QUOTE(1234_4321 @ Jan 20 2023, 12:19 PM)

Temporarily rally again 🤦♀️ Let’s see whether sustain to 4.20 as it is the lower band

RM this year will be very difficult to breach 4.20 and should be around range 4.24 to 4.38 for 2023

USD/MYR v5

|

|

Jan 20 2023, 04:56 PM Jan 20 2023, 04:56 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jan 22 2023, 02:38 PM Jan 22 2023, 02:38 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(Cubalagi @ Jan 22 2023, 12:11 PM) Stronger no, steadier yes. The basket itself will consists mostly Asian currencies with at least 10% of it is in USD Steadier because MAS will intervene in SGD based a valuation of a basket of currencies. This basket is secret but should consist of the currency of SG major trading partners USD, RMB, MYR etc. The secret is lies in the band value itself which NEER is consists and what is upper and lower band for the policy to be in place |

|

|

Jul 12 2023, 05:24 PM Jul 12 2023, 05:24 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

4,665 posts Joined: Jan 2003 |

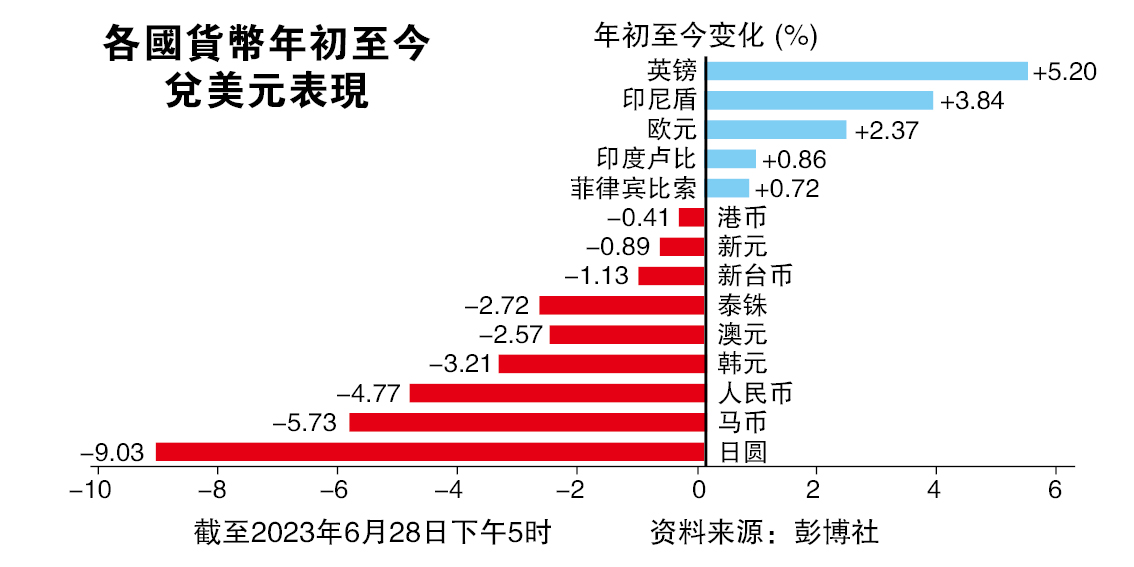

QUOTE(TOS @ Jun 28 2023, 08:32 PM) https://www.sinchew.com.my/20230628/%e7%bb%...96%b2%e6%80%81/ Don’t forget that if they use 1.5billion each time to defend the currency 🤦♀️ it can hold them off within 2 years with every week defensive mechanism to deplete it 🤦♀️ Interesting statistics. MYR FX market daily trading volume is about 15 billion USD. Malaysia FX reserves amounts to 115 billion USD. If BNM really wants to play hard, our foreign reserve may evaporate in days. |

