Dead2 @ Jul 16 2021, 03:32 PM) Some improvement in the online rates as at Friday 16 July 2021.Hong Leong TIA offers p0m3 2.45 %, p0m6 2.50 %, p0m12 2.55 %. Placement from HL account on-line. No PIDM. Hong Leong conventional and Islamic promo offers thru FPX at p0m3 2.35 %, p0m6 2.40 %, p0m12 2.45 % with PIDM.. MBSB only normal board rates but can place from account online. p0m1 and p0m2 1.85 %. This already better than Maybank rate. p0m3 1.90 %, p0m6 1.95 %, p0m9 2.05 %, p0m12 2.15 %, p0m15 2.20 % with PIDM. Any more interesting online rates? OTC Bank Rakyat is still top but no PIDM. p1m8 2.48 %, p1m11 2.58 %, p1m18 2.78%. Any other competitive offers? This post has been edited by Deal Hunter: Jul 16 2021, 05:59 PM |

|

|

Jul 17 2021, 05:46 PM Jul 17 2021, 05:46 PM

|

Junior Member

233 posts Joined: Mar 2007 |

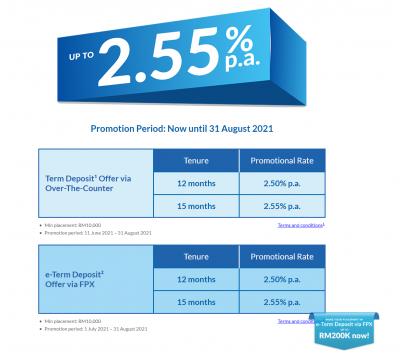

RHB promo:

https://www.rhbgroup.com/255/index.html?utm...tm_campaign=255

This post has been edited by shuin1986: Jul 17 2021, 06:35 PM |

|

|

Jul 17 2021, 06:03 PM Jul 17 2021, 06:03 PM

|

All Stars

17,502 posts Joined: Feb 2006 From: KL |

|

|

|

Jul 17 2021, 06:18 PM Jul 17 2021, 06:18 PM

|

All Stars

26,528 posts Joined: Jan 2003 |

That is from RHB

|

| Change to: |  0.0330sec 0.0330sec

0.45 0.45

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:36 PM |