QUOTE(T231H @ Sep 27 2016, 03:57 PM)

Caveat emptor!...

IRR "may" not be a good indicator of how your current basket of funds in your current portfolio performed....

a few pages ago... forummers did bring it up regarding the "BAD" of looking too much into IRR....

btw,..thre are some forummers just managed to get < 4% IRR after > 3 yrs...

Of course, precautions apply but I suppose in the long run when your time to retirement runs out......

QUOTE(pisces88 @ Sep 27 2016, 03:58 PM)

do note that my total investment includes my PRS funds too.

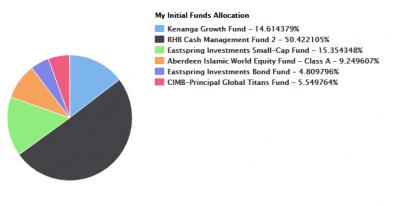

my investment journey in FSM started with 30k, around mid 2013, dca monthly. portfolio +12%.

worst fund is Rhb Kidsave, invested and topped up 3 years, now still -3%. looking to dump by jan 2017...

» Click to show Spoiler - click again to hide... «

I rough calc TVM still close to 7-8%, not bad what.

Ops, my bad IRR is closer to 3-4%

This post has been edited by lee82gx: Sep 27 2016, 04:40 PM

Sep 8 2016, 05:08 PM

Sep 8 2016, 05:08 PM

Quote

Quote

0.0947sec

0.0947sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled