QUOTE(ironman16 @ Oct 13 2016, 09:31 AM)

Sorry, i'm just wanna ask u guy something. Pls dont shoot me if nonsense...

How you guy make judgement whether the UT is worth to invest or not?

How you guy make judgement whether the UT is worth to invest or not?What i mean is other than look for the return, sharpe ratio, consistency ....

Normally i will look at the

Annual Performance (%) VS Benchmark at factsheet.

If the fund performance is always

beat by the Benchmark every year, i won't invest in that fund.

Are u guy the same?

Most of us here are clueless as well, we either just:

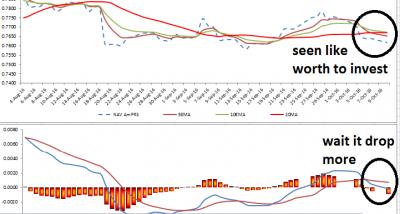

I) Wait for the NAV to drop further then whack kaw-kaw

II) Wait for distribution to happen then whack kaw-kaw

III) Blur-blur wait for some divine sign like a black crow flying across the chimney or rooster crowing at specific time or perhaps see a pregnant black cat jump across a coffin or something like that

IV) Some just whack kaw-kaw and then pray

V) Just buy all the FSM recommended funds and whack kaw-kaw

V) Some just wait for some silly crystal-ball to give some hints and then whack kaw-kaw

VI) Some just do DCA slowly and steady into FSM's recommended UTF

VII) Some come here ask tonnes of questions and stuff in the end kecut bola and end up whack kaw-kaw into ASX & FD.

VII) Most use a combination of method I) to VII)

Xuzen

This post has been edited by xuzen: Oct 13 2016, 10:03 AM

Oct 13 2016, 09:44 AM

Oct 13 2016, 09:44 AM

Quote

Quote

0.0197sec

0.0197sec

0.16

0.16

6 queries

6 queries

GZIP Disabled

GZIP Disabled