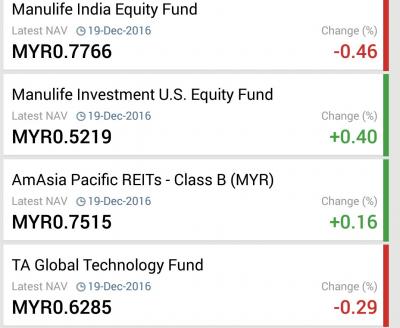

QUOTE(larisSa @ Dec 20 2016, 10:58 PM)

I am struggling between Manulife US and TA technology... The latter is sector specific whereas the main sector allocation for the former is IT...

I am scared if I go in high for Manulife as the NAV is at its max now

1)

diversification. apples to oranges. Manulife US =/= TA Global in terms of the allocation the funds invest in please look into the fund fact sheets

2)

The NAV price of the fund that I'm interested in is quite high now, should I stay away? Investment gurus always say "buy low, sell high"...

» Click to show Spoiler - click again to hide... «

First of all, understand what is NAV price. I always like to explain things by using simple examples. Here goes...

- Fund ABC issues 1 million units at Initial Offer Price of RM1.00 per unit.

- As such, at Day 1, NAV of ABC is 1 million units x RM1.00 = RM1 million. NAV price is RM1.00.

- After the end of the Initial Offer Period, ABC starts to operate, it starts to invest.

- Let's say ABC bought RM200,000 worth of Maybank shares, RM300,000 of Dutch Lady shares and RM500,000 of BAT shares.

- Let's say after 1 month,

Market value of holdings

Maybank RM180,000

Dutch Lady RM360,000

Guinness Anchor RM400,000

BAT shares were sold off during the month

Total value of equities held: RM940,000

Cash: RM50,000 (dividends received from BAT)

Total value of net assets i.e. NAV: RM990,000

NAV price per unit: RM990,000 / 1 million units = RM0.9900

Ah Beng says: "ABC is now cheaper, can buy!"

Answer:

NO! You cannot determine the "cheapness" of a fund by looking at its NAV price alone. We can only deduce that the ABC had made an NAV loss of 1% during the 1-month period, but you cannot say that it is "cheap".

The fund could have bought Maybank when it was overpriced, and now its holdings of Maybank had gone down 10%. Maybank is now cheap!

Guinness Anchor could be oversold, thus ABC sold its holdings of BAT and bought into Guinness Anchor. Another undervalued stock in ABC's holding!

However, Dutch Lady have rallied 20% in the past 1 month, it could be overbought i.e. expensively valued now.

Simply said, you determine the "cheapness" of a fund by reference to its underlying holdings. The NAV price CANNOT give you a single clue as to whether it is an opportune time to buy into a fund.

Let's say u are looking at a fund which focuses on plantation stocks. Plantation stocks on the KLCI could be oversold, went down 20% in the past 1 month yet the fund only recorded an NAV loss of 5% in the same period. You might think, "aiya, only -5%, the fund is still expensive, don't want buy in now lah". But you could be terribly wrong; it could be that the fund was sitting on a heavy cashpile during the past 1 month, hence it did not lose much. But plantation stocks are now trading at a discount, it is an opportune time for the fund to buy!

Of course, all this is based on the assumption that the fund manager is not stupid. tongue.gif

If the fund manager still sits on its huge cashpile and refuses to enter the market, then later when plantation stocks rally up 30% the fund could still be sitting there with -5%/+5%.

PAGE 1. READ IT. if don't know what I mean. READ AGAIN. This post has been edited by Avangelice: Dec 21 2016, 10:48 AM

Dec 20 2016, 10:22 PM

Dec 20 2016, 10:22 PM

Quote

Quote

0.0278sec

0.0278sec

0.19

0.19

6 queries

6 queries

GZIP Disabled

GZIP Disabled