|

|

Oct 19 2023, 05:05 PM Oct 19 2023, 05:05 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(TOS @ Oct 19 2023, 02:07 PM) Not suprising 🤦♀️ 4.80 anytime this year QUOTE(Hansel @ Oct 19 2023, 03:03 PM) Soon,... must impose capital controls already, bros,... Otherwise,... our Ringgit is done ! It'll be too late ! Imposed what capital control 🤦♀️ the problem is stagnating economy and foreign capital is not flowing as much what PMX thinking 🤦♀️ pegging would spell disaster because the reserves to fund it will deplete quickly in a few months |

|

|

Oct 20 2023, 11:49 AM Oct 20 2023, 11:49 AM

Return to original view | IPv6 | Post

#5

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Oct 20 2023, 05:44 PM Oct 20 2023, 05:44 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Oct 20 2023, 12:31 PM) bnm imposed partial capital control a few times in the last decade. those not in foreign trade or business has no idea. Only for reporting but not full scale capital control 🤦♀️ mostly only affecting those certain sectors for import and export businessWhat he is implied is a full scale capital control including fixing the currency rate like what CCP is doing since day 1 |

|

|

|

|

|

Oct 22 2023, 06:09 PM Oct 22 2023, 06:09 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(silverwave @ Oct 21 2023, 10:45 AM) Where do most of you store your money now since RM is so weak? Store where you think you will gain more but not holding too much cash 🤦♀️ and hold currency that will gain while generating income I was thinking of moving some to SG or hold in IBKR. QUOTE(Cubalagi @ Oct 22 2023, 10:36 AM) Possible 🤦♀️ but unlikely until Fed start cutting rates silverwave liked this post

|

|

|

Oct 22 2023, 06:11 PM Oct 22 2023, 06:11 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Oct 20 2023, 11:16 PM) For certain you were not in banking or foreign trade. During bn administration, foreign proceeds was compulsory converted to RM for some time to build up depleted foreign reserve. That was only after late 90s 🤦♀️ but before that it was in pounds until the stupid Governor lost money by playing FX during the 80s while free floating RM |

|

|

Oct 22 2023, 06:26 PM Oct 22 2023, 06:26 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Oct 22 2023, 06:20 PM) Bnm and mamak thought they were smart, didn't realize bankers in London and NYC were smarter, beat them in the trade. A reason why they hate the west until today. Thanks to this bunch of idiots 🤦♀️ yet playing the blame game on the dead https://www.nst.com.my/amp/news/nation/2017...t-rm4b-annually |

|

|

Oct 22 2023, 08:46 PM Oct 22 2023, 08:46 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Oct 22 2023, 10:43 PM Oct 22 2023, 10:43 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Oct 22 2023, 10:03 PM) Given pmx support on hamas; many mnc, fdi and ff are likely to stay away, would lack catalyst for rm to rebound. For sure especially those so called latest investment 🤦♀️ look at the past 10 years when a lot MNCs especially in the semiconductor have move out from Malaysia prior to the war due govt flip flop in policies as well |

|

|

Oct 24 2023, 06:55 AM Oct 24 2023, 06:55 AM

Return to original view | IPv6 | Post

#12

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(evangelion @ Oct 23 2023, 10:09 PM) I might be wrong, but I sense higher myr interest rate really might be on the cards this time round…… It won’t happen 🤦♀️ as I did mention before that OPR has to be at least 3.5 withstand the current shock but yet the useless BNM have no guts to raise it and stand pat due to slow domestic economy and pressure from PMX 🤦♀️QUOTE(icemanfx @ Oct 24 2023, 05:20 AM) Bnm foreign reserve supposed to increase with current account surplus. How much bnm foreign reserve has improved in the last few years? Stagnant for the past few years since the time of PM8 until now 🤦♀️ at around rm110 billion range and the worse part it used to able to cover 6months of import trade and now it is at 5.1 months so you can calculate that is worse off by 15% depreciation hence the currency should be depreciated at that range from low of 4.27 during Feb 🤦♀️ and it will hit 5 by Xmas this yearIf pmx is willing to compromise the national interest for hamas, how do you expect the market to react? RM will soon be worse off than AFC time. |

|

|

Oct 24 2023, 01:00 PM Oct 24 2023, 01:00 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(batman1172 @ Oct 24 2023, 09:05 AM) I wouldn’t listen to this mamak 🤦♀️ as he has no idea on monetary policy and just follow the orders QUOTE(Ramjade @ Oct 24 2023, 09:18 AM) And they love use the word no crisis of confidence 🤦♀️ but when the fact it is because even Indonesia central bank admitted earlier today while months back they have raise rates to 6% to stem their currency depreciation while our joker mamak 🤦♀️ says nothing to see no action needed while falling QUOTE(CommodoreAmiga @ Oct 24 2023, 10:10 AM) Imagine if BNM Gov say: Smart move 👏 you will be happy by CNY in your gainsOk peeps, we are screwed. I have no control of RM. Packing my bags to Singapore tonight. Already asked wife to convert alll RM to USD and SGD. See Ya! |

|

|

|

|

|

Oct 25 2023, 06:34 PM Oct 25 2023, 06:34 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Oct 25 2023, 06:59 PM Oct 25 2023, 06:59 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(tifosi @ Oct 25 2023, 06:51 PM) It'll continue to go south. You need an intervention to prevent the run but there's nothing we are doing to stop it. Their approach is let's see how low it will go. Their approach is basically TNA 🤦♀️ and just boost domestic economy Capital control will be even worse if they implement it because in their mind cheaper RM is beneficial to those in power 🤦♀️ by giving scribbles |

|

|

Nov 2 2023, 05:07 PM Nov 2 2023, 05:07 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Nov 2 2023, 05:43 PM Nov 2 2023, 05:43 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(abcn1n @ Nov 2 2023, 05:19 PM) Don't think they will rate hike anymore this year. During war, rates usually are kept low from what I read. So although Fed rates are not low at the moment, they unlikely will raise it. It is not a war by US in the 1st place 🤦♀️ Fed will hike if tomorrow jobs data if unemployment goes down and the upcoming Core CPI if it goes up 🤦♀️ so there is 2 more readings before next meeting which can turn tables and they will hike if necessary |

|

|

Nov 4 2023, 02:44 PM Nov 4 2023, 02:44 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(abcn1n @ Nov 2 2023, 06:04 PM) Fed already said not hiking rate on Wednesday. Already guessed correctly the last 2 times, rates will not hike and have been right. December at this moment I don't think they will hike either but its a bit too early to tell right now Said only 🤦♀️ but if Core CPI goes up in the next reading the hike will come and like you said too early to tell QUOTE(Hansel @ Nov 2 2023, 08:41 PM) Yes but the word possibility is there a lot |

|

|

Nov 8 2023, 12:27 PM Nov 8 2023, 12:27 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,665 posts Joined: Jan 2003 |

|

|

|

Nov 15 2023, 07:15 PM Nov 15 2023, 07:15 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,665 posts Joined: Jan 2003 |

QUOTE(joeblow @ Nov 14 2023, 08:45 PM) Today I want to change my ringgit (BIG AMOUNT) to SGD then move to IBKR. I look at the rates, I am SO ANGRY! Not the last 5 years but in span of 9 months 🤦♀️ when in Feb it was high 4.2 and now we are moving around 4.7 range which 12% in 3 quarters only 🤦♀️To make matter worse, all the bankers I talk to say they don't know if ringgit will continue to poop. Considering US either maintains the rate longer than expected or might even raise one more time, our govt still think they can do option 2... Dedollarize... Come on man. This is a joke. So painful to convert. In 3 months time our ringgit depreciated almost 3% vs SGD USD and last 5 years over 12%... and to make matter worse no one from the BNM side can tell us what's the fair rate we should have vs USD. With the middle east situation, I fear our ringgit will poop more. Need to start moving out the ringgits but so painful to do so.... even Vietnam dong strengthened so much against us... Joke! |

| Change to: |  0.1262sec 0.1262sec

0.32 0.32

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 10:28 PM |