QUOTE(drbone @ Feb 16 2017, 10:43 PM)

Yeah, it's clearly written however I find it weird that they do not show it clearly in m2u, only when one clicks on the information icon.

Please guide more clearly on m2u where to check the rates.TQ

Maybank eGIA-i 3.45% p.a., Rojak of SA + FD + MMF

|

|

Feb 17 2017, 02:25 PM Feb 17 2017, 02:25 PM

|

Senior Member

1,216 posts Joined: Mar 2009 From: Cut Throat Land |

|

|

|

|

|

|

Feb 17 2017, 03:45 PM Feb 17 2017, 03:45 PM

|

|

Staff

72,815 posts Joined: Sep 2005 From: KUL |

|

|

|

Feb 17 2017, 04:43 PM Feb 17 2017, 04:43 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Feb 17 2017, 05:20 PM Feb 17 2017, 05:20 PM

|

Senior Member

1,757 posts Joined: May 2011 |

|

|

|

Feb 17 2017, 06:11 PM Feb 17 2017, 06:11 PM

|

Senior Member

1,216 posts Joined: Mar 2009 From: Cut Throat Land |

|

|

|

Feb 17 2017, 06:23 PM Feb 17 2017, 06:23 PM

|

Junior Member

59 posts Joined: Jun 2015 |

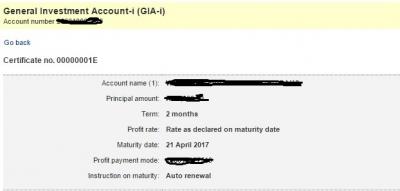

Dividen rate will be declared on maturity date?

😲 |

|

|

|

|

|

Feb 17 2017, 06:25 PM Feb 17 2017, 06:25 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Feb 17 2017, 06:39 PM Feb 17 2017, 06:39 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

QUOTE(fruitie @ Feb 17 2017, 03:45 PM) I just want to know the latest rate. Last month was 3.5% as what I have seen in GIA-i page on Maybank2U. It should have a new rate recently. QUOTE(duckaton @ Feb 17 2017, 06:11 PM) Can check from here. Latest rate is 3.5% |

|

|

Feb 17 2017, 08:14 PM Feb 17 2017, 08:14 PM

|

|

Staff

72,815 posts Joined: Sep 2005 From: KUL |

QUOTE(AIYH @ Feb 17 2017, 04:43 PM) Oh.. My Quick Balance already blocked because forgot password. Thanks by the way. QUOTE(ohcipala @ Feb 17 2017, 06:39 PM) OK, just updated then. This afternoon was still old rate. No changes. |

|

|

Feb 17 2017, 09:31 PM Feb 17 2017, 09:31 PM

|

Senior Member

1,757 posts Joined: May 2011 |

Luckily it's still at the old rate

This post has been edited by drbone: Feb 17 2017, 09:31 PM |

|

|

Feb 17 2017, 10:25 PM Feb 17 2017, 10:25 PM

|

All Stars

65,307 posts Joined: Jan 2003 |

|

|

|

Feb 20 2017, 08:06 PM Feb 20 2017, 08:06 PM

Show posts by this member only | IPv6 | Post

#552

|

Senior Member

970 posts Joined: Jul 2016 |

so it is still 3.5%, still not bad compared to other FD

|

|

|

Feb 21 2017, 08:52 AM Feb 21 2017, 08:52 AM

|

Senior Member

2,650 posts Joined: Feb 2009 |

guys

i just dont understand what does it mean by Profit Sharing Ratio (PSR) Investor / Bank 70 / 30 what does it mean? and another thing, which one did u choose? a) Mudarabah Investment Account b) Islamic Deposit Account: let say if i click "dont want to open investment account", is my transaction will be cancel? i afraid later maybank create another one additional unnecessary account for me This post has been edited by suadrif: Feb 21 2017, 08:59 AM |

|

|

|

|

|

Feb 21 2017, 09:09 AM Feb 21 2017, 09:09 AM

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(suadrif @ Feb 21 2017, 08:52 AM) guys PSR is basically how much you get. The 3.5% is = 70% portion. Bank get 30%.i just dont understand what does it mean by Profit Sharing Ratio (PSR) Investor / Bank 70 / 30 what does it mean? and another thing, which one did u choose? a) Mudarabah Investment Account b) Islamic Deposit Account: let say if i click "dont want to open investment account", is my transaction will be cancel? i afraid later maybank create another one additional unnecessary account for me Don't know why you don't get the General investment account -i. |

|

|

Feb 21 2017, 09:39 AM Feb 21 2017, 09:39 AM

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(suadrif @ Feb 21 2017, 08:52 AM) guys a) Mudarabah Investment Accounti just dont understand what does it mean by Profit Sharing Ratio (PSR) Investor / Bank 70 / 30 what does it mean? and another thing, which one did u choose? a) Mudarabah Investment Account b) Islamic Deposit Account: let say if i click "dont want to open investment account", is my transaction will be cancel? i afraid later maybank create another one additional unnecessary account for me |

|

|

Feb 21 2017, 01:41 PM Feb 21 2017, 01:41 PM

|

Senior Member

2,650 posts Joined: Feb 2009 |

QUOTE(Ramjade @ Feb 21 2017, 09:09 AM) PSR is basically how much you get. The 3.5% is = 70% portion. Bank get 30%. actually it didDon't know why you don't get the General investment account -i. after i clicked General Investment Account-i, it refers me to a questionnaire page. in that page, i was asked to choose preference which is A and B (mudarabah & islamic) |

|

|

Feb 21 2017, 01:42 PM Feb 21 2017, 01:42 PM

|

Senior Member

2,650 posts Joined: Feb 2009 |

|

|

|

Feb 21 2017, 01:46 PM Feb 21 2017, 01:46 PM

|

All Stars

65,307 posts Joined: Jan 2003 |

QUOTE(suadrif @ Feb 21 2017, 01:42 PM) and then agree to open Mudarabah Investment Account? technically it's a virtual account for each type of efd/gia placement.this doesn't lead to any additional account right? or is it Mudarabah actually referring to GIA itself? Islamic one account, gia one account, conventional one account. gia is a general product name for mudarabah. |

|

|

Feb 21 2017, 01:55 PM Feb 21 2017, 01:55 PM

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(suadrif @ Feb 21 2017, 01:41 PM) actually it did That's maybank agreement. So you are forced to read it. lolafter i clicked General Investment Account-i, it refers me to a questionnaire page. in that page, i was asked to choose preference which is A and B (mudarabah & islamic) Well technically it create one account for you (only if you place egia). If you have no placement, that account is not seen. Under that account, you can have lots of different placement of eGIA-i which matures at different time with different amount. Nothing to be concern about. No extra charge, nothing. You cannot even see that account via atm. Account is like that.  |

|

|

Feb 21 2017, 01:55 PM Feb 21 2017, 01:55 PM

|

Senior Member

2,650 posts Joined: Feb 2009 |

QUOTE(cybpsych @ Feb 21 2017, 01:46 PM) technically it's a virtual account for each type of efd/gia placement. i seeIslamic one account, gia one account, conventional one account. gia is a general product name for mudarabah. but why i didnt get the option "add to principal" for the interest gain? only have credit to my saving account and the interest rate also didnt lock yet

|

| Change to: |  0.0289sec 0.0289sec

0.42 0.42

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 08:16 AM |