by

Michael Heath

December 6, 2016 — 7:40 PM EST Updated on December 6, 2016 — 11:55 PM EST

➞

Economy suffers only fourth quarterly slump in past 25 years

➞

Most observers see growth rebound from rising resource exports

While Australia’s economy shrunk last quarter, it’s probably more of a red flag than a precursor to recession.

One of only four quarterly contractions in the past 25 years, the so-called ‘lucky country’ is unlikely to suffer a second consecutive slump -- just as in those prior periods. But it’s a wake-up call for lawmakers that recent political timidity and gridlock is unsustainable, as is reliance on monetary policy to support growth with a 1.5 percent interest rate that may not even fall further.

A growing chorus of high-profile economists and international institutions are calling on Australia to follow U.K. and U.S. plans to use infrastructure stimulus, particularly with global borrowing costs so low. But the government has made clear its priority is returning the budget to balance as it seeks to protect a prized AAA credit rating.

Wednesday’s report showed:

•Gross domestic product fell 0.5% from previous quarter, when it gained a revised 0.6%

•Decline was driven by slump in construction and government spending

•Result was worst since depths of global financial crisis at the end of 2008 and well below economists’ estimates of a 0.1% drop

•The economy grew 1.8% from a year earlier, compared with a forecast 2.2% gain

•Australian dollar fell almost half a U.S. cent on the data

Annette Beacher, head of Asia-Pacific research at TD Securities Ltd. in Singapore, summed up the general consensus among economists to the contraction.

“We’re still confident that this is just a perfect storm of negatives and we shouldn’t be talking about technical recessions -- we should be talking about what rebound we can expect for the fourth quarter,” she said. “It just seemed like an unexpected confluence of negatives that all happened to be concentrated in one quarter.”

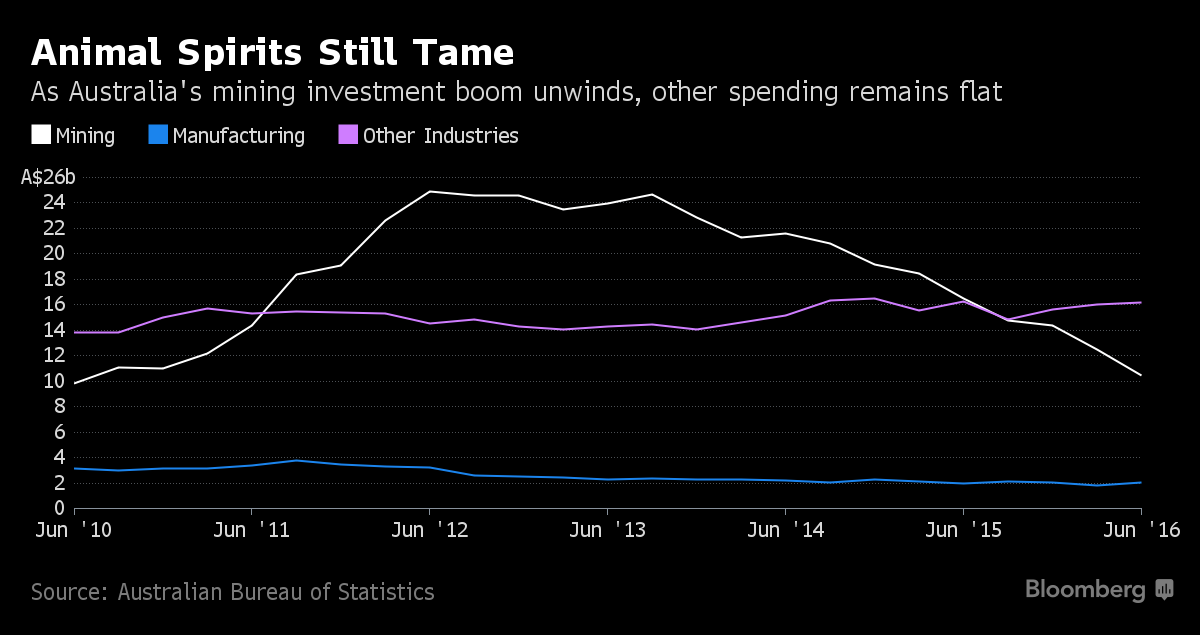

But while growth will probably resume given resource export volumes have further to rise, this requires little labor. Meanwhile, a residential building boom that’s employed many ex-miners is forecast by some economists to peak next year, removing a driver of growth and employment. Balancing that is an unwinding of mining investment, which is forecast to soon stop acting as a drag on growth.

What the economy urgently needs is business investment outside mining, which has failed to emerge despite the best efforts of the Reserve Bank of Australia to talk up the economy and via rate cuts. While the government is betting a proposed cut in corporate tax will encourage firms to spend and hire, opposition parties are blocking the passage of the legislation. Outside of this, there’s little on Prime Minister Malcolm Turnbull’s agenda.

One region where business investment has been strong is New South Wales, running at 10 percent per annum for the past three years. Coincidentally, that’s the only Australian state undertaking meaningful infrastructure investment.

“Effective public investments can boost GDP over the long term by creating demand, boosting business confidence, lifting growth and ultimately reducing, not increasing, the debt-to-GDP ratio over time,” said Andrew Charlton, director of consultancy AlphaBeta in Sydney. “Australia needs a short term plan to increase spending on infrastructure and other productive public assets, especially while interest rates are so low, and a medium term plan to reign in recurrent spending over time.”

His views echo those put forward by the International Monetary Fund and the Organization for Economic Cooperation and Development.

Other Details

Wednesday’s GDP report showed that government spending and resource exports failed to lift growth as they did in the previous two quarters. The slowdown from an annual 3.1 percent rate in the second quarter was dramatic, particularly when the Treasury estimates the economy’s potential at 2.75 percent and central bank forecasts match or exceed that level.

The data also showed:

•Private investment in new buildings cut 0.3 percentage point from GDP

•New engineering and new and used dwellings shaved 0.2 and 0.1 percentage points respectively

•The household savings ratio fell to 6.3% from a revised 6.7%, which helped support household spending

•The terms of trade, a gauge of export prices relative to import prices, jumped 4.5%

•Household spending rose 0.4% and added 0.3 point

Dec 7 2016, 02:11 PM

Dec 7 2016, 02:11 PM

Quote

Quote

0.0516sec

0.0516sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled