QUOTE(T231H @ Oct 13 2016, 10:12 AM)

he meant the fund beat BY the benchmark Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

|

|

Oct 13 2016, 10:14 AM Oct 13 2016, 10:14 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

|

|

|

Oct 13 2016, 10:14 AM Oct 13 2016, 10:14 AM

Show posts by this member only | IPv6 | Post

#1482

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(T231H @ Oct 13 2016, 10:09 AM) if based only on this question.... I oso do the same like u....no ball too.... some sifus (ada Cert punya) would do this.... refer to the methodology as in here.... https://www.fundsupermart.com.my/main/resea...tormaincode=All for a layman like me,..i would 1) decide on the allocation of FI:EQ to have in my portfolio 2) split up the allocations into different regions/sector 3) find the funds that suit those regions/sectors...most of the time thru the use of recommended funds lists 4) doing them with an eye of the 3 yrs volatility ratio score. if the fund that is worth to buy, but are found to be way above my risk appetite.....I just forget about it......I got no balls. (but some would suggest to allocate some % for this type of opportunity and trills.) btw, how do you decide? |

|

|

Oct 13 2016, 10:17 AM Oct 13 2016, 10:17 AM

Show posts by this member only | IPv6 | Post

#1483

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(T231H @ Oct 13 2016, 10:12 AM) QUOTE(AIYH @ Oct 13 2016, 10:14 AM) Sorry guy.......due to my lousy language i mean Benchmark beat the annual performance .......very very sorry.... **** i gonna bla liao.....chat to u all sifu here next time This post has been edited by ironman16: Oct 13 2016, 10:22 AM |

|

|

Oct 13 2016, 10:21 AM Oct 13 2016, 10:21 AM

|

Senior Member

1,055 posts Joined: Nov 2015 |

|

|

|

Oct 13 2016, 10:23 AM Oct 13 2016, 10:23 AM

|

All Stars

33,619 posts Joined: May 2008 |

QUOTE(T231H @ Oct 13 2016, 10:09 AM) if based only on this question.... Just on the risk part. some sifus (ada Cert punya) would do this.... refer to the methodology as in here.... https://www.fundsupermart.com.my/main/resea...tormaincode=All for a layman like me,..i would 1) decide on the allocation of FI:EQ to have in my portfolio 2) split up the allocations into different regions/sector 3) find the funds that suit those regions/sectors...most of the time thru the use of recommended funds lists 4) doing them with an eye of the 3 yrs volatility ratio score. if the fund that is worth to buy, but are found to be way above my risk appetite.....I just forget about it......I got no balls. (but some would suggest to allocate some % for this type of opportunity and trills.) btw, how do you decide? You seem to know your own risk appetite very well. Question for me is that, how does one find out his own risk appetite ? When market is good, one's risk appetite is high but when market is bad, one's risk appetite is low. But by then it is too late. How does one access his risk appetite ? p/s: Not a challenging question. A humble question to find out the way to do it. This post has been edited by puchongite: Oct 13 2016, 10:24 AM |

|

|

Oct 13 2016, 10:24 AM Oct 13 2016, 10:24 AM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(ironman16 @ Oct 13 2016, 10:17 AM) Sorry guy.......due to my lousy language not youi mean Benchmark beat the annual performance .......very very sorry.... it was mine "Mistake" by your English composition.... btw, you really do the buying/selling decision by using those analysis as post in post# 1464? |

|

|

|

|

|

Oct 13 2016, 10:25 AM Oct 13 2016, 10:25 AM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE From 2003 onwards, I also started using my EPF Account 1 to invest in unit trust but locked in profit by selling 80% of my unit trusts in May 2007 when I felt that I had made enough i.e. profit close to 100% of my capital, the market went up further before sliding down in 2008. I am now (refer to early 2012 when this article was first published) considering selling off the balance 20% not sold in 2007 as the market is at an all time high where I am still making close to 100% profit but if I had sold the 20% in 2007, I would actually be making more after considering the annual dividend from EPF. In 2008 when the market was in bear mode, the value of my unit trust if I had not sold would be about half of what it was in 2007. Investing in unit trust especially relating to equities is no different than investing in stocks. There is a yearly annual management fee on your unit trust besides the initial fee when you purchase the units. Anyway, it will be more than 10 years before I can actually withdraw from my EPF Account 1. So I am waiting patiently for the next round of bear market and then jump into buying unit trust again with my EPF Account 1, but no one really knows what will happen in the future and a bear market can last for 10 years too. https://genxgenygenz.com/2016/10/08/investm...lth-retirement/ Food for thought. |

|

|

Oct 13 2016, 10:27 AM Oct 13 2016, 10:27 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(puchongite @ Oct 13 2016, 10:23 AM) Just on the risk part. Are you able to accept that your fund will go crash to 50% or below? (like RHB Gold You seem to know your own risk appetite very well. Question for me is that, how does one find out his own risk appetite ? When market is good, one's risk appetite is high but when market is bad, one's risk appetite is low. But by then it is too late. How does one access his risk appetite ? p/s: Not a challenging question. A humble question to find out the way to do it. Are you able to stomach a fund that drops more than 10%? (like most US market fund where if another 2008 happen again) and believe it will rise up again to cover your losses? |

|

|

Oct 13 2016, 10:29 AM Oct 13 2016, 10:29 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 13 2016, 10:30 AM Oct 13 2016, 10:30 AM

Show posts by this member only | IPv6 | Post

#1490

|

Senior Member

2,437 posts Joined: Sep 2016 |

btw, you really do the buying/selling decision by using those analysis as post in post# 1464? [/quote] no really la.....just use it to decide the time to start invest in the UT that i interest or whack it kaw kaw nia normally i will select a few funds that i interested n doing some analisis......only hope not enter at the peak time... |

|

|

Oct 13 2016, 10:34 AM Oct 13 2016, 10:34 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Oct 13 2016, 10:35 AM Oct 13 2016, 10:35 AM

|

All Stars

33,619 posts Joined: May 2008 |

QUOTE(AIYH @ Oct 13 2016, 10:27 AM) Are you able to accept that your fund will go crash to 50% or below? (like RHB Gold Obvious there will be various shades or categories of this for each person.Are you able to stomach a fund that drops more than 10%? (like most US market fund where if another 2008 happen again) and believe it will rise up again to cover your losses? Example, the first question is not acceptable to me. The second question I am ok with it. So how does one find out which category he belongs to ? |

|

|

Oct 13 2016, 10:37 AM Oct 13 2016, 10:37 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

[quote=ironman16,Oct 13 2016, 10:30 AM]

btw, you really do the buying/selling decision by using those analysis as post in post# 1464? [/quote] no really la.....just use it to decide the time to start invest in the UT that i interest or whack it kaw kaw nia normally i will select a few funds that i interested n doing some analisis......only hope not enter at the peak time... [/quote] FSM would recommends follow their Star rating on the countries/sectors to focus in. btw,...I think the prognosis from the use of those analysis charts as in post 1464, should also take into taking into considerations of NAVs that is due the currency sell off fluctuations or the abnormality of the liquidity crush that had just recently happens to the Small Caps segment...just my 2 cents |

|

|

|

|

|

Oct 13 2016, 10:39 AM Oct 13 2016, 10:39 AM

|

Senior Member

1,055 posts Joined: Nov 2015 |

|

|

|

Oct 13 2016, 10:45 AM Oct 13 2016, 10:45 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(puchongite @ Oct 13 2016, 10:23 AM) Just on the risk part. You seem to know your own risk appetite very well. Question for me is that, how does one find out his own risk appetite ? When market is good, one's risk appetite is high but when market is bad, one's risk appetite is low. But by then it is too late. How does one access his risk appetite ? p/s: Not a challenging question. A humble question to find out the way to do it. QUOTE(puchongite @ Oct 13 2016, 10:35 AM) Obvious there will be various shades or categories of this for each person. I got the risk level that I know I am comfortable with either thru "burn" or ...... So how does one find out which category he belongs to ? how to know your own risk appetite?..... "Start by using a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher". https://secure.fundsupermart.com/main/resea...SJBlog_20141031 This post has been edited by T231H: Oct 13 2016, 11:03 AM |

|

|

Oct 13 2016, 10:45 AM Oct 13 2016, 10:45 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(puchongite @ Oct 13 2016, 10:35 AM) Obvious there will be various shades or categories of this for each person. I believe that if you can't accept the first scenario, is best not to invest in funds that are sector focus (like minerals, property, technology etc...) as if anything happen to the sector as a whole your investment will go down to the drain Example, the first question is not acceptable to me. The second question I am ok with it. So how does one find out which category he belongs to ? If still can accept 10-20% loss then diversified EQ funds will be ok if can accept 5-10% loss then balanced fund will be good. Less than that, just stick to fixed income Above is how I evaluate, others will have different opinion |

|

|

Oct 13 2016, 10:55 AM Oct 13 2016, 10:55 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(David3700 @ Oct 13 2016, 10:39 AM) I posted something about my perspective about topping up in page# 71....post# 1407, 1412if you just need to have those funds as your planned to have funds in your portfolio, then it is a good time as it is still 5 Stars, This post has been edited by T231H: Oct 13 2016, 11:03 AM |

|

|

Oct 13 2016, 10:55 AM Oct 13 2016, 10:55 AM

Show posts by this member only | IPv6 | Post

#1498

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(AIYH @ Oct 13 2016, 10:45 AM) I believe that if you can't accept the first scenario, is best not to invest in funds that are sector focus (like minerals, property, technology etc...) as if anything happen to the sector as a whole your investment will go down to the drain If still can accept 10-20% loss then diversified EQ funds will be ok if can accept 5-10% loss then balanced fund will be good. Less than that, just stick to fixed income Above is how I evaluate, others will have different opinion This post has been edited by ironman16: Oct 13 2016, 10:56 AM |

|

|

Oct 13 2016, 11:07 AM Oct 13 2016, 11:07 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

I want to add on about those saying that they belive they will lose their investments. understand that when the global economy falls rest assure that your stocks, equities, balance, fixed income, fix deposit and even money will have diarrhea. in this sequence mind you but everything will be affected.

Do not buy into fear. understand that your funds will rebound when the storm has passed. do you think those funds in our portfolio today fared better during the 2008 storm? look at them now. the ultimate question is are you willing you see your investments lose their NAV and bail out or ride the storm and reap the benefits of your stead fast ways. This post has been edited by Avangelice: Oct 13 2016, 11:08 AM |

|

|

Oct 13 2016, 11:08 AM Oct 13 2016, 11:08 AM

Show posts by this member only | IPv6 | Post

#1500

|

Senior Member

3,806 posts Joined: Feb 2012 |

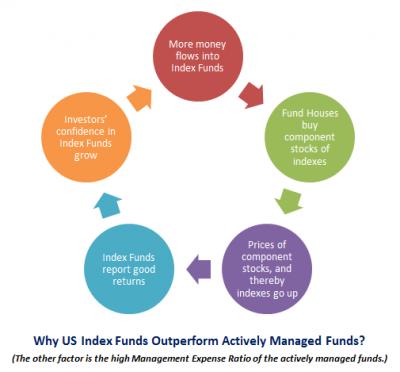

QUOTE(ironman16 @ Oct 13 2016, 09:44 AM) Let take TA-Global-Technology-Fund as example; I am also pretty new to UTF investment, so let's learn together.Seen like the annual performance always beat by the Benchmark, then i won't invest it BUT it seen that so many ppl interest in this UT... From the table, even though the fund underperformed the index for 5 years, the returns were still very good. I pointed out elsewhere, certain indexes are probably bubbles waiting to burst. See attachment... In any case, if you can't buy a corresponding index fund, maybe TA Global Tech is an acceptable alternative. Attached thumbnail(s)

|

|

Topic ClosedOptions

|

| Change to: |  0.0261sec 0.0261sec

0.14 0.14

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 09:52 AM |