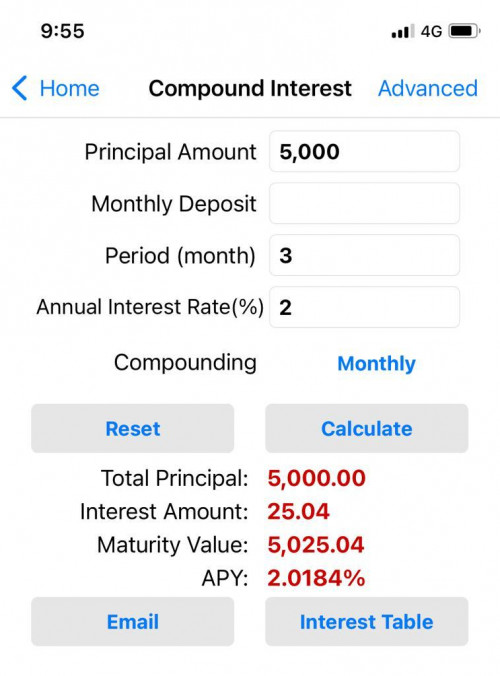

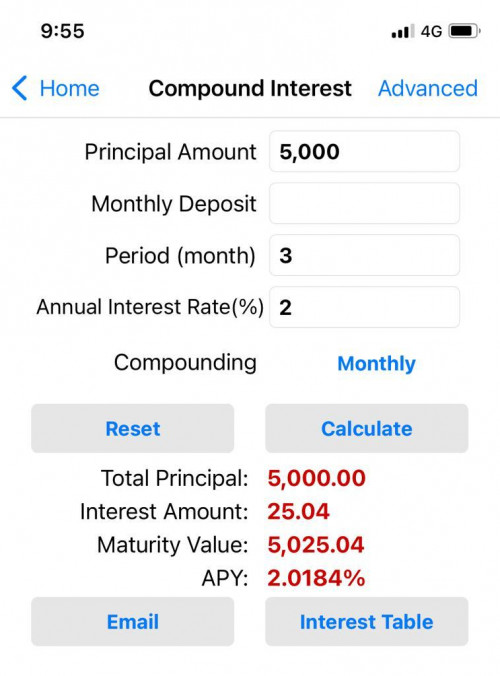

QUOTE(potenza10 @ Jul 11 2021, 09:58 PM)

Is this the correct way to calculate..5k park for 3mths with 2% p.a...

This is the sneaky way that some banks may use to give impression of a better deal to depsitors. The calculation method is known as APY and is more properly used for person who borrow loans from bank. For FD depositors and savers, the APR calculation method should be used.

https://www.investopedia.com/personal-finan...ell-difference/As explained by the others, what you actually receive is based on the number of days of the period of your FD. This Interest Bearing Days varies according to the Effective Date when you place, and how the particular bank determines the Maturity Date as a consequence. Different banks may have different ways in doing this regarding weekends, holidays and end of month placements. Rounding can either be rounded down or to the nearest sen depending on the bank.

For most depositors the differences is insignificant. Only those with bigger amounts and have a tight cashflow plan will pay serious attention and study how things actually operate at different banks to avoid problems to the plan.

To do better, it is necessary to plan/calculate in advance. But if the plan is off and calculated based on wrong ideas and multitudes of errors over time, then what do you expect? It is good to check whether something is valid and not a sloppy case of misunderstanding. Attitude of being dismissive, ignorant, tidak apa, and not getting it right can be serious matters in professional management.

This post has been edited by Deal Hunter: Jul 12 2021, 08:41 PM

Jul 9 2021, 09:19 AM

Jul 9 2021, 09:19 AM

Quote

Quote

0.0295sec

0.0295sec

0.96

0.96

6 queries

6 queries

GZIP Disabled

GZIP Disabled