QUOTE(AVFAN @ Mar 6 2017, 05:18 PM)

this report, analysis is good, very sound.

"MYR might strengthen against SGD"... i read it saying MAS might recalibrate their band and slope to keep the SGD from rising in tandem with USD, i.e. it needs to balance with the SGD with RM and RMB which are major trading partners. now, that has been speculated, rumured since >1 year ago. yet, month after month, it strengthens against the RM.

last couple of days, SGD declined against RM. i see this as not due to MAS/SGD but that the USD regaining strength from $ index 99.6100 to 102 to 101.4 today as the fed gets hawkish. The RM has been crawl pegged to the USD (at 4.45) with BNM intervention which explains why it gained against SGD.

for the near future, i do not see MAS/SGD doing anything unusual. and i quite certain the fed will hike rates by 25bps on mar 15 (mar 16 here).

where the RM goes will depend how much more BNM wants to intervene with FX reserves to keep up with USD.

my bet is after fed hike rates, it will let go and let it slip but not higher than 4.50.

SGD will be closer to 3.20.

just what i think... let's see, shall we?

SGD has always been tightly controlled by MAS. MAS has adopted the strategy of currency control as a tool to stabilize the economy, where other country mostly use interest rate as a tool. Because SG does not use interest rate as a tool, the interest rate has been mostly flat. Sg is the only country in the world to use currency control as a monetary policy.

Current MAS position is 'neutral' against a basket of currency. The composition of the basket is secret but it is speculated to include most of it;s major trading partners which includes mostly RMB and USD..

Why MAS use currency control instead of interest rate? It is maybe because of cash horde of foreign currency it is holding, its positive current account balance and surplus budget. No other country can match the financial powers of small Singapore which is why it is rated at AAA. (Super safe)

In comparison USA is rated AA+, EU is rated AA and Malaysia is only rated A-

As long as MAS maintain neutral or positive position, your SGD buying power is mostly guaranteed. Unless MAS change to negative, then only you need to worry. MAS revise the policy every April and October.

QUOTE

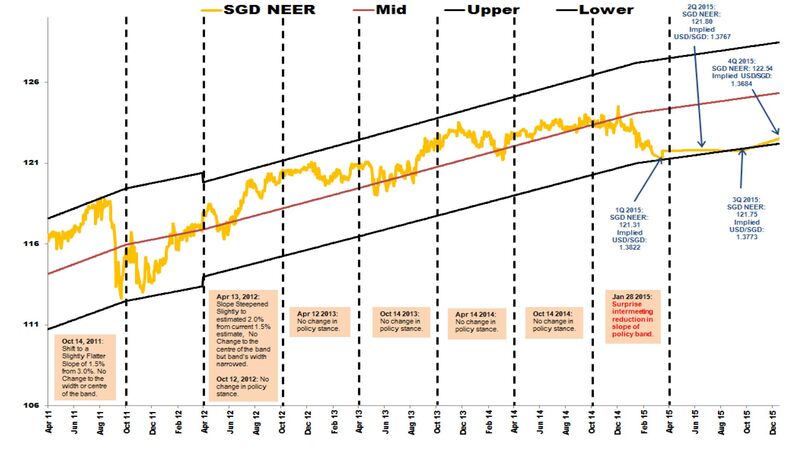

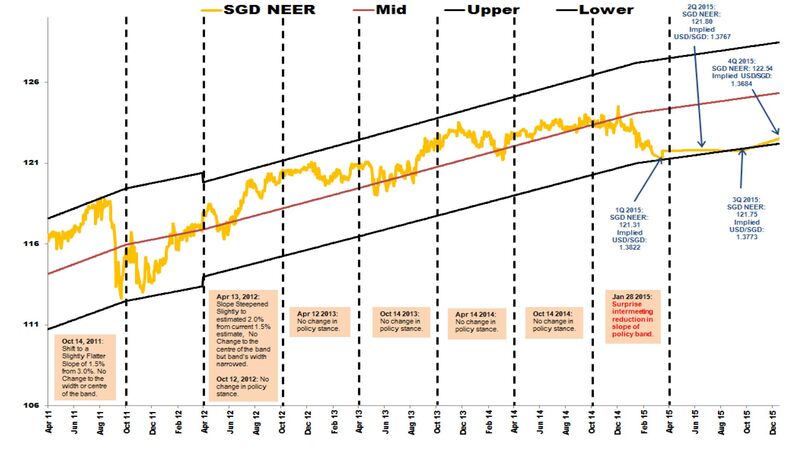

Since October 2012, MAS' broad policy stance has been of a "modest and gradual appreciation" of the Singdollar. But on Jan 28 2015, it made an unscheduled move to ease monetary policy, the first since July 2005, after Singapore's economic growth sagged in 2014 to its weakest in five years. MAS reduced the slope of its policy band, in effect slowing the pace of the Singdollar's gains versus the currencies of its main trading partners.

So SGD strength over the many many years is not by chance, but is tightly controlled by MAS. Below is the estimated SGD NEER chart, last policy in changed 2015 has left unchanged until now.

This post has been edited by gark: Mar 6 2017, 05:42 PM

This post has been edited by gark: Mar 6 2017, 05:42 PM

Mar 5 2017, 10:17 PM

Mar 5 2017, 10:17 PM

Quote

Quote

0.5857sec

0.5857sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled