A Shariah-compliant investment account based on the contract of Mudarabah (profit sharing)

Minimum investment:

RM5,000 (1 month)

RM1,000 (2 months and above)

* Not covered by PIDM. Principal is not guaranteed

More info : Maybank eGIA-i

Layman explanation : This is an islamic investment instrument that practically function in between of SA and FD.

Eligibility:

i) Malaysian (irrespective of race/religion/gender)

ii) Maybank2u online account

iii) At least RM 1,000.00

Steps to open new/place subsequent:

i) Log in to Maybank2u -> Accounts & Banking -> Fixed Deposits & Mudarabah IA

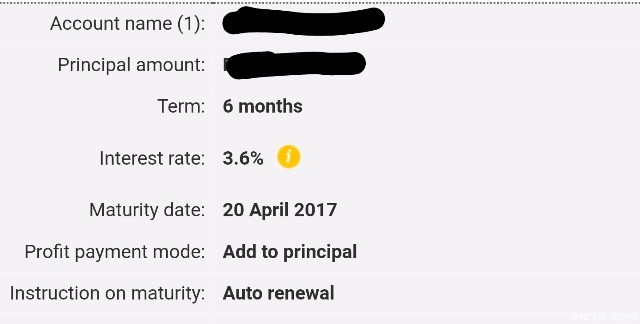

ii) Make a placement -> Product type select General Investment Account (GIA-i)

(Only for frist placement, fill in the questionaire, and proceed)

iii) Select your preferred tenure (practically doesn't matter except 1 month vs other months, explain later)

iv) Enter your principal amount and other options, then click Continue

v) Verify information and click Confirm

Step to uplift eGIA-i:

similar to how you uplift eFD.

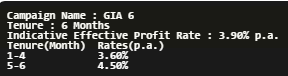

Historical Profit Rate:

1st July 2015 - 15th April 2016 : 4.00% p.a.

16th April 2016 - 15th May 2016 : 4.00% p.a.

16th May 2016 - 15th June 2016 : 4.00% p.a.

16th June 2016 - 15th July 2016 : 4.00% p.a.

16th July 2016 - 15th August 2016 : 3.75% p.a.

16th August 2016 - 15th September 2016 : 3.58% p.a.

16th September 2016 - 15th October 2016 : 3.60% p.a.

16th October 2016 - 15th November 2016 : 3.60% p.a.

16th November 2016 - 15th December 2016 : 3.55% p.a.

16th December 2016 - 15th January 2017 : 3.55% p.a.

16th January 2017 - 15th February 2017 : 3.50% p.a.

16th February 2017 - 15th March 2017 : 3.50% p.a.

16th March 2017 - 15th April 2017 : 3.45% p.a.

16th April 2017 - 15th May 2017 :

Note : Profit Sharing Ratio (PSR) in the page is just FYI on how the profit was shared between the bank and you as part of the islamic Mudarabah concept.

Note 2 : Layman wise, you are entitled to the profit rate quoted without any extra calculation

Pros:

i) Profit calculated daily, flat profit rate for the whole balance, no tiered and hidden condition

ii) Irregardless of placed tenure, you will get back principal + profit for the amount days placed even if you uplift prematurely, provides high flexibility and liquidity.

iii) Higher profit rate compared to saving accounts and board FD.

iv) Similar to eFD, you can place multiple certificates, each with different amount and tenure to suit your purposes

Cons:

i) Once you placed, you cannot uplift on the day itself, can only uplift the next day onwards

ii) Similar to eFD, you can only place and uplift from 6am to 10pm, daily including weekends and public holiday

iii) No PIDM protection.

iv) Influenced by OPR, in the event of profit rate changes, you will entitled the profit rate according to the duration of your placement (refer to historical profit rate)

eGIA-i Review by others:

i) GenX GenY GenZ - Earn More FREE Money with Maybank Mudarabah Islamic Accounts versus Savings Accounts

ii) Stretch Your Ringgit - Maybank General Investment Account-i (GIA-i)

iii) Personal Loan Malaysia - Maybank GIA (General Investment Account) review

iv) Dividend Magic - Where to park your money? Maybank GIA-i

This post has been edited by AIYH: Apr 20 2017, 10:52 PM

Nov 8 2016, 02:01 PM, updated 9y ago

Nov 8 2016, 02:01 PM, updated 9y ago

Quote

Quote

0.2356sec

0.2356sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled