So.... The billions of yuan najib pinjam from tongsan will be worthless in the long run?

![]() China blew USD 1 trillion reserve to defend Yuan, Unsustainable move ahead of CRISIS News

China blew USD 1 trillion reserve to defend Yuan, Unsustainable move ahead of CRISIS News

![]() China blew USD 1 trillion reserve to defend Yuan, Unsustainable move ahead of CRISIS News

China blew USD 1 trillion reserve to defend Yuan, Unsustainable move ahead of CRISIS News

|

|

Dec 9 2016, 10:38 AM Dec 9 2016, 10:38 AM

Show posts by this member only | IPv6 | Post

#21

|

Junior Member

24 posts Joined: Feb 2011 |

So.... The billions of yuan najib pinjam from tongsan will be worthless in the long run?

|

|

|

Dec 9 2016, 10:44 AM Dec 9 2016, 10:44 AM

|

|

VIP

9,692 posts Joined: Jan 2003 From: Mongrel Isle |

QUOTE(xenogearz88 @ Dec 9 2016, 10:38 AM) No, it is just as planned.When you see KNN Commies™ are so desperate reaching out to Africa, Pakistan, Iran and countries like Bolehland, you'd know they have shit in their pants and fire in the hole. |

|

|

Dec 9 2016, 10:44 AM Dec 9 2016, 10:44 AM

Show posts by this member only | IPv6 | Post

#23

|

Senior Member

967 posts Joined: Jan 2013 |

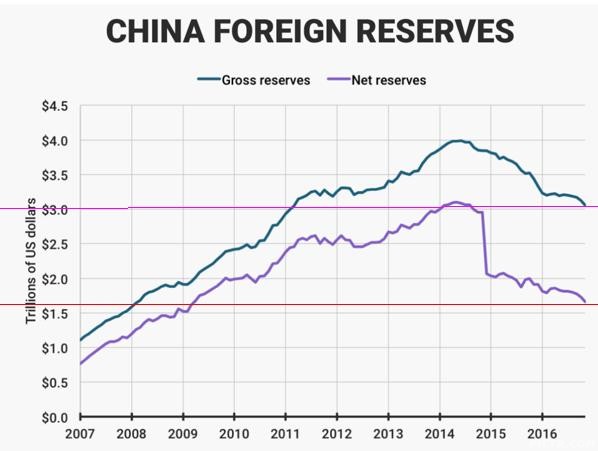

QUOTE(news channel @ Dec 8 2016, 09:01 PM)  China Just Blew Through A Quarter Of Its Foreign Currency Reserves We seem to have yet again an acceleration in the outflow of Chinese capital, putting huge pressure on the yuan, the forex reserves, as well as the authorities. These reserves decreased in November by a whopping $69.1 billion, to $3.05 trillion. This is down a whopping $1 trillion from its peak in 2014. Up to half of the November decline could have been the result of the rise of the dollar, which reduces the value of the non-dollar forex reserves, and capital losses on fixed income instruments. The picture is even worse if one considers net reserves (gross reserves minus foreign debt) which now stand at just $1.7 trillion. They spend these reserves on defending the yuan, which has kept on sliding lower nevertheless. The losses are even more remarkable given China's still sizable current account surplus. Somebody should tell the incoming US government, because President elect Trump was tweeting against China's currency policy only a few days ago. There is actually additional pressure from the rising dollar, anticipating Fed interest rate hikes and a reflationary policy package of the incoming US government. China fixes its currency to a basket of 13 trade-weighted currencies, and the rising dollar means that the yuan gradually depreciates against the US dollar automatically when the dollar rises against these other currencies (like euro, yen, Swiss frank, a couple of Asian currencies like the Hong Kong dollar, the Thai baht, etc.). Read more: http://seekingalpha.com/article/4029095-ch...rrency-reserves |

|

|

Dec 17 2016, 09:24 AM Dec 17 2016, 09:24 AM

|

Newbie

0 posts Joined: Jul 2016 |

|

|

|

Dec 17 2016, 09:47 AM Dec 17 2016, 09:47 AM

|

Junior Member

86 posts Joined: Jan 2005 |

|

| Bump Topic Add ReplyOptions New Topic |

| Change to: |  0.0168sec 0.0168sec

0.50 0.50

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:41 AM |