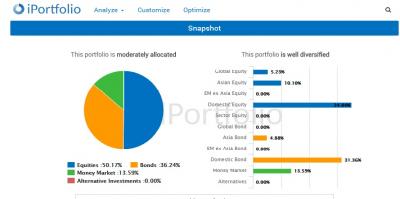

but quite satisfied with the return with low volatility

#thanksforsharing

This post has been edited by DearWJ: Oct 30 2016, 04:48 PM

Attached thumbnail(s)

FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Oct 30 2016, 04:48 PM Oct 30 2016, 04:48 PM

Return to original view | Post

#1

|

Junior Member

34 posts Joined: Oct 2016 |

|

|

|

|

|

|

Nov 17 2016, 10:17 PM Nov 17 2016, 10:17 PM

Return to original view | Post

#2

|

Junior Member

34 posts Joined: Oct 2016 |

QUOTE(Avangelice @ Nov 17 2016, 10:11 PM) it's on libra site. so continue to hold bond until FED hike or let it go now before rugi teruk? @@ yesterday she went up slightly. lastest NAV showed she puked. the party is not over, the USD/MYR guys in the other thread there will be another round of chronic fever until fed hike and over |

|

|

Nov 17 2016, 10:25 PM Nov 17 2016, 10:25 PM

Return to original view | Post

#3

|

Junior Member

34 posts Joined: Oct 2016 |

QUOTE(Avangelice @ Nov 17 2016, 10:22 PM) be advised. libra Anita distribution is in March. check past distribution history. keep it. just don't touch it and close one eye. continue dca in Asia ex Japanese noted.or this one bro first time see bond fund turned red. wont rise again in short time right? should endure the psychological pressure and wait... |

|

|

Nov 18 2016, 09:05 PM Nov 18 2016, 09:05 PM

Return to original view | Post

#4

|

Junior Member

34 posts Joined: Oct 2016 |

Oopps, looks like bond fund continue to drop kaw kaw today~

rhb bond and islamic bond sakit teruk asyik lausai... |

|

|

Dec 16 2016, 08:26 PM Dec 16 2016, 08:26 PM

Return to original view | Post

#5

|

Junior Member

34 posts Joined: Oct 2016 |

Regarding to FSM recommendation for 2017,should we sell out bond fund and concentrate on equity fund? bleeding again since yesterday, sigh......

|

|

|

Dec 16 2016, 08:41 PM Dec 16 2016, 08:41 PM

Return to original view | Post

#6

|

Junior Member

34 posts Joined: Oct 2016 |

QUOTE(Avangelice @ Dec 16 2016, 08:30 PM) Remember to approach UT investment via the portfolio method. You need a good foundation built by stable bond funds and slowly build it up with balance funds and top it up with equity funds. yeah,im look into Esther bond too since every sifus also love it very muchbut i enter rhb bond on oct, still suffer lost and gona pay redemption fee if sell out now T^T gona wait for recover first for now.... |

|

|

|

|

|

Dec 16 2016, 08:47 PM Dec 16 2016, 08:47 PM

Return to original view | Post

#7

|

Junior Member

34 posts Joined: Oct 2016 |

|

|

|

Dec 16 2016, 10:36 PM Dec 16 2016, 10:36 PM

Return to original view | Post

#8

|

Junior Member

34 posts Joined: Oct 2016 |

|

|

|

Dec 22 2016, 10:54 AM Dec 22 2016, 10:54 AM

Return to original view | Post

#9

|

Junior Member

34 posts Joined: Oct 2016 |

QUOTE(Avangelice @ Dec 22 2016, 10:47 AM) KUALA LUMPUR: RAM Rating Services Bhd expects less participation by foreign investors in the Malaysian bond market for at least another quarter, until the onshore foreign exchange (forex) forward market becomes more established. means gona run away from malaysia bond ASAP? The local rating agency said the US Federal Reserve’s recent lifting of the federal funds rate and subsequent signal of several more to follow in 2017 may see foreign investors price in this rate normalisation in the coming year and this could also exacerbate the decline in foreign participation. “Other uncertainties such as US President-elect Donald Trump’s much-anticipated policy direction and the Organization of the Petroleum Exporting Countries’ commitment on oil output could further influence the direction of global fund flows,” it noted in its latest issue of Bond Market Monthly report released yesterday. “That said, we still expect some capital-market volatility despite the reduced level of participation on account of lingering external uncertainties,” it added. Following Trump’s unexpected victory that has heightened uncertainties, RAM pointed out that the Malaysian bond market saw the largest net monthly outflow to date of RM19.9 billion in November 2016. The value of foreign holdings stood at RM221 billion as at end-November 2016, an 8.3% month-on-month drop. who else is still holding Malaysian bond funds? have a read at this |

|

Topic ClosedOptions

|

| Change to: |  0.1119sec 0.1119sec

0.12 0.12

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 10:43 AM